Market Brief 30/01/2023

VIETNAM STOCK MARKET

1,102.57

1D -1.30%

YTD 9.48%

1,113.95

1D -1.48%

YTD 10.82%

220.78

1D 0.01%

YTD 7.53%

75.40

1D 0.55%

YTD 5.23%

772.38

1D 0.00%

YTD 0.00%

15,747.87

1D 25.19%

YTD 82.78%

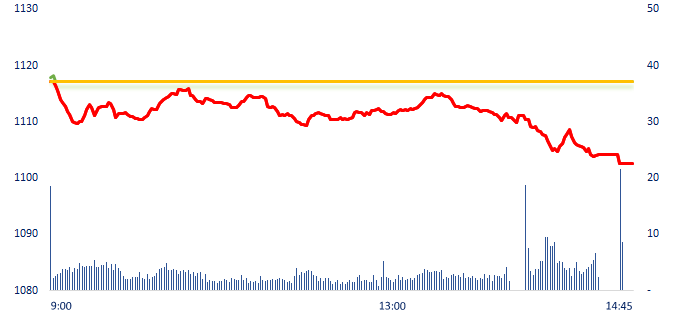

After the Tet holiday officially ended, VN-Index dropped with high trading volume and increased selling pressure. Today's volatility mainly came from the decline of banking stocks and large-cap stocks. Accordingly, HDB was the only banking stock that kept the green in the VN30 group, today is also the first day HDB is allowed to expand foreign ownership restrictions from 18% to 20%.

ETF & DERIVATIVES

19,000

1D -1.09%

YTD 9.64%

13,150

1D -1.28%

YTD 10.32%

13,530

1D -2.03%

YTD 8.41%

15,900

1D -0.19%

YTD 13.17%

15,970

1D -2.08%

YTD 11.29%

24,090

1D -1.51%

YTD 7.54%

14,590

1D 0.07%

YTD 12.66%

1,090

1D -1.46%

YTD 0.00%

1,097

1D -1.30%

YTD 0.00%

1,108

1D -1.48%

YTD 0.00%

1,110

1D -1.53%

YTD 0.00%

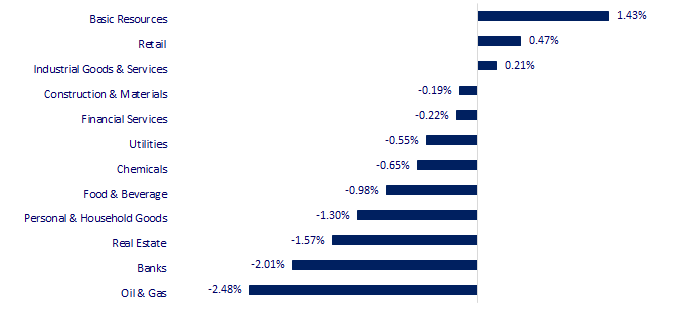

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

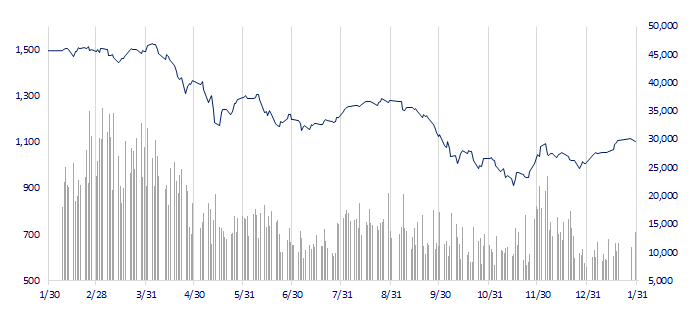

VNINDEX (12M)

GLOBAL MARKET

27,433.40

1D 0.19%

YTD 5.13%

3,269.32

1D 0.14%

YTD 5.83%

2,450.47

1D -1.35%

YTD 9.57%

22,069.73

1D -2.73%

YTD 11.57%

3,378.29

1D -0.47%

YTD 3.91%

1,681.22

1D -0.03%

YTD 0.65%

86.31

1D -0.62%

YTD 0.47%

1,928.70

1D 0.10%

YTD 5.61%

Stocks in the Asia-Pacific mostly fell on Monday as shares of Adani Group remained volatile after the conglomerate rebutted short seller firm Hindenburg’s accusations of embezzlement and fraud. In Hong Kong, Hang Seng index fell sharply as property and technology stocks led losses.

VIETNAM ECONOMY

6.10%

1D (bps) -10

YTD (bps) 113

7.40%

4.50%

1D (bps) -3

YTD (bps) -29

4.57%

1D (bps) -1

YTD (bps) -33

23,658

1D (%) 0.08%

YTD (%) -0.43%

26,026

1D (%) -0.79%

YTD (%) 1.43%

3,543

1D (%) 0.40%

YTD (%) 1.66%

In the session on January 30, on the OMO channel, SBV provided liquidity into the market for 11 commercial banks with a value of about VND13,000 billion, with an interest rate of 6%/year with a term of 7 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the first month of 2023, the trade surplus was estimated at USD3.6 billion;

- Industrial production in January 2023 dropped sharply, due to Tet and the lack of orders;

- Steel enterprises simultaneously increased prices, the highest level was 710,000 VND/ton;

- China is in the top 3 in terms of global auto exports;

- Chinese cars dominate the Russian market;

- South Korea: The cost of heating increases as the cold persists.

VN30

BANK

89,900

1D -3.33%

5D -3.33%

Buy Vol. 1,558,694

Sell Vol. 1,527,893

44,500

1D -0.11%

5D -3.16%

Buy Vol. 2,437,694

Sell Vol. 1,988,813

29,750

1D -1.98%

5D -4.34%

Buy Vol. 6,255,715

Sell Vol. 6,771,834

28,700

1D -1.20%

5D -1.37%

Buy Vol. 8,983,241

Sell Vol. 9,547,005

19,250

1D -2.28%

5D -1.28%

Buy Vol. 35,244,683

Sell Vol. 40,565,161

19,250

1D -2.28%

5D -1.79%

Buy Vol. 20,259,341

Sell Vol. 24,593,767

18,250

1D 3.11%

5D 4.29%

Buy Vol. 5,698,125

Sell Vol. 6,241,446

23,900

1D -2.45%

5D -0.42%

Buy Vol. 13,819,750

Sell Vol. 14,582,743

25,850

1D -3.00%

5D -3.54%

Buy Vol. 29,409,902

Sell Vol. 28,299,959

23,050

1D -1.28%

5D 0.66%

Buy Vol. 6,399,189

Sell Vol. 7,215,997

25,400

1D -3.61%

5D -2.31%

Buy Vol. 7,032,985

Sell Vol. 8,479,755

ACB: ACB has just announced the consolidated pre-tax profit in 2022 of VND17,100 billion, reaching 114% of the year plan. Outstanding loans balance reached VND413,700 billion, up 14.3% and deposits reached VND414,000 billion, up 9% compared to 2021. Along with profit growth, ACB's NPL ratio was only 0.74% - one of the lowest in the banking industry.

REAL ESTATE

13,950

1D 0.00%

5D -0.71%

Buy Vol. 27,624,775

Sell Vol. 28,815,092

27,750

1D 0.36%

5D 0.54%

Buy Vol. 2,440,553

Sell Vol. 1,882,844

13,700

1D 0.00%

5D -3.18%

Buy Vol. 10,863,382

Sell Vol. 11,463,671

PDR: PDR's financial revenue in 2022 increased sharply to VND1,267 billion due to the recognition of nearly VND1,249 billion in profit from the transfer of 26% shares at Saigon KL Real Estate JSC.

OIL & GAS

106,600

1D -1.48%

5D 2.01%

Buy Vol. 388,081

Sell Vol. 751,379

12,350

1D 1.23%

5D 1.23%

Buy Vol. 22,625,492

Sell Vol. 21,012,757

37,050

1D -2.76%

5D -2.50%

Buy Vol. 1,527,972

Sell Vol. 1,851,592

In 2022, Vietnam imported 8.87 million tons of petroleum, worth USD8.97 billion, the output increased sharply by 27.7% compared to 2021.

VINGROUP

57,700

1D -2.53%

5D 0.52%

Buy Vol. 1,643,946

Sell Vol. 2,320,064

51,500

1D -3.38%

5D -1.34%

Buy Vol. 1,795,719

Sell Vol. 2,389,399

29,800

1D -1.65%

5D 0.51%

Buy Vol. 2,356,941

Sell Vol. 4,130,553

VRE: Vincom Retail JSC earned nearly VND2,735 billion in net profit in 2022, twice as much as the previous year.

FOOD & BEVERAGE

79,400

1D -0.75%

5D -2.34%

Buy Vol. 2,226,643

Sell Vol. 2,450,814

102,000

1D -1.64%

5D 0.00%

Buy Vol. 468,605

Sell Vol. 773,806

190,000

1D -1.61%

5D 2.32%

Buy Vol. 265,489

Sell Vol. 279,335

MSN: Masan's net revenue in the fourth quarter of 2022 was VND20,643 billion, down 13.4% yoy and net profit was VND447 billion, down 93%.

OTHERS

50,500

1D -0.98%

5D 1.20%

Buy Vol. 1,052,568

Sell Vol. 1,213,564

113,000

1D -2.75%

5D -1.31%

Buy Vol. 388,864

Sell Vol. 529,525

83,700

1D -0.36%

5D -0.24%

Buy Vol. 1,438,595

Sell Vol. 1,659,976

46,200

1D 0.65%

5D 1.32%

Buy Vol. 5,230,121

Sell Vol. 5,094,352

16,500

1D -2.08%

5D 1.23%

Buy Vol. 4,751,051

Sell Vol. 5,887,860

21,000

1D 0.24%

5D -0.94%

Buy Vol. 39,908,097

Sell Vol. 34,558,253

21,750

1D 1.16%

5D 2.84%

Buy Vol. 61,518,435

Sell Vol. 70,835,926

HPG: Despite the deep loss for two consecutive quarters, the group's management believe that the most difficult period of the steel industry has passed. Accordingly, steel sales volume in December reached 558 thousand tons, up 26% compared to November. Besides, China's reopening will help resume construction activities and boost infrastructure investment, thereby helping the demand for construction steel recover.

Market by numbers

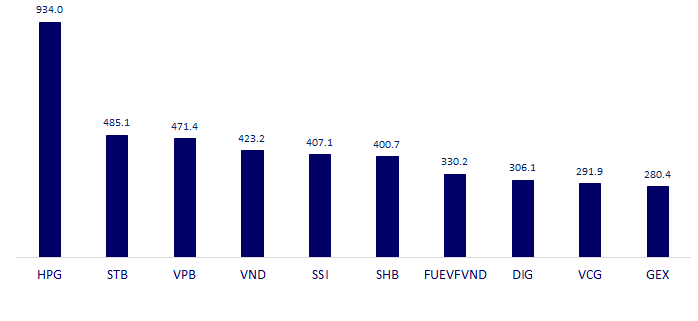

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

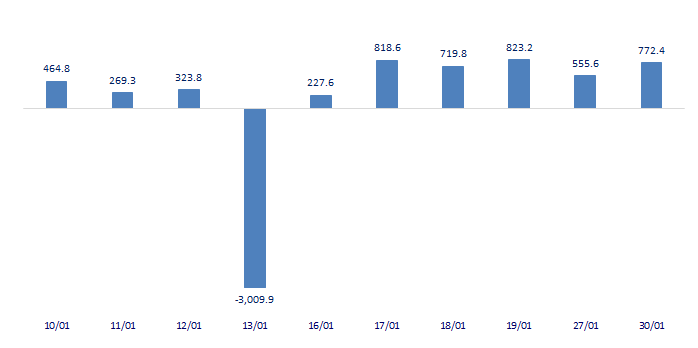

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

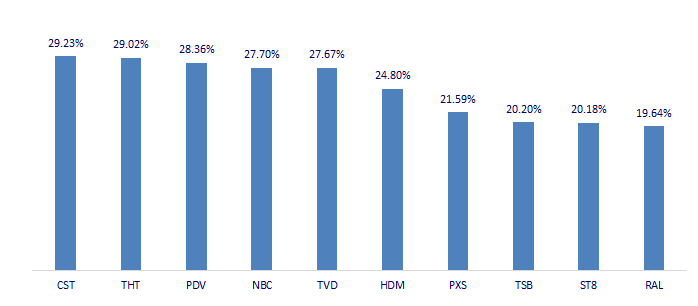

TOP INCREASES 3 CONSECUTIVE SESSIONS

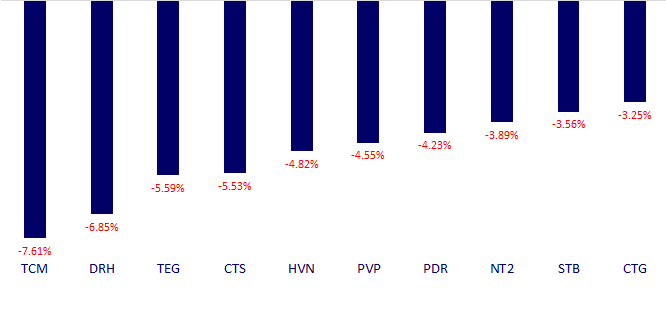

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.