Market Brief 28/09/2022

VIETNAM STOCK MARKET

1,143.62

1D -1.96%

YTD -23.67%

1,160.66

1D -1.84%

YTD -24.42%

252.35

1D -1.24%

YTD -46.76%

85.84

1D -1.00%

YTD -23.82%

-33.48

1D 0.00%

YTD 0.00%

13,509.79

1D 6.09%

YTD -56.52%

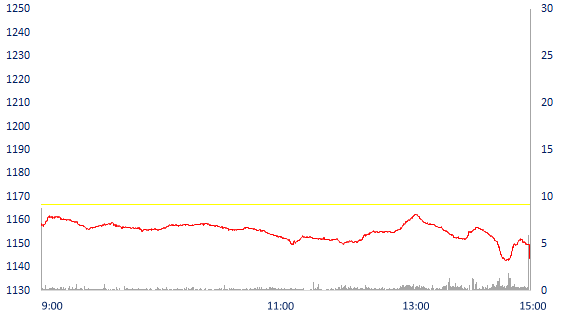

The selling force of key stocks increased strongly in the afternoon session of September 28, causing the index to fall sharply towards the end of the session, VN-Index lost nearly 23 points to a 20-month low, causing the VN-Index to officially penetrate the bottom in June 2022. Liquidity remained at low level, showing a cautious sentiment in the face of world risks

ETF & DERIVATIVES

20,170

1D -0.30%

YTD -21.91%

13,760

1D -1.36%

YTD -23.94%

14,250

1D -19.99%

YTD -25.00%

18,400

1D -0.05%

YTD -19.65%

15,650

1D 0.00%

YTD -30.38%

24,770

1D -1.59%

YTD -11.69%

15,010

1D -1.25%

YTD -30.12%

1,156

1D -2.73%

YTD 0.00%

1,158

1D -2.24%

YTD 0.00%

1,163

1D -1.72%

YTD 0.00%

1,165

1D -1.69%

YTD 0.00%

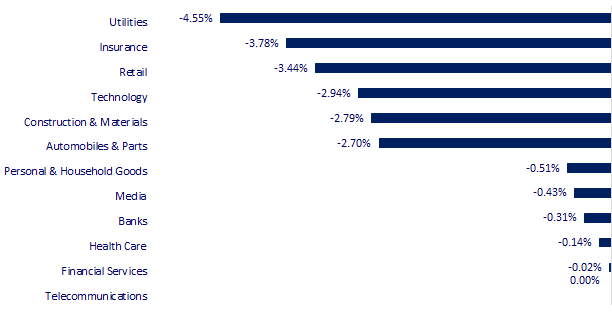

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

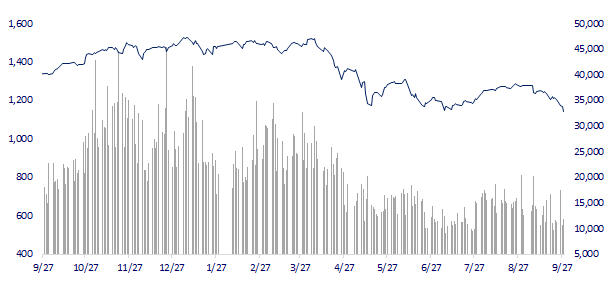

VNINDEX (12M)

GLOBAL MARKET

26,173.98

1D -0.74%

YTD -9.09%

3,045.07

1D -1.58%

YTD -16.34%

2,169.29

1D -2.45%

YTD -27.15%

17,250.88

1D -3.41%

YTD -26.27%

3,116.31

1D -1.55%

YTD -0.24%

1,599.23

1D -0.70%

YTD -3.52%

79.18

1D 1.19%

YTD 3.50%

1,635.60

1D 0.12%

YTD -10.17%

Asian stocks all dropped in the session of September 28 after yesterday's recovery session. In Japan, the Nikkei 225 index fell 0.74% to 26,173.98 points. South Korea's Kospi index fell 2.45% to 2,169.29. Hong Kong stocks fell the most in the region, with the Hang Seng index down 3.41% to 17,250.88 points

VIETNAM ECONOMY

5.12%

YTD (bps) 431

5.60%

4.28%

1D (bps) 15

YTD (bps) 327

4.71%

1D (bps) 15

YTD (bps) 271

23,923

1D (%) 0.16%

YTD (%) 4.29%

23,431

1D (%) -0.33%

YTD (%) -11.47%

3,353

1D (%) -0.74%

YTD (%) -8.34%

The USD Index, which measures the strength of the dollar, bounced near 109 points at the end of August, its highest level in two decades. Under pressure from the world USD price, the State Bank had to sell a large amount of foreign currencies by both spot and forward methods at the price range of 23,400 VND. The above data partly shows the State Bank's determination to keep the exchange rate stable, thereby keeping the VND interest rate gap lower than that of the USD

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has the opportunity to become the world's chip manufacturing center

- Research on highway 16,729 billion VND connecting Ho Chi Minh City with the border gate to Cambodia

- Need 13 billion USD to invest in seaport infrastructure

- World Bank lowers economic growth forecast for East Asia and Pacific region

- The lowest Chinese Yuan in 14 years

- The vacant "golden land" in the heart of New York reveals the dilemma of global real estate

VN30

BANK

75,000

1D 0.94%

5D -4.94%

Buy Vol. 1,227,251

Sell Vol. 948,277

33,500

1D -0.59%

5D -3.60%

Buy Vol. 1,543,911

Sell Vol. 1,545,707

23,300

1D -0.64%

5D -8.81%

Buy Vol. 5,398,997

Sell Vol. 4,674,868

33,250

1D -0.75%

5D -3.62%

Buy Vol. 4,549,846

Sell Vol. 3,665,279

18,500

1D 1.27%

5D -5.94%

Buy Vol. 14,920,022

Sell Vol. 16,124,519

19,950

1D -1.24%

5D -5.90%

Buy Vol. 7,557,895

Sell Vol. 6,079,031

19,150

1D -0.78%

5D -3.09%

Buy Vol. 1,761,890

Sell Vol. 1,949,704

24,650

1D -1.00%

5D -2.38%

Buy Vol. 2,259,233

Sell Vol. 2,164,808

20,300

1D -0.98%

5D -6.67%

Buy Vol. 13,838,375

Sell Vol. 11,225,421

22,800

1D -1.94%

5D 3.64%

Buy Vol. 2,164,162

Sell Vol. 2,581,648

22,000

1D -1.79%

5D -2.65%

Buy Vol. 4,081,008

Sell Vol. 4,641,265

BID: BIDV announced the auction of collateral assets of Hong Phong Cement Joint Stock Company (UPCoM: LCC). The auctioned property is a cement factory with a capacity of 350,000 tons/year and all assets attached to land and infrastructure in Tenh Che village, Hong Phong commune, Cao Loc district, Lang Son province. BIDV said that the cement plant is currently in moderate operation, the land use right is leased by the State, paying the annual land rent and the land use term is until 2034 and 2036. The starting price offered by BIDV is 168.2 billion VND, deposit is 30 billion VND. The bank plans to hold an auction on October 6 in Lang Son city, Lang Son province

REAL ESTATE

84,200

1D -0.36%

5D -0.47%

Buy Vol. 2,935,217

Sell Vol. 4,117,884

29,400

1D 0.00%

5D -6.52%

Buy Vol. 3,527,563

Sell Vol. 2,465,799

50,300

1D 0.60%

5D -2.52%

Buy Vol. 1,565,923

Sell Vol. 1,866,270

PDR: Phat Dat is focusing resources to develop high-end resort real estate products in the period of 2022 - 2025, the total land bank PDR owns is more than 7,500 hectares in Q2/2022

OIL & GAS

104,000

1D -6.73%

5D -4.59%

Buy Vol. 915,318

Sell Vol. 1,278,452

12,850

1D -0.77%

5D -4.46%

Buy Vol. 18,499,234

Sell Vol. 19,145,004

34,900

1D -1.41%

5D -7.92%

Buy Vol. 1,596,947

Sell Vol. 2,119,588

Oil prices rallied on September 27 from nine-month lows in the previous session, supported by supply disruptions in the US Gulf of Mexico region before Ian storm

VINGROUP

57,500

1D -5.74%

5D -8.87%

Buy Vol. 1,961,669

Sell Vol. 1,762,571

51,200

1D -5.36%

5D -12.18%

Buy Vol. 3,774,670

Sell Vol. 3,751,233

26,850

1D 0.75%

5D -6.12%

Buy Vol. 2,165,442

Sell Vol. 1,680,166

VIC: VinFast aims to be profitable within 3 years. VinFast said that there have been about 65,000 pre-orders for VF electric cars, VF8 and VF9 will arrive in the US and Europe before the end of 2022

FOOD & BEVERAGE

71,800

1D -0.83%

5D -6.63%

Buy Vol. 4,165,324

Sell Vol. 3,054,433

102,100

1D -5.20%

5D -8.84%

Buy Vol. 661,520

Sell Vol. 585,621

183,000

1D -1.24%

5D -2.66%

Buy Vol. 157,607

Sell Vol. 235,054

SAB: Through the annual press conference on September 27, CEO of ThaiBev Group called Sabeco a "jewel" and wanted SCIC to sell 36% of the shares it holds in SAB

OTHERS

110,100

1D -0.36%

5D -4.26%

Buy Vol. 523,680

Sell Vol. 701,404

110,100

1D -0.36%

5D -4.26%

Buy Vol. 523,680

Sell Vol. 701,404

78,000

1D -3.11%

5D -5.22%

Buy Vol. 3,094,021

Sell Vol. 3,133,862

65,000

1D -3.13%

5D -7.14%

Buy Vol. 4,362,921

Sell Vol. 5,544,095

22,200

1D -2.42%

5D -4.52%

Buy Vol. 2,220,415

Sell Vol. 2,572,930

19,750

1D 1.02%

5D -3.89%

Buy Vol. 26,592,403

Sell Vol. 26,930,532

21,800

1D -2.68%

5D -4.80%

Buy Vol. 23,028,573

Sell Vol. 23,677,216

FPT: FPT Semiconductor, a subsidiary of FPT Software under FPT Corporation, has officially launched the first line of microchips applied in Internet of Things (IoT) products for the medical field. In the next two years, FPT Semiconductor plans to supply 25 million chip units to the global market. At the same time, the company plans to bring to the market 7 more chip lines in 2023, serving a variety of different fields

Market by numbers

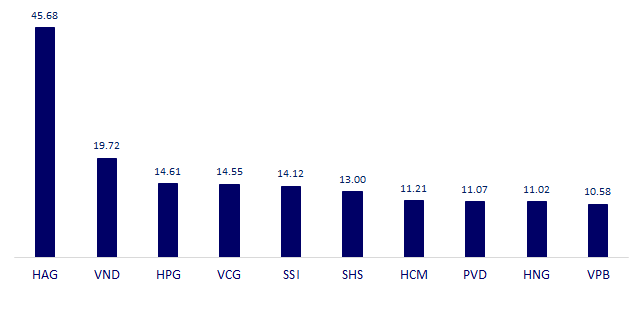

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

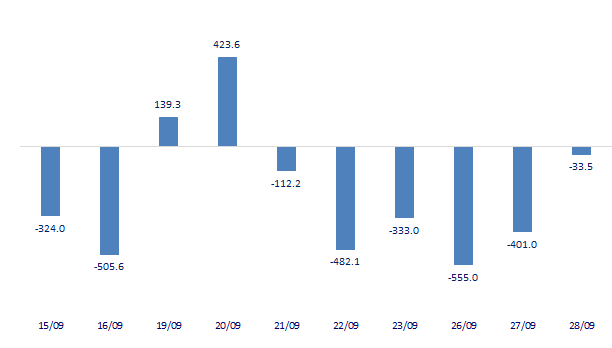

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

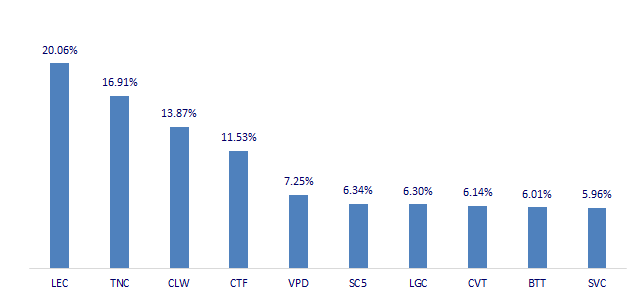

TOP INCREASES 3 CONSECUTIVE SESSIONS

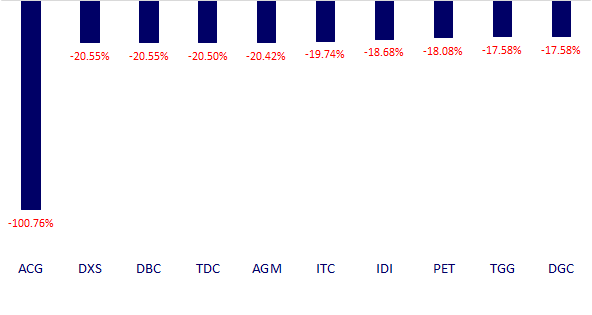

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.