Market brief 12/12/2022

VIETNAM STOCK MARKET

1,032.07

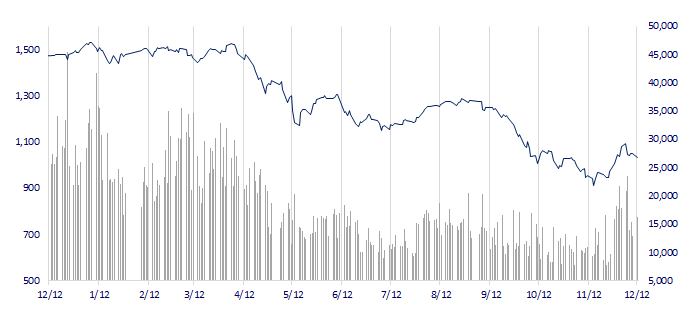

1D -1.88%

YTD -31.12%

1,037.42

1D -2.60%

YTD -32.45%

210.53

1D -2.98%

YTD -55.58%

71.50

1D -0.14%

YTD -36.55%

343.89

1D 0.00%

YTD 0.00%

18,671.99

1D 21.29%

YTD -39.91%

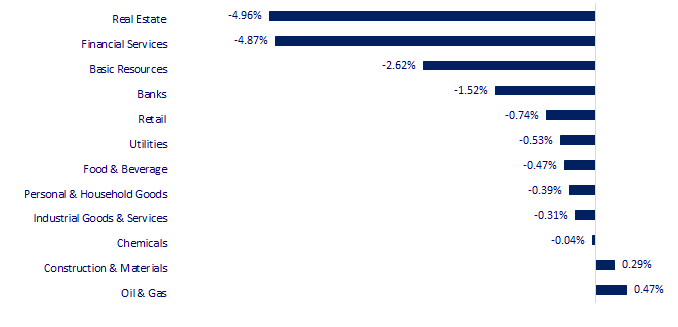

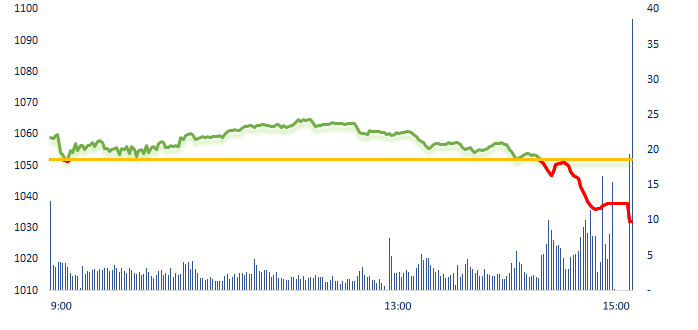

Negative at the end of the session, VN-Index dropped sharply today. Many stocks in sectors such as real estate, securities, steel,... suffered from strong selling pressure after a hot rally from the bottom. Foreign net buying value continued to decrease compared to previous sessions.

ETF & DERIVATIVES

17,800

1D -2.09%

YTD -31.09%

12,240

1D -2.70%

YTD -32.34%

12,740

1D -4.07%

YTD -32.95%

15,000

1D -0.07%

YTD -34.50%

14,500

1D -2.55%

YTD -35.50%

22,630

1D -1.57%

YTD -19.32%

13,290

1D -1.48%

YTD -38.13%

1,021

1D -2.14%

YTD 0.00%

1,022

1D -2.52%

YTD 0.00%

1,032

1D -2.67%

YTD 0.00%

1,035

1D -3.25%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,842.33

1D -0.21%

YTD -3.30%

3,179.04

1D -0.87%

YTD -12.66%

2,373.02

1D -0.67%

YTD -20.31%

19,463.63

1D -2.20%

YTD -16.81%

3,239.66

1D -0.19%

YTD 3.71%

1,623.13

1D 0.00%

YTD -2.08%

75.29

1D -1.90%

YTD -1.58%

1,803.65

1D 0.03%

YTD -0.94%

At the end of the session, Asian stocks mostly fell on negative news about US PPI higher than expected in November as well as inflationary pressure which may affect the next move of FED.

VIETNAM ECONOMY

5.50%

1D (bps) 2

YTD (bps) 469

7.40%

YTD (bps) 180

4.91%

1D (bps) -2

YTD (bps) 390

4.95%

1D (bps) -3

YTD (bps) 295

23,905

1D (%) 0.74%

YTD (%) 4.21%

25,825

1D (%) 1.20%

YTD (%) -2.43%

3,478

1D (%) 0.52%

YTD (%) -4.92%

After 2 weeks of plunging, USD price at banks on December 12 reversed to increase strongly. This is the first strong increase of the exchange rate after 2 consecutive weeks of falling. From November 30 to December 9, the price of USD at banks decreased by VND 1,150-1,200, equivalent to a decrease of 4.6%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Gasoline price dropped sharply by 1,500 VND/liter, RON 92 was close to 20,000 VND/liter;

- Prime Minister: Vietnam wants to become an international logistics and distribution center;

- Resuming the Hong Kong - Hanoi route after nearly 3 years of hiatus;

- China continues to signal to ease 'Zero-COVID' policy;

- JPMorgan: Southeast Asian stocks will recover in the second half of 2023;

- The Fed's message on interest rates is in conflict with market expectations.

VN30

BANK

77,400

1D 0.13%

5D -8.94%

Buy Vol. 3,107,844

Sell Vol. 2,860,232

38,100

1D -2.81%

5D -7.64%

Buy Vol. 2,613,482

Sell Vol. 3,617,730

27,450

1D -2.14%

5D -4.02%

Buy Vol. 6,229,233

Sell Vol. 8,891,204

27,200

1D -3.72%

5D -6.21%

Buy Vol. 8,845,604

Sell Vol. 12,096,881

16,650

1D -1.48%

5D -8.26%

Buy Vol. 35,236,362

Sell Vol. 39,925,621

17,700

1D -2.75%

5D -6.84%

Buy Vol. 19,875,599

Sell Vol. 23,461,635

16,200

1D -3.57%

5D -4.42%

Buy Vol. 5,575,374

Sell Vol. 8,202,071

22,900

1D 1.78%

5D -1.08%

Buy Vol. 22,037,885

Sell Vol. 23,882,270

21,300

1D -4.91%

5D -4.48%

Buy Vol. 28,481,000

Sell Vol. 34,544,969

20,350

1D -2.86%

5D -7.08%

Buy Vol. 7,627,614

Sell Vol. 8,795,339

22,500

1D -2.39%

5D -4.66%

Buy Vol. 4,748,266

Sell Vol. 6,125,774

TCB: On December 8, Techcombank applied a new deposit interest rate. In this adjustment, the bank raised interest rates on both new open savings and revolving savings. In which, Techcombank tends to increase interest rates for regular customers and revolving savings accounts. Specifically, the highest interest rate for customers who prefer to deposit from VND3 billion, for the term of 6 months or more, regardless of whether new or revolving deposits, is 9.5%/year.

REAL ESTATE

17,800

1D 6.91%

5D -19.64%

Buy Vol. 65,038,653

Sell Vol. 6,990,439

27,950

1D -6.99%

5D -10.13%

Buy Vol. 4,347,633

Sell Vol. 6,843,262

15,500

1D -6.06%

5D -6.91%

Buy Vol. 27,733,967

Sell Vol. 32,625,874

NVL: Novaland's stock was "rescued", reaching the ceiling price in a decreasing session of VN-Index.

OIL & GAS

105,000

1D -0.94%

5D -7.24%

Buy Vol. 607,520

Sell Vol. 714,905

11,150

1D -0.45%

5D -3.04%

Buy Vol. 21,227,454

Sell Vol. 21,546,586

31,100

1D 2.30%

5D -2.96%

Buy Vol. 1,543,485

Sell Vol. 1,739,994

POW: In November 2022, PV Power has achieved electricity output of 1.45 billion kWh, accumulated 11 months of reaching 12.6 billion kWh.

VINGROUP

63,100

1D -6.93%

5D -7.34%

Buy Vol. 3,444,314

Sell Vol. 4,848,086

50,500

1D -6.65%

5D -13.38%

Buy Vol. 5,256,357

Sell Vol. 5,508,287

27,050

1D -6.40%

5D -14.26%

Buy Vol. 4,570,340

Sell Vol. 4,223,329

VIC: VinFast Singapore currently has 3 shareholders: Vingroup (51.52%), Vietnam Investment Group Joint Stock Company - VIG (33.48%) and Asian Star Trading & Investment (15%).

FOOD & BEVERAGE

78,500

1D -1.88%

5D -7.65%

Buy Vol. 4,658,250

Sell Vol. 5,001,003

97,000

1D 0.00%

5D -7.62%

Buy Vol. 1,266,860

Sell Vol. 1,398,835

178,300

1D 0.17%

5D -0.78%

Buy Vol. 335,128

Sell Vol. 380,507

SAB: Thai Beverage - which holds 54% of Sabeco's capital - seeks to diversify its business model when the prospects for the beer industry in Vietnam and Thailand are both negative.

OTHERS

48,500

1D 1.25%

5D -3.96%

Buy Vol. 1,636,823

Sell Vol. 1,750,036

111,400

1D -0.09%

5D 4.21%

Buy Vol. 591,832

Sell Vol. 697,387

77,000

1D -1.28%

5D -1.66%

Buy Vol. 2,078,768

Sell Vol. 2,428,954

45,900

1D -0.65%

5D -3.57%

Buy Vol. 5,196,928

Sell Vol. 6,563,650

14,800

1D -1.66%

5D -5.13%

Buy Vol. 4,976,987

Sell Vol. 5,585,347

19,150

1D -5.43%

5D -7.93%

Buy Vol. 41,839,063

Sell Vol. 51,965,181

18,600

1D -3.13%

5D -7.00%

Buy Vol. 57,865,644

Sell Vol. 65,542,932

HPG: Since the beginning of the year, Hoa Phat Dung Quat has exported more than 500,000 tons of B500B and 500B steel, accounting for 45% of Hoa Phat exported steel volume in the past 11 months. These are high quality steel grades certified by UKCares of BS4449 and CS2:2012 British standards.

Market by numbers

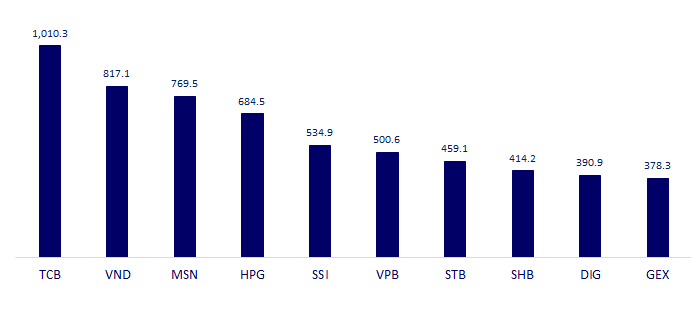

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

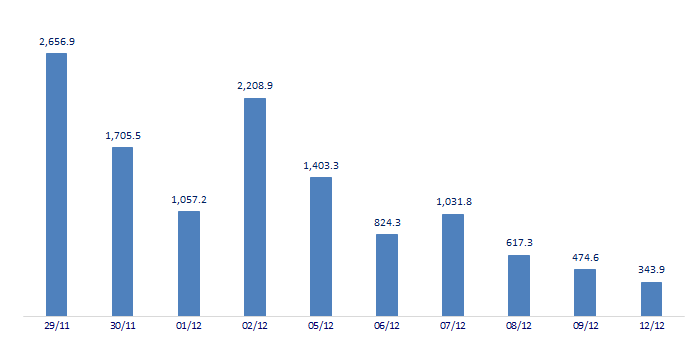

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

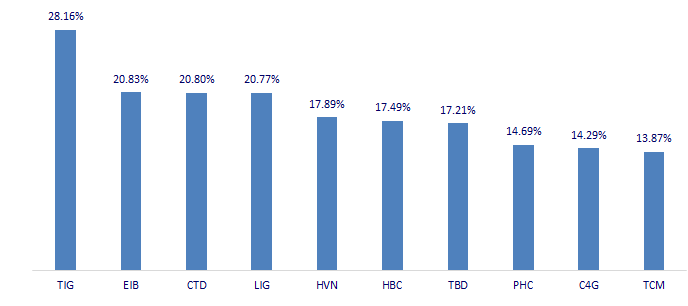

TOP INCREASES 3 CONSECUTIVE SESSIONS

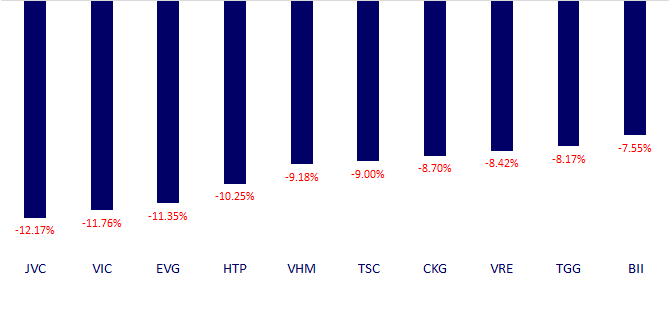

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.