Market Brief 4/11/2022

VIETNAM STOCK MARKET

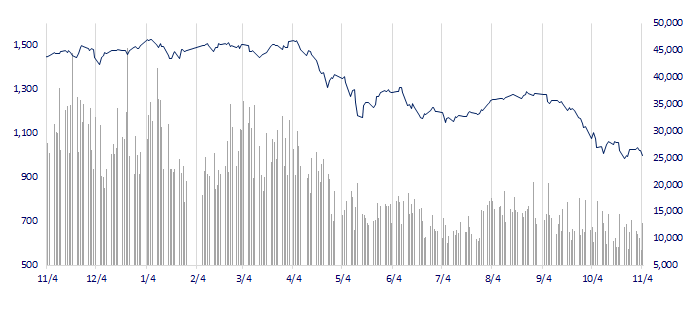

997.15

1D -2.22%

YTD -33.45%

997.72

1D -2.55%

YTD -35.03%

204.56

1D -2.93%

YTD -56.84%

74.26

1D -1.85%

YTD -34.10%

-5.72

1D 0.00%

YTD 0.00%

14,309.51

1D 63.86%

YTD -53.95%

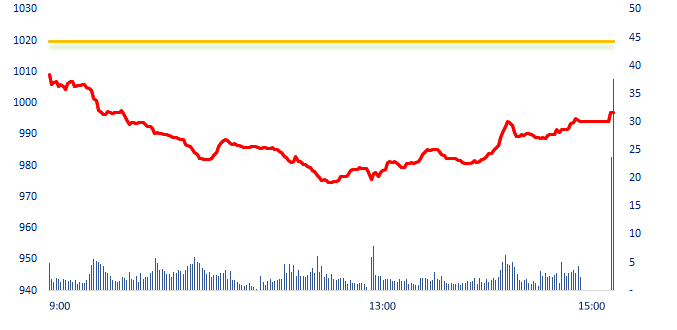

The market on November 4 fell deeply after a session of investors who seemed to be unaffected by the impact of Fed, when the global market dropped sharply yesterday. VN-Index liquidity reached the highest level of the week, the negative started appearing in real estate stocks, representatives of NVL and PDR fell to the floor since the opening.

ETF & DERIVATIVES

16,930

1D -2.81%

YTD -34.46%

11,750

1D -2.89%

YTD -35.05%

12,800

1D 1.27%

YTD -32.63%

14,910

1D -0.07%

YTD -34.89%

13,210

1D -1.86%

YTD -41.24%

21,800

1D -1.80%

YTD -22.28%

12,880

1D -1.00%

YTD -40.04%

958

1D -3.33%

YTD 0.00%

972

1D -2.51%

YTD 0.00%

957

1D -4.32%

YTD 0.00%

980

1D -2.11%

YTD 0.00%

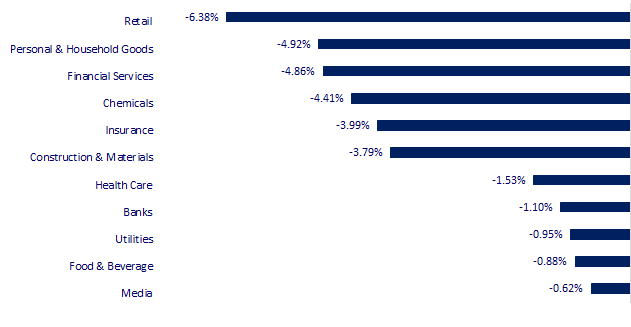

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,199.74

1D -1.68%

YTD -5.53%

3,070.80

1D 2.43%

YTD -15.63%

2,348.43

1D 0.83%

YTD -21.13%

16,161.14

1D 5.36%

YTD -30.93%

3,130.11

1D 0.89%

YTD 0.21%

1,626.32

1D 0.04%

YTD -1.89%

96.81

1D 2.23%

YTD 26.55%

1,648.35

1D 0.92%

YTD -9.47%

Speculation of China easing Covid Zero policy boosts sentiment. After more than 2.5 years under the cloud of the pandemic, Hong Kong is tentatively emerging by resuming one of its trademark, big-ticket events, the Rugby Sevens. Shares of Chinese technology companies rebounded in Hong Kong after a report that US audit inspectors completed the first round of on-site inspections of Chinese companies ahead of schedule, signaling progress in the process of preventing the delisting of shares of US-listed Chinese companies.

VIETNAM ECONOMY

6.93%

1D (bps) -19

YTD (bps) 612

7.40%

YTD (bps) 180

4.83%

1D (bps) 1

YTD (bps) 382

4.90%

1D (bps) 3

YTD (bps) 290

24,878

1D (%) 0.03%

YTD (%) 8.45%

25,044

1D (%) 0.23%

YTD (%) -5.38%

3,497

1D (%) 0.60%

YTD (%) -4.40%

On November 3, SBV suspended the issuance of new bills, while VND10,000 billion of previously issued bills were due to mature. On the OMO channel, SBV gave 12 commercial banks nearly VND5,000 billion loans with a term of 14 days, the interest rate is 6%/year. This figure corresponds to the amount of OMO to maturity of VND5,000 billion. In both T-bills and OMO channels, SBV injected VND10,000 billion into the banking system during the session 3/11.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- SBV suspended the issuance of bills, net injected nearly VND50,000 billion in the past 2 days;

- Governor of the SBV stresses prudent governance in terms of real estate credit

- Vietnam's auto industry have the fastest growth in Southeast Asia after 9 months;

- U.S. job growth seen smallest in nearly two years in October, unemployment rate up;

- Morgan Stanley plans to cut about 50 investment bankers in Asia;

- German factory orders accelerate drop as recession looms;

VN30

BANK

71,800

1D -1.64%

5D 0.28%

Buy Vol. 2,352,343

Sell Vol. 2,183,881

33,300

1D 0.91%

5D -1.48%

Buy Vol. 4,989,911

Sell Vol. 3,705,828

24,500

1D 3.81%

5D 1.87%

Buy Vol. 24,998,631

Sell Vol. 19,338,761

25,500

1D -1.35%

5D 4.51%

Buy Vol. 18,565,078

Sell Vol. 18,685,601

16,950

1D -3.14%

5D 3.67%

Buy Vol. 48,610,544

Sell Vol. 48,791,821

17,900

1D 1.42%

5D 1.42%

Buy Vol. 41,112,442

Sell Vol. 32,535,560

15,400

1D -3.75%

5D -6.67%

Buy Vol. 8,756,800

Sell Vol. 9,284,469

21,300

1D 0.24%

5D 2.16%

Buy Vol. 10,776,201

Sell Vol. 9,287,849

16,600

1D -3.77%

5D 2.79%

Buy Vol. 66,016,682

Sell Vol. 58,055,075

19,750

1D -2.71%

5D 0.25%

Buy Vol. 9,329,782

Sell Vol. 11,465,080

20,150

1D -5.62%

5D -9.64%

Buy Vol. 22,423,366

Sell Vol. 15,216,694

VPB: VPBank has just announced a plan to buy treasury shares, in the context that the market price of VPB has dropped quite deeply since the beginning of the year. In VPBank's equity structure, charter capital reached VND 45,056 billion at the end of the third quarter of 2022. After completing the issuance of shares to pay dividends, VPBank's charter capital will increase to VND67 trillion, expected in November.

REAL ESTATE

59,900

1D -6.99%

5D -17.38%

Buy Vol. 337,994

Sell Vol. 5,783,071

21,450

1D -6.94%

5D -6.74%

Buy Vol. 2,504,515

Sell Vol. 3,457,365

37,500

1D -6.95%

5D -15.92%

Buy Vol. 108,607

Sell Vol. 7,107,289

NVL: On November 3, Novaland announced to suspend issuing shares to increase capital because the plan is no longer suitable with the current situation.

OIL & GAS

111,000

1D -0.36%

5D 1.83%

Buy Vol. 552,039

Sell Vol. 662,671

9,800

1D -2.97%

5D -5.31%

Buy Vol. 14,444,894

Sell Vol. 14,307,792

28,800

1D -1.54%

5D -0.69%

Buy Vol. 1,980,646

Sell Vol. 1,560,261

On November 4, PVEP's oil and gas production reached the milestone of 3.18 million tons of oil equivalent, reaching the finish line 57 days early.

VINGROUP

54,300

1D -1.45%

5D -2.51%

Buy Vol. 2,558,013

Sell Vol. 2,526,806

44,500

1D -1.11%

5D -0.89%

Buy Vol. 6,379,234

Sell Vol. 6,735,133

26,000

1D 0.00%

5D 9.70%

Buy Vol. 2,942,843

Sell Vol. 2,997,803

VIC: On November 3, VinES announced a global cooperation with Li-Cycle - a leading company in the field of resource recovery and lithium-ion battery recycling.

FOOD & BEVERAGE

80,000

1D 0.00%

5D 2.56%

Buy Vol. 5,759,382

Sell Vol. 5,063,864

84,300

1D -1.29%

5D 0.48%

Buy Vol. 1,763,356

Sell Vol. 1,514,565

182,000

1D 0.00%

5D -2.20%

Buy Vol. 285,874

Sell Vol. 340,328

MSN: According to Q3 financial statements, MSN said that after the first 9M/2022, Phuc Long tea brand recorded a revenue of VND1,143 billion; EBITDA reached VND199 billion.

OTHERS

50,000

1D -4.58%

5D -4.76%

Buy Vol. 2,005,427

Sell Vol. 1,762,530

100,100

1D -2.53%

5D -7.14%

Buy Vol. 527,447

Sell Vol. 446,316

72,900

1D -1.62%

5D -2.80%

Buy Vol. 3,693,841

Sell Vol. 2,581,207

46,050

1D -6.97%

5D -13.44%

Buy Vol. 7,948,989

Sell Vol. 9,755,317

13,350

1D -6.32%

5D -7.93%

Buy Vol. 2,989,229

Sell Vol. 3,208,670

15,350

1D -6.97%

5D -3.46%

Buy Vol. 40,330,063

Sell Vol. 44,175,420

14,650

1D -3.62%

5D -12.80%

Buy Vol. 82,462,014

Sell Vol. 66,897,804

MWG: MWG said in Q3 consolidated financial statements, the "Short-term investment" item is worth VND8,846 billion, including VND7,235 billion, which is a deposit at reputable banks and has no liquidity problems, with tenor of 1 - 6 months and VND1,611 billion as investments in short-term bonds. 100% of the bonds have absolutely no relationship with the organizations mentioned in relation to the violations in the bond issuance recently.

Market by numbers

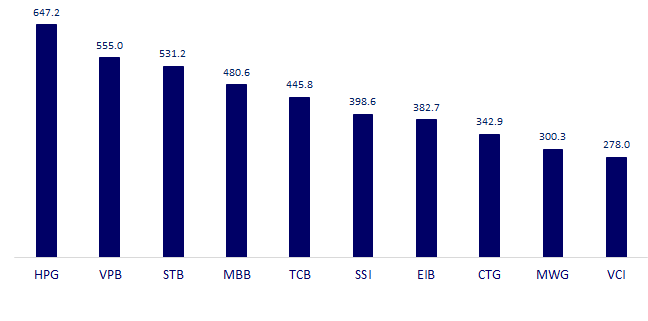

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

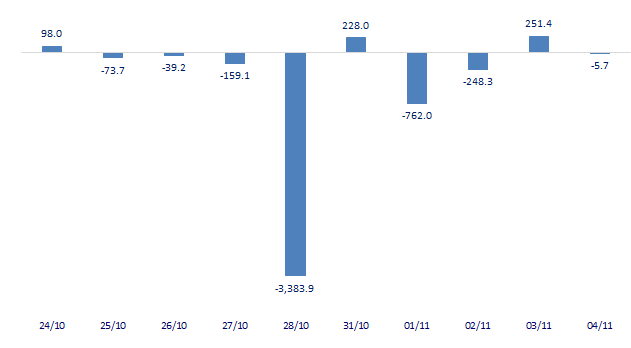

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

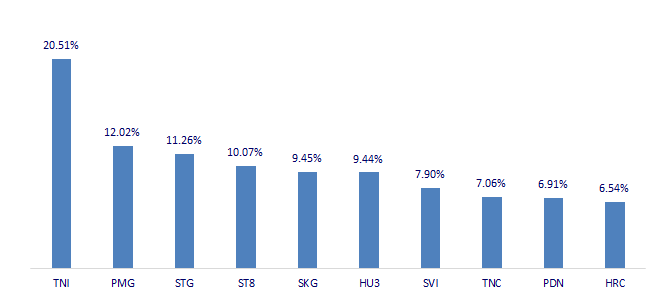

TOP INCREASES 3 CONSECUTIVE SESSIONS

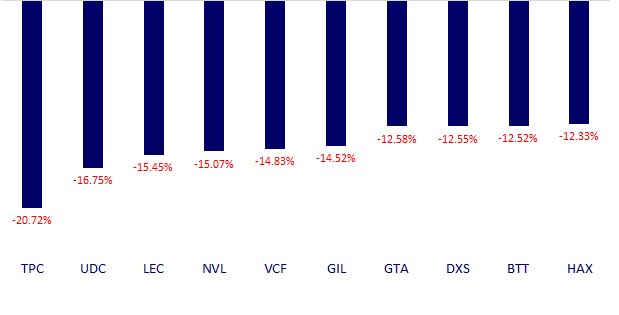

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.