Market brief 25/11/2022

VIETNAM STOCK MARKET

971.46

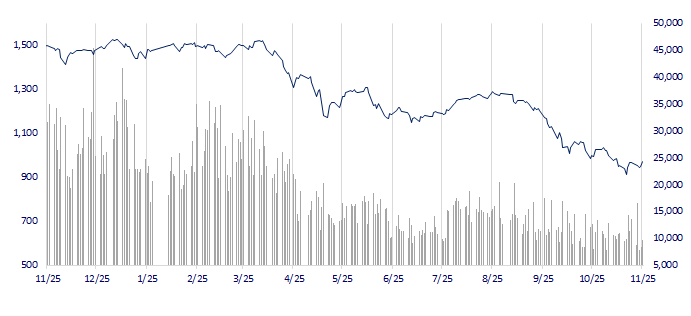

1D 2.51%

YTD -35.16%

967.49

1D 2.84%

YTD -37.00%

196.77

1D 2.90%

YTD -58.49%

68.41

1D 1.33%

YTD -39.29%

986.06

1D 0.00%

YTD 0.00%

10,717.71

1D 14.95%

YTD -65.51%

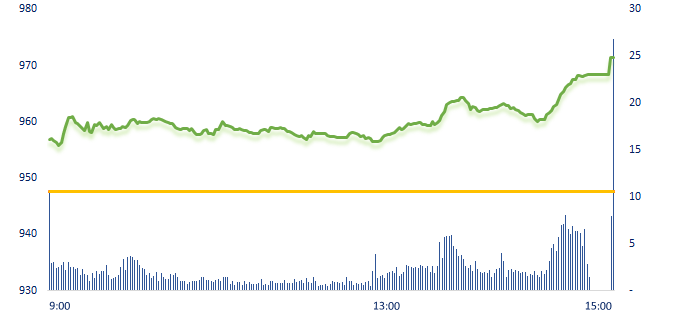

VN-Index recovered strongly, foreign investors continued to buy more than VND1,000 billion of shares. VIC, BID and VHM were the most positive in today's session, contributing a total of more than 8 points to the market. In contrast, NVL, GAS, VHC,… are the most negative stocks.

ETF & DERIVATIVES

16,410

1D 2.43%

YTD -36.47%

11,420

1D 2.88%

YTD -36.87%

11,800

1D 1.99%

YTD -37.89%

13,000

1D 0.31%

YTD -43.23%

12,840

1D 4.14%

YTD -42.88%

20,680

1D 0.98%

YTD -26.27%

12,030

1D 2.91%

YTD -43.99%

955

1D 2.92%

YTD 0.00%

958

1D 3.02%

YTD 0.00%

966

1D 3.39%

YTD 0.00%

969

1D 3.21%

YTD 0.00%

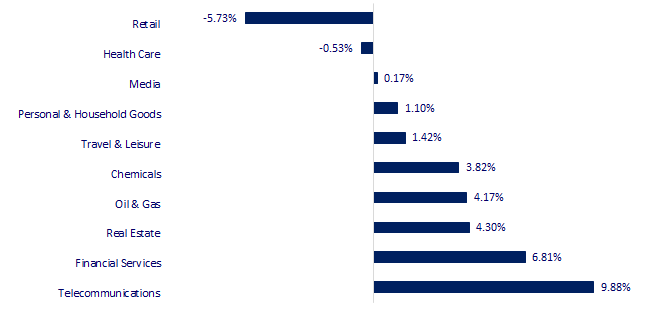

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,283.03

1D -0.35%

YTD -1.77%

3,101.69

1D 0.40%

YTD -14.78%

2,437.86

1D -0.14%

YTD -18.13%

17,573.58

1D -0.49%

YTD -24.89%

3,244.55

1D -0.26%

YTD 3.87%

1,620.84

1D -0.17%

YTD -2.22%

86.75

1D 1.46%

YTD 13.40%

1,751.65

1D -0.26%

YTD -3.80%

At the end of the session, Asian markets mostly dropped. Hong Kong-listed technology stocks led declines among Chinese shares as investors weighed recent gains against an upswing in Covid-19 infections.

VIETNAM ECONOMY

5.97%

1D (bps) 1

YTD (bps) 516

7.40%

YTD (bps) 180

4.88%

1D (bps) -3

YTD (bps) 387

4.91%

1D (bps) -7

YTD (bps) 291

24,852

1D (%) -0.01%

YTD (%) 8.33%

26,546

1D (%) -0.15%

YTD (%) 0.29%

3,526

1D (%) -0.45%

YTD (%) -3.61%

This morning, SBV continued to reduce the selling price of USD, from VND 24,850 to VND 24,840. This is the 3rd time SBV has reduced the USD selling rate this month, the 2 previous times both reduced by VND10 each. The decrease of USD exchange rate by SBV took place after two sharp increases in operating interest rates on September 23 and October 25, each increasing 1% per year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Forbes: Vietnam's GDP per capita has grown most impressively in the world over the past 15 years;

- Prime Minister: The issue of corporate bonds cannot be ignored;

- HoREA proposes to extend the bond term by 1 year, allowing non-specialist investors to buy individual bonds;

- Germany will increase debt in response to the energy crisis and recession;

- EU Energy Ministers still disagree on gas price ceiling;

- China ramps up monetary stimulus as growth outlook bleak.

VN30

BANK

73,100

1D 0.14%

5D -4.44%

Buy Vol. 2,211,529

Sell Vol. 2,655,050

40,000

1D 5.26%

5D 11.27%

Buy Vol. 4,231,650

Sell Vol. 4,813,502

25,800

1D 4.88%

5D 4.45%

Buy Vol. 21,196,756

Sell Vol. 22,617,090

23,000

1D 3.84%

5D 1.32%

Buy Vol. 8,686,401

Sell Vol. 8,798,754

15,500

1D 2.65%

5D 0.00%

Buy Vol. 15,773,605

Sell Vol. 19,217,547

16,200

1D 3.18%

5D 3.18%

Buy Vol. 24,560,423

Sell Vol. 19,227,976

14,950

1D 1.01%

5D -0.33%

Buy Vol. 1,595,379

Sell Vol. 2,516,164

20,300

1D 1.50%

5D -1.46%

Buy Vol. 4,803,599

Sell Vol. 5,842,119

18,900

1D 3.85%

5D 10.53%

Buy Vol. 48,147,749

Sell Vol. 42,100,323

18,300

1D 2.52%

5D -0.54%

Buy Vol. 5,476,393

Sell Vol. 5,474,458

21,500

1D 2.38%

5D 1.65%

Buy Vol. 4,969,899

Sell Vol. 5,965,615

VCB: On the evening of November 24, Vietcombank released information about the reduction of lending interest rate. Accordingly, this bank decided to reduce the interest rate up to 1%/year for VND loan to existing corporate and individual customers from November 1, 2022 to the end of the year.

REAL ESTATE

20,450

1D -6.83%

5D -30.09%

Buy Vol. 7,362,006

Sell Vol. 102,572,725

22,450

1D 6.90%

5D 1.58%

Buy Vol. 6,882,834

Sell Vol. 5,733,308

12,900

1D -6.86%

5D -29.70%

Buy Vol. 4,600,087

Sell Vol. 165,041,072

PDR: Phat Dat has just announced the finalization of the 9th issued bond in 2021 with total par value of VND150 billion.

OIL & GAS

104,800

1D -0.95%

5D -8.31%

Buy Vol. 716,103

Sell Vol. 658,121

10,850

1D 2.36%

5D 7.43%

Buy Vol. 15,821,450

Sell Vol. 16,167,380

28,250

1D 2.73%

5D 12.55%

Buy Vol. 2,225,516

Sell Vol. 2,314,047

Despite forecasts of reduced demand due to the economic recession, crude oil price is considered to hardly fall when the freight cost between ports around the world increases.

VINGROUP

65,000

1D 6.56%

5D -0.91%

Buy Vol. 2,986,114

Sell Vol. 2,886,424

47,000

1D 4.44%

5D -2.08%

Buy Vol. 4,729,658

Sell Vol. 4,952,655

27,400

1D 1.11%

5D -0.72%

Buy Vol. 1,665,010

Sell Vol. 2,147,704

VIC: On the morning of November 25, Prime Minister Pham Minh Chinh attended the export ceremony of the first batch of 999 VF electric cars to the US market from MPC Port, Hai Phong.

FOOD & BEVERAGE

82,200

1D 1.23%

5D 6.75%

Buy Vol. 4,551,582

Sell Vol. 5,792,999

94,000

1D 5.62%

5D -1.26%

Buy Vol. 1,326,443

Sell Vol. 1,445,902

180,000

1D -0.28%

5D 0.45%

Buy Vol. 202,512

Sell Vol. 313,427

MSN: Masan has been in the top 15 for 3 years in "Listed companies with good financial management capacity".

OTHERS

46,900

1D 2.68%

5D 3.53%

Buy Vol. 1,230,589

Sell Vol. 932,637

102,000

1D 0.79%

5D -0.20%

Buy Vol. 325,195

Sell Vol. 372,366

72,000

1D 2.13%

5D 0.70%

Buy Vol. 1,849,772

Sell Vol. 2,452,099

37,800

1D 0.27%

5D -10.32%

Buy Vol. 6,275,208

Sell Vol. 4,639,301

13,500

1D 3.85%

5D 11.11%

Buy Vol. 4,201,713

Sell Vol. 4,155,590

17,100

1D 6.88%

5D 5.23%

Buy Vol. 42,210,186

Sell Vol. 37,055,450

15,300

1D 6.62%

5D 1.32%

Buy Vol. 45,962,959

Sell Vol. 44,187,522

FPT: According to 10-month business results announcement, despite the sharp decline of JPY, revenue from IT services for foreign markets still grew by 30% over the same period and accounting for 43.4% of the total revenue, equivalent to VND15,249 billion. The volume of new orders also increased sharply over the same period, reaching VND18,266 billion (up 40.5%).

Market by numbers

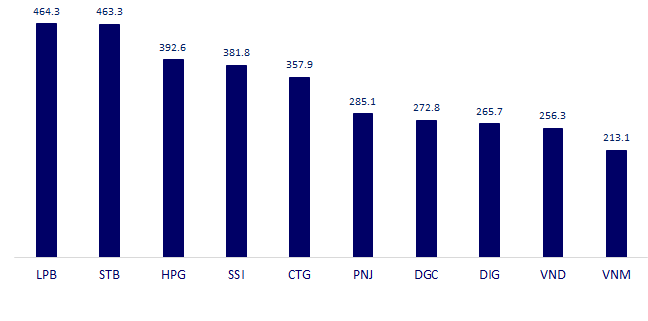

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

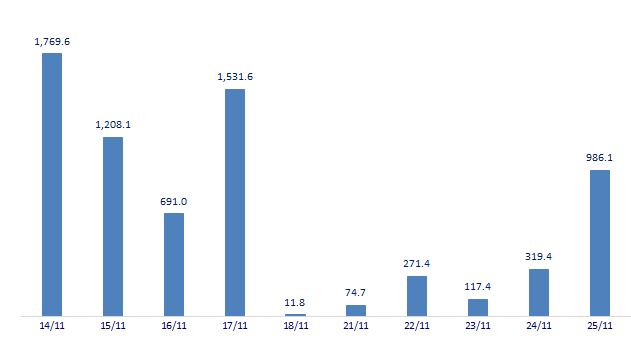

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

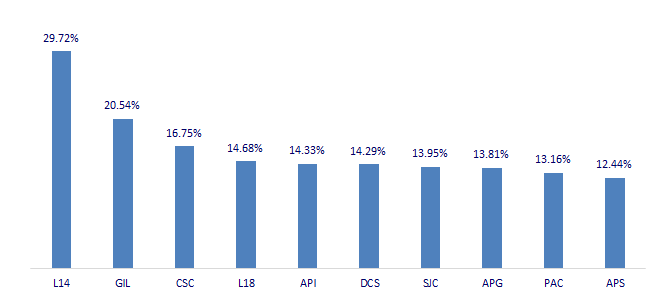

TOP INCREASES 3 CONSECUTIVE SESSIONS

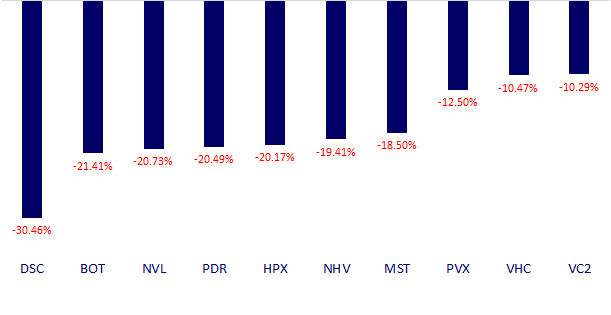

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.