Market Brief 15/02/2023

VIETNAM STOCK MARKET

1,048.20

1D 0.92%

YTD 4.08%

1,043.34

1D 0.81%

YTD 3.80%

207.97

1D 1.52%

YTD 1.30%

79.47

1D 1.96%

YTD 10.91%

-321.57

1D 0.00%

YTD 0.00%

11,227.87

1D 49.67%

YTD 30.32%

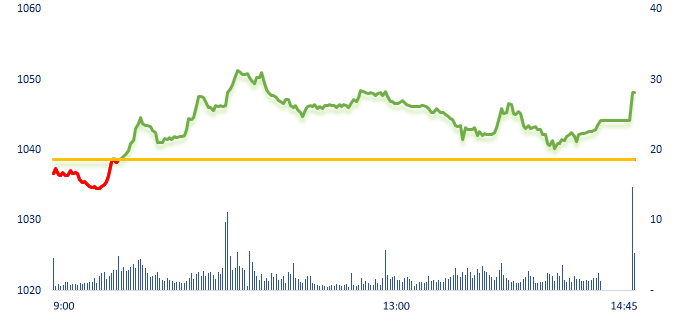

Session 15/02, the market almost regained what was lost in the previous two sessions with the liquidity improved by more than 46% compared to the session 14/02. Many public investment stocks have increased to price ceiling such as VCG, KSB, PLC, LCG,...after some rumors related to the list of winning businesses of 12 north-south expressway component projects.

ETF & DERIVATIVES

17,740

1D 0.51%

YTD 2.37%

12,260

1D 0.66%

YTD 2.85%

12,810

1D 0.87%

YTD 2.64%

15,480

1D -3.25%

YTD 10.18%

14,810

1D 1.37%

YTD 3.21%

22,650

1D 0.27%

YTD 1.12%

13,200

1D -0.15%

YTD 1.93%

1,028

1D 1.00%

YTD 0.00%

1,033

1D 1.14%

YTD 0.00%

1,037

1D 1.10%

YTD 0.00%

1,037

1D 0.59%

YTD 0.00%

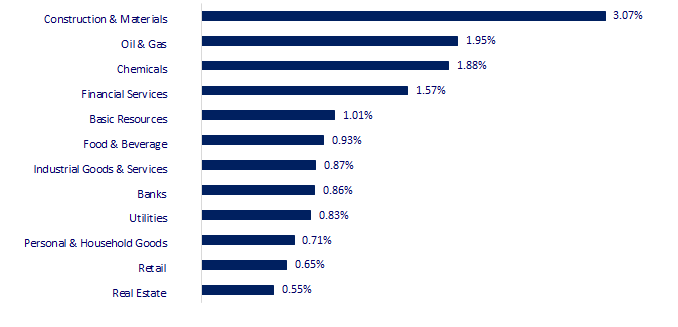

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

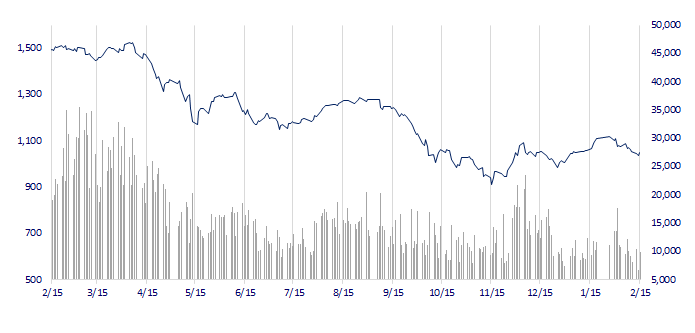

VNINDEX (12M)

GLOBAL MARKET

27,501.86

1D -0.37%

YTD 5.39%

3,280.49

1D -0.39%

YTD 6.19%

2,427.90

1D -1.53%

YTD 8.56%

20,812.17

1D -1.43%

YTD 5.21%

3,280.82

1D -1.13%

YTD 0.91%

1,647.39

1D -0.32%

YTD -1.38%

84.53

1D -1.03%

YTD -1.61%

1,846.90

1D -1.10%

YTD 1.13%

Asian stocks slipped following U.S. inflation data and remarks from central bank officials that have investors worrying interest rates are going to be higher for longer. Meanwhile, China's central bank ramped up medium-term liquidity injections, while keeping the interest rate unchanged, matching market expectations. But the mainland's stock markets slid broadly by early afternoon as investors wait for more signs of whether an expected economic recovery is gaining traction and result in sharp declines until at the end of the session.

VIETNAM ECONOMY

4.10%

1D (bps) -34

YTD (bps) -87

7.40%

3.91%

1D (bps) -6

YTD (bps) -88

4.09%

1D (bps) -2

YTD (bps) -81

23,793

1D (%) 0.10%

YTD (%) 0.14%

26,067

1D (%) -0.05%

YTD (%) 1.59%

3,523

1D (%) -0.11%

YTD (%) 1.09%

Session 15/02, the State Bank continued to withdrew about VND29,999 billion through the channel of issuing bills for 12 commercial banks. In which, T-bills with term of 7 days have interest rate of 5%/year, with total value of T-bills is VND24,999 billion. T-bills with term of 91 days have interest rate of 5.75%/year, with total value of VND5,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Textiles enter the race to compete for market share in the domestic market;

- Vietnam's exports in 2022 ranked second in ASEAN-6, higher than Thailand and the Philippines combined;

- At the end of 2023, Quang Ngai will operate a VND10,000 billion pulp mill;

- Warren Buffett's quick USD3.7 billion sale of TSMC stock spooks investors;

- Russia wants the UN to punish the Nord Stream case after revealing the blockbuster;

- OPEC raises world oil demand forecast for 2023.

VN30

BANK

93,000

1D 0.54%

5D -1.27%

Buy Vol. 1,592,702

Sell Vol. 1,579,521

44,000

1D 1.38%

5D -1.12%

Buy Vol. 1,707,064

Sell Vol. 1,644,876

28,900

1D 0.70%

5D -3.34%

Buy Vol. 2,811,657

Sell Vol. 3,497,168

27,400

1D 2.05%

5D -1.62%

Buy Vol. 4,755,388

Sell Vol. 4,726,255

17,200

1D 2.99%

5D -4.18%

Buy Vol. 23,052,655

Sell Vol. 21,363,365

18,000

1D 0.84%

5D -2.17%

Buy Vol. 14,986,851

Sell Vol. 23,465,087

17,800

1D 0.85%

5D -2.73%

Buy Vol. 2,904,830

Sell Vol. 3,165,629

23,800

1D 1.28%

5D -3.25%

Buy Vol. 11,780,607

Sell Vol. 11,455,490

23,350

1D -4.30%

5D -6.60%

Buy Vol. 59,250,525

Sell Vol. 56,358,797

20,700

1D 0.98%

5D -6.76%

Buy Vol. 5,535,287

Sell Vol. 5,399,529

24,550

1D 2.94%

5D -0.41%

Buy Vol. 5,234,903

Sell Vol. 4,981,664

According to financial statements published by 28 banks, by the end of 2022, banks collect funds from customer deposits with a total of more than VND8,300 trillion, up 10.7% over the same period last year. In which, 16/28 banks recorded an increase in deposits balance by over 10%. Most impressive is TPBank with the growth rate of deposits up to approximately 40% over the past year, far surpassing the next position of VPBank with 25%, ABBank and MSB with 24%, LienVietPostBank with 20%, HDBank with 17.74%...

REAL ESTATE

11,150

1D -6.69%

5D -22.03%

Buy Vol. 64,280,317

Sell Vol. 104,714,879

84,900

1D 0.47%

5D 0.47%

Buy Vol. 113,461

Sell Vol. 97,353

10,900

1D 2.83%

5D -11.74%

Buy Vol. 12,028,160

Sell Vol. 10,071,736

NVL: Petroleum Securities (PSI) requests Novaland to remedy the non-payment of a VND1,000 billion bond, which PSI represented as the owner, consultant and secured asset manager.

OIL & GAS

107,100

1D 1.42%

5D -0.19%

Buy Vol. 412,619

Sell Vol. 542,084

12,000

1D 1.27%

5D -2.04%

Buy Vol. 36,629,520

Sell Vol. 12,159,249

38,750

1D 1.97%

5D 4.17%

Buy Vol. 1,640,005

Sell Vol. 1,360,429

POW: PV Power has just announced January business results with estimated revenue of VND1,712 billion, down 21% over the same period.

VINGROUP

52,900

1D 0.00%

5D -2.76%

Buy Vol. 4,824,297

Sell Vol. 4,675,278

42,500

1D -0.58%

5D -8.80%

Buy Vol. 7,009,124

Sell Vol. 5,494,709

28,350

1D 1.25%

5D -0.53%

Buy Vol. 1,634,832

Sell Vol. 1,925,055

VIC: After information from Bloomberg that Mr.Pham Nhat Vuong has no plans to personally invest any more money in VinFast, VIC confirmed that VIC still provides financial support to VF.

FOOD & BEVERAGE

76,000

1D 1.74%

5D 0.26%

Buy Vol. 2,360,788

Sell Vol. 2,698,004

93,000

1D 0.11%

5D -0.53%

Buy Vol. 894,923

Sell Vol. 1,061,925

189,000

1D 0.53%

5D -4.16%

Buy Vol. 141,620

Sell Vol. 170,258

VNM: Vinamilk's management is not too optimistic about the ability to recover milk demand and said it is reducing inventories at distributors.

OTHERS

49,400

1D 0.61%

5D 0.30%

Buy Vol. 499,220

Sell Vol. 701,385

102,700

1D -0.10%

5D -4.91%

Buy Vol. 253,934

Sell Vol. 239,450

81,600

1D 0.99%

5D 0.49%

Buy Vol. 1,750,811

Sell Vol. 1,596,093

42,750

1D 0.59%

5D -3.93%

Buy Vol. 2,101,189

Sell Vol. 2,238,418

14,500

1D 2.47%

5D -1.69%

Buy Vol. 4,206,306

Sell Vol. 2,763,637

19,100

1D 1.06%

5D -2.05%

Buy Vol. 18,608,817

Sell Vol. 21,908,954

20,800

1D 0.97%

5D -0.24%

Buy Vol. 35,675,337

Sell Vol. 44,703,308

GVR: The Vietnam Rubber Association said that the recovery of global rubber consumption has spurred rubber exporters. Accordingly, GVR said the group will increase the rubber plantation area, increase production and consumption, develop the wood processing industry and the rubber industry to effectively exploit the value chain.

Market by numbers

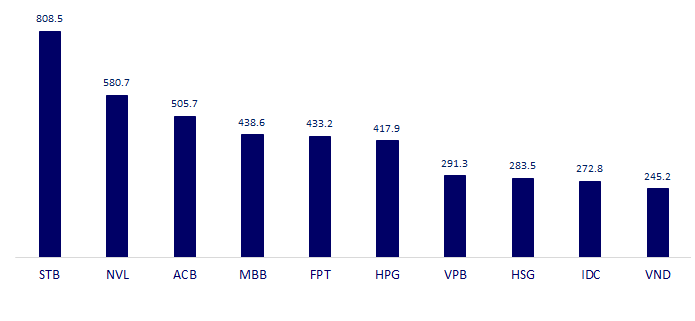

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

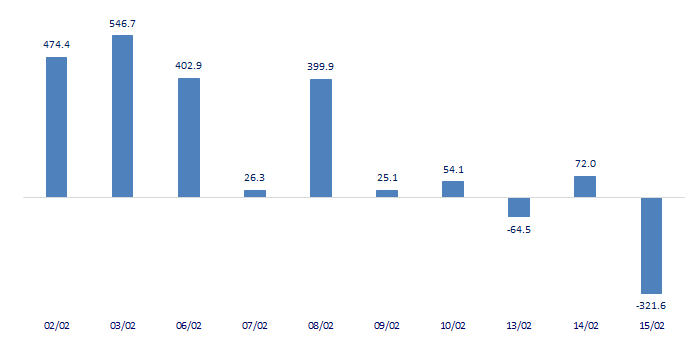

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

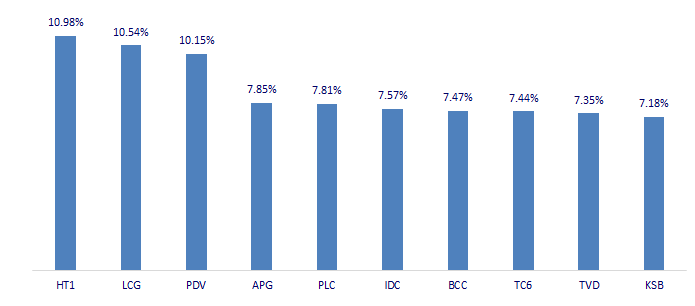

TOP INCREASES 3 CONSECUTIVE SESSIONS

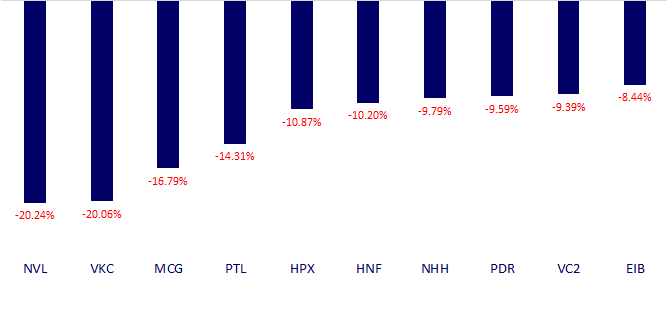

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.