Market brief 08/11/2022

VIETNAM STOCK MARKET

981.65

1D 0.66%

YTD -34.48%

980.09

1D 0.74%

YTD -36.18%

199.77

1D 0.61%

YTD -57.85%

72.28

1D 0.04%

YTD -35.85%

578.09

1D 0.00%

YTD 0.00%

11,501.13

1D -3.20%

YTD -62.99%

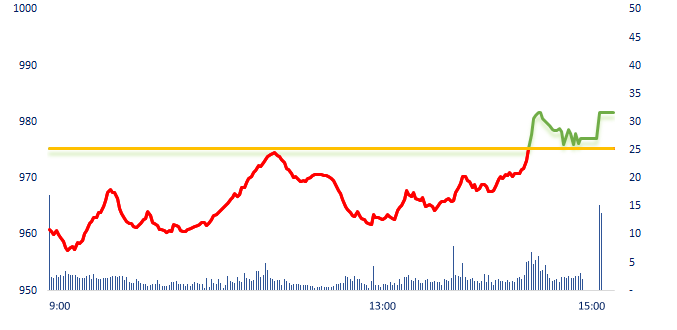

Bank stocks today had the most positive impact on VN-Index, in which BID helped increase 2.09 points and VCB helped increase 0.94 points. While NVL, HPG, and PDR was the three stocks that had the worst impact on the market, causing the market to decrease by 1.75 points, 0.75 points and 0.37 points, respectively.

ETF & DERIVATIVES

16,560

1D 0.06%

YTD -35.89%

11,450

1D 0.00%

YTD -36.71%

12,040

1D 0.67%

YTD -36.63%

13,900

1D -0.64%

YTD -39.30%

12,900

1D 1.57%

YTD -42.62%

21,250

1D 1.48%

YTD -24.24%

12,500

1D -0.16%

YTD -41.81%

950

1D 4.33%

YTD 0.00%

952

1D 1.47%

YTD 0.00%

953

1D 1.93%

YTD 0.00%

972

1D 2.33%

YTD 0.00%

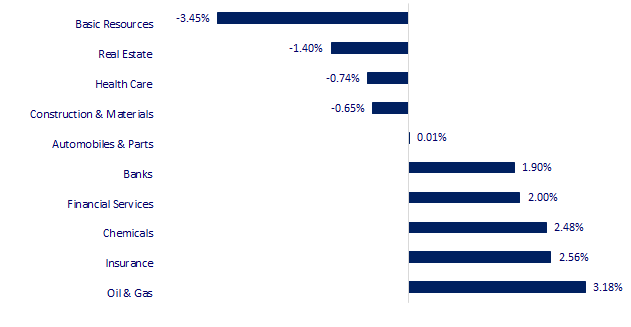

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

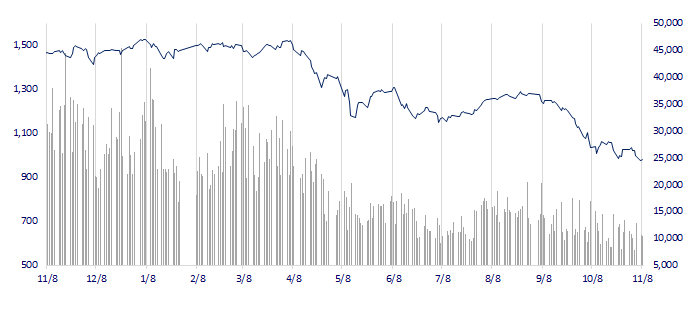

VNINDEX (12M)

GLOBAL MARKET

27,872.11

1D 1.25%

YTD -3.19%

3,064.49

1D -0.43%

YTD -15.81%

2,399.04

1D 1.15%

YTD -19.43%

16,557.31

1D -0.23%

YTD -29.24%

3,145.83

1D 0.14%

YTD 0.71%

1,631.07

1D 0.46%

YTD -1.60%

97.31

1D -0.72%

YTD 27.20%

1,673.65

1D -0.19%

YTD -8.08%

Asian stocks mixed as caution reigns ahead of U.S. midterms. Shanghai Composite (China) and Hang Seng (Hong Kong) adjusted in this session, after a sharp increase last week when Zero-Covid policy was loosen. In contrast, Nikkei 225 (Japanese) and Kospi (Korea) went up by 1.25% and 1.15%, respectively.

VIETNAM ECONOMY

5.52%

1D (bps) -148

YTD (bps) 471

7.40%

YTD (bps) 180

4.90%

1D (bps) -2

YTD (bps) 389

4.93%

1D (bps) -5

YTD (bps) 293

24,872

1D (%) -0.01%

YTD (%) 8.42%

25,578

1D (%) -0.31%

YTD (%) -3.36%

3,496

1D (%) -0.40%

YTD (%) -4.43%

The SBV injected nearly VND9,470 billion into the banking system in the first session of the week, mainly through mature bills. Previously, the money management agency net injected into the system nearly VND74,100 billion last week. The SBV maintained the trend of net injection after this agency raised the operating rate and the ceiling deposit rate by 1 percentage point from October 25. This is the second increase in operating interest rates in just over a month.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The interbank exchange rate exceeds the selling price of the State Bank;

- Proposing additional capital of VND200,000 billion to support the economy in the peak period at the end of the year;

- This morning, many large real estate firms had a meeting with the Government and the Ministry of Construction;

- Euro and Pound soar, USD level off as risky assets attract investors;

- Container freight from Asia to Europe and the US dropped sharply;

- China has offered to buy foreign bonds from El Salvador.

VN30

BANK

72,600

1D 1.11%

5D -3.20%

Buy Vol. 2,462,036

Sell Vol. 2,327,719

34,900

1D 4.80%

5D 2.50%

Buy Vol. 4,622,733

Sell Vol. 5,038,596

23,850

1D 2.14%

5D -2.45%

Buy Vol. 10,961,355

Sell Vol. 13,651,339

24,150

1D 1.68%

5D -5.85%

Buy Vol. 9,237,382

Sell Vol. 9,507,618

17,200

1D 0.58%

5D 0.00%

Buy Vol. 36,332,908

Sell Vol. 40,497,625

17,200

1D 1.47%

5D -4.44%

Buy Vol. 16,175,820

Sell Vol. 17,502,127

14,500

1D 1.05%

5D -12.65%

Buy Vol. 9,542,833

Sell Vol. 8,012,269

20,500

1D 1.99%

5D -5.96%

Buy Vol. 6,643,391

Sell Vol. 7,110,076

16,450

1D 6.13%

5D -2.66%

Buy Vol. 44,787,926

Sell Vol. 37,090,894

18,550

1D 0.54%

5D -7.94%

Buy Vol. 5,610,922

Sell Vol. 5,983,286

21,300

1D 3.15%

5D -5.12%

Buy Vol. 6,572,270

Sell Vol. 7,020,950

VPB: Vietnam Prosperity Commercial Joint Stock Bank (VPBank) has just announced the closing of the last registration date on November 18 to collect shareholders' written opinions on the repurchase of treasury shares and other contents within its competence of the General Meeting of Shareholders. The bank has not yet announced details of its plan to buy back treasury shares.

REAL ESTATE

51,900

1D -6.99%

5D -25.86%

Buy Vol. 349,611

Sell Vol. 26,757,688

20,300

1D 1.75%

5D -10.96%

Buy Vol. 3,680,756

Sell Vol. 2,921,852

32,500

1D -6.88%

5D -23.35%

Buy Vol. 313,096

Sell Vol. 37,292,212

PDR: Leaders and major shareholders of PDR continue to be called on margin by securities companies since November 8.

OIL & GAS

114,400

1D 1.33%

5D 4.00%

Buy Vol. 505,511

Sell Vol. 838,480

10,450

1D 6.74%

5D 0.97%

Buy Vol. 26,663,987

Sell Vol. 15,565,377

29,450

1D 2.08%

5D 1.20%

Buy Vol. 1,374,119

Sell Vol. 1,336,209

POW: Quang Ninh has officially granted a business registration certificate to QN LNG Power - a joint venture between POW, COVALI, Marubeni and Tokyo Gas for investment cooperation.

VINGROUP

53,300

1D -0.19%

5D -3.79%

Buy Vol. 3,066,360

Sell Vol. 3,595,725

43,800

1D -0.23%

5D -2.67%

Buy Vol. 7,273,824

Sell Vol. 7,744,076

25,250

1D -0.98%

5D -3.81%

Buy Vol. 2,723,961

Sell Vol. 3,972,352

VHM: Vinhomes cooperates with Mitsubishi to develop The Metropolitan project located in the Vinhomes Ocean Park megacity, inspired by design from four world-famous cities.

FOOD & BEVERAGE

82,400

1D 0.24%

5D 2.74%

Buy Vol. 3,445,159

Sell Vol. 4,238,877

86,000

1D 1.78%

5D -0.58%

Buy Vol. 1,788,044

Sell Vol. 1,736,312

183,000

1D -0.54%

5D -0.33%

Buy Vol. 221,480

Sell Vol. 252,485

MSN: Masan plans to enter the technology sector through a USD65 million deal to own 25% of Trusting Social.

OTHERS

50,800

1D 3.89%

5D -4.15%

Buy Vol. 1,643,196

Sell Vol. 1,182,370

100,400

1D 0.20%

5D -5.55%

Buy Vol. 405,534

Sell Vol. 392,539

73,300

1D 0.96%

5D -2.91%

Buy Vol. 1,937,999

Sell Vol. 1,560,175

44,600

1D 4.08%

5D -10.98%

Buy Vol. 8,859,162

Sell Vol. 6,503,503

13,050

1D 4.82%

5D -10.00%

Buy Vol. 2,477,293

Sell Vol. 2,138,709

15,000

1D 4.90%

5D -11.50%

Buy Vol. 36,260,452

Sell Vol. 27,419,150

13,150

1D -4.01%

5D -12.33%

Buy Vol. 83,285,317

Sell Vol. 64,792,188

HPG: Hoa Phat has just announced to its supplier partners about the shutdown of 4 blast furnaces, including 2 blast furnaces in Hoa Phat Dung Quat and 2 blast furnaces in Hoa Phat Hai Duong since November 2022. According to the document, in addition to stopping the above 4 furnaces, in December, Hoa Phat will stop producing 1 more blast furnace at Dung Quat.

Market by numbers

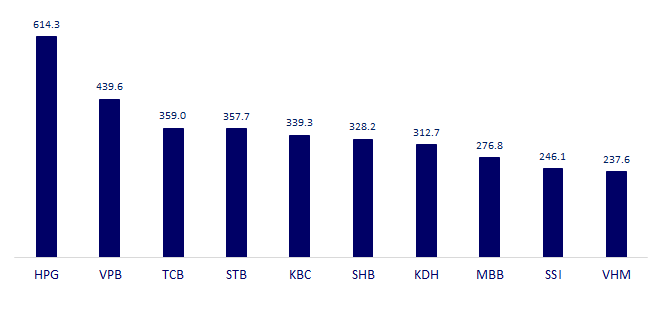

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

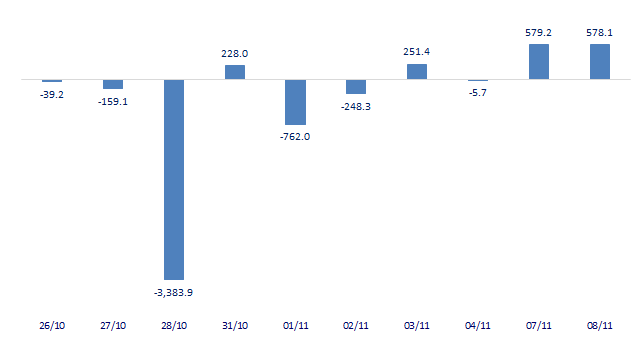

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

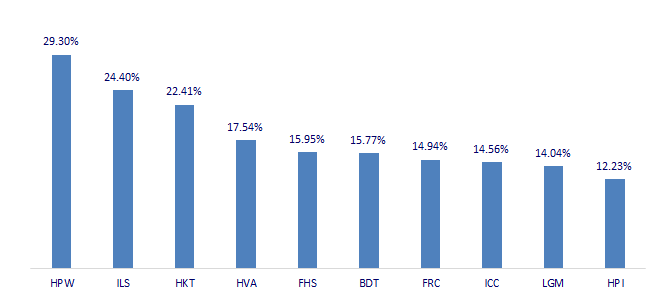

TOP INCREASES 3 CONSECUTIVE SESSIONS

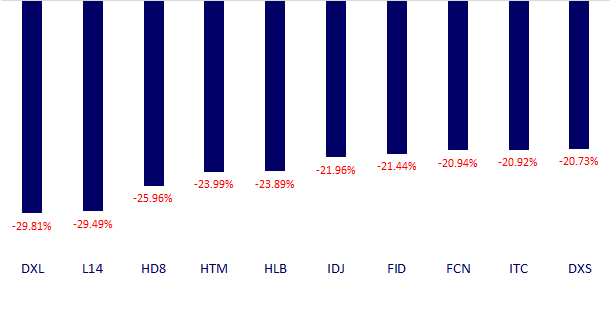

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.