Market Brief 11/01/2023

VIETNAM STOCK MARKET

1,055.76

1D 0.23%

YTD 4.83%

1,065.22

1D 0.44%

YTD 5.97%

211.67

1D 0.49%

YTD 3.10%

72.37

1D -0.15%

YTD 1.00%

269.12

1D 0.00%

YTD 0.00%

10,125.50

1D -7.83%

YTD 17.52%

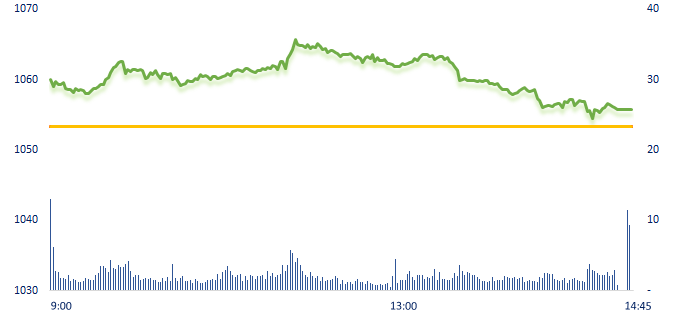

The market in the session near Tet is dull, contrast to the excitement of the last days of the lunar year. Today's cash flow focus on securities stocks, the gain appeared in main tickers like VND (+2.43%), SSI (+2.12%), VCI (+3.99%), HCM (+ 2.23%), although the gain at the end of the session was narrow, the liquidity of this group improved significantly today.

ETF & DERIVATIVES

18,080

1D 0.06%

YTD 4.33%

12,570

1D 0.48%

YTD 5.45%

12,820

1D 0.08%

YTD 2.72%

14,700

1D 1.24%

YTD 4.63%

15,280

1D 0.46%

YTD 6.48%

23,000

1D -0.43%

YTD 2.68%

13,720

1D 1.63%

YTD 5.95%

1,039

1D 0.75%

YTD 0.00%

1,054

1D 0.83%

YTD 0.00%

1,060

1D 0.73%

YTD 0.00%

1,063

1D 0.58%

YTD 0.00%

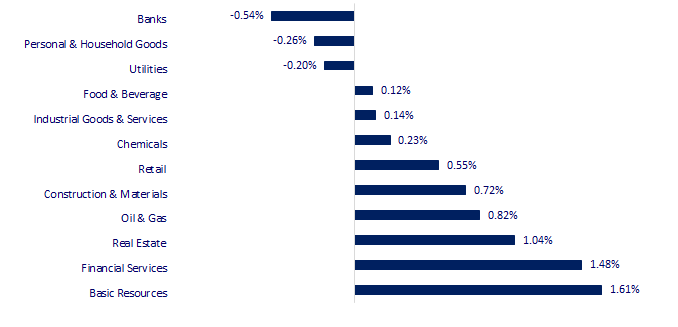

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

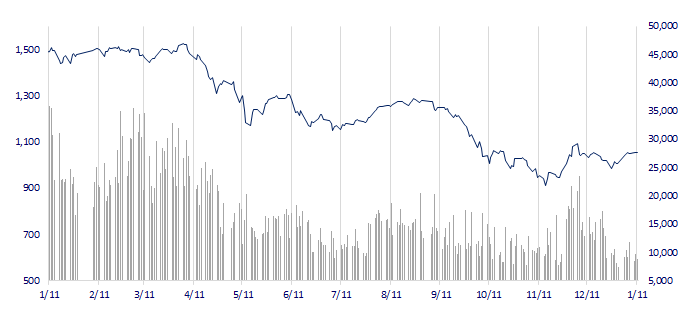

VNINDEX (12M)

GLOBAL MARKET

26,446.00

1D 1.03%

YTD 1.35%

3,161.84

1D -0.24%

YTD 2.35%

2,359.53

1D 0.35%

YTD 5.51%

21,436.05

1D 0.49%

YTD 8.36%

3,271.51

1D 0.26%

YTD 0.62%

1,684.40

1D -0.41%

YTD 0.84%

80.47

1D 1.18%

YTD -6.33%

1,888.95

1D 0.63%

YTD 3.44%

Asian shares mostly rose to a six-month high on Wednesday while the dollar steadied, as investors waited for U.S. inflation data for cues on the Federal Reserve's interest rate policy.

VIETNAM ECONOMY

5.50%

1D (bps) 33

YTD (bps) 53

7.40%

4.63%

1D (bps) -6

YTD (bps) -16

4.70%

YTD (bps) -20

23,605

1D (%) -0.01%

YTD (%) -0.65%

25,923

1D (%) 0.12%

YTD (%) 1.03%

3,532

1D (%) 0.14%

YTD (%) 1.35%

VND has been under great pressure to depreciate against a strong USD, in order to protect the domestic currency, SBV has sold off reserve dollars, causing foreign currency reserves to drop sharply by 20% by the end of Q3/2022 compared to the end of 2021. However, the VND has recovered strongly in recent weeks but the recovery rate is likely to slow down. Increasing foreign exchange reserves will likely be the main priority of the State Bank.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Reuters: Apple supplier plans to build factory in Vietnam;

- Vietnam attracts nearly USD30 billion of FDI from Hong Kong (China);

- In 2023, Vietnam's pangasius export is still full of potential;

- Just reopened, China massively imported crude oil;

- One month after the ceiling was imposed, Russia's flagship oil is selling at less than half international prices;

- China’s loss is Southeast Asia’s gain as supply chains shift away to cheaper climes.

VN30

BANK

85,100

1D -2.52%

5D 2.78%

Buy Vol. 1,519,352

Sell Vol. 1,966,224

41,250

1D -0.12%

5D 1.10%

Buy Vol. 2,578,879

Sell Vol. 3,765,795

29,100

1D 1.93%

5D 2.11%

Buy Vol. 5,944,136

Sell Vol. 7,762,299

27,650

1D 0.73%

5D 1.28%

Buy Vol. 5,383,148

Sell Vol. 7,333,687

18,450

1D -1.34%

5D -2.38%

Buy Vol. 27,616,768

Sell Vol. 34,956,199

18,250

1D 0.27%

5D 1.67%

Buy Vol. 11,236,561

Sell Vol. 14,956,749

16,700

1D -0.30%

5D 2.14%

Buy Vol. 4,441,864

Sell Vol. 4,070,434

22,450

1D -0.22%

5D 2.05%

Buy Vol. 9,667,364

Sell Vol. 10,333,925

24,700

1D -1.00%

5D 6.01%

Buy Vol. 16,274,983

Sell Vol. 30,068,744

21,200

1D 0.24%

5D 6.53%

Buy Vol. 8,142,255

Sell Vol. 10,146,314

24,200

1D 3.20%

5D 6.84%

Buy Vol. 10,836,299

Sell Vol. 8,684,089

BID: By the end of December 31, BIDV's business targets have all met the plan assigned by the State Bank and the annuual general meeting of shareholders. In which, consolidated pre-tax profit reached VND23,190 billion. Total assets by the end of last year were estimated at more than VND2,080 triilion, an increase of nearly 21% compared to 2021.

REAL ESTATE

14,900

1D 6.81%

5D 6.43%

Buy Vol. 54,156,779

Sell Vol. 34,701,548

28,100

1D 0.72%

5D 0.90%

Buy Vol. 1,865,034

Sell Vol. 2,346,513

14,800

1D 3.86%

5D -1.33%

Buy Vol. 21,570,093

Sell Vol. 23,273,026

NVL: Session 11/1, foreign investors net bought NVL with the value of VND15.4billion, corresponding to proprietary traders.

OIL & GAS

104,200

1D -0.38%

5D -0.76%

Buy Vol. 229,856

Sell Vol. 381,926

11,650

1D -0.43%

5D 5.91%

Buy Vol. 17,882,152

Sell Vol. 16,438,945

37,250

1D 1.09%

5D 5.67%

Buy Vol. 11,511,957

Sell Vol. 3,225,011

From the afternoon of January 11, the Inter-Ministry of Industry and Trade - Finance has adjusted gasoline prices according to the cycle. Gasoline prices E5 RON92 and RON95 remained unchanged.

VINGROUP

55,100

1D 1.10%

5D -1.61%

Buy Vol. 1,963,858

Sell Vol. 1,902,010

50,800

1D 2.11%

5D 3.67%

Buy Vol. 1,784,472

Sell Vol. 2,348,251

28,500

1D -3.06%

5D -0.35%

Buy Vol. 1,595,269

Sell Vol. 2,569,888

VHM: Although the supply of new apartments is decreasing, in Q4/2022, the market still recorded the opening of new apartments from ZR 1 building of The Zurich - Vinhomes Ocean Park project.

FOOD & BEVERAGE

79,400

1D -1.98%

5D 0.13%

Buy Vol. 2,041,837

Sell Vol. 3,435,899

96,000

1D 0.63%

5D -3.32%

Buy Vol. 801,708

Sell Vol. 926,163

181,000

1D 2.78%

5D 5.54%

Buy Vol. 292,589

Sell Vol. 240,568

VNM: The product of Vinamilk's Optimum Gold brand has become the first Asian baby formula to receive the Purity Award of the US.

OTHERS

48,600

1D 1.25%

5D 1.89%

Buy Vol. 1,061,162

Sell Vol. 1,346,879

110,100

1D 0.92%

5D -0.27%

Buy Vol. 494,210

Sell Vol. 636,768

80,900

1D 0.62%

5D 1.13%

Buy Vol. 2,002,695

Sell Vol. 1,904,542

42,550

1D 0.83%

5D -2.18%

Buy Vol. 2,373,217

Sell Vol. 2,888,898

14,500

1D 0.69%

5D -2.36%

Buy Vol. 3,231,335

Sell Vol. 5,473,082

19,300

1D 2.12%

5D 1.58%

Buy Vol. 25,705,926

Sell Vol. 33,760,448

20,200

1D 2.02%

5D 4.12%

Buy Vol. 45,222,282

Sell Vol. 58,166,725

FPT: FPT's software exports in 2023 is expected to reach USD1 billion based on two factors. Firstly, the total value of FPT Software contracts signed in 2022 has reached USD1 billion. Secondly, the average growth rate of FPT Software in the last 3 years is 26%, including 2 years of pandemic. The sales plan of USD1 billion in 2023 is calculated on the basis of 26% growth, equal to the same rate growth in 3 years 2020-2022.

Market by numbers

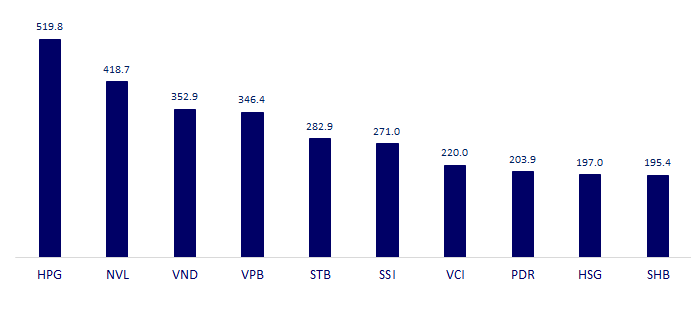

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

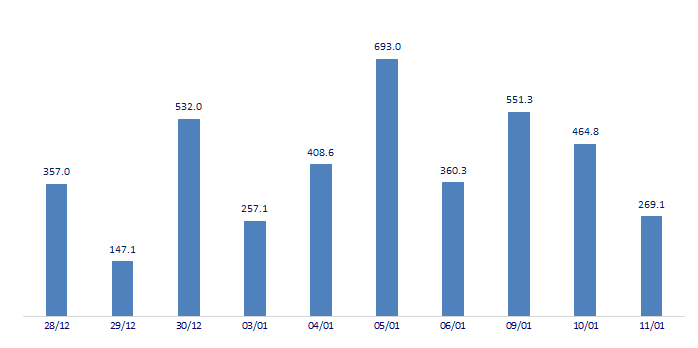

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

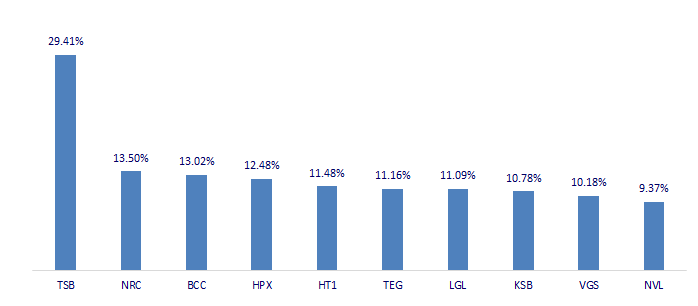

TOP INCREASES 3 CONSECUTIVE SESSIONS

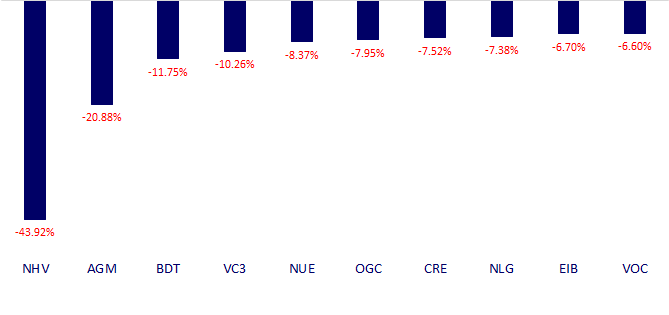

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.