Market Brief 13/02/2023

VIETNAM STOCK MARKET

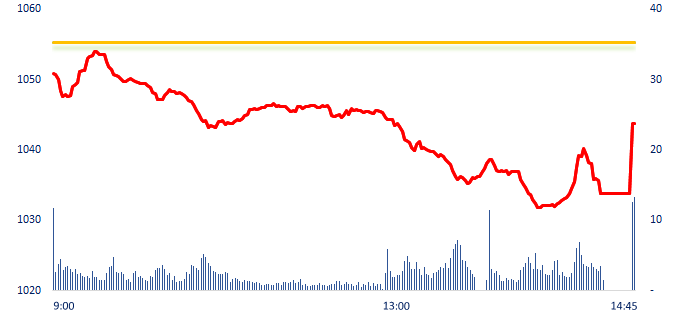

1,043.70

1D -1.10%

YTD 3.64%

1,040.40

1D -0.80%

YTD 3.50%

204.49

1D -1.92%

YTD -0.40%

77.20

1D -0.18%

YTD 7.75%

-64.51

1D 0.00%

YTD 0.00%

12,013.05

1D 30.12%

YTD 39.43%

The market continued to decline, trading volume increased by 50% compared to session 10/02. The duo of real estate stocks NVL and PDR together experienced a negative session when right from the opening, two tickers dropped to the floor price and remained throughout the session after NVL said that the business is capable of trading sell off assets.

ETF & DERIVATIVES

17,790

1D -1.82%

YTD 2.65%

12,200

1D -1.21%

YTD 2.35%

12,660

1D -1.86%

YTD 1.44%

16,000

1D 4.37%

YTD 13.88%

14,640

1D -3.17%

YTD 2.02%

22,480

1D -1.40%

YTD 0.36%

13,200

1D -1.79%

YTD 1.93%

1,025

1D -1.24%

YTD 0.00%

1,029

1D -0.63%

YTD 0.00%

1,034

1D -0.92%

YTD 0.00%

1,039

1D -0.61%

YTD 0.00%

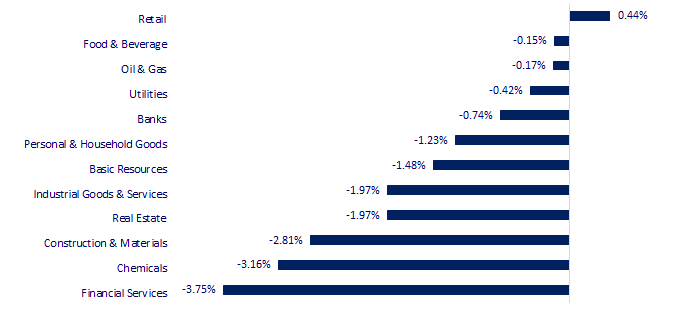

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

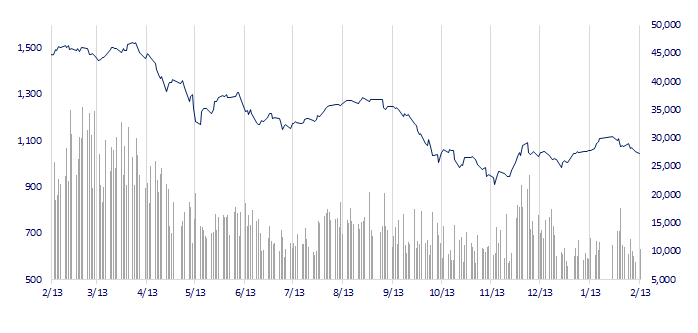

VNINDEX (12M)

GLOBAL MARKET

27,427.32

1D -0.88%

YTD 5.11%

3,284.16

1D 0.72%

YTD 6.31%

2,452.70

1D -0.69%

YTD 9.67%

21,164.42

1D -0.12%

YTD 6.99%

3,324.70

1D -1.07%

YTD 2.26%

1,664.89

1D 0.03%

YTD -0.33%

85.27

1D -0.35%

YTD -0.74%

1,869.10

1D -0.08%

YTD 2.35%

Asian shares slid on Monday as investors hunkered down for U.S. inflation data that could jolt the outlook for interest rates globally, while accelerating or reversing the recent spike in bond yields.

VIETNAM ECONOMY

4.58%

1D (bps) -39

YTD (bps) -39

7.40%

3.99%

1D (bps) 1

YTD (bps) -80

4.12%

1D (bps) 1

YTD (bps) -78

23,815

1D (%) 0.34%

YTD (%) 0.23%

25,645

1D (%) -0.87%

YTD (%) -0.05%

3,528

1D (%) -0.08%

YTD (%) 1.23%

According to the latest data just released by the State Bank, the average overnight interbank interest rate (the main tenor accounts for more than 95% of trading volume) has decreased sharply from the 6.21% recorded at the end of last week. The deep drop in interbank interest rates despite the SBV's strong net withdrawal activity shows that systemic liquidity has been much more abundant than in the previous period.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In the morning of February 14, the Prime Minister chaired a nationwide online conference to promote the real estate market;

- Banks lending to real estate businesses have increased 1.7 times in amount since mid-2019;

- Vietnamese rice is exported to Europe at the price of 1,800 USD/ton;

- Bloomberg: Turkey earthquake damage could reach USD84 billion;

- Egypt plans to invest around USD1.2billion planned for Zohr field;

- IEA convenes Special Ministerial on natural gas markets and actions to reinforce supply security.

VN30

BANK

93,500

1D -1.06%

5D -2.60%

Buy Vol. 1,264,003

Sell Vol. 1,735,449

44,400

1D 3.38%

5D -1.33%

Buy Vol. 2,857,645

Sell Vol. 2,527,480

29,150

1D 0.17%

5D -2.51%

Buy Vol. 3,283,401

Sell Vol. 3,959,465

26,600

1D -1.30%

5D -4.83%

Buy Vol. 5,623,829

Sell Vol. 4,826,224

17,000

1D -2.86%

5D -8.11%

Buy Vol. 45,810,405

Sell Vol. 39,457,471

18,000

1D -1.64%

5D -3.74%

Buy Vol. 18,207,155

Sell Vol. 25,231,213

18,050

1D -0.55%

5D -2.43%

Buy Vol. 3,277,771

Sell Vol. 3,175,753

23,000

1D -2.34%

5D -4.56%

Buy Vol. 8,707,154

Sell Vol. 7,763,422

24,500

1D 3.59%

5D -4.67%

Buy Vol. 36,234,248

Sell Vol. 31,094,721

20,200

1D -3.81%

5D -10.74%

Buy Vol. 6,691,191

Sell Vol. 5,644,118

23,900

1D -1.24%

5D -4.02%

Buy Vol. 4,516,701

Sell Vol. 4,759,260

MBB: MBBank implements a program to reduce loan interest rates for corporate customers with revenue below VND100 billion. Starting from February 10, 2023, customers can apply for a loan with a preferential interest rate down to 1%/year.

REAL ESTATE

12,800

1D -6.91%

5D -16.88%

Buy Vol. 22,068,005

Sell Vol. 54,284,261

83,800

1D -0.83%

5D -0.24%

Buy Vol. 116,463

Sell Vol. 130,943

11,250

1D -6.64%

5D -18.18%

Buy Vol. 14,931,820

Sell Vol. 26,790,821

NVL: At the end of 2022, Novaland's unrealized backlog was USD10.4 billion - increased by 39% over the same period.

OIL & GAS

105,900

1D -0.19%

5D -0.09%

Buy Vol. 335,494

Sell Vol. 497,660

11,700

1D -2.50%

5D -6.77%

Buy Vol. 20,393,033

Sell Vol. 13,900,533

37,900

1D -1.04%

5D -2.32%

Buy Vol. 878,978

Sell Vol. 875,183

From 3pm on February 13, gasoline products increased by 540 - 620 VND/liter, diesel and kerosene simultaneously decreased by nearly 1,000 VND/liter.

VINGROUP

53,400

1D -1.11%

5D -4.64%

Buy Vol. 2,282,418

Sell Vol. 3,886,842

44,400

1D -2.20%

5D -7.40%

Buy Vol. 3,867,708

Sell Vol. 4,055,868

28,500

1D 1.06%

5D -3.39%

Buy Vol. 3,064,566

Sell Vol. 1,988,833

VIC: VinFast plans to operate 100 mobile battery chargers across the country by June 2023.

FOOD & BEVERAGE

75,300

1D -0.79%

5D -2.71%

Buy Vol. 2,712,149

Sell Vol. 2,969,674

92,900

1D 1.86%

5D -3.53%

Buy Vol. 837,800

Sell Vol. 905,465

191,900

1D 1.32%

5D -1.79%

Buy Vol. 171,508

Sell Vol. 167,866

MSN: The Sherpa Company Limited, a subsidiary of Masan Group Corporation, has received the offshore investment registration certificate to carry out investment activities in Singapore.

OTHERS

48,500

1D -2.61%

5D -4.15%

Buy Vol. 672,710

Sell Vol. 748,796

103,100

1D 1.08%

5D -5.84%

Buy Vol. 265,789

Sell Vol. 230,922

80,700

1D 0.00%

5D 0.25%

Buy Vol. 1,675,660

Sell Vol. 1,208,739

42,500

1D 0.95%

5D -9.86%

Buy Vol. 3,789,593

Sell Vol. 2,723,758

14,000

1D -4.44%

5D -10.26%

Buy Vol. 4,673,429

Sell Vol. 4,094,364

18,500

1D -2.63%

5D -7.50%

Buy Vol. 23,718,318

Sell Vol. 21,068,900

20,200

1D -1.46%

5D -4.49%

Buy Vol. 38,340,385

Sell Vol. 34,029,447

HPG: As of the end of December 2022, Hoa Phat recorded an inventory of about VND35,737 billion, down 18% compared to the beginning of the year and down 40% compared to June, the lowest level in the past 2 years. The reduction in inventory helps the company reduce its working capital burden and financing costs.

Market by numbers

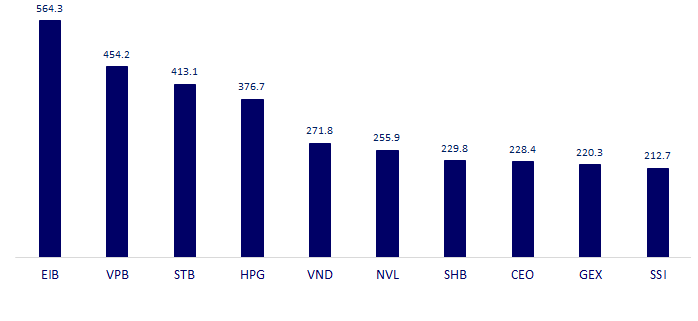

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

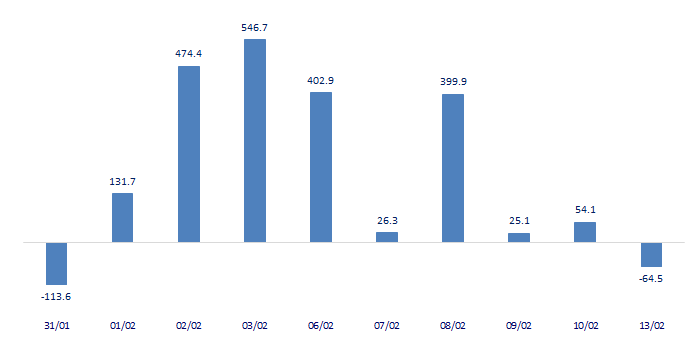

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

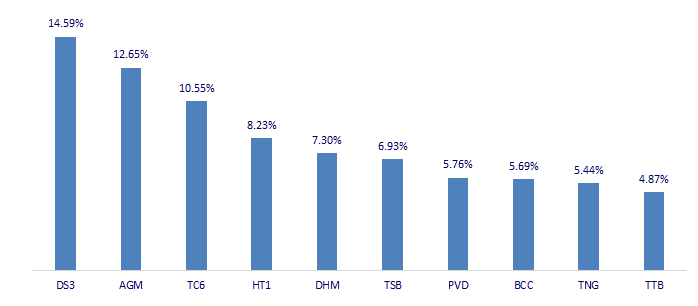

TOP INCREASES 3 CONSECUTIVE SESSIONS

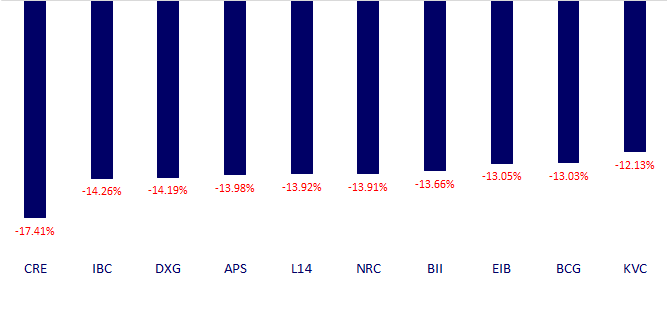

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.