Market Brief 17/02/2023

VIETNAM STOCK MARKET

1,059.31

1D 0.10%

YTD 5.19%

1,053.72

1D -0.15%

YTD 4.83%

209.95

1D -0.42%

YTD 2.26%

78.94

1D -0.90%

YTD 10.17%

17.24

1D 0.00%

YTD 0.00%

9,013.63

1D -11.32%

YTD 4.62%

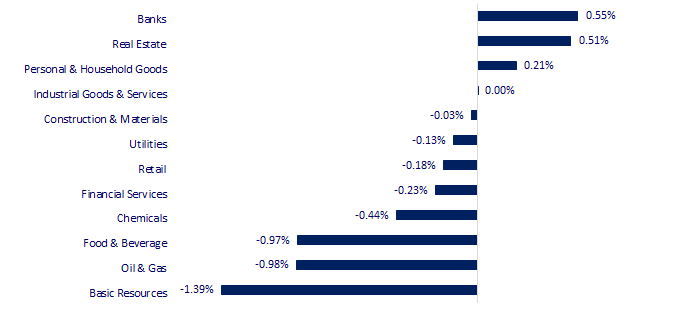

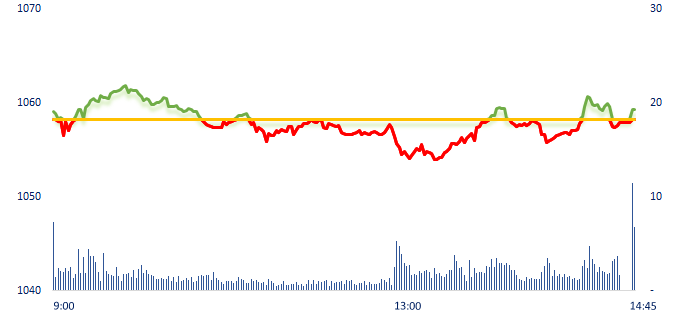

Session 17/02, the market struggled in a narrow range. The sentiment was reflected in the bullish and bearish divergence among industry groups in the session when there was no particular industry leading the market. The banking group led the gain but the increase was only 0.55%, mainly contributed by VCB and BID.

ETF & DERIVATIVES

17,860

1D -0.33%

YTD 3.06%

12,410

1D -0.32%

YTD 4.11%

12,810

1D -0.39%

YTD 2.64%

15,550

1D -0.64%

YTD 10.68%

15,010

1D 1.01%

YTD 4.60%

22,920

1D -0.04%

YTD 2.32%

13,390

1D 0.15%

YTD 3.40%

1,042

1D -0.33%

YTD 0.00%

1,047

1D -0.16%

YTD 0.00%

1,045

1D -1.42%

YTD 0.00%

1,049

1D -0.52%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

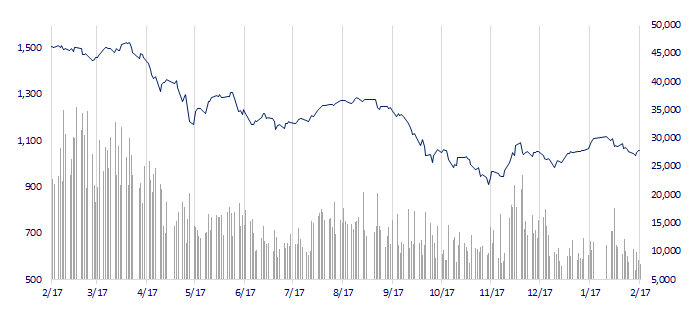

VNINDEX (12M)

GLOBAL MARKET

27,513.13

1D -0.66%

YTD 5.44%

3,224.02

1D -0.77%

YTD 4.36%

2,451.21

1D -0.98%

YTD 9.61%

20,719.81

1D -1.28%

YTD 4.74%

3,328.37

1D 0.52%

YTD 2.37%

1,651.67

1D -0.40%

YTD -1.12%

83.23

1D -1.92%

YTD -3.12%

1,832.40

1D -0.49%

YTD 0.34%

Asian equities were at the lowest in more than a month on Friday and the dollar hovered around six-week highs amid revived expectations the U.S. central bank would stick to its monetary tightening path.

VIETNAM ECONOMY

4.76%

YTD (bps) -21

7.40%

4.00%

1D (bps) 4

YTD (bps) -79

4.13%

1D (bps) 5

YTD (bps) -77

24,000

1D (%) 0.42%

YTD (%) 1.01%

26,078

1D (%) 0.23%

YTD (%) 1.63%

3,532

1D (%) 0.09%

YTD (%) 1.35%

In the context of the recent decline in interbank interest rates, the State Bank has stepped up the issuance of T-bills with the aim of withdrawing liquidity regularly at 10,000 - 20,000 billion VND/session and temporarily time to stop providing liquidity on OMO channel. Notably, SBV also raised the tenor of the T-bills from 7 days to 91 days, showing the orientation to attract liquidity in a long time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Construction proposed a support package of VND110,000 billion to "rescue" the real estate market;

- North - South Expressway lacks materials for construction;

- Big4-banks agreed to spend a credit package of VND120,000 billion for real estate;

- Tesla recalls nearly 363,000 electric vehicles due to problems with driver assistance technology;

- Russia and Ukraine run out of ammunition, factories from the US to Europe stretch their production to keep up with supply;

- China’s USD2 trillion LGFV market flashes new credit warning.

VN30

BANK

93,000

1D 0.65%

5D -1.59%

Buy Vol. 1,353,013

Sell Vol. 1,429,025

45,800

1D 1.78%

5D 6.64%

Buy Vol. 2,451,719

Sell Vol. 3,009,527

29,650

1D -0.17%

5D 1.89%

Buy Vol. 3,441,259

Sell Vol. 4,990,501

27,800

1D -0.36%

5D 3.15%

Buy Vol. 3,212,762

Sell Vol. 3,612,109

17,300

1D -1.14%

5D -1.14%

Buy Vol. 20,533,348

Sell Vol. 20,073,617

18,100

1D -0.82%

5D -1.09%

Buy Vol. 9,496,103

Sell Vol. 14,402,569

18,450

1D -0.27%

5D 1.65%

Buy Vol. 3,230,351

Sell Vol. 4,416,305

23,850

1D -0.63%

5D 1.27%

Buy Vol. 8,039,925

Sell Vol. 10,402,923

24,400

1D 2.09%

5D 3.17%

Buy Vol. 33,739,353

Sell Vol. 36,484,783

21,500

1D 2.87%

5D 2.38%

Buy Vol. 7,580,013

Sell Vol. 5,577,174

24,800

1D 0.00%

5D 2.48%

Buy Vol. 3,150,315

Sell Vol. 3,196,062

At the National Online Conference "Promote the safe, healthy, and sustainable development of the real estate market" on February 17, economist Dr. Can Van Luc suggested that the State Bank of Vietnam consider early providing credit room to commercial banks this month to remove difficulties for the real estate sector.

REAL ESTATE

11,650

1D 1.30%

5D -15.27%

Buy Vol. 51,701,024

Sell Vol. 52,432,294

84,900

1D -0.12%

5D 0.47%

Buy Vol. 130,446

Sell Vol. 130,739

10,950

1D -0.45%

5D -9.13%

Buy Vol. 12,312,552

Sell Vol. 13,057,610

NVL: Chairman of Novaland proposed to choose Aqua City to test solving difficulties.

OIL & GAS

107,200

1D -0.65%

5D 1.04%

Buy Vol. 348,031

Sell Vol. 409,110

12,400

1D 0.40%

5D 3.33%

Buy Vol. 27,918,975

Sell Vol. 22,984,756

38,600

1D -1.03%

5D 0.78%

Buy Vol. 801,624

Sell Vol. 1,349,051

Petrol distributors proposed to adjust gasoline prices every 15 days to balance prices, allowing them to continue to receive goods from many sources, avoiding market disruptions.

VINGROUP

53,500

1D 0.19%

5D -0.93%

Buy Vol. 3,781,786

Sell Vol. 2,878,684

43,300

1D 1.88%

5D -4.63%

Buy Vol. 3,984,477

Sell Vol. 2,950,248

28,400

1D 0.00%

5D 0.71%

Buy Vol. 2,401,428

Sell Vol. 2,243,895

VIC: VinFast was officially licensed to start building a factory in the US.

FOOD & BEVERAGE

76,000

1D -0.65%

5D 0.13%

Buy Vol. 1,552,206

Sell Vol. 1,930,267

91,300

1D -1.72%

5D 0.11%

Buy Vol. 593,801

Sell Vol. 858,483

187,100

1D -1.37%

5D -1.21%

Buy Vol. 82,347

Sell Vol. 93,442

MSN: Hanoi Stock Exchange will delist 30 million MSN12002 bonds worth VND3,000 billion on February 23, due to the bond's maturity, in the case of delisting according to regulations.

OTHERS

50,400

1D 0.60%

5D 1.20%

Buy Vol. 1,389,406

Sell Vol. 1,775,275

102,600

1D -0.19%

5D 0.59%

Buy Vol. 343,921

Sell Vol. 294,428

81,600

1D 0.00%

5D 1.12%

Buy Vol. 1,249,862

Sell Vol. 1,047,036

43,250

1D -0.12%

5D 2.73%

Buy Vol. 2,000,650

Sell Vol. 1,875,533

14,700

1D -0.34%

5D 0.34%

Buy Vol. 3,080,794

Sell Vol. 2,658,640

19,450

1D -0.26%

5D 2.37%

Buy Vol. 16,958,374

Sell Vol. 17,512,240

21,000

1D -1.41%

5D 2.44%

Buy Vol. 24,270,372

Sell Vol. 30,454,184

MWG: MWG has just announced its business plan for 2023 with net revenue of VND135,000 - 150,000 billion. Expected net profit is VND4,200 billion - 4,700 billion. Bach Hoa Xanh chain is expected to contribute 20% - 25% of sales for MWG this year.

Market by numbers

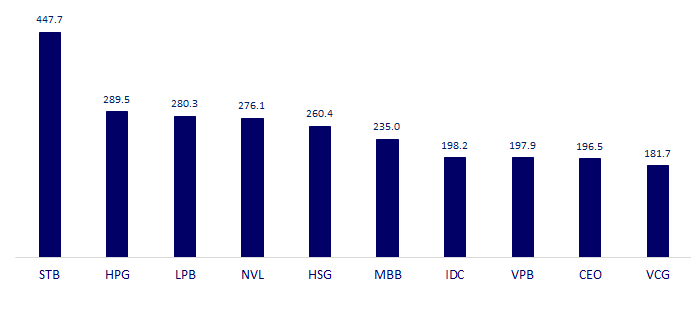

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

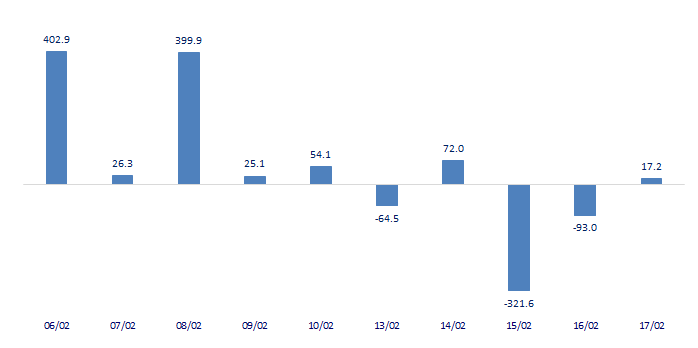

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

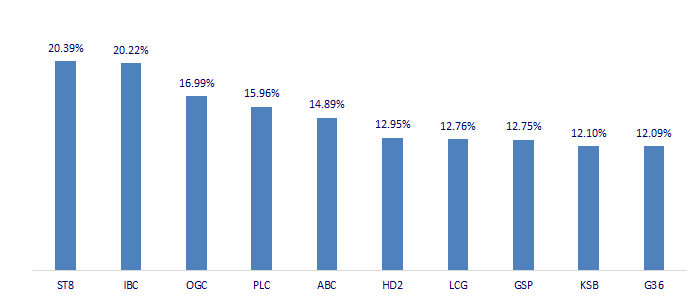

TOP INCREASES 3 CONSECUTIVE SESSIONS

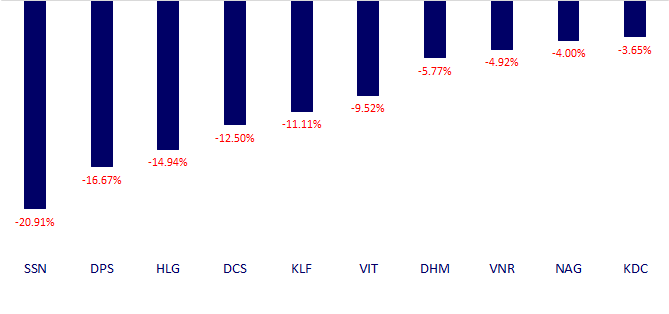

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.