Market brief 07/10/2022

VIETNAM STOCK MARKET

1,035.91

1D -3.59%

YTD -30.86%

1,039.54

1D -3.87%

YTD -32.31%

226.09

1D -3.84%

YTD -52.30%

79.98

1D -2.95%

YTD -29.02%

268.33

1D 0.00%

YTD 0.00%

18,863.14

1D 48.24%

YTD -39.29%

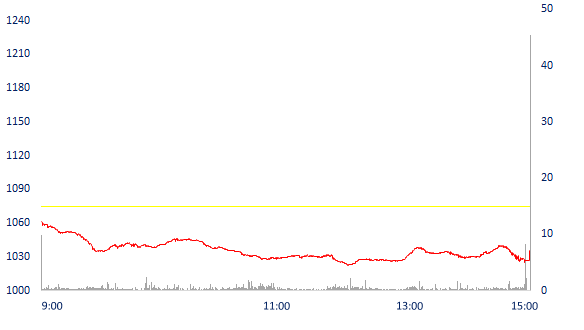

Closing the session on October 7, the VN-Index dropped nearly 39 points (equivalent to 3.59%) to 1,035.91 points, the lowest level since 19 months. The capitalization of all 3 exchanges decreased by 196 trillion dong on October 7. A rare bright spot on October 7th was that the liquidity increased sharply to nearly 19 trillion dong, significantly higher than the previous session.

ETF & DERIVATIVES

17,660

1D -5.66%

YTD -31.63%

12,160

1D -3.87%

YTD -32.78%

12,710

1D -28.64%

YTD -33.11%

17,410

1D -5.38%

YTD -23.97%

13,290

1D -7.00%

YTD -40.88%

22,000

1D -4.35%

YTD -21.57%

13,180

1D -5.25%

YTD -38.64%

1,025

1D -5.52%

YTD 0.00%

1,026

1D -4.96%

YTD 0.00%

1,029

1D -4.37%

YTD 0.00%

1,032

1D -4.43%

YTD 0.00%

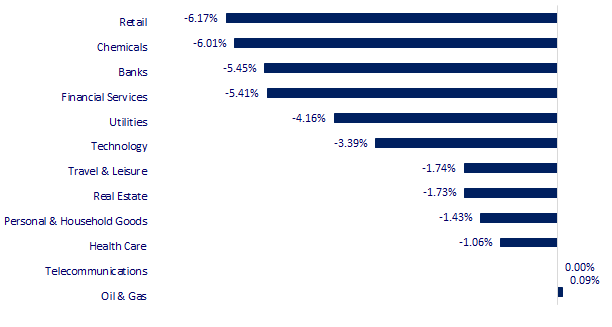

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

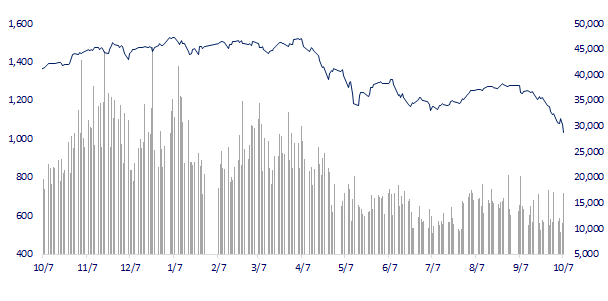

VNINDEX (12M)

GLOBAL MARKET

27,116.11

1D 0.23%

YTD -5.82%

3,024.39

1D 0.00%

YTD -16.91%

2,232.84

1D -0.22%

YTD -25.01%

17,740.05

1D -1.51%

YTD -24.18%

3,145.81

1D -0.18%

YTD 0.71%

1,579.66

1D -0.60%

YTD -4.70%

89.28

1D 0.81%

YTD 16.71%

1,716.50

1D -0.12%

YTD -5.73%

Asian stocks mixed ahead of US jobs report. In Japan, the Nikkei 225 index rose 0.23% to 27,116.11 points. The Kospi (South Korea) index fell 0.22%. Hong Kong's Hang Seng Index fell 1.51%. Chinese stocks were closed for a holiday for the whole week.

VIETNAM ECONOMY

7.86%

1D (bps) -58

YTD (bps) 705

5.60%

4.76%

1D (bps) 3

YTD (bps) 375

4.89%

1D (bps) 4

YTD (bps) 289

23,422

1D (%) 0.02%

YTD (%) 2.10%

24,146

1D (%) 0.15%

YTD (%) -8.77%

3,426

1D (%) 0.00%

YTD (%) -6.34%

According to newly released data, the accumulated budget revenue of the General Department of Taxation in the first 9 months of the year is estimated at VND 1,102,931 billion, equaling 93.9% of the ordinance estimate, up 21.6% yoy. In September, the total state budget revenue managed by tax authorities was estimated at VND 78,200 billion, reaching 6.7% of the ordinance estimate, up 29.1% yoy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The General Department of Taxation achieved nearly 94% budget revenue, aiming to exceed 15.5% of the whole year estimate

- Interbank overnight interest rate exceeds 8.4%/year, with term up to 9.7%/year

- Labor market recovered, average income in 9 months increased by 12.4%

- European Union finds new gas supplies

- European reserves are 90% full, gas prices fall by 8.7%

- IMF Director General: Countries should be cautious with the strategy of tightening monetary policy

VN30

BANK

66,700

1D -4.85%

5D -8.88%

Buy Vol. 3,015,903

Sell Vol. 3,073,474

29,200

1D -5.81%

5D -13.86%

Buy Vol. 2,917,576

Sell Vol. 2,617,266

19,950

1D -6.78%

5D -14.01%

Buy Vol. 11,369,469

Sell Vol. 12,467,159

27,250

1D -7.00%

5D -16.15%

Buy Vol. 17,066,074

Sell Vol. 20,984,408

15,350

1D -6.97%

5D -14.72%

Buy Vol. 28,766,986

Sell Vol. 27,050,947

16,950

1D -6.35%

5D -15.25%

Buy Vol. 49,404,968

Sell Vol. 49,414,958

17,450

1D -3.86%

5D -8.88%

Buy Vol. 3,920,232

Sell Vol. 4,305,715

22,350

1D -6.88%

5D -10.60%

Buy Vol. 2,668,198

Sell Vol. 4,353,636

16,750

1D -6.94%

5D -18.69%

Buy Vol. 49,848,141

Sell Vol. 52,119,374

20,000

1D -3.61%

5D -9.09%

Buy Vol. 3,131,396

Sell Vol. 3,763,893

18,650

1D -6.75%

5D -15.99%

Buy Vol. 12,429,927

Sell Vol. 13,119,610

4 joint-stock commercial banks including VPBank, HDBank, MB and Vietcombank have been adjusted more credit limits for 2022. Notably, these are banks that have participated in restructuring weak financial institutions by subject. After this adjustment, about 83.5 trillion VND will be added to the economy.

REAL ESTATE

79,000

1D -1.50%

5D -6.95%

Buy Vol. 4,234,162

Sell Vol. 5,146,529

25,000

1D -4.76%

5D -10.87%

Buy Vol. 5,300,603

Sell Vol. 4,712,915

49,500

1D -2.56%

5D -3.13%

Buy Vol. 2,251,035

Sell Vol. 3,723,176

NVL: On October 3, Novagroup received the transfer of ownership of nearly 94.7m shares of NVL. The reason is "Receiving the transfer of ownership of securities to contribute capital to the enterprise".

OIL & GAS

102,000

1D -4.58%

5D -7.27%

Buy Vol. 705,409

Sell Vol. 811,924

10,650

1D -6.58%

5D -13.77%

Buy Vol. 28,648,112

Sell Vol. 29,441,673

31,800

1D -1.24%

5D -3.34%

Buy Vol. 2,902,653

Sell Vol. 2,373,296

Oil prices rose about 1% in the session of October 6, extending the chain of gains from the beginning of last week affected by OPEC +'s decision to sharply cut output.

VINGROUP

60,200

1D 0.17%

5D 9.45%

Buy Vol. 4,009,610

Sell Vol. 3,814,757

53,800

1D 0.37%

5D 6.11%

Buy Vol. 5,607,516

Sell Vol. 5,929,608

26,000

1D -1.89%

5D -7.14%

Buy Vol. 3,636,673

Sell Vol. 4,350,347

VIC: From October 12 to November 10, Chairman Pham Nhat Vuong registered to transfer ownership of 243.46m VIC shares to contribute capital to VMI Real Estate Investment and Management JSC.

FOOD & BEVERAGE

69,800

1D -0.29%

5D -3.46%

Buy Vol. 4,138,108

Sell Vol. 4,160,909

81,500

1D -6.00%

5D -17.68%

Buy Vol. 2,251,728

Sell Vol. 2,234,757

187,000

1D 0.65%

5D 1.08%

Buy Vol. 247,369

Sell Vol. 261,446

MSN: In the first 6 months, Revenue at Masan Consumer Holdings, Masan High-Tech Materials, Phuc Long Heritage all grew by double digits.

OTHERS

48,200

1D -1.43%

5D -9.91%

Buy Vol. 2,937,433

Sell Vol. 2,254,848

115,000

1D 0.70%

5D 3.70%

Buy Vol. 951,090

Sell Vol. 1,051,578

74,000

1D -3.27%

5D -8.07%

Buy Vol. 3,215,301

Sell Vol. 3,005,609

54,000

1D -6.90%

5D -15.63%

Buy Vol. 7,463,734

Sell Vol. 8,803,759

16,600

1D -6.74%

5D -20.57%

Buy Vol. 3,248,912

Sell Vol. 4,206,892

16,800

1D -3.45%

5D -15.15%

Buy Vol. 35,762,369

Sell Vol. 35,123,066

17,600

1D -2.22%

5D -16.98%

Buy Vol. 65,745,824

Sell Vol. 49,454,287

HPG: announced in September production of 540,000 tons of crude steel. Sales volume of steel products reached 555,000 tons, down 11.6% MoM. In which, hot rolled coil (HRC) reached 228,000 tons, down 2% from the previous month and up 29% over the same period. Construction steel recorded 318,000 tons, down 17.6% month-on-month and down 3% over the same period.

Market by numbers

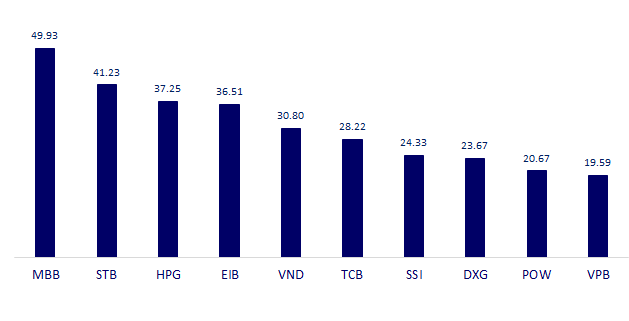

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

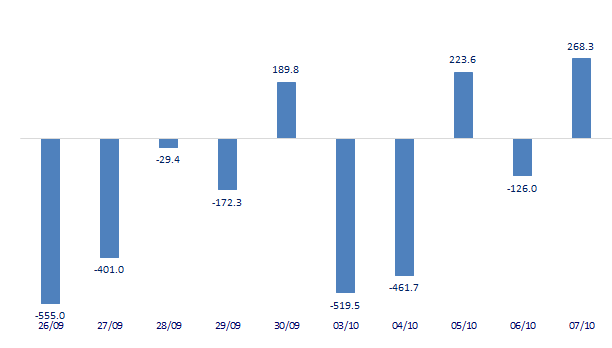

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

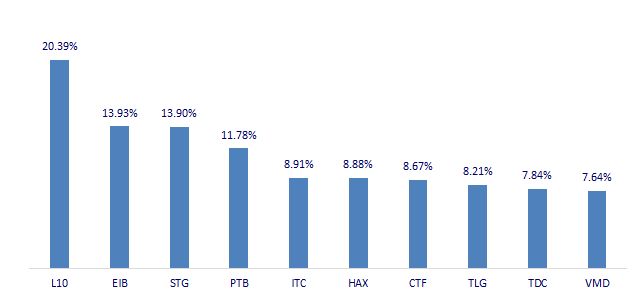

TOP INCREASES 3 CONSECUTIVE SESSIONS

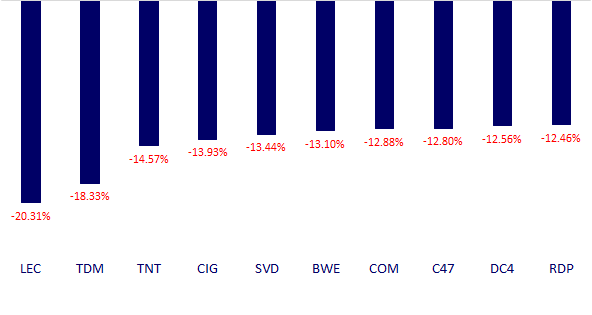

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.