Market Brief 18/10/2022

VIETNAM STOCK MARKET

1,063.66

1D 1.15%

YTD -29.01%

1,059.06

1D 1.13%

YTD -31.04%

229.12

1D 1.17%

YTD -51.66%

80.32

1D 0.39%

YTD -28.72%

14.30

1D 0.00%

YTD 0.00%

11,911.18

1D 9.52%

YTD -61.67%

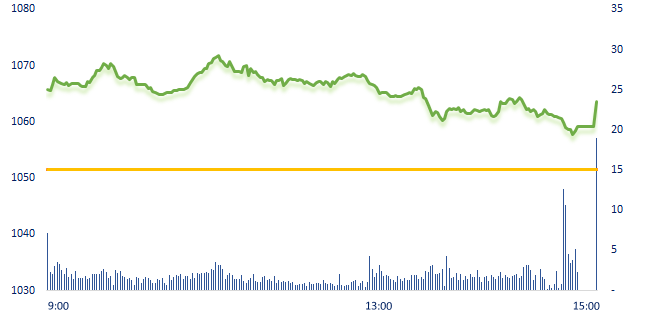

Profit-taking pressure appeared on October 18, VN-Index remained stable thanks to large stocks. Two minutes before entering the ATC session, VN-Index only increased by more than 6 points compared to the morning peak of over 20 points and many stocks narrowed their gain. At the end of the session, VN-Index recovered and gained more than 12 points.

ETF & DERIVATIVES

17,950

1D 1.13%

YTD -30.51%

12,430

1D 0.81%

YTD -31.29%

13,180

1D 1.93%

YTD -30.63%

15,950

1D -0.31%

YTD -30.35%

13,310

1D 0.83%

YTD -40.79%

22,800

1D 0.75%

YTD -18.72%

13,600

1D 1.12%

YTD -36.69%

1,048

1D 1.54%

YTD 0.00%

1,046

1D 0.75%

YTD 0.00%

1,045

1D 1.06%

YTD 0.00%

1,058

1D 0.75%

YTD 0.00%

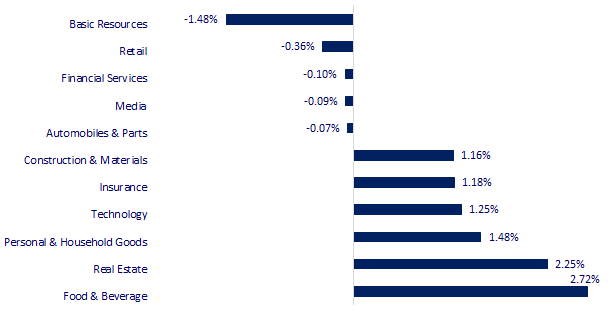

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

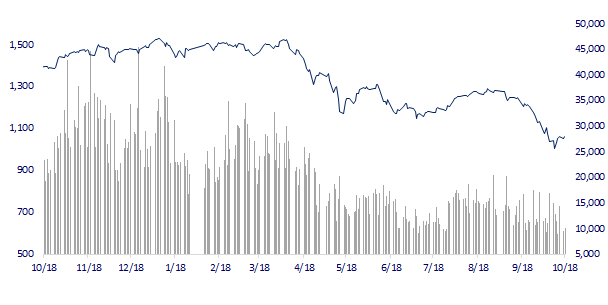

VNINDEX (12M)

GLOBAL MARKET

27,156.14

1D 0.89%

YTD -5.68%

3,080.96

1D -0.27%

YTD -15.35%

2,249.95

1D 0.83%

YTD -24.44%

16,914.58

1D 0.83%

YTD -27.71%

3,025.88

1D 0.34%

YTD -3.13%

1,591.64

1D 1.29%

YTD -3.98%

84.09

1D -1.00%

YTD 9.92%

1,655.90

1D -0.03%

YTD -9.06%

Asian stocks had quite a positive session on October 18. Japan's Nikkei 225 index increased by 0.89% to 27,156.14 points. The Kospi index increased by 0.83% to 2,249.95 points. The Hang Seng Index increased by 0.83% to 16,914.58 points.

VIETNAM ECONOMY

4.92%

1D (bps) -56

YTD (bps) 411

6.60%

YTD (bps) 100

4.79%

1D (bps) 8

YTD (bps) 378

4.88%

1D (bps) 20

YTD (bps) 288

24,580

1D (%) 0.39%

YTD (%) 7.15%

24,803

1D (%) 0.51%

YTD (%) -6.29%

3,465

1D (%) 0.35%

YTD (%) -5.28%

More than 9,000 Korean companies have entered Vietnam and cooperated in various fields such as manufacturing, energy, culture, education and tourism. Records from the Ministry of Planning and Investment show that Korea's cumulative registered FDI into Vietnam in the period from 1988 to September 2022 reached more than USD80.5 billion with over 9,400 projects in effect.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is the 'center' of the wave of Korean investment in Southeast Asia

- Long Thanh airport project: Re-bid for 5 bidding packages in mid-November-2022

- Proposing to allocate more than 7,000 billion dong of foreign capital for Hanoi - Hai Phong expressway

- China stops selling liquefied natural gas (LNG) to Europe

- After 2 years of heating, global ocean freight rates are falling rapidly

- Bloomberg predicts with 100% certainty that the US economy will be in a recession

VN30

BANK

67,700

1D 2.11%

5D 9.19%

Buy Vol. 1,913,632

Sell Vol. 1,880,806

32,800

1D 0.31%

5D 15.09%

Buy Vol. 1,596,215

Sell Vol. 2,170,360

23,000

1D 2.00%

5D 16.16%

Buy Vol. 7,677,577

Sell Vol. 8,056,704

25,300

1D 0.80%

5D 5.42%

Buy Vol. 8,130,666

Sell Vol. 9,463,109

15,950

1D 0.00%

5D 3.91%

Buy Vol. 12,341,396

Sell Vol. 14,516,745

17,550

1D 0.29%

5D 9.35%

Buy Vol. 19,821,316

Sell Vol. 18,534,554

16,800

1D 1.82%

5D 3.70%

Buy Vol. 2,124,858

Sell Vol. 2,588,651

20,600

1D 0.00%

5D 6.46%

Buy Vol. 3,660,663

Sell Vol. 5,043,569

17,700

1D -2.48%

5D 11.67%

Buy Vol. 28,950,137

Sell Vol. 28,436,329

19,950

1D 0.25%

5D 3.10%

Buy Vol. 2,420,210

Sell Vol. 3,483,903

21,400

1D 2.15%

5D 22.29%

Buy Vol. 4,566,446

Sell Vol. 4,974,107

Many banks continued to make large profits in the third quarter of 2022. Preliminary results of the first 9 months of commercial banks show positive numbers such as TPBank's pre-tax profit of 5,926 billion dong, up nearly 35% over the same period last year; SHB's profit reached 9,035 billion dong, increased by 79%; SeABank's profit reached 4,016 billion dong, increased by 58.7%. In which, the non-performing loan ratio of SeABank was very low, only 1.59%; All other business indicators achieved high growth.

REAL ESTATE

75,100

1D 0.13%

5D 0.13%

Buy Vol. 3,291,565

Sell Vol. 3,310,401

26,300

1D 2.73%

5D 7.79%

Buy Vol. 2,577,431

Sell Vol. 2,813,680

49,700

1D 0.20%

5D 1.84%

Buy Vol. 2,368,358

Sell Vol. 2,553,903

Dong Nai promotes the construction progress of 8 industrial zones with a total area of more than 8,200 ha that are facing problems in investment procedures, treatment of rubber land, forest land,…

OIL & GAS

111,000

1D -0.45%

5D 4.62%

Buy Vol. 614,390

Sell Vol. 1,151,698

11,100

1D -0.45%

5D 8.29%

Buy Vol. 13,230,110

Sell Vol. 15,169,192

33,250

1D 1.06%

5D 0.76%

Buy Vol. 1,406,436

Sell Vol. 1,807,450

Gas price today (October 18) decreased by 0.49% to 5.94 USD/mmBTU for natural gas contract delivered in November 2022 at 10:30 am (Vietnam time).

VINGROUP

58,400

1D 4.29%

5D -2.67%

Buy Vol. 1,227,122

Sell Vol. 1,137,468

50,500

1D 2.02%

5D -2.51%

Buy Vol. 4,183,904

Sell Vol. 4,022,682

25,800

1D 3.61%

5D 9.09%

Buy Vol. 1,419,358

Sell Vol. 1,742,145

VIC: Within the framework of the Paris Motor Show 2022, VinFast announced its business plan in Europe and opened its headquarters in France, Germany and the Netherlands.

FOOD & BEVERAGE

76,500

1D 3.24%

5D 8.97%

Buy Vol. 4,556,693

Sell Vol. 5,626,700

82,000

1D 3.80%

5D 2.76%

Buy Vol. 2,914,421

Sell Vol. 2,583,966

189,800

1D 2.54%

5D 3.43%

Buy Vol. 254,675

Sell Vol. 295,836

VNM: The General Department of Taxation recently announced the list of 10 largest corporate income tax payers in 2021. VNM and GAS are two representatives in this list.

OTHERS

50,900

1D 0.39%

5D 8.30%

Buy Vol. 1,231,334

Sell Vol. 1,665,832

109,100

1D 0.09%

5D 1.96%

Buy Vol. 465,719

Sell Vol. 442,159

74,900

1D 1.49%

5D 5.49%

Buy Vol. 1,735,164

Sell Vol. 1,702,265

59,000

1D 0.17%

5D 6.50%

Buy Vol. 3,286,863

Sell Vol. 4,965,869

16,800

1D 1.20%

5D 9.51%

Buy Vol. 2,706,341

Sell Vol. 2,902,565

17,800

1D -1.11%

5D 9.88%

Buy Vol. 28,420,883

Sell Vol. 40,224,022

18,850

1D -2.08%

5D 7.71%

Buy Vol. 42,957,962

Sell Vol. 43,893,235

VJC: The Ministry of Transport issued the Consolidated Document No. 53 on the management of domestic air transportation service prices and specialized aviation service prices, including: take-off and landing services; departure and arrival flight control services; support services to ensure flight operations; passenger service; aviation security assurance services; flight control services over the flight information area managed by Vietnam.

Market by numbers

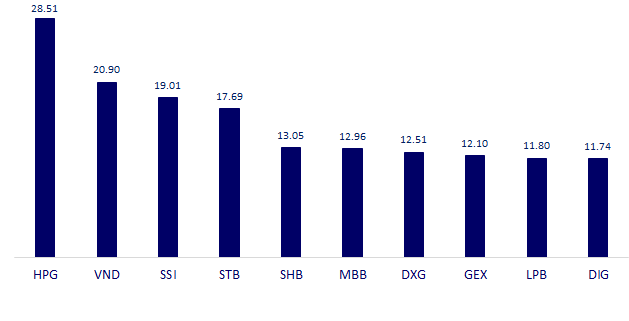

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

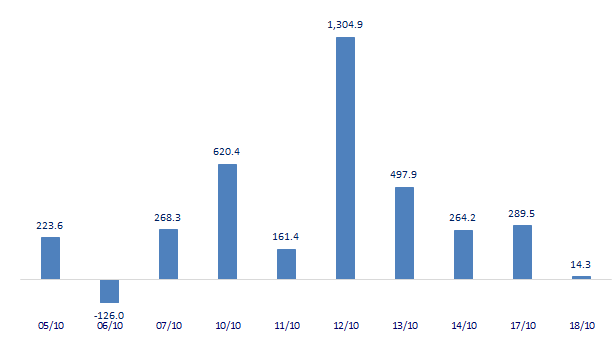

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

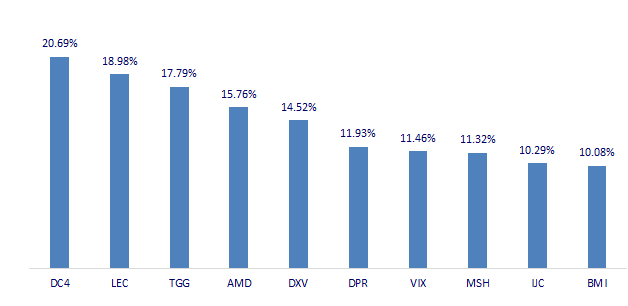

TOP INCREASES 3 CONSECUTIVE SESSIONS

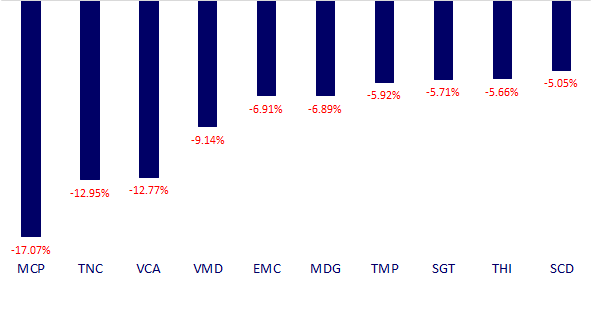

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.