Market Brief 14/12/2022

VIETNAM STOCK MARKET

1,050.43

1D 0.28%

YTD -29.89%

1,056.17

1D -0.02%

YTD -31.23%

213.21

1D -0.18%

YTD -55.02%

72.11

1D 0.38%

YTD -36.00%

23.72

1D 0.00%

YTD 0.00%

15,491.27

1D 2.17%

YTD -50.14%

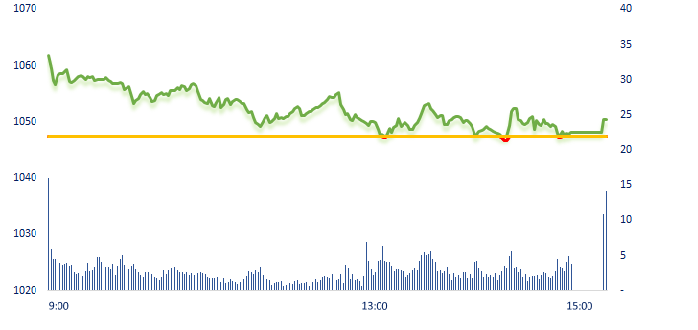

Vn-Index was struggling in the context that the market did not have much supporting information. The liquidity was low, volume on HOSE and HNX decreased by 9.24% and 10.4% respectively compared to yesterday, showing that investors are restricting their transactions in a market where there is not much information.

ETF & DERIVATIVES

17,960

1D 0.34%

YTD -30.47%

12,470

1D 0.24%

YTD -31.07%

13,000

1D 1.88%

YTD -31.58%

14,990

1D -0.07%

YTD -34.54%

15,050

1D 1.69%

YTD -33.05%

22,870

1D 0.22%

YTD -18.47%

13,400

1D 0.22%

YTD -37.62%

1,039

1D 0.36%

YTD 0.00%

1,047

1D 0.12%

YTD 0.00%

1,059

1D 0.51%

YTD 0.00%

1,060

1D 0.15%

YTD 0.00%

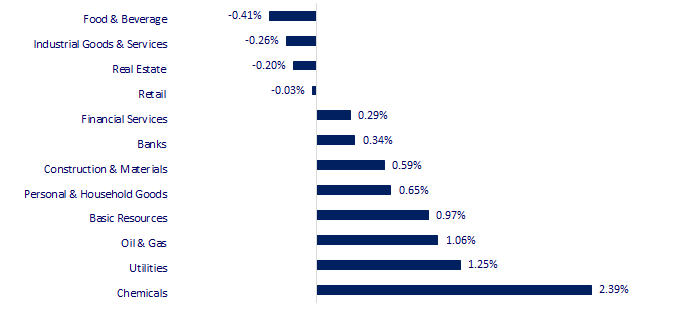

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

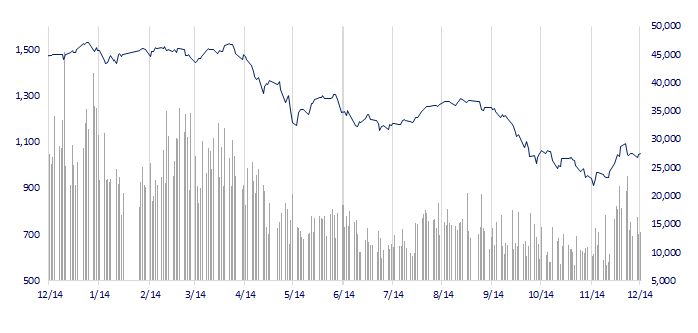

VNINDEX (12M)

GLOBAL MARKET

28,165.84

1D 0.75%

YTD -2.17%

3,176.53

1D 0.01%

YTD -12.73%

2,399.25

1D 1.13%

YTD -19.42%

19,673.45

1D 0.39%

YTD -15.92%

3,278.57

1D 0.22%

YTD 4.96%

1,633.36

1D 0.46%

YTD -1.46%

81.39

1D 1.42%

YTD 6.39%

1,820.25

1D -0.19%

YTD -0.03%

Asian stocks rose on Wednesday after data showed U.S. consumer prices barely rose in November, stoking hopes that inflation has peaked and interest rate increases will slow and eventually stop in 2023. Nervousness about policymakers' next moves, though, kept the mood in check ahead of a Federal Reserve meeting later in the day and central bank meetings in Britain and Europe on Thursday. Investors are also turning watchful on China's reopening.

VIETNAM ECONOMY

5.28%

1D (bps) -19

YTD (bps) 447

7.40%

YTD (bps) 180

4.85%

YTD (bps) 384

4.94%

1D (bps) 4

YTD (bps) 294

23,680

1D (%) -0.06%

YTD (%) 3.23%

25,828

1D (%) 0.17%

YTD (%) -2.42%

3,458

1D (%) -0.03%

YTD (%) -5.47%

Oil rallied for a second day after US inflation rose less than expected and bad weather delayed initial efforts to restart a key oil pipeline. Compounding bullish sentiment, China’s ambassador to the US said the country will continue relaxing its pandemic curbs and will welcome more international travelers soon, lifting demand prospects in the world’s top oil importer.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Bloomberg: Vietnam nears USD15 billion climate pact to curb coal dependence;

- In 2022, gross regional domestic product (GRDP) of Da Nang will increase by 14.05%;

- India and Vietnam could benefit as chipmakers shift away from China;

- IMF: Global public and private debt saw its biggest drop in 70 years;

- Billions of dollars of electronic components still find their way to Russia, despite the embargo;

- Beijing relaxes anti-epidemic: The number of people with fever increased 16 times.

VN30

BANK

78,800

1D 0.77%

5D 0.38%

Buy Vol. 1,933,123

Sell Vol. 1,746,366

38,800

1D 0.26%

5D -0.51%

Buy Vol. 1,440,825

Sell Vol. 1,985,797

27,900

1D -0.89%

5D 2.01%

Buy Vol. 4,539,525

Sell Vol. 9,249,958

28,800

1D 0.00%

5D 9.09%

Buy Vol. 11,643,508

Sell Vol. 15,823,256

17,050

1D -0.29%

5D 5.25%

Buy Vol. 26,558,634

Sell Vol. 35,045,510

18,150

1D 0.83%

5D 4.91%

Buy Vol. 15,176,618

Sell Vol. 24,012,345

16,450

1D 0.00%

5D 3.46%

Buy Vol. 5,477,327

Sell Vol. 6,018,847

22,800

1D -0.87%

5D 8.83%

Buy Vol. 10,555,564

Sell Vol. 12,196,712

23,250

1D 3.10%

5D 14.53%

Buy Vol. 35,324,077

Sell Vol. 42,246,146

20,600

1D -0.72%

5D 0.73%

Buy Vol. 8,817,755

Sell Vol. 8,775,526

23,150

1D 0.43%

5D 3.81%

Buy Vol. 5,712,489

Sell Vol. 6,248,620

The Asian Banker has just released a ranking of the 500 strongest banks in the Asia-Pacific region, updating the ranking positions related to the financial health of banks. This year's ranking has many unexpected changes, especially in Vietnam with the leading position belonging to TPBank.

REAL ESTATE

18,500

1D 1.65%

5D -3.65%

Buy Vol. 38,127,857

Sell Vol. 55,251,323

28,000

1D 0.36%

5D -6.35%

Buy Vol. 2,627,529

Sell Vol. 2,719,328

15,000

1D -3.23%

5D -5.06%

Buy Vol. 17,398,164

Sell Vol. 17,832,688

In Q4/2022, the number of searches for real estate in HCM City was estimated to increase by 18% compared to the first quarter of 2022, while this figure in Hanoi decreased by 8%.

OIL & GAS

107,500

1D 1.80%

5D 0.66%

Buy Vol. 615,327

Sell Vol. 641,560

11,400

1D 0.00%

5D 4.11%

Buy Vol. 20,334,695

Sell Vol. 25,411,079

31,350

1D -0.16%

5D 7.36%

Buy Vol. 932,460

Sell Vol. 1,069,765

POW: In November, PV Power recorded a revenue of VND2,759 billion, exceeding 5% of monthly revenue target. Accumulating 11 months, total revenue reached VND25,387 billion (+10% yoy).

VINGROUP

60,800

1D -1.30%

5D -14.61%

Buy Vol. 4,624,163

Sell Vol. 4,197,694

53,000

1D 0.00%

5D -4.50%

Buy Vol. 4,059,460

Sell Vol. 5,149,292

27,950

1D -0.18%

5D -5.25%

Buy Vol. 4,534,118

Sell Vol. 3,548,838

VIC: VinFast aims to sell 750,000 cars by 2026 in the US market.

FOOD & BEVERAGE

77,500

1D -0.64%

5D -6.06%

Buy Vol. 5,336,085

Sell Vol. 5,022,402

96,000

1D -1.03%

5D -4.00%

Buy Vol. 1,615,443

Sell Vol. 1,959,699

179,000

1D 0.56%

5D 0.00%

Buy Vol. 410,925

Sell Vol. 367,652

MSN: Euromonitor pointed out that Acecook and Masan are the two leading enterprises in the instant noodle market, accounting for a total of 33% of market share.

OTHERS

49,750

1D -0.30%

5D 3.00%

Buy Vol. 1,268,788

Sell Vol. 1,871,979

112,200

1D 0.18%

5D 5.85%

Buy Vol. 560,034

Sell Vol. 577,886

76,300

1D -1.17%

5D -0.26%

Buy Vol. 1,965,957

Sell Vol. 2,415,630

46,450

1D 0.11%

5D 3.57%

Buy Vol. 3,547,587

Sell Vol. 5,170,166

15,500

1D 3.33%

5D 10.71%

Buy Vol. 6,959,970

Sell Vol. 7,031,844

20,100

1D -1.47%

5D 4.42%

Buy Vol. 34,413,016

Sell Vol. 44,411,590

19,200

1D 1.05%

5D 5.21%

Buy Vol. 54,952,868

Sell Vol. 70,092,769

FPT: In the first 11 months of 2022, FPT's revenue is estimated at VND39,249 billion and pre-tax profit of VND7,168 billion, up 23.4% and 22.5% respectively over the same period last year. Deducting expenses, FPT's after-tax profit in 11 months is VND6,155 billion, an increase of more than 26% compared to the same period in 2021

Market by numbers

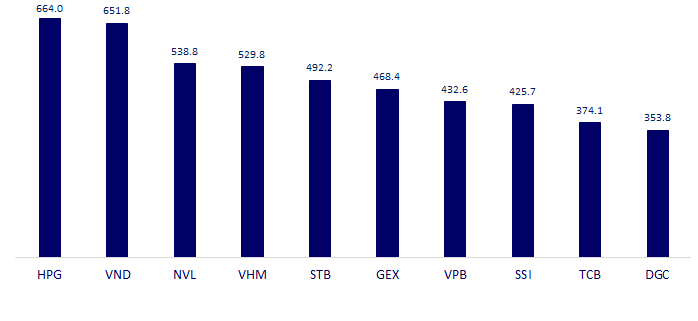

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

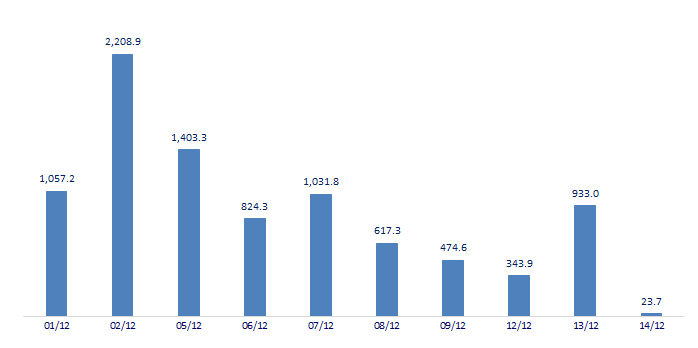

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

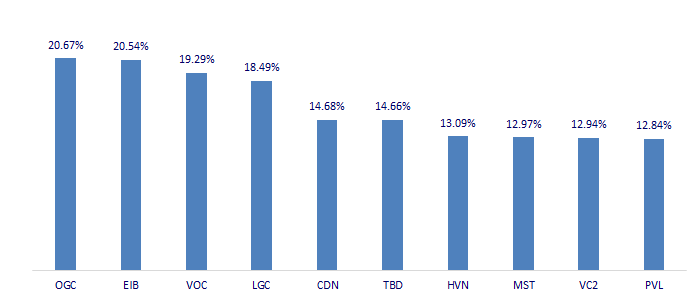

TOP INCREASES 3 CONSECUTIVE SESSIONS

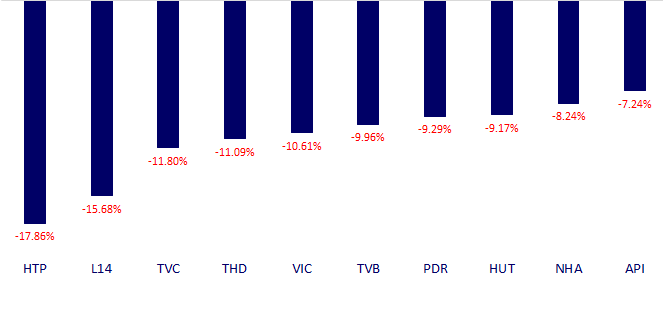

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.