Market brief 06/02/2023

VIETNAM STOCK MARKET

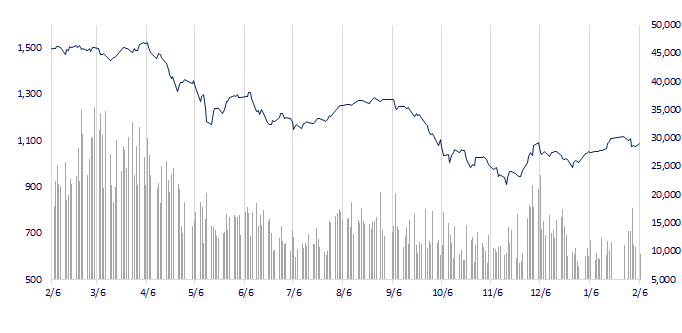

1,089.29

1D 1.13%

YTD 8.16%

1,094.37

1D 0.80%

YTD 8.87%

214.47

1D -0.38%

YTD 4.46%

75.96

1D 0.56%

YTD 6.02%

402.79

1D 0.00%

YTD 0.00%

10,662.24

1D -10.83%

YTD 23.75%

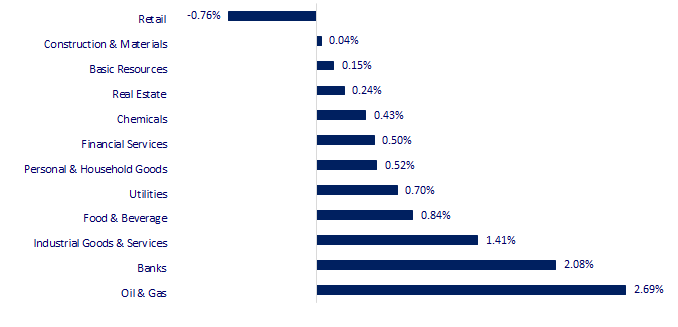

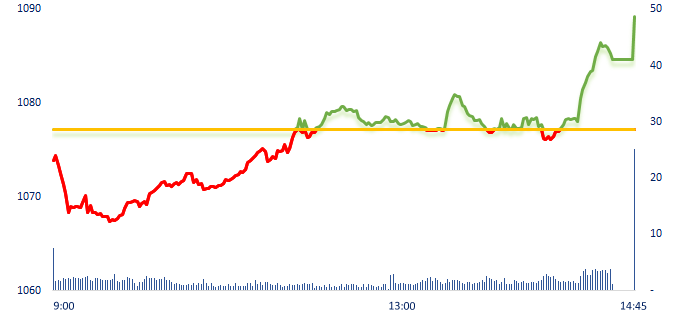

Before the negative news from the US market, VN-Index was in the red at the beginning of the morning session, but gradually regained back to reference at the end of the morning session, before rebounding strongly after 14h. Oil and gas, banking and industrial goods & services were the 3 most active sectors in today's session with typical stocks such as PLX, BID, VCB,...

ETF & DERIVATIVES

18,560

1D 0.38%

YTD 7.10%

12,850

1D 0.39%

YTD 7.80%

13,270

1D -0.97%

YTD 6.33%

15,700

1D -1.88%

YTD 11.74%

15,560

1D -0.51%

YTD 8.43%

23,650

1D 0.38%

YTD 5.58%

13,920

1D 0.07%

YTD 7.49%

1,071

1D 0.63%

YTD 0.00%

1,077

1D 0.93%

YTD 0.00%

1,088

1D 0.51%

YTD 0.00%

1,091

1D 0.80%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,693.65

1D 0.66%

YTD 6.13%

3,238.70

1D -0.76%

YTD 4.84%

2,438.19

1D -1.70%

YTD 9.02%

21,215.50

1D -2.05%

YTD 7.25%

3,380.53

1D -0.11%

YTD 3.97%

1,685.34

1D -0.18%

YTD 0.90%

80.62

1D 0.86%

YTD -6.16%

1,892.65

1D 0.54%

YTD 3.64%

At the end of the session, Asian markets mostly fell, following the US market, when the result of jobs report made some investors worry that the FED will continue to raise interest rates in the near future.

VIETNAM ECONOMY

6.21%

1D (bps) 9

YTD (bps) 124

7.40%

4.08%

1D (bps) -12

YTD (bps) -71

4.21%

1D (bps) -5

YTD (bps) -69

23,650

1D (%) 0.12%

YTD (%) -0.46%

26,030

1D (%) -0.02%

YTD (%) 1.45%

3,531

1D (%) -0.03%

YTD (%) 1.32%

After 5 consecutive sessions of net support of liquidity to the banking system after the Lunar New Year holiday, SBV has reopened the issuance of bills to attract VND 15,000 billion from 3 members with a term of 7 days and an interest rate of 5.79 %/year, at the same time, there is no previous contract to sell T-bill that expires in session 3/2.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Industry and Trade requested to review the licensing of petrol and oil agents after a series of violations;

- Many FDI enterprises expand production;

- Many large projects poured into the North Central Coast and Central Coast;

- Apple forecasts revenue will continue to decline, iPhone production has passed a period of distress;

- Goldman Sachs: Oil market will face production problems in 2024;

- The IEA forecasts 50% of global oil demand growth will come from China.

VN30

BANK

96,000

1D 3.23%

5D 6.79%

Buy Vol. 1,899,749

Sell Vol. 1,892,140

45,000

1D 3.81%

5D 1.12%

Buy Vol. 3,528,427

Sell Vol. 2,724,234

29,900

1D 2.93%

5D 0.50%

Buy Vol. 4,459,391

Sell Vol. 5,962,438

27,950

1D 3.14%

5D -2.61%

Buy Vol. 7,534,290

Sell Vol. 5,451,620

18,500

1D 1.37%

5D -3.90%

Buy Vol. 30,481,645

Sell Vol. 24,074,812

18,700

1D 0.54%

5D -2.86%

Buy Vol. 13,675,540

Sell Vol. 12,847,478

18,500

1D -0.27%

5D 1.37%

Buy Vol. 2,681,349

Sell Vol. 4,334,029

24,100

1D 0.42%

5D 0.84%

Buy Vol. 7,898,422

Sell Vol. 7,909,590

25,700

1D -1.34%

5D -0.58%

Buy Vol. 30,679,787

Sell Vol. 36,139,425

23,650

1D -2.67%

5D 2.60%

Buy Vol. 4,716,298

Sell Vol. 6,834,277

24,900

1D 1.63%

5D -1.97%

Buy Vol. 6,098,911

Sell Vol. 4,281,933

VIB: According to information from the Ho Chi Minh City Stock Exchange (HOSE), Ms. Dang Minh Trang, the daughter of Vice President of Vietnam International Commercial Joint Stock Bank (VIB) Dang Van Son, has just registered to buy 3.5 million VIB shares to serve investment needs. This number of shares is equivalent to 0.166% of VIB's outstanding shares. The transaction is expected to be carried out from February 8 to March 6, 2023 by order matching or agreement method.

REAL ESTATE

15,400

1D 3.01%

5D 10.39%

Buy Vol. 37,584,481

Sell Vol. 45,264,608

27,350

1D 1.48%

5D -1.44%

Buy Vol. 2,546,148

Sell Vol. 2,125,160

13,750

1D 0.36%

5D 0.36%

Buy Vol. 8,098,480

Sell Vol. 10,785,188

KDH: In the fourth quarter of 2022, KDH had a revenue of VND 1,234 billion, more than double the same period in 2021, but PAT decreased by 73% compared to the same period last year.

OIL & GAS

106,000

1D 0.76%

5D -0.56%

Buy Vol. 558,653

Sell Vol. 551,430

12,550

1D 3.29%

5D 1.62%

Buy Vol. 31,924,980

Sell Vol. 17,491,896

38,800

1D 4.02%

5D 4.72%

Buy Vol. 2,178,602

Sell Vol. 2,223,318

Oil plunges 3% after strong US jobs report stoked fears of higher interest rates.

VINGROUP

56,000

1D 0.00%

5D -2.95%

Buy Vol. 2,040,256

Sell Vol. 2,857,028

47,950

1D -0.31%

5D -6.89%

Buy Vol. 2,918,070

Sell Vol. 2,765,133

29,500

1D 1.03%

5D -1.01%

Buy Vol. 2,626,568

Sell Vol. 1,809,099

VIC: VinFast postponed the delivery of electric cars to US customers until the end of February to update the software.

FOOD & BEVERAGE

77,400

1D 1.84%

5D -2.52%

Buy Vol. 2,998,101

Sell Vol. 3,567,730

96,300

1D -0.21%

5D -5.59%

Buy Vol. 1,010,329

Sell Vol. 1,151,040

195,400

1D 1.35%

5D 2.84%

Buy Vol. 163,172

Sell Vol. 173,747

MSN: Masan sets a revenue target of VND90,000 billion to VND100,000 billion in 2023.

OTHERS

50,600

1D 1.81%

5D 0.20%

Buy Vol. 1,179,420

Sell Vol. 1,068,629

109,500

1D 0.37%

5D -3.10%

Buy Vol. 336,463

Sell Vol. 399,920

80,500

1D 0.50%

5D -3.82%

Buy Vol. 1,856,197

Sell Vol. 1,607,963

47,150

1D -1.36%

5D 2.06%

Buy Vol. 3,938,949

Sell Vol. 5,884,950

15,600

1D 1.30%

5D -5.45%

Buy Vol. 3,107,819

Sell Vol. 2,284,487

20,000

1D 1.27%

5D -4.76%

Buy Vol. 22,388,842

Sell Vol. 20,523,308

21,150

1D 0.24%

5D -2.76%

Buy Vol. 44,608,986

Sell Vol. 36,274,409

HPG: In January 2023, Hoa Phat Group produced 392,000 tons of crude steel, equivalent to 56% over the same period in 2022. Sales volume of construction steel, billet and hot rolled coil (HRC) reached 402,000 tons, equal to 64% compared to the first month of last year.

Market by numbers

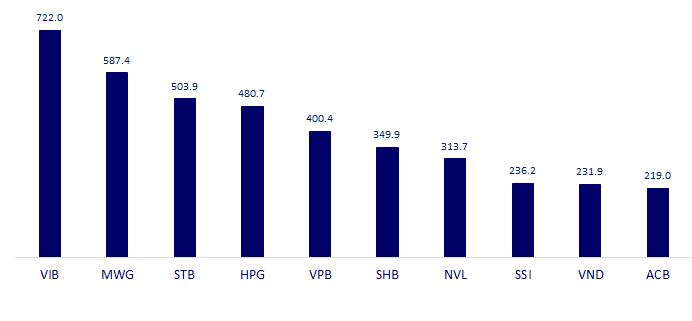

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

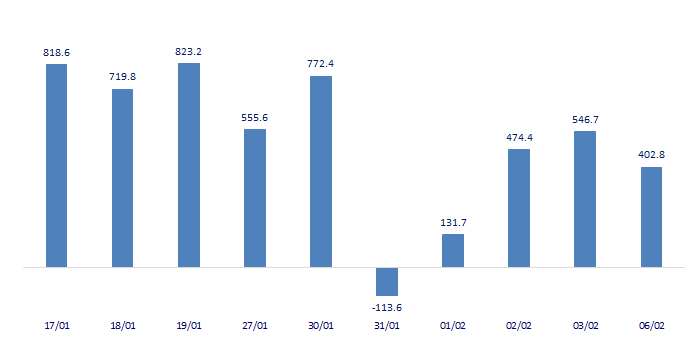

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

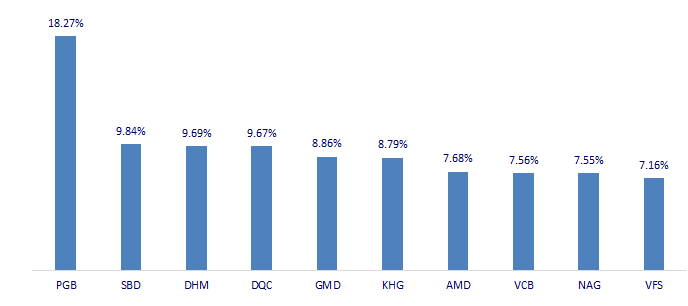

TOP INCREASES 3 CONSECUTIVE SESSIONS

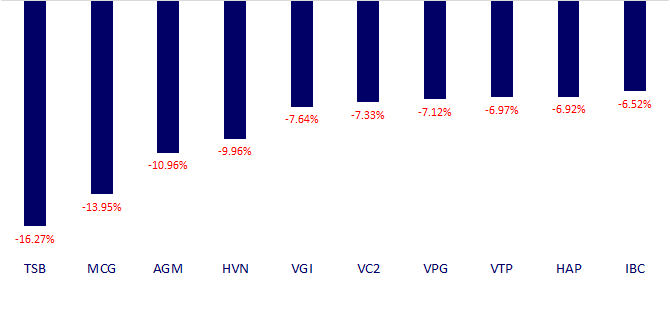

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.