Market Brief 16/11/2022

VIETNAM STOCK MARKET

942.90

1D 3.40%

YTD -37.07%

940.29

1D 3.93%

YTD -38.77%

183.45

1D 4.36%

YTD -61.30%

65.32

1D 3.19%

YTD -42.03%

690.97

1D 0.00%

YTD 0.00%

16,367.43

1D 44.95%

YTD -47.32%

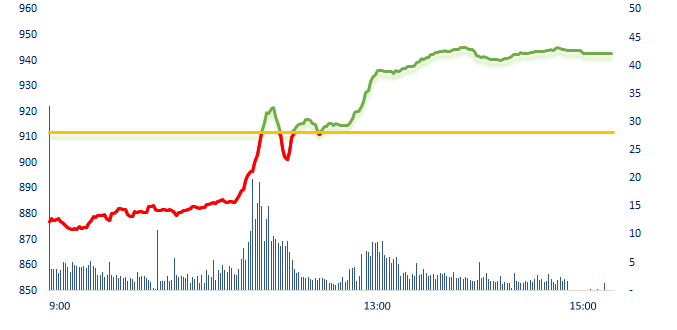

The market today recorded an emotional session, investors were dizzy with the market amplitude fluctuating between more than 70 points, from the deepest drop of nearly 40 points to an increase of 31 points at the end of the session. The liquidity was explosive, recording the highest trading volume since April.

ETF & DERIVATIVES

16,150

1D 5.56%

YTD -37.48%

11,050

1D 3.08%

YTD -38.92%

11,290

1D 3.67%

YTD -40.58%

12,200

1D 5.17%

YTD -46.72%

11,930

1D 6.61%

YTD -46.93%

20,300

1D 6.28%

YTD -27.63%

11,920

1D -4.64%

YTD -44.51%

935

1D 6.25%

YTD 0.00%

939

1D 6.89%

YTD 0.00%

949

1D 6.93%

YTD 0.00%

958

1D 6.99%

YTD 0.00%

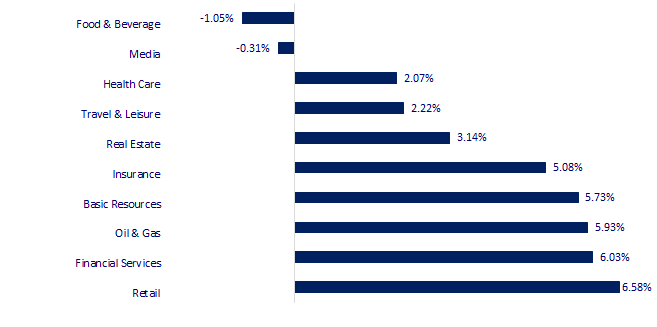

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

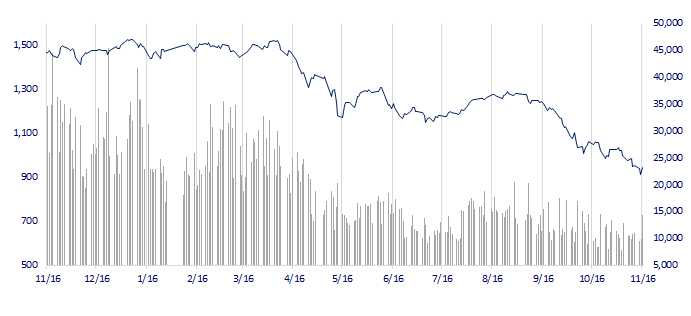

VNINDEX (12M)

GLOBAL MARKET

28,028.30

1D 0.14%

YTD -2.65%

3,119.98

1D -0.45%

YTD -14.28%

2,477.45

1D -0.12%

YTD -16.80%

18,256.48

1D -0.47%

YTD -21.97%

3,266.17

1D -0.28%

YTD 4.56%

1,619.98

1D -0.58%

YTD -2.27%

94.37

1D 0.75%

YTD 23.36%

1,786.75

1D 0.41%

YTD -1.87%

Asian stocks dropped on Wednesday after a blast in Poland that Ukraine and Polish authorities said was caused by a Russian-made missile. Worries over a potential ratcheting up of geopolitical tensions spurred index of Asia-Pacific shares fell. In addition, the struggling property sector weighed on the markets, with China's new home prices falling at their fastest pace in more than seven years in October, weighed down by COVID 19-related curbs and industry-wide problems.

VIETNAM ECONOMY

4.65%

1D (bps) 40

YTD (bps) 384

7.40%

YTD (bps) 180

4.92%

1D (bps) -1

YTD (bps) 391

4.92%

1D (bps) -8

YTD (bps) 292

24,861

1D (%) 0.00%

YTD (%) 8.37%

26,556

1D (%) 0.77%

YTD (%) 0.33%

3,570

1D (%) -0.47%

YTD (%) -2.41%

In the session on November 15, SBV reopened the bill issuance after nearly 2 weeks of pause. Specifically, SBV has successfully offered nearly VND20,000 billion of bills to 6 commercial banks, with an interest rate of 6%/year. Notably, this time the bill has a maturity of 28 days, much longer than the 14-day and 7-day maturities in the previous issuances.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- National power development plan VIII: Proposing to remove more than 1,600MW of solar power by 2030;

- The National Assembly stated 2 reasons for the delay in disbursement of public investment capital;

- The trade surplus is estimated at USD12-14 billion in 2022;

- UK inflation accelerates to 41-year high of 11.1%;

- China’s refunded more taxes in 2022 than last 3 years combined;

- Weak yen puts Japan’s economy into reverse in third quarter.

VN30

BANK

75,100

1D 0.13%

5D 1.49%

Buy Vol. 4,066,216

Sell Vol. 3,507,393

35,700

1D 6.89%

5D -1.24%

Buy Vol. 3,566,778

Sell Vol. 2,474,893

24,800

1D 5.98%

5D 1.43%

Buy Vol. 20,593,676

Sell Vol. 22,171,494

22,100

1D 6.76%

5D -9.24%

Buy Vol. 25,027,486

Sell Vol. 22,747,409

15,500

1D 5.80%

5D -11.43%

Buy Vol. 39,252,889

Sell Vol. 44,699,216

15,100

1D 6.71%

5D -10.91%

Buy Vol. 46,018,558

Sell Vol. 31,960,086

14,900

1D 6.43%

5D 0.68%

Buy Vol. 6,704,881

Sell Vol. 6,106,547

20,850

1D 4.77%

5D 3.22%

Buy Vol. 9,639,069

Sell Vol. 10,589,777

16,150

1D 6.95%

5D -0.62%

Buy Vol. 53,810,937

Sell Vol. 39,915,104

18,000

1D 5.88%

5D -2.17%

Buy Vol. 5,964,407

Sell Vol. 5,584,675

20,400

1D 6.81%

5D -1.69%

Buy Vol. 13,061,093

Sell Vol. 10,083,380

Deposit interest rates continued to increase and the credit room was almost full, which put great pressure on lending rates of banks. Specifically at ACB, the base interest rate of this bank was raised from 8% by 0.5% to 8.5%; SeABank is recording a base interest rate of 9.9%, up 0.3% from the previous month. At VPBank, mortgage lending interest rates for retail customers have also been raised. The lowest base interest rate is 9.7%/year for terms from 1-3 months (1-month interest adjustment period) and the highest is 11.7%/year for terms of more than 15 years (3 months interest adjustment period).

REAL ESTATE

33,750

1D -6.90%

5D -30.12%

Buy Vol. 176,947

Sell Vol. 62,919,461

20,250

1D 4.38%

5D -0.25%

Buy Vol. 5,538,302

Sell Vol. 6,166,681

21,150

1D -6.83%

5D -30.08%

Buy Vol. 99,614

Sell Vol. 145,420,369

PDR: PDR uses the ownership and exploitation rights of assets belonging to the "Cach mang thang Tam" 239 Project (HCMC) by AKYN as an investor to add collateral for bonds issuances in 2021/2022.

OIL & GAS

117,000

1D 4.93%

5D 0.52%

Buy Vol. 492,779

Sell Vol. 594,980

10,100

1D 5.43%

5D -6.91%

Buy Vol. 17,084,782

Sell Vol. 19,505,802

26,000

1D 5.48%

5D -10.03%

Buy Vol. 3,170,529

Sell Vol. 3,475,658

The Ministry of Industry and Trade said that it will focus on directing petrol and oil wholesalers to fully supply gasoline to the market, ensuring that there is no shortage of petrol and oil.

VINGROUP

60,400

1D 5.96%

5D 12.48%

Buy Vol. 3,481,978

Sell Vol. 2,977,978

44,900

1D 3.46%

5D 0.79%

Buy Vol. 5,536,053

Sell Vol. 5,569,082

26,550

1D 6.41%

5D 4.53%

Buy Vol. 3,878,402

Sell Vol. 3,429,727

VIC: VIC had the strongest increase since the beginning of the month at 60,400 VND/share, leading to Mr.Pham Nhat Vuong's assets increasing to VND16,000 billion compared to November 10.

FOOD & BEVERAGE

74,500

1D -3.25%

5D -7.91%

Buy Vol. 4,805,356

Sell Vol. 5,932,823

90,900

1D 1.68%

5D 4.48%

Buy Vol. 1,816,704

Sell Vol. 1,771,930

180,800

1D -3.06%

5D -2.01%

Buy Vol. 354,312

Sell Vol. 348,267

VNM and SAB were the two stocks that fell in the VN30 today, while these are also the two stocks that have still maintained their upward momentum, since the beginning of June until now.

OTHERS

47,300

1D 6.77%

5D -7.80%

Buy Vol. 2,800,543

Sell Vol. 2,499,482

101,900

1D 0.10%

5D 1.29%

Buy Vol. 540,897

Sell Vol. 606,477

69,300

1D 5.16%

5D -6.35%

Buy Vol. 4,523,717

Sell Vol. 4,838,557

40,450

1D 6.87%

5D -11.10%

Buy Vol. 12,765,439

Sell Vol. 14,051,482

10,700

1D 7.00%

5D -19.55%

Buy Vol. 5,346,296

Sell Vol. 3,602,408

14,850

1D 6.83%

5D -0.34%

Buy Vol. 52,745,255

Sell Vol. 38,030,792

13,350

1D 6.80%

5D 2.69%

Buy Vol. 93,551,788

Sell Vol. 44,141,993

BVH: According to the Insurance Association of Vietnam in the first 9 months of 2022, total life insurance premium revenue is estimated at VND127,511 billion, up 16.2% over the same period in 2021. In which, Bao Viet ranks in the top 1 life insurance market share with the rate of 19.25%, premium revenue reached VND24,457 billion.

Market by numbers

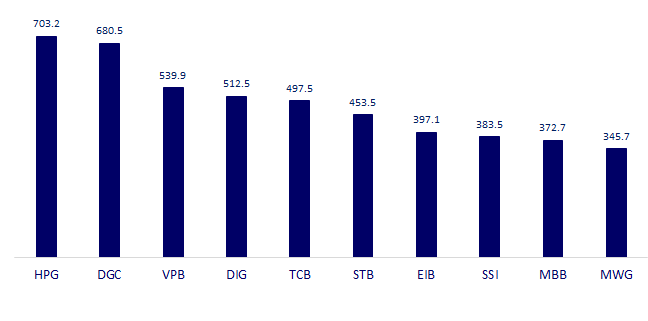

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

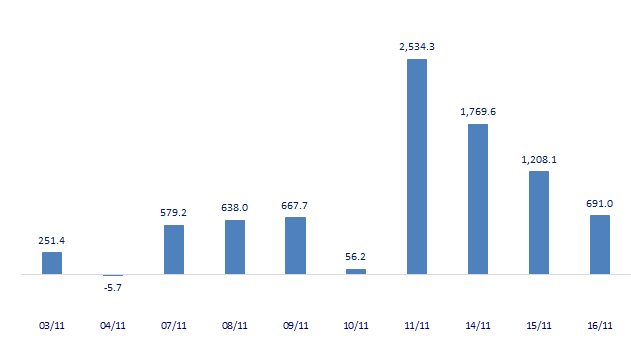

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

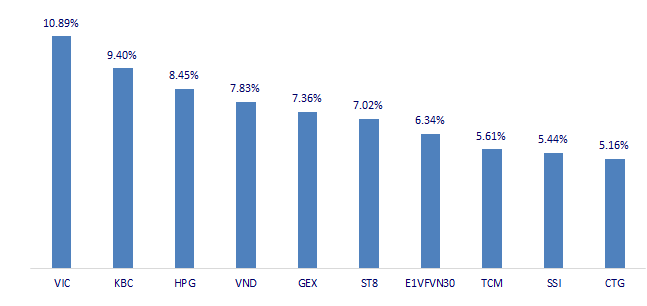

TOP INCREASES 3 CONSECUTIVE SESSIONS

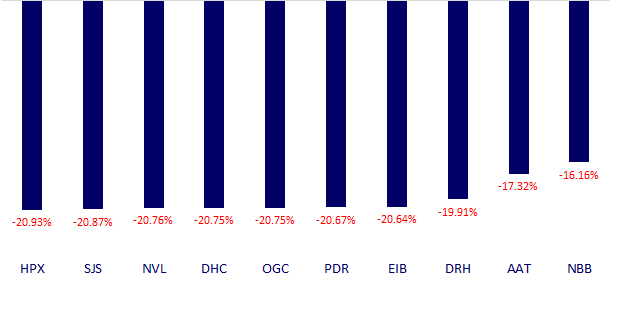

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.