Market brief 10/11/2022

VIETNAM STOCK MARKET

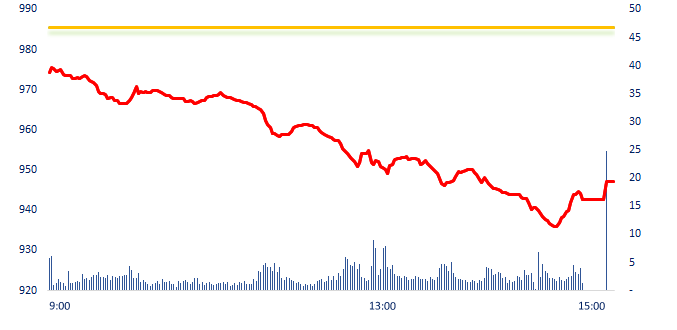

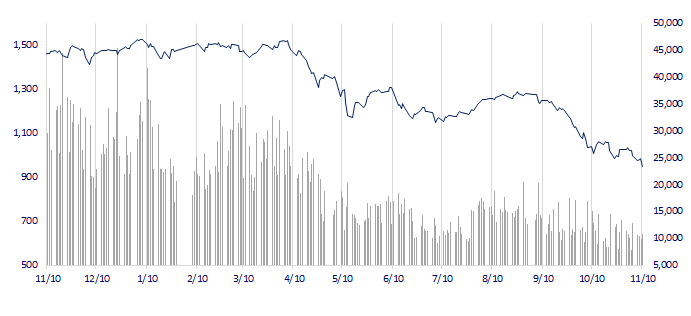

947.24

1D -3.89%

YTD -36.78%

936.80

1D -4.38%

YTD -39.00%

192.39

1D -4.47%

YTD -59.41%

68.80

1D -4.71%

YTD -38.94%

57.45

1D 0.00%

YTD 0.00%

12,145.79

1D 5.90%

YTD -60.91%

The number of stocks that fell today reached to 735 (of which 303 stocks fell to the floor price) showing the negativity of market sentiment. Many large-cap stocks such as MSN, HPG, GVR, VPB, CTG, NVL... fell to the floor price. The sector that mostly fell in this session were securities with 24/25 decreased stocks, of which 16 stocks fell to the floor price.

ETF & DERIVATIVES

15,600

1D -5.68%

YTD -39.61%

11,080

1D -3.48%

YTD -38.75%

11,260

1D -6.40%

YTD -40.74%

12,260

1D -5.69%

YTD -46.46%

12,500

1D -4.94%

YTD -44.40%

19,860

1D -6.32%

YTD -29.20%

11,800

1D -5.45%

YTD -45.07%

896

1D -5.19%

YTD 0.00%

905

1D -3.97%

YTD 0.00%

902

1D -4.55%

YTD 0.00%

913

1D -4.82%

YTD 0.00%

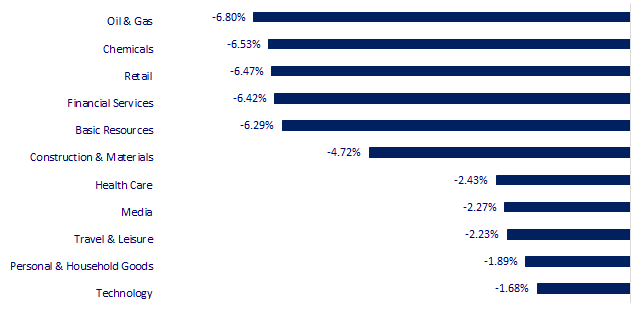

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,446.10

1D -0.97%

YTD -4.67%

3,036.13

1D -0.39%

YTD -16.58%

2,402.23

1D -0.91%

YTD -19.32%

16,081.04

1D -1.70%

YTD -31.27%

3,173.79

1D 0.26%

YTD 1.60%

1,621.24

1D -0.01%

YTD -2.19%

92.61

1D 0.12%

YTD 21.06%

1,710.25

1D -0.08%

YTD -6.07%

At the end of the session, Asian stock markets such as Japan, Korea, China and Hong Kong all dropped on the forecast of upcoming inflation data providing clues about the severity of the interest rate hikes in the future, as well as the recent events related to the bankruptcy risk of FTX crypto exchange.

VIETNAM ECONOMY

4.82%

1D (bps) -25

YTD (bps) 401

7.40%

YTD (bps) 180

4.90%

YTD (bps) 389

4.94%

1D (bps) -2

YTD (bps) 294

24,870

1D (%) 0.00%

YTD (%) 8.41%

25,533

1D (%) -0.48%

YTD (%) -3.53%

3,498

1D (%) -0.14%

YTD (%) -4.37%

The SBV net withdrew nearly VND15,200 billion on November 9 when the loans secured by valuable papers matured. Previously, SBV also withdrew VND3,253 billion from the system in the session of November 8. This action has occurred when interbank interest rates have continuously dropped in recent sessions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The state budget is more than VND245,000 billion in 10 months of 2022;

- The selling price hit the ceiling, big banks continued to raise the buying price in USD;

- There will be a North-South railway with a speed of 250 km/h;

- Rejected to buy back by Binance, FTX is on the verge of bankruptcy;

- Investors predict that the Fed will soon raise interest rates to 6% like during the dotcom bubble event;

- China supports real estate enterprises to issue bonds.

VN30

BANK

72,800

1D -1.62%

5D -0.27%

Buy Vol. 1,373,250

Sell Vol. 1,551,221

34,700

1D -4.01%

5D 5.15%

Buy Vol. 3,802,542

Sell Vol. 4,790,096

22,750

1D -6.95%

5D -3.60%

Buy Vol. 13,350,783

Sell Vol. 16,573,330

22,750

1D -6.57%

5D -11.99%

Buy Vol. 10,697,599

Sell Vol. 11,326,610

16,300

1D -6.86%

5D -6.86%

Buy Vol. 32,998,573

Sell Vol. 44,415,483

15,800

1D -6.78%

5D -10.48%

Buy Vol. 24,325,975

Sell Vol. 30,790,276

14,600

1D -1.35%

5D -8.75%

Buy Vol. 4,453,356

Sell Vol. 6,642,351

19,900

1D -1.49%

5D -6.35%

Buy Vol. 3,993,110

Sell Vol. 4,746,592

15,150

1D -6.77%

5D -12.17%

Buy Vol. 52,952,587

Sell Vol. 59,411,370

17,500

1D -4.89%

5D -13.79%

Buy Vol. 6,598,747

Sell Vol. 9,000,070

20,000

1D -3.61%

5D -6.32%

Buy Vol. 8,845,338

Sell Vol. 8,956,692

BIDV: From the beginning of November, BIDV has continuously announced the auction of properties in many localities, the most prominent of which is a real estate in Ho Chi Minh City with more than 4 hectares wide. Specifically, the largest number of real estate auctioned by BIDV mainly concentrated in Nha Be district, Ho Chi Minh City, with a starting price of more than VND48 billion.

REAL ESTATE

44,950

1D -6.94%

5D -30.20%

Buy Vol. 332,019

Sell Vol. 38,183,328

19,000

1D -6.40%

5D -17.57%

Buy Vol. 2,463,872

Sell Vol. 2,751,199

28,150

1D -6.94%

5D -30.15%

Buy Vol. 175,757

Sell Vol. 80,932,031

NVL: According to Novaland, NVL's share price has dropped recently due to psychological factors in the stock market and affected by many macroeconomic conditions.

OIL & GAS

113,400

1D -2.58%

5D 1.80%

Buy Vol. 486,109

Sell Vol. 669,389

10,250

1D -5.53%

5D 1.49%

Buy Vol. 21,519,564

Sell Vol. 23,878,577

27,000

1D -6.57%

5D -3.78%

Buy Vol. 1,538,601

Sell Vol. 2,039,503

POW: In October, the total electricity output of PetroVietnam Power Corporation (PV Power) reached 1,003 billion kWh, revenue in the month was estimated at VND1,860 billion.

VINGROUP

53,000

1D -1.30%

5D -3.81%

Buy Vol. 2,367,620

Sell Vol. 2,689,459

43,950

1D -1.35%

5D -2.33%

Buy Vol. 5,207,876

Sell Vol. 5,520,966

24,800

1D -2.36%

5D -4.62%

Buy Vol. 2,249,595

Sell Vol. 2,914,641

VIC: VinFast was awarded the "Sustainable Enterprise" - ORIGIN Innovation Awards 2022.

FOOD & BEVERAGE

78,400

1D -3.09%

5D -2.00%

Buy Vol. 3,868,031

Sell Vol. 5,465,466

81,000

1D -6.90%

5D -5.15%

Buy Vol. 1,232,664

Sell Vol. 1,988,397

184,500

1D 0.00%

5D 1.37%

Buy Vol. 295,306

Sell Vol. 293,492

VNM: At the product announcement ceremony of the Vietnam National Brand in 2022, Vietnam Dairy Products Joint Stock Company (Vinamilk) was honored at this event for the 7th time in a row.

OTHERS

48,650

1D -5.17%

5D -7.16%

Buy Vol. 1,788,011

Sell Vol. 1,915,318

100,000

1D -0.60%

5D -2.63%

Buy Vol. 448,406

Sell Vol. 329,454

73,000

1D -1.35%

5D -1.48%

Buy Vol. 2,652,200

Sell Vol. 2,771,905

42,350

1D -6.92%

5D -14.44%

Buy Vol. 4,630,053

Sell Vol. 7,269,707

12,400

1D -6.77%

5D -12.98%

Buy Vol. 2,301,488

Sell Vol. 4,100,367

13,900

1D -6.71%

5D -15.76%

Buy Vol. 22,380,773

Sell Vol. 34,325,700

12,100

1D -6.92%

5D -20.39%

Buy Vol. 92,682,404

Sell Vol. 113,979,660

MWG: Market price slipped to the 18-month bottom, BOD of MWG massively signed up to buy MWG shares. According to the financial report of the 3rd quarter of 2022, MWG achieved net revenue of VND32,012 billion and profit after tax of VND906 billion, up 32% and 16% over the same period last year. Accumulated in the first 9 months, revenue and profit are VND102,816 billion and VND3,483 billion, respectively.

Market by numbers

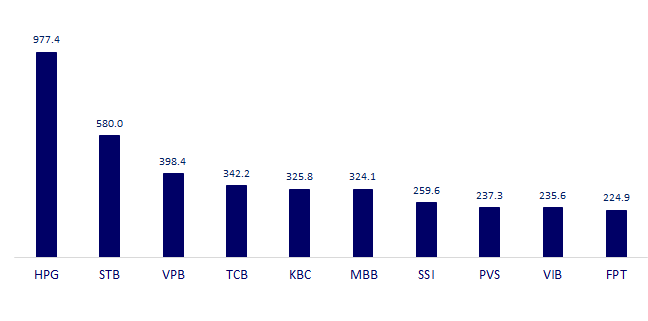

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

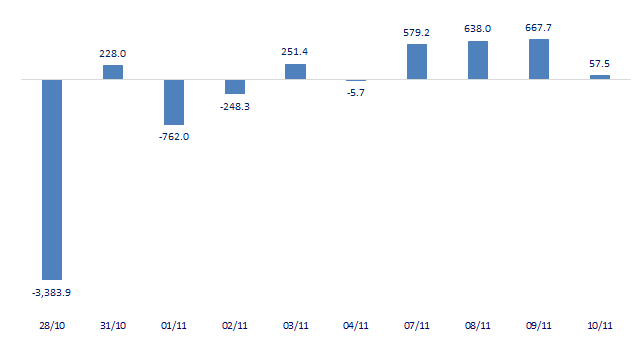

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

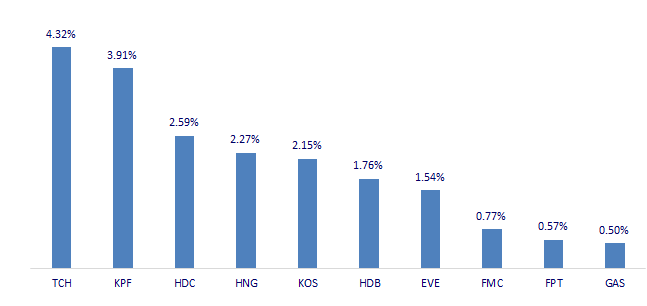

TOP INCREASES 3 CONSECUTIVE SESSIONS

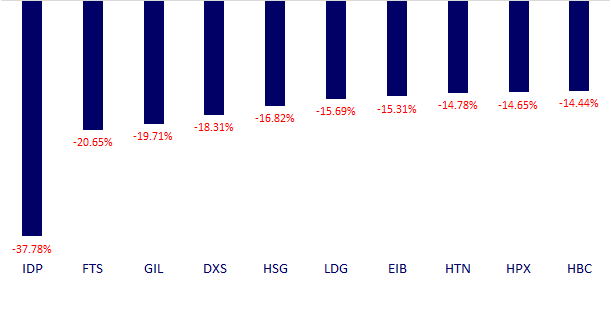

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.