Market Brief 20/10/2022

VIETNAM STOCK MARKET

1,058.45

1D -0.15%

YTD -29.36%

1,053.26

1D -0.04%

YTD -31.42%

225.88

1D -0.89%

YTD -52.34%

80.78

1D 0.14%

YTD -28.31%

196.03

1D 0.00%

YTD 0.00%

9,355.07

1D -1.70%

YTD -69.89%

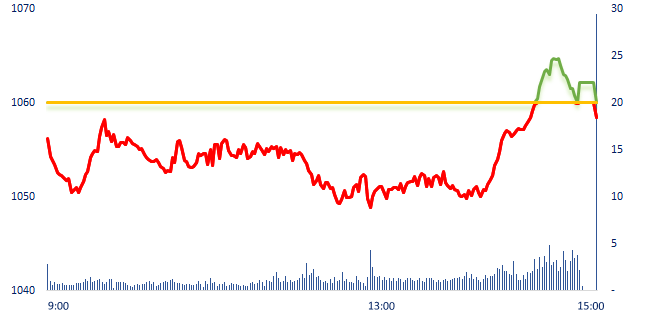

On October 20: derivatives gained strongly, VN-Index suddenly reversed and narrowed the decline. End of ATC session, VN-Index dropped 0.15%. The driving force for the recovery at the end of the session came from the support efforts of large-cap stocks, including banking, oil and gas, and technology groups such as VCB, GAS, FPT, VNM, ACB, BID, etc.

ETF & DERIVATIVES

17,920

1D -0.50%

YTD -30.62%

12,480

1D 0.65%

YTD -31.01%

12,990

1D 0.31%

YTD -31.63%

15,540

1D -1.21%

YTD -32.14%

13,280

1D -0.15%

YTD -40.93%

23,090

1D 0.96%

YTD -17.68%

13,390

1D 0.68%

YTD -37.66%

1,031

1D -1.09%

YTD 0.00%

1,040

1D -0.17%

YTD 0.00%

1,037

1D -0.09%

YTD 0.00%

1,058

1D 0.47%

YTD 0.00%

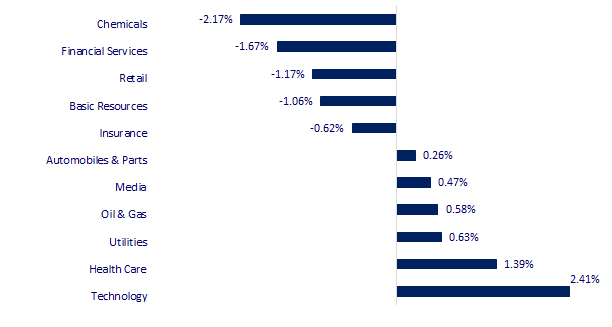

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

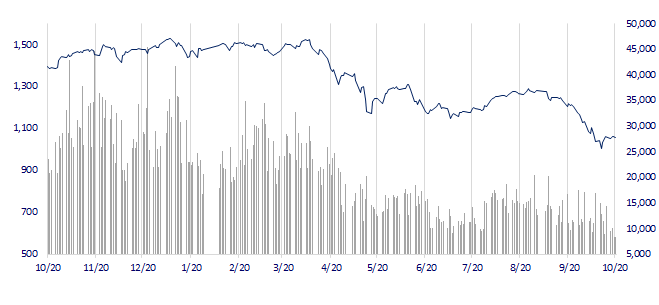

VNINDEX (12M)

GLOBAL MARKET

27,006.96

1D 0.40%

YTD -6.20%

3,035.05

1D 0.05%

YTD -16.61%

2,218.09

1D 0.37%

YTD -25.51%

16,280.22

1D 0.72%

YTD -30.42%

3,018.09

1D -0.16%

YTD -3.38%

1,594.08

1D 0.34%

YTD -3.83%

93.65

1D 1.57%

YTD 22.42%

1,637.20

1D 0.44%

YTD -10.08%

Asian stocks rebounded strongly in the session of October 20 after the red session in most markets yesterday. In Japan, the Nikkei 225 increased by 0.4% to 27,006.96 points. Hong Kong's Hang Seng Index increased by 0.72% to 16,280.22 points. South Korea's Kospi index advanced 0.37% to 2,218.09 points.

VIETNAM ECONOMY

4.10%

YTD (bps) 329

6.60%

YTD (bps) 100

4.73%

1D (bps) -4

YTD (bps) 372

4.78%

1D (bps) -3

YTD (bps) 278

24,680

1D (%) 0.37%

YTD (%) 7.59%

24,737

1D (%) 0.57%

YTD (%) -6.54%

3,461

1D (%) 0.26%

YTD (%) -5.39%

In the first 9 months of 2022, Vietnam's disbursement of investment capital reached over 15 billion USD - the highest level in the past 5 years, typically OECD companies are also tending to Vietnam to diversify the supply chain. According to the OECD Secretary General, Vietnam is one of the few countries that has avoided a recession related to COVID-19.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Industry and Trade proposes to increase line of credit for petroleum enterprises

- Ho Chi Minh City: Revenue from the natural resources and environment industry is more than VND 35,500 billion

- Shrimp exports to the US and EU market fell sharply

- EU summit: Gas price cap still elusive as leaders meet again over energy crunch

- 30% of Ukraine's power stations destroyed

- FITCH: US economy may face recession like 1990s

VN30

BANK

69,200

1D 1.91%

5D 4.06%

Buy Vol. 2,313,121

Sell Vol. 2,303,156

33,150

1D 0.45%

5D 2.16%

Buy Vol. 2,145,901

Sell Vol. 3,221,148

23,250

1D 0.22%

5D 3.79%

Buy Vol. 6,953,938

Sell Vol. 7,944,743

24,600

1D -2.38%

5D -2.77%

Buy Vol. 8,305,280

Sell Vol. 8,018,989

15,950

1D 0.00%

5D -0.31%

Buy Vol. 13,411,938

Sell Vol. 16,411,221

17,150

1D -2.00%

5D -1.44%

Buy Vol. 11,317,724

Sell Vol. 13,332,218

16,800

1D 0.60%

5D 0.00%

Buy Vol. 4,041,254

Sell Vol. 4,307,737

20,600

1D 0.24%

5D 0.00%

Buy Vol. 3,044,986

Sell Vol. 3,533,557

17,150

1D -0.87%

5D -2.83%

Buy Vol. 26,896,699

Sell Vol. 24,332,345

19,950

1D -2.21%

5D 1.27%

Buy Vol. 2,307,234

Sell Vol. 3,104,088

21,350

1D 1.18%

5D 7.02%

Buy Vol. 5,683,501

Sell Vol. 5,977,114

VPB: In 9 months of 2022, VPBank recorded a consolidated pre-tax profit of more than VND 19.8 trillion, up 69% over the same period, completing 67% of the profit plan for 2022. Thanks to business diversification, total consolidated operating income reached VND 45 trillion, up nearly 36% over the same period, asset quality was stable; capital adequacy ratio (CAR) and loan-to-deposit ratio (LDR) were maintained. Net profit from service activities of the consolidated bank in 9M/2022 increased by 59.2%, bringing the proportion of non-interest income in the operating income structure of the consolidated bank to over 30%.

REAL ESTATE

75,100

1D 0.13%

5D -0.53%

Buy Vol. 2,371,380

Sell Vol. 2,215,179

25,500

1D -1.35%

5D -3.77%

Buy Vol. 1,979,545

Sell Vol. 2,475,697

49,000

1D -1.01%

5D 0.10%

Buy Vol. 2,101,176

Sell Vol. 2,193,327

In the end of August, outstanding loans in the real estate sector increased by nearly 15.7% compared to the end of 2021, accounting for about 20.9% of the total outstanding loans of the economy.

OIL & GAS

110,900

1D 1.65%

5D 2.69%

Buy Vol. 458,777

Sell Vol. 807,514

10,850

1D -1.36%

5D 2.36%

Buy Vol. 12,673,438

Sell Vol. 11,626,868

33,500

1D 0.75%

5D -0.59%

Buy Vol. 1,524,779

Sell Vol. 1,873,000

The Ministry of Industry and Trade proposed the State Bank to raise line of credit to access preferential interest rates to import or purchase gasoline.

VINGROUP

58,600

1D 0.17%

5D -2.98%

Buy Vol. 1,795,654

Sell Vol. 2,097,069

50,000

1D 0.00%

5D -5.30%

Buy Vol. 4,114,587

Sell Vol. 4,881,774

25,100

1D -0.40%

5D -1.95%

Buy Vol. 2,437,964

Sell Vol. 2,273,651

VIC: Within the framework of the Paris Motor Show 2022, VinFast has been honored as "The Rising Star" by AUTOBEST - a prestigious car evaluation organization in Europe.

FOOD & BEVERAGE

77,500

1D 1.17%

5D 5.01%

Buy Vol. 3,422,633

Sell Vol. 4,050,060

80,200

1D 0.25%

5D 1.91%

Buy Vol. 2,409,564

Sell Vol. 2,722,411

191,300

1D 0.21%

5D 0.68%

Buy Vol. 200,821

Sell Vol. 200,563

OTHERS

51,000

1D -0.39%

5D 3.55%

Buy Vol. 1,087,691

Sell Vol. 1,145,697

108,900

1D -0.18%

5D 0.18%

Buy Vol. 316,180

Sell Vol. 325,845

77,800

1D 3.05%

5D 6.58%

Buy Vol. 2,768,115

Sell Vol. 3,181,944

58,400

1D -1.02%

5D 1.39%

Buy Vol. 2,953,139

Sell Vol. 4,009,100

16,200

1D -2.11%

5D 1.25%

Buy Vol. 1,902,650

Sell Vol. 2,275,847

17,400

1D -1.42%

5D -0.57%

Buy Vol. 20,972,533

Sell Vol. 21,310,882

18,100

1D -1.63%

5D -7.18%

Buy Vol. 51,652,134

Sell Vol. 44,844,425

FPT: At Vietnam Blockchain Summit 2022, FPT introduced typical products such as: Teaching and learning platform based on social construction method - Edunext; Payment solution by letter of credit bank documents - eTradevn. In particular, eTradevn is the first domestic Blockchain Letter of Credit (L/C) platform in Vietnam, researched by FPT IS - a member company of FPT Corp and two leading commercial banks.

Market by numbers

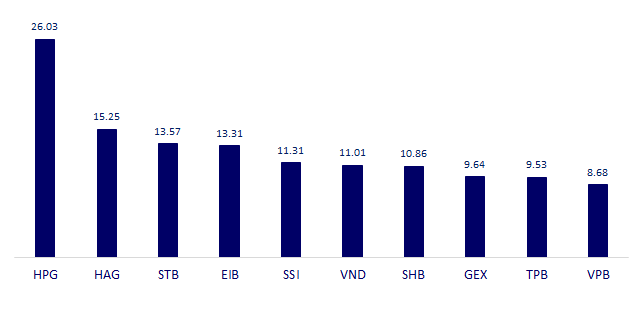

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

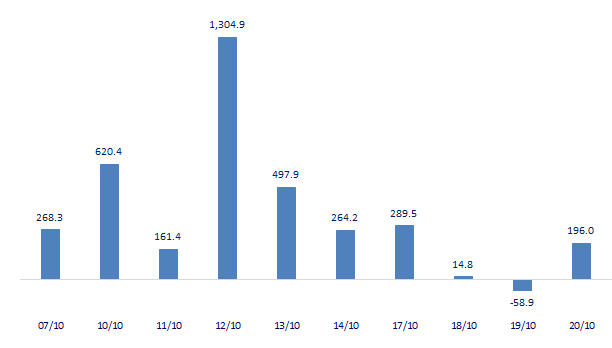

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

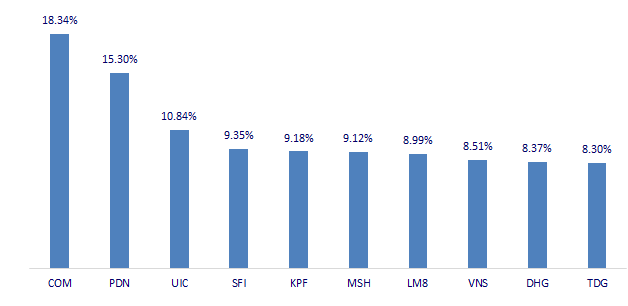

TOP INCREASES 3 CONSECUTIVE SESSIONS

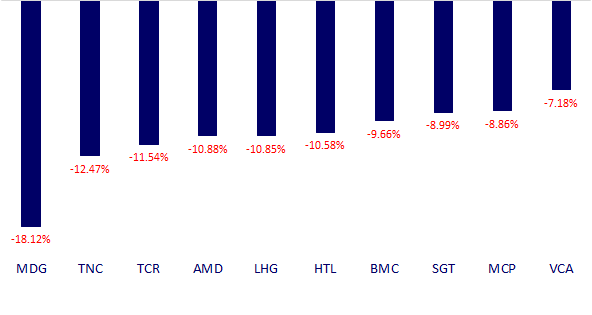

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.