Market Brief 07/12/2022

VIETNAM STOCK MARKET

1,041.02

1D -0.73%

YTD -30.52%

1,047.58

1D -0.61%

YTD -31.79%

209.93

1D -1.35%

YTD -55.71%

70.45

1D -0.80%

YTD -37.48%

1,031.84

1D 0.00%

YTD 0.00%

16,228.95

1D -39.85%

YTD -47.77%

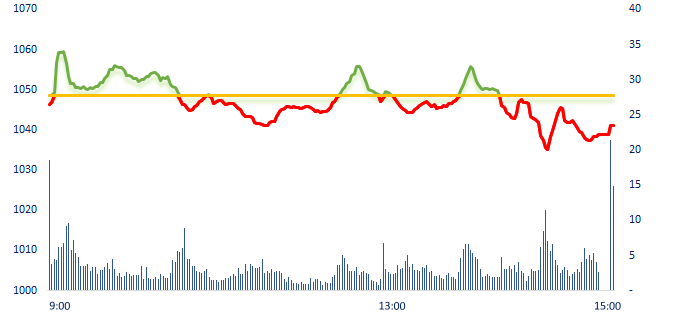

In the session of December 7, VN-Index continued to decrease with the liquidity dropping by about 40% compared to yesterday. Most of banking stocks dropped sharply, which was the group that put pressure on the main index but attracted foreign capital flows today.

ETF & DERIVATIVES

18,000

1D -0.55%

YTD -30.31%

12,330

1D -1.36%

YTD -31.84%

12,850

1D -1.15%

YTD -32.37%

15,700

1D 5.80%

YTD -31.44%

14,200

1D -3.40%

YTD -36.83%

22,600

1D -0.88%

YTD -19.43%

13,090

1D -1.95%

YTD -39.06%

1,026

1D -0.27%

YTD 0.00%

1,033

1D -0.01%

YTD 0.00%

1,045

1D 0.29%

YTD 0.00%

1,053

1D 0.70%

YTD 0.00%

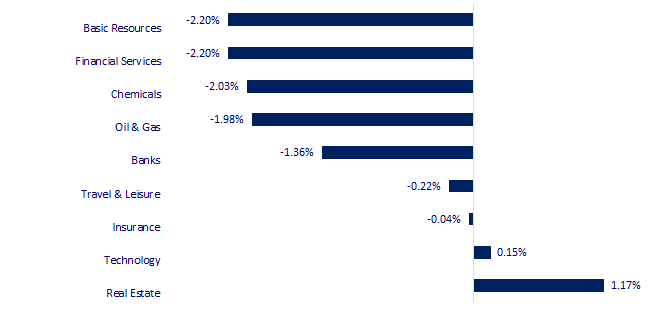

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

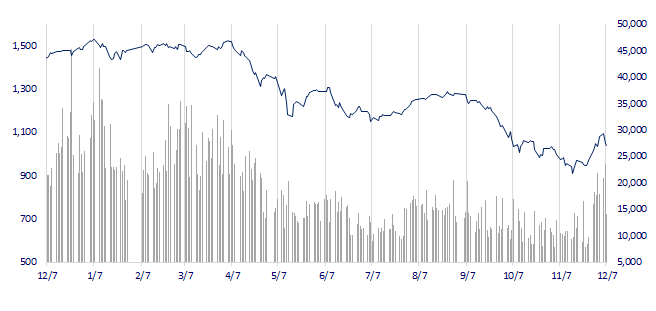

VNINDEX (12M)

GLOBAL MARKET

27,686.40

1D -0.72%

YTD -3.84%

3,199.62

1D -0.40%

YTD -12.09%

2,382.81

1D -0.43%

YTD -19.98%

18,814.82

1D -3.22%

YTD -19.59%

3,225.45

1D -0.83%

YTD 3.26%

1,622.28

1D -0.65%

YTD -2.13%

78.57

1D -1.03%

YTD 2.71%

1,785.05

1D 0.22%

YTD -1.96%

Asian stocks eased on Wednesday after a chorus of Wall Street bankers warned about a likely recession ahead, tempering optimism about China's major shift in its tough zero-COVID policy.

VIETNAM ECONOMY

5.50%

1D (bps) 8

YTD (bps) 469

7.40%

YTD (bps) 180

4.82%

1D (bps) -11

YTD (bps) 381

4.95%

1D (bps) -2

YTD (bps) 295

24,110

1D (%) -0.19%

YTD (%) 5.10%

25,510

1D (%) -1.28%

YTD (%) -3.62%

3,495

1D (%) -0.23%

YTD (%) -4.46%

In the session of December 7, SBV provided more than VND7,000 billion to 11 commercial banks through open market operation (OMO). In which, the value of the pledged valuable papers is more than VND4,000 billion with a term of 14 days, the interest rate is 6%/year. The value of the transaction with a term of 91 days is about VND3,000 billion, the interest rate is 6.33%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Binh Duong attracts nearly USD40 billion of foreign investment capital;

- The number of international visitors to Vietnam in November sets 'record' after pandemic;

- Samsung Electronics will raise its total investment in Vietnam to USD20 billion;

- Japan's tourism restart stirs hope of service-sector recovery;

- The World Bank warns a new wave of national debt;

- China's trade suffers worst slump in 2.5 years as COVID woes.

VN30

BANK

78,500

1D -1.88%

5D -3.09%

Buy Vol. 2,089,634

Sell Vol. 2,308,281

39,000

1D -0.26%

5D -5.11%

Buy Vol. 3,039,521

Sell Vol. 3,471,175

27,350

1D 1.30%

5D 0.37%

Buy Vol. 8,457,612

Sell Vol. 9,042,721

26,400

1D -2.40%

5D 1.93%

Buy Vol. 12,549,461

Sell Vol. 12,171,117

16,200

1D -4.14%

5D -3.57%

Buy Vol. 43,423,710

Sell Vol. 39,089,477

17,300

1D -2.26%

5D -0.57%

Buy Vol. 26,326,085

Sell Vol. 22,251,881

15,900

1D -3.05%

5D 2.25%

Buy Vol. 2,913,080

Sell Vol. 3,555,605

20,950

1D -3.01%

5D -4.77%

Buy Vol. 13,679,230

Sell Vol. 13,689,610

20,300

1D -2.17%

5D 1.50%

Buy Vol. 55,812,440

Sell Vol. 45,921,608

20,450

1D 0.25%

5D 0.99%

Buy Vol. 8,703,209

Sell Vol. 9,239,093

22,300

1D 0.00%

5D 0.90%

Buy Vol. 5,321,241

Sell Vol. 6,160,729

TCB: Techcombank has just sent a written request to shareholders on the purchase of TCBS's private placement shares with a total value of VND10,038 billion. The collection of shareholders' opinions will be closed on December 17. Before that, TCBS plans to offer 105 million shares to Techcombank. The offering price is expected to be 95,600 VND/share, and the total amount from the offering is more than VND10,038 billion.

REAL ESTATE

19,200

1D -6.80%

5D -17.77%

Buy Vol. 25,198,779

Sell Vol. 85,379,237

29,900

1D 1.18%

5D 9.12%

Buy Vol. 4,541,943

Sell Vol. 5,253,790

15,800

1D 1.94%

5D 15.75%

Buy Vol. 35,616,814

Sell Vol. 37,479,794

PDR: Since the beginning of Q4 until now, PDR has settled a total of more than VND1,300 billion loans and bonds buyback before maturity date.

OIL & GAS

106,800

1D -2.47%

5D -3.09%

Buy Vol. 711,914

Sell Vol. 664,527

10,950

1D 0.46%

5D -6.01%

Buy Vol. 24,865,380

Sell Vol. 16,299,249

29,200

1D -3.31%

5D -1.02%

Buy Vol. 1,390,493

Sell Vol. 1,747,742

GAS: On December 7, foreign investors net sold GAS shares with a value of about VND15 billion, ranked second after VCB.

VINGROUP

71,200

1D 6.91%

5D 2.30%

Buy Vol. 12,787,693

Sell Vol. 11,088,276

55,500

1D 0.91%

5D 1.83%

Buy Vol. 4,991,885

Sell Vol. 5,117,352

29,500

1D 0.51%

5D -3.44%

Buy Vol. 3,306,578

Sell Vol. 3,706,606

VIC: VinFast said on Tuesday it had filed for an IPO in the U.S to list on the Nasdaq under ticker symbol "VFS".

FOOD & BEVERAGE

82,500

1D 0.00%

5D -0.36%

Buy Vol. 2,777,922

Sell Vol. 3,464,065

100,000

1D -1.96%

5D -1.96%

Buy Vol. 1,081,413

Sell Vol. 1,362,675

179,000

1D 0.28%

5D -0.56%

Buy Vol. 353,712

Sell Vol. 379,583

VNM: Among the Top 20 VNSI stocks of HoSE, the G factor in Vinamilk's total ESG score (Environmental, Social, Governance) is up to 96%, higher than the industry average and VN100.

OTHERS

48,300

1D 0.63%

5D -0.31%

Buy Vol. 1,564,087

Sell Vol. 1,364,898

106,000

1D 0.00%

5D 2.91%

Buy Vol. 546,634

Sell Vol. 557,433

76,500

1D 0.66%

5D 2.55%

Buy Vol. 1,823,806

Sell Vol. 1,639,680

44,850

1D 1.13%

5D 1.70%

Buy Vol. 5,794,890

Sell Vol. 4,506,628

14,000

1D -3.78%

5D -1.41%

Buy Vol. 3,568,866

Sell Vol. 3,658,598

19,250

1D -1.53%

5D 0.00%

Buy Vol. 43,965,374

Sell Vol. 41,277,553

18,250

1D -1.88%

5D -0.82%

Buy Vol. 73,721,890

Sell Vol. 63,330,273

MWG: As of November 30, the retail system of An Khang pharmacy recorded 510 stores, down 19 stores compared to the peak in October 2022. Immediately after raising its ownership to 100% in An Khang, MWG announced an ambitious plan with this pharmacy chain: increasing the number of retail stores from 178 to 800 by the end of 2022. However, after reached 529 stores, this pharmacy chain showed signs of shrinking.

Market by numbers

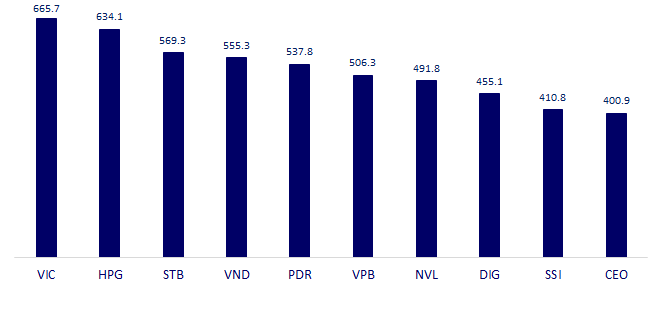

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

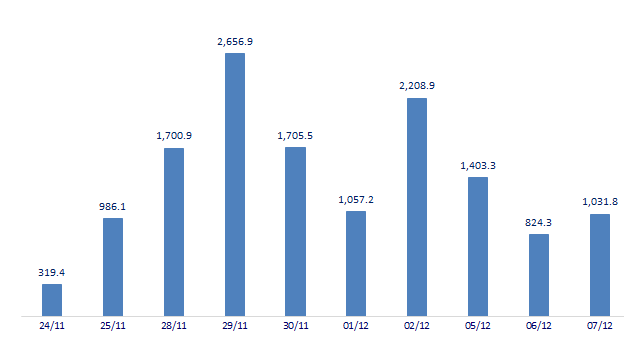

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

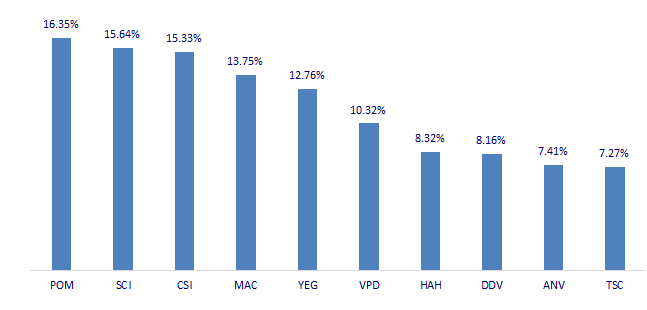

TOP INCREASES 3 CONSECUTIVE SESSIONS

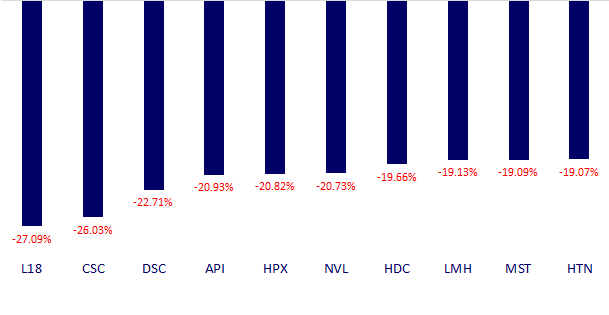

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.