Market Brief 15/12/2022

VIETNAM STOCK MARKET

1,055.32

1D 0.47%

YTD -29.56%

1,068.08

1D 1.13%

YTD -30.45%

212.95

1D -0.12%

YTD -55.07%

72.59

1D 0.67%

YTD -35.58%

307.69

1D 0.00%

YTD 0.00%

13,893.66

1D -10.31%

YTD -55.29%

The situation of struggling trading took place during the derivatives maturity session, accompanied by a strong divergence among stock sectors. Banking stocks held the leading position until the end of the session, most notably today was VPB, which hit the ceiling price.

ETF & DERIVATIVES

18,300

1D 1.89%

YTD -29.15%

12,630

1D 1.28%

YTD -30.18%

13,010

1D 0.08%

YTD -31.53%

14,920

1D -0.47%

YTD -34.85%

15,250

1D 1.33%

YTD -32.16%

23,220

1D 1.53%

YTD -17.22%

13,480

1D 0.60%

YTD -37.24%

1,045

1D 0.63%

YTD 0.00%

1,059

1D 1.12%

YTD 0.00%

1,071

1D 1.09%

YTD 0.00%

1,065

1D 0.52%

YTD 0.00%

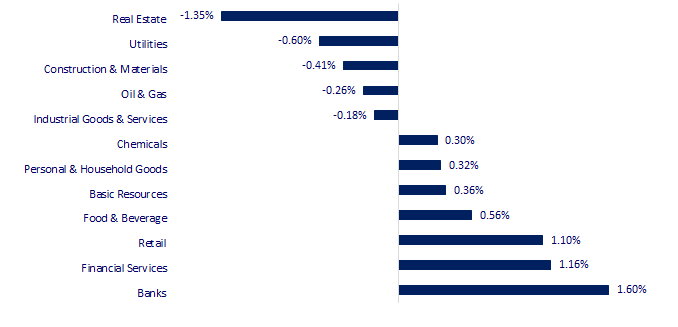

CHANGE IN PRICE BY SECTOR

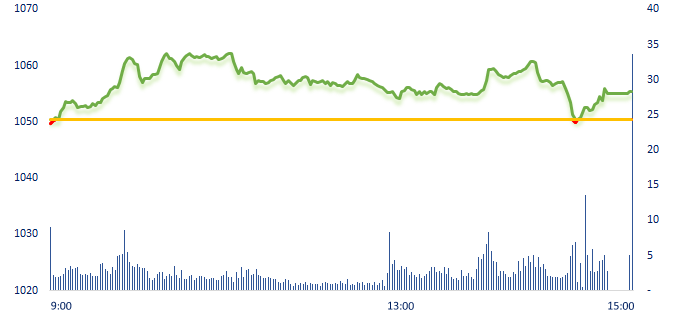

INTRADAY VNINDEX

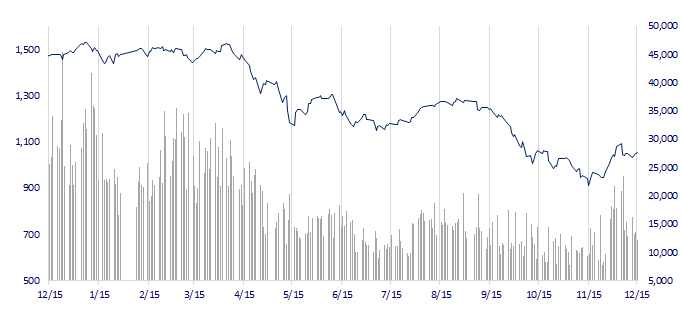

VNINDEX (12M)

GLOBAL MARKET

28,051.70

1D -0.41%

YTD -2.57%

3,168.65

1D -0.25%

YTD -12.94%

2,360.97

1D -1.60%

YTD -20.71%

19,368.59

1D -1.55%

YTD -17.22%

3,273.75

1D -0.15%

YTD 4.80%

1,620.28

1D -0.80%

YTD -2.25%

82.72

1D 0.11%

YTD 8.13%

1,789.85

1D -1.28%

YTD -1.70%

Asian stocks followed US equities lower after the Federal Reserve signaled interest rates will climb higher than anticipated next year. In Japan, foreign investors were net buyers of Japanese stocks last week, as worries about the U.S. Federal Reserve's interest rate hikes eased and sentiment improved after China eased its COVID-19 restrictions.

VIETNAM ECONOMY

5.03%

1D (bps) -25

YTD (bps) 422

7.40%

YTD (bps) 180

4.81%

1D (bps) -4

YTD (bps) 380

4.87%

1D (bps) -7

YTD (bps) 287

23,730

1D (%) 0.19%

YTD (%) 3.44%

25,422

1D (%) -1.66%

YTD (%) -3.95%

3,447

1D (%) -0.29%

YTD (%) -5.77%

In the session of December 15, SBV provided about VND6,000 billion into the market through the OMO channel. At the 14-days term, SBV provided about VND3,000 billion to 6 commercial banks with the interest rate of 6%/year. At 91-days term, SBV provided about VND3,000 billion VND to 7 commercial banks with interest rate of 6.4%/year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- WB: Vietnam will lead Asia - Pacific in economic growth;

- JETP will raise USD15.5 billion in initial public and private financing over the next three to five years to support Vietnam's green transition;

- Planning to start construction of a highway project of more than VND9,700 billion in the West;

- The Prime Minister of Belgium will send a request to the EC to consider removing the "yellow card" for Vietnamese seafood;

- Goldman Sachs: Asian currencies' rally may continue into 2023;

- Inflation in the UK fell more sharply than expected.

VN30

BANK

79,500

1D 0.89%

5D 3.25%

Buy Vol. 2,825,099

Sell Vol. 2,002,886

39,000

1D 0.52%

5D 0.00%

Buy Vol. 3,448,493

Sell Vol. 3,211,367

28,250

1D 1.25%

5D 1.62%

Buy Vol. 5,235,772

Sell Vol. 9,731,245

29,500

1D 2.43%

5D 4.61%

Buy Vol. 11,529,242

Sell Vol. 13,516,759

18,200

1D 6.74%

5D 7.06%

Buy Vol. 112,722,812

Sell Vol. 85,831,482

18,950

1D 4.41%

5D 4.70%

Buy Vol. 60,020,072

Sell Vol. 43,270,151

16,750

1D 1.82%

5D 1.52%

Buy Vol. 9,563,368

Sell Vol. 10,972,232

23,000

1D 0.88%

5D 4.55%

Buy Vol. 19,867,056

Sell Vol. 19,776,218

23,250

1D 0.00%

5D 7.14%

Buy Vol. 44,718,178

Sell Vol. 42,368,113

21,000

1D 1.94%

5D 0.24%

Buy Vol. 11,851,010

Sell Vol. 10,744,415

23,200

1D 0.22%

5D 2.43%

Buy Vol. 6,024,619

Sell Vol. 8,164,007

According to information from the Vietnam Banks Association given at the conference to agree on solutions to support enterprises to develop production and business on the morning of December 15, up to now, 16 banks have committed to reduce money interest in the amount of about VND3,500 billion, with the interest rate reduced from 0.5% - 3%/year.

REAL ESTATE

17,900

1D -3.24%

5D 0.00%

Buy Vol. 38,887,064

Sell Vol. 55,523,775

28,200

1D 0.71%

5D -6.93%

Buy Vol. 2,019,944

Sell Vol. 1,930,094

14,350

1D -4.33%

5D -13.55%

Buy Vol. 20,376,106

Sell Vol. 22,678,738

Prime Minister Pham Minh Chinh asked the State Bank to direct and guide commercial banks to reduce costs to provide capital for qualified real estate projects and businesses as prescribed.

OIL & GAS

106,300

1D -1.12%

5D 0.28%

Buy Vol. 1,015,578

Sell Vol. 985,974

11,400

1D 0.00%

5D 1.79%

Buy Vol. 16,643,276

Sell Vol. 16,768,583

31,250

1D -0.32%

5D 4.87%

Buy Vol. 800,543

Sell Vol. 1,033,261

POW: Power production of PV Power in November reached 1,450 million kWh, only reaching 89% of the monthly plan.

VINGROUP

60,600

1D -0.33%

5D -13.30%

Buy Vol. 3,662,658

Sell Vol. 3,899,317

50,700

1D -4.34%

5D -8.48%

Buy Vol. 4,586,997

Sell Vol. 6,654,284

27,900

1D -0.18%

5D -2.96%

Buy Vol. 3,183,498

Sell Vol. 3,365,532

VIC: On December 13, 2022, Vingroup approved the establishment of a subsidiary, VinMedtech JSC with a charter capital of VND300 billion, Vingroup contributed 99% of the capital.

FOOD & BEVERAGE

77,600

1D 0.13%

5D -4.20%

Buy Vol. 4,990,643

Sell Vol. 4,104,211

98,200

1D 2.29%

5D 2.29%

Buy Vol. 1,108,413

Sell Vol. 1,277,529

179,000

1D 0.00%

5D 0.56%

Buy Vol. 299,568

Sell Vol. 274,292

MSN: Phuc Long's EBITDA in 2022 is estimated at 32%. It is expected that in Q4/2022, Masan will continue to open 30 new Phuc Long flagship stores to increase revenue.

OTHERS

49,500

1D -0.50%

5D 2.06%

Buy Vol. 1,187,080

Sell Vol. 1,660,895

112,900

1D 0.62%

5D 5.51%

Buy Vol. 428,643

Sell Vol. 378,465

77,700

1D 1.83%

5D 0.91%

Buy Vol. 1,813,092

Sell Vol. 2,356,917

47,000

1D 1.18%

5D 2.17%

Buy Vol. 4,130,117

Sell Vol. 5,565,525

15,600

1D 0.65%

5D 6.12%

Buy Vol. 5,313,607

Sell Vol. 6,698,113

20,250

1D 0.75%

5D -1.46%

Buy Vol. 27,010,954

Sell Vol. 35,291,639

19,350

1D 0.78%

5D 2.38%

Buy Vol. 35,480,759

Sell Vol. 50,501,720

FPT: Revenue structure in the first 11 months, Technology segment recorded VND22,477 billion in revenue and pre-tax profit of VND3,322 billion, up 23% and 26%, respectively. Technology profit accounted for more than 46% of the group's pre-tax profit structure. At the same time, digital transformation service revenue in the first 10 months reached VND6,534 billion (+27% yoy); focusing on new technologies such as Cloud, AI/Data Analytics, Blockchain.

Market by numbers

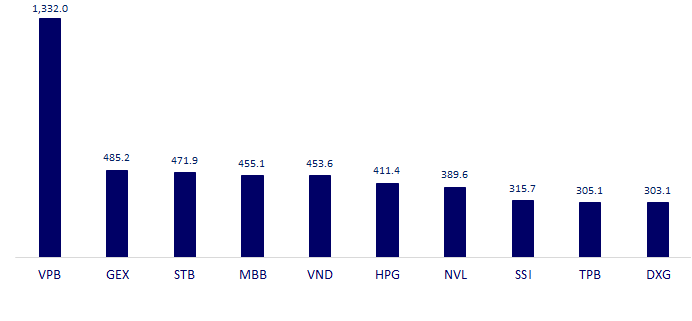

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

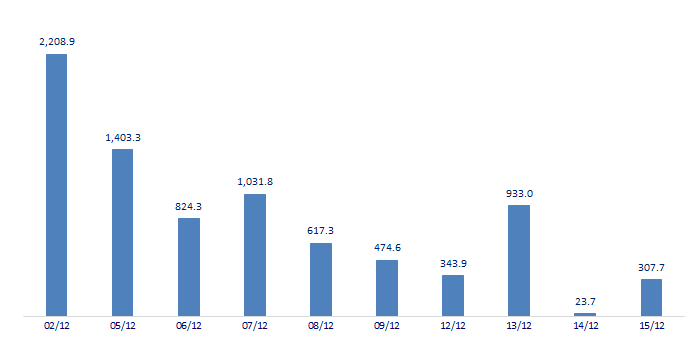

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

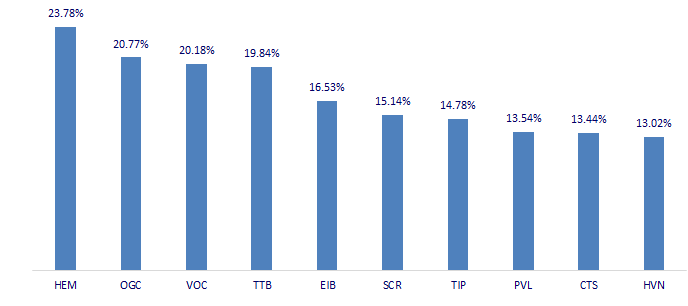

TOP INCREASES 3 CONSECUTIVE SESSIONS

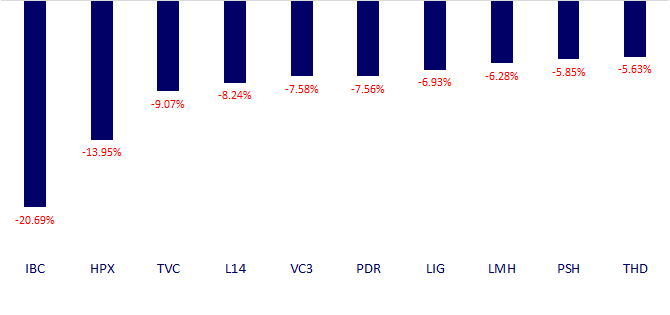

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.