Market Brief 28/12/2022

VIETNAM STOCK MARKET

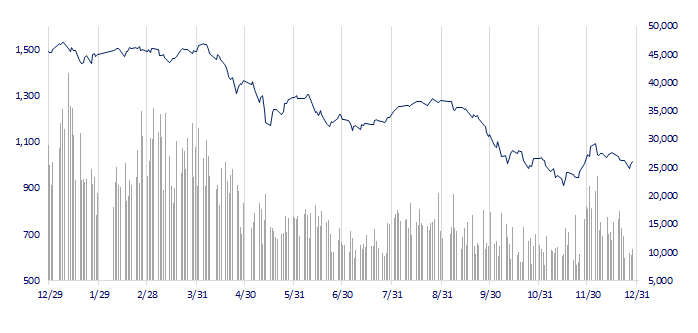

1,015.66

1D 1.10%

YTD -32.21%

1,013.95

1D 0.65%

YTD -33.98%

206.04

1D 1.43%

YTD -56.53%

70.44

1D -0.11%

YTD -37.49%

356.95

1D 0.00%

YTD 0.00%

12,431.62

1D 9.29%

YTD -59.99%

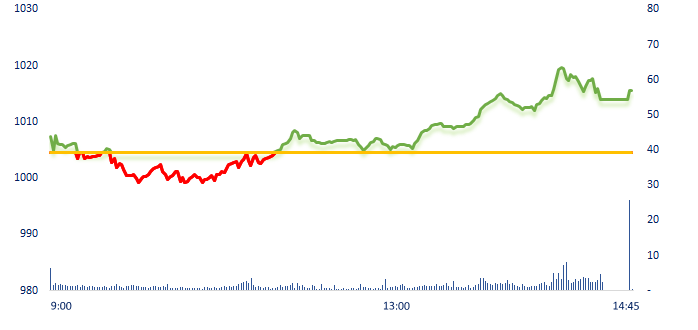

The market continued to recover for the second consecutive session but the liquidity was still low. Banking stocks were the main driving force pulling the index up today, especially state-owned bank tickers, BID had the best performance in VN30 when gaining 4.8%.

ETF & DERIVATIVES

17,400

1D -0.57%

YTD -32.64%

12,000

1D 0.42%

YTD -33.67%

12,410

1D -0.24%

YTD -34.68%

14,220

1D 3.87%

YTD -37.90%

14,380

1D 1.63%

YTD -36.03%

22,230

1D 1.05%

YTD -20.75%

12,900

1D 0.70%

YTD -39.94%

983

1D 0.34%

YTD 0.00%

993

1D 0.02%

YTD 0.00%

1,003

1D 0.22%

YTD 0.00%

1,008

1D 0.70%

YTD 0.00%

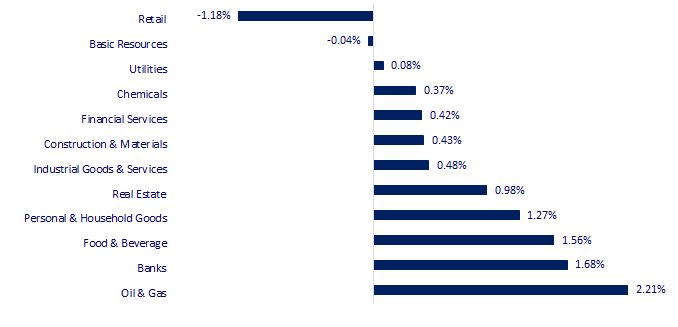

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

26,340.50

1D -0.41%

YTD -8.51%

3,087.40

1D -0.26%

YTD -15.18%

2,280.45

1D -2.24%

YTD -23.41%

19,898.91

1D 1.56%

YTD -14.95%

3,266.97

1D 0.02%

YTD 4.59%

1,647.28

1D 0.25%

YTD -0.62%

84.34

1D -0.78%

YTD 10.25%

1,810.45

1D -0.56%

YTD -0.57%

South Korea's exports likely extended their falling streak to a third straight month in December, a Reuters poll showed on Wednesday, with demand from China yet to recover from loosening COVID-19 restrictions. The country's outbound shipments were projected to have fallen 10.1% in December from the same month a year ago, according to the median forecast of 12 economists.

VIETNAM ECONOMY

3.39%

1D (bps) -5

YTD (bps) 258

7.40%

YTD (bps) 180

4.81%

1D (bps) -1

YTD (bps) 380

4.90%

1D (bps) 1

YTD (bps) 290

23,835

1D (%) 0.32%

YTD (%) 3.90%

25,595

1D (%) -0.88%

YTD (%) -3.30%

3,459

1D (%) -0.06%

YTD (%) -5.44%

The session 28/12, SBV net withdrew more than VND23,000 billion through both channels. In OMO chanel, SBV provided about VND6,669 trillion to 7 commercial banks, with an interest rate of 6%/month. In the treasury bills issuance channel, SBV attracted about VND30,000 billion to 11 commercial banks with an interest rate of 5.3%/year. Both instruments have a term of 7 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Apple's major supplier plans to begin producing MacBooks in Vietnam around May 2023;

- Commencement of the project of nearly VND1,500 billion connecting Ho Chi Minh City - Long An;

- New economic policies takes effect from January 2023;

- The world doesn't have enough airplanes as travel rebounds;

- Putin bans Russian oil exports to countries that implement price cap;

- U.S. congress passes USD1.66 trillion government spending bill.

VN30

BANK

80,000

1D 1.14%

5D 1.65%

Buy Vol. 2,356,495

Sell Vol. 1,867,081

41,900

1D 4.75%

5D 8.55%

Buy Vol. 5,894,224

Sell Vol. 6,587,995

27,150

1D 2.07%

5D -1.27%

Buy Vol. 3,857,157

Sell Vol. 4,734,891

26,150

1D -0.57%

5D -5.60%

Buy Vol. 6,432,143

Sell Vol. 6,352,107

18,150

1D 1.40%

5D 2.83%

Buy Vol. 31,727,199

Sell Vol. 36,687,972

17,450

1D 1.16%

5D -1.41%

Buy Vol. 12,453,594

Sell Vol. 10,475,894

16,200

1D -0.92%

5D -3.57%

Buy Vol. 2,579,549

Sell Vol. 2,699,560

21,400

1D 1.66%

5D -0.93%

Buy Vol. 4,591,068

Sell Vol. 4,669,498

22,900

1D 1.78%

5D -2.76%

Buy Vol. 42,182,039

Sell Vol. 30,258,691

19,000

1D 0.00%

5D -3.55%

Buy Vol. 4,314,573

Sell Vol. 3,180,046

22,000

1D -0.45%

5D -3.51%

Buy Vol. 2,905,705

Sell Vol. 3,530,497

BID: BIDV deployed 16 credit packages with a scale of VND700,000 billion to support businesses and people affected by COVID-19. Specifically, BIDV's revenue in 2022 has decreased by VND5,500 billion to support businesses and the revenue of the three years 2020, 2021, and 2022 decreased by VND19,400 billion.

REAL ESTATE

14,350

1D -0.35%

5D -5.59%

Buy Vol. 25,337,637

Sell Vol. 28,197,458

27,050

1D 2.66%

5D 7.77%

Buy Vol. 2,492,784

Sell Vol. 2,262,781

13,450

1D 6.75%

5D 12.08%

Buy Vol. 27,883,959

Sell Vol. 16,510,250

According to the Ministry of Construction, the real estate market still has potential destabilizing factors, from the risk of a "bubble" to a "recession".

OIL & GAS

103,000

1D -0.10%

5D -0.48%

Buy Vol. 460,743

Sell Vol. 572,372

10,650

1D 0.00%

5D 1.91%

Buy Vol. 28,859,533

Sell Vol. 8,036,075

31,500

1D 2.94%

5D 6.78%

Buy Vol. 1,204,713

Sell Vol. 1,580,593

POW: Consolidated revenue for the whole year is estimated at VND28,527 billion, exceeding 18% of the year plan and increasing 17% compared to 2021.

VINGROUP

53,500

1D 0.19%

5D -2.55%

Buy Vol. 3,678,851

Sell Vol. 3,536,969

47,700

1D 0.42%

5D -1.65%

Buy Vol. 3,015,365

Sell Vol. 3,108,372

26,900

1D 4.26%

5D 3.46%

Buy Vol. 4,255,397

Sell Vol. 3,112,733

VIC: Implemented a highway worth VND30,000 billion because the Vingroup - Techcombank consortium faced difficulties due to lack of capital, investors only managed to arrange VND16,000 billion.

FOOD & BEVERAGE

77,000

1D 0.52%

5D -1.66%

Buy Vol. 2,232,733

Sell Vol. 2,433,684

93,000

1D 1.53%

5D -2.00%

Buy Vol. 1,330,347

Sell Vol. 1,254,892

176,500

1D 2.92%

5D 0.86%

Buy Vol. 363,704

Sell Vol. 234,160

MSN: Within 4 months, the total number of WIN stores has increased to 102 from 30 stores in Hanoi and HCM City, spreading to many other cities such as Hai Phong, Da Nang, Binh Duong,…

OTHERS

46,700

1D 0.43%

5D -2.71%

Buy Vol. 731,857

Sell Vol. 577,682

110,500

1D 2.31%

5D -0.99%

Buy Vol. 429,635

Sell Vol. 358,742

76,700

1D 0.26%

5D -0.65%

Buy Vol. 1,331,048

Sell Vol. 1,658,661

43,000

1D -1.83%

5D -7.33%

Buy Vol. 3,289,365

Sell Vol. 3,105,109

14,200

1D -0.35%

5D 0.00%

Buy Vol. 1,629,622

Sell Vol. 1,858,592

18,150

1D -0.27%

5D -5.96%

Buy Vol. 20,070,551

Sell Vol. 35,005,815

18,200

1D -0.27%

5D -3.70%

Buy Vol. 28,389,318

Sell Vol. 33,341,034

MWG: In 11 months, the Mobile World (including TopZone) and Dien May Xanh chains contributed VND32.4 trillion and VND64.3 trillion respectively, accounting for a total of 78% of MWG's revenue. Bach Hoa Xanh chain's revenue reached VND24.6 trillion, accounting for nearly 20% of MWG's revenue structure.

Market by numbers

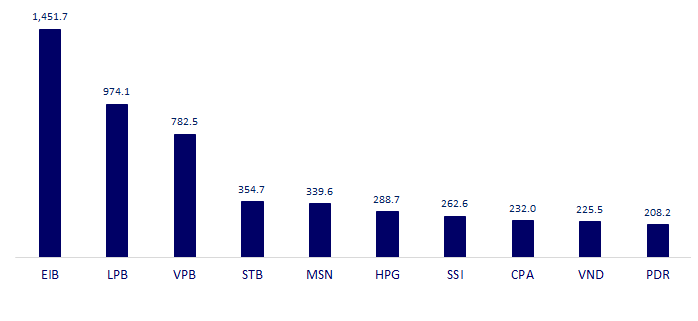

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

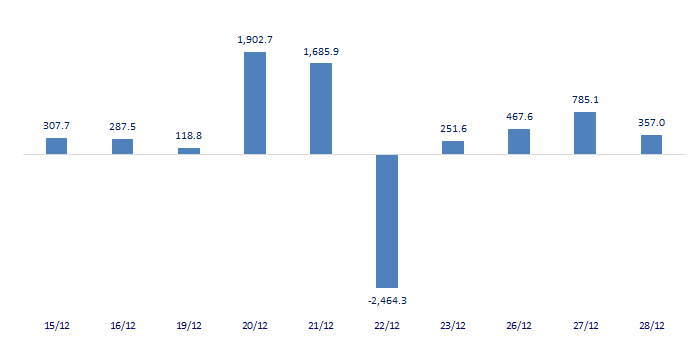

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

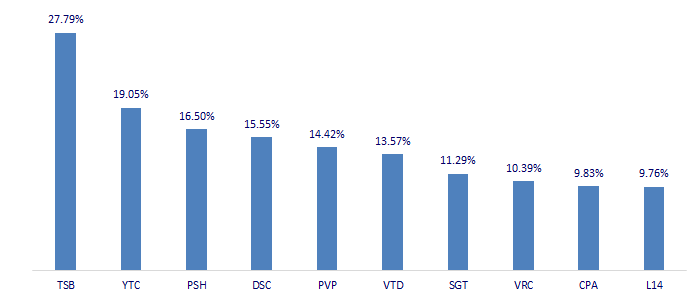

TOP INCREASES 3 CONSECUTIVE SESSIONS

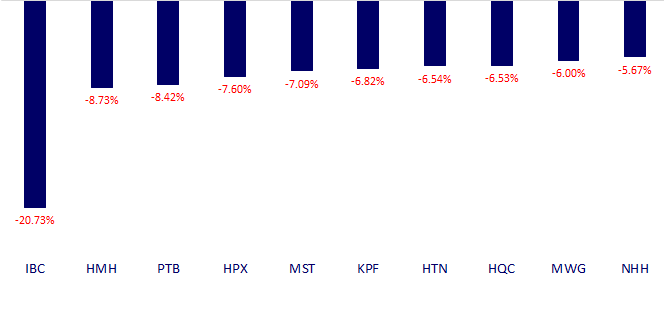

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.