Market brief 07/11/2022

VIETNAM STOCK MARKET

975.19

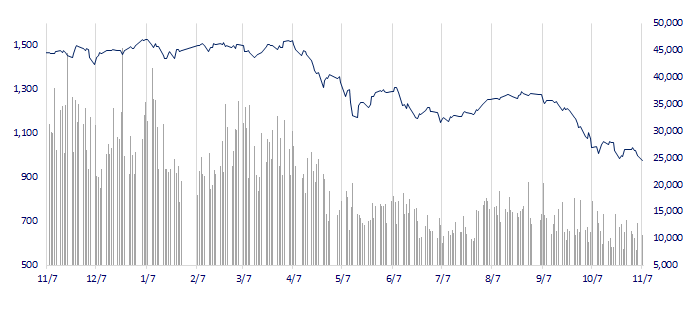

1D -2.20%

YTD -34.91%

972.85

1D -2.49%

YTD -36.65%

198.56

1D -2.93%

YTD -58.11%

72.25

1D -2.71%

YTD -35.88%

579.19

1D 0.00%

YTD 0.00%

11,880.94

1D -16.97%

YTD -61.76%

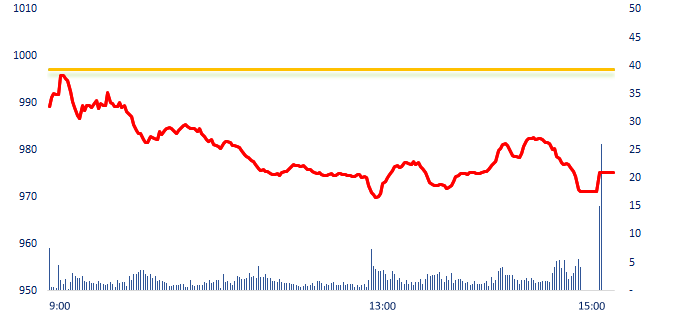

On November 7, a sell-off wave of stocks occurred in the session. Nearly 70 real estate stocks were in red, of which 39 stocks fell to the floor. PDR and NVL oversold at the floor price up to millions of shares. The sell-off session took place after the market had a lot of information about selling mortgage shares of real estate business leaders.

ETF & DERIVATIVES

16,550

1D -2.24%

YTD -35.93%

11,450

1D -2.55%

YTD -36.71%

11,960

1D -6.56%

YTD -37.05%

13,990

1D -6.17%

YTD -38.91%

12,700

1D -3.86%

YTD -43.51%

20,940

1D -3.94%

YTD -25.35%

12,520

1D -2.80%

YTD -41.71%

911

1D -4.95%

YTD 0.00%

938

1D -3.48%

YTD 0.00%

935

1D -2.28%

YTD 0.00%

950

1D -3.06%

YTD 0.00%

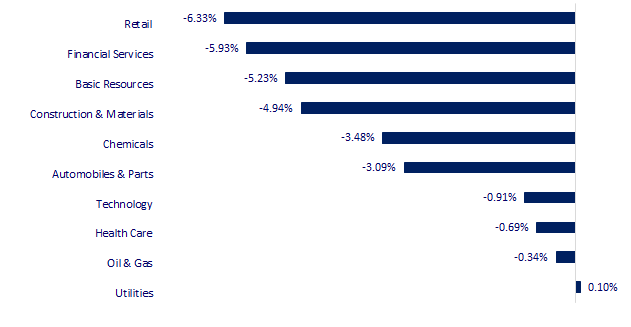

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,527.64

1D 1.21%

YTD -4.39%

3,077.82

1D 0.23%

YTD -15.44%

2,371.79

1D 0.99%

YTD -20.35%

16,595.91

1D 2.69%

YTD -29.07%

3,141.31

1D 0.36%

YTD 0.56%

1,623.57

1D -0.17%

YTD -2.05%

98.64

1D 1.89%

YTD 28.94%

1,681.75

1D 2.03%

YTD -7.64%

At the end of the session, Asian markets mostly gained, including Nikkei (Japan), Kospi (Korea), Shanghai Composite (China), especially Hang Seng (Hong Kong) increased sharply by 2.69%, when investors were optimistic about the government's loosening policies on Covid-19 epidemic restriction.

VIETNAM ECONOMY

7.00%

1D (bps) 7

YTD (bps) 619

7.40%

YTD (bps) 180

4.92%

1D (bps) 9

YTD (bps) 391

4.98%

1D (bps) 8

YTD (bps) 298

24,875

1D (%) -0.01%

YTD (%) 8.44%

25,290

1D (%) 0.98%

YTD (%) -4.45%

3,511

1D (%) 0.40%

YTD (%) -4.02%

Many real estate businesses are borrowing from the society at very high interest rates, narrowing the scale of investment and business activities due to a deep drop in liquidity. HoREA forecasts that the real estate market will still be difficult because of the limitation of the construction of real estate projects in most localities, leading to a decrease in housing supply.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Thua Thien Hue will start many big projects in the last 2 months of the year;

- Vietnam has a trade surplus of USD9.4 billion in 10 months;

- Binh Duong's public investment plan in 2023 is VND12,182 billion;

- China's exports unexpectedly fell in October;

- China continues its Zero COVID policy;

- The vice governor of the People's Bank of China is under investigation.

VN30

BANK

71,800

1D 0.00%

5D -2.31%

Buy Vol. 1,649,673

Sell Vol. 1,875,061

33,300

1D 0.00%

5D -3.62%

Buy Vol. 2,574,519

Sell Vol. 2,668,899

23,350

1D -4.69%

5D -5.08%

Buy Vol. 11,952,115

Sell Vol. 12,956,051

23,750

1D -6.86%

5D -3.46%

Buy Vol. 9,752,641

Sell Vol. 10,396,848

17,100

1D 0.88%

5D 4.59%

Buy Vol. 37,637,041

Sell Vol. 35,561,936

16,950

1D -5.31%

5D -4.24%

Buy Vol. 22,509,193

Sell Vol. 22,497,928

14,350

1D -6.82%

5D -12.50%

Buy Vol. 5,377,580

Sell Vol. 6,747,500

20,100

1D -5.63%

5D -2.90%

Buy Vol. 5,712,386

Sell Vol. 4,752,223

15,500

1D -6.63%

5D -4.02%

Buy Vol. 32,472,396

Sell Vol. 43,850,009

18,450

1D -6.58%

5D -5.87%

Buy Vol. 7,403,483

Sell Vol. 9,627,434

20,650

1D 2.48%

5D -7.81%

Buy Vol. 7,374,400

Sell Vol. 7,625,276

TCB: Techcombank said that from November 5, the bank increased the interest rate on demand deposits by 33 times, to 1% per year. This is also the maximum interest rate applicable to demand deposits and deposits with term less than 1 month as regulated by the State Bank. Previously, despite other banks raising demand deposit rates since the end of September, Techcombank still maintained the interest rate of this deposit at the lowest level in the system, only 0.03% per year.

REAL ESTATE

55,800

1D -6.84%

5D -20.29%

Buy Vol. 393,636

Sell Vol. 18,417,037

19,950

1D -6.99%

5D -12.11%

Buy Vol. 2,027,374

Sell Vol. 2,779,024

34,900

1D -6.93%

5D -20.14%

Buy Vol. 280,261

Sell Vol. 19,142,479

NVL: Nova Saigon Royal Real Estate Investment Ltd - a subsidiary of Novaland has just announced the results of the unsuccessful bond issue of NSRCH2223002.

OIL & GAS

112,900

1D 1.71%

5D 1.62%

Buy Vol. 590,064

Sell Vol. 832,382

9,790

1D -0.10%

5D -5.41%

Buy Vol. 10,075,629

Sell Vol. 10,082,874

28,850

1D 0.17%

5D 1.23%

Buy Vol. 1,231,764

Sell Vol. 1,623,476

Not only in HCMC and neighboring provinces, but the situation of temporarily suspending sales in stores has also appeared in Hanoi.

VINGROUP

53,400

1D -1.66%

5D -3.61%

Buy Vol. 2,277,062

Sell Vol. 2,839,839

43,900

1D -1.35%

5D -2.44%

Buy Vol. 5,159,242

Sell Vol. 7,097,499

25,500

1D -1.92%

5D 3.66%

Buy Vol. 2,309,658

Sell Vol. 3,174,107

VHM: In order for Vinhomes to focus on real estate business as well as promote the efficiency of construction activities, Vingroup has transferred all shares in Vincons to Vinhomes.

FOOD & BEVERAGE

82,200

1D 2.75%

5D 4.71%

Buy Vol. 4,298,404

Sell Vol. 4,537,607

84,500

1D 0.24%

5D -1.17%

Buy Vol. 1,983,776

Sell Vol. 1,868,456

184,000

1D 1.10%

5D -0.70%

Buy Vol. 255,663

Sell Vol. 283,734

VNM: Vinamilk plans to replicate the model of Vinamilk Green Farm.

OTHERS

48,900

1D -2.20%

5D -6.86%

Buy Vol. 1,249,076

Sell Vol. 1,350,619

100,200

1D 0.10%

5D -6.88%

Buy Vol. 523,563

Sell Vol. 327,311

72,600

1D -0.41%

5D -3.97%

Buy Vol. 2,475,428

Sell Vol. 2,538,316

42,850

1D -6.95%

5D -16.96%

Buy Vol. 7,494,301

Sell Vol. 8,927,812

12,450

1D -6.74%

5D -13.54%

Buy Vol. 2,592,451

Sell Vol. 3,271,184

14,300

1D -6.84%

5D -12.27%

Buy Vol. 30,417,928

Sell Vol. 35,428,254

13,700

1D -6.48%

5D -12.46%

Buy Vol. 59,228,564

Sell Vol. 56,251,469

HPG: In October 2022, Hoa Phat Group achieved a crude steel output of 567,000 tons, down 19% over the same period. Sales volume of construction steel, billet and hot rolled coil (HRC) reached 492,000 tons, down 42% compared to October 2021. In which, construction steel reached nearly 210,000 tons, equaling 45% of the same period. Hot rolled coil (HRC) recorded 267,000 tons, up 30%.

Market by numbers

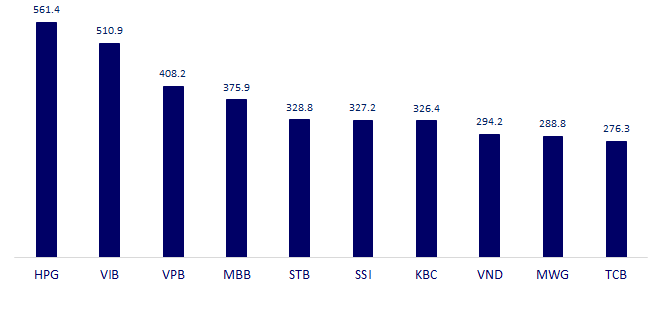

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

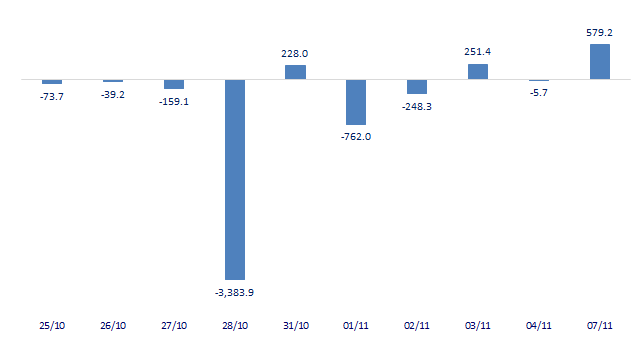

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

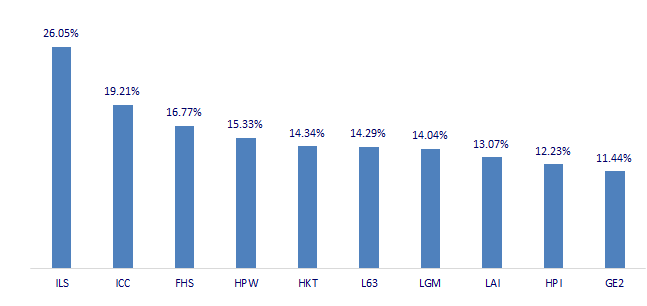

TOP INCREASES 3 CONSECUTIVE SESSIONS

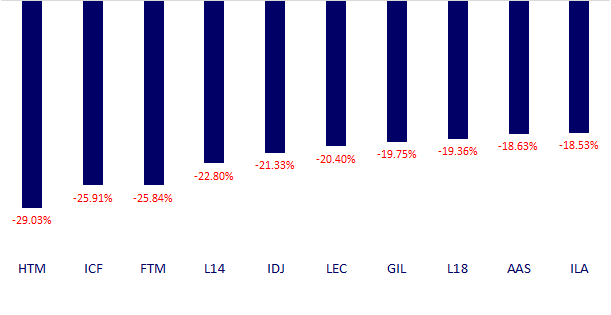

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.