Market Brief 01/03/2023

VIETNAM STOCK MARKET

1,040.55

1D 1.55%

YTD 3.32%

1,034.43

1D 1.92%

YTD 2.91%

206.83

1D 2.20%

YTD 0.74%

76.64

1D 0.26%

YTD 6.96%

-300.01

1D 0.00%

YTD 0.00%

9,540.92

1D 27.15%

YTD 10.74%

Vietnam stocks today had a positive session when VN-Index closed at the highest level of the session. The world oil price rebounded after hitting the bottom in February, boosting oil and gas stocks today, helping the oil and gas industry to lead the gain in all groups. Besides, today's the government spending group has boomed again.

ETF & DERIVATIVES

17,540

1D 1.39%

YTD 1.21%

12,180

1D 1.67%

YTD 2.18%

12,560

1D 1.29%

YTD 0.64%

16,100

1D 4.27%

YTD 14.59%

14,760

1D 1.37%

YTD 2.86%

22,100

1D 0.45%

YTD -1.34%

13,150

1D 2.10%

YTD 1.54%

1,026

1D 2.31%

YTD 0.00%

1,029

1D 2.52%

YTD 0.00%

1,029

1D 2.18%

YTD 0.00%

1,032

1D 2.38%

YTD 0.00%

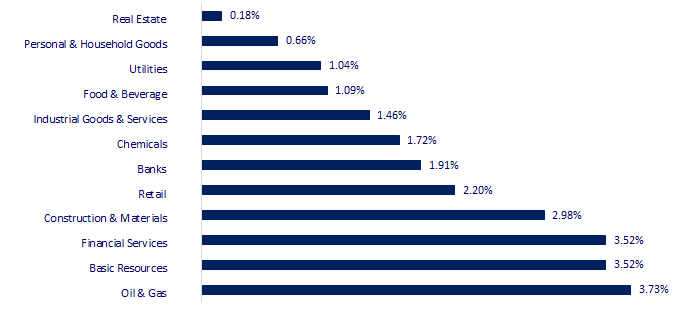

CHANGE IN PRICE BY SECTOR

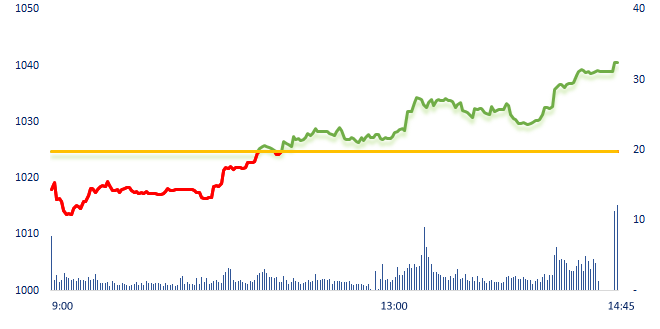

INTRADAY VNINDEX

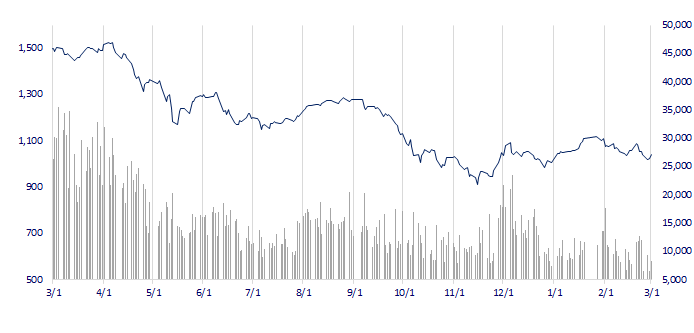

VNINDEX (12M)

GLOBAL MARKET

27,516.53

1D 0.26%

YTD 5.45%

3,312.35

1D 1.00%

YTD 7.22%

2,412.85

1D 0.00%

YTD 7.89%

20,619.71

1D 4.21%

YTD 4.24%

3,255.08

1D -0.23%

YTD 0.12%

1,619.98

1D -0.15%

YTD -3.02%

83.14

1D -0.14%

YTD -3.22%

1,839.45

1D 0.33%

YTD 0.73%

Hang Seng index rose 4.21% – leading gains in the region after China's National Bureau of Statistics announced that China's factory sector grew in February at the fastest pace in more than a decade, a standout in Asia where manufacturing growth stalled elsewhere, weighed down by slowing global demand, high inflation and interest rates, surveys showed on Wednesday.

VIETNAM ECONOMY

6.00%

1D (bps) 72

YTD (bps) 103

7.40%

4.06%

1D (bps) -2

YTD (bps) -73

4.25%

1D (bps) -1

YTD (bps) -65

23,895

1D (%) -0.17%

YTD (%) 0.57%

25,978

1D (%) 0.41%

YTD (%) 1.24%

3,519

1D (%) 0.51%

YTD (%) 0.98%

The dollar eased and China's yuan gained on Wednesday after China's manufacturing activity expanded at its fastest pace since April 2012, while the euro rose after regional German price data added to inflation worries.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- UOB completes deal for Citi's Vietnam consumer banking business;

- Gasoline prices fell for the second time in a row;

- Adjustment of the general planning on construction of Dung Quat economic zone;

- China's factory activity stuns with fastest growth in a decade

- Latest UK-EU deal no game changer for sterling;

- Nearly 2 million barrels of Russian diesel are stranded at sea because no one wants to buy them.

VN30

BANK

93,000

1D -0.53%

5D 0.00%

Buy Vol. 1,199,597

Sell Vol. 1,123,663

45,650

1D 3.51%

5D 1.44%

Buy Vol. 2,082,632

Sell Vol. 1,165,513

28,250

1D 3.10%

5D -2.25%

Buy Vol. 5,092,879

Sell Vol. 3,336,099

27,300

1D 3.02%

5D -0.73%

Buy Vol. 4,016,149

Sell Vol. 3,449,383

17,450

1D 2.35%

5D 0.00%

Buy Vol. 20,060,729

Sell Vol. 15,953,126

17,650

1D 2.32%

5D -3.29%

Buy Vol. 17,479,667

Sell Vol. 10,453,742

17,700

1D 3.81%

5D -4.32%

Buy Vol. 3,004,359

Sell Vol. 2,415,822

24,000

1D 3.00%

5D 1.91%

Buy Vol. 8,476,576

Sell Vol. 7,058,387

25,400

1D 6.95%

5D 2.83%

Buy Vol. 47,349,079

Sell Vol. 32,994,600

21,100

1D 2.68%

5D 0.48%

Buy Vol. 4,690,458

Sell Vol. 4,112,571

25,150

1D 3.07%

5D 1.21%

Buy Vol. 4,251,289

Sell Vol. 4,396,168

TPB: FPT Investment Fund Management JSC (FPT Capital) sold 783,322 TPB shares of Tien Phong Commercial Joint Stock Bank, equivalent to 0.049% of the bank's charter capital. Previously, FPT Capital had registered to sell 1 million TPB shares, equivalent to 0.063% of the bank's charter capital. However, the company only had matched 216,678 shares by put-through transaction because the selling price was lower than expected.

REAL ESTATE

10,250

1D -3.30%

5D -14.58%

Buy Vol. 21,078,390

Sell Vol. 21,036,369

84,300

1D 0.72%

5D -0.24%

Buy Vol. 119,295

Sell Vol. 93,487

10,400

1D 2.97%

5D -5.45%

Buy Vol. 9,505,860

Sell Vol. 7,047,725

NVL: As planned, NVL's bonds maturing in March are worth VND2,057 billion.

OIL & GAS

105,100

1D 1.55%

5D -1.78%

Buy Vol. 415,521

Sell Vol. 334,099

12,350

1D 2.07%

5D 2.92%

Buy Vol. 29,232,098

Sell Vol. 13,130,665

38,650

1D 3.62%

5D 1.18%

Buy Vol. 1,410,737

Sell Vol. 1,082,739

PLX: Petrolimex publicly auctioned 40% of PGBank shares with the asking price higher than the market price by 25%.

VINGROUP

52,700

1D 0.19%

5D -0.57%

Buy Vol. 1,727,584

Sell Vol. 2,372,453

41,200

1D -0.72%

5D -3.29%

Buy Vol. 5,403,558

Sell Vol. 5,336,669

26,800

1D 0.37%

5D -4.63%

Buy Vol. 3,346,581

Sell Vol. 3,693,024

VIC: VinFast delivered the VF 8 electric car (docked last December) in the US from March 1.

FOOD & BEVERAGE

76,900

1D 1.85%

5D 1.85%

Buy Vol. 2,869,139

Sell Vol. 2,929,199

80,500

1D -1.83%

5D -11.54%

Buy Vol. 1,549,819

Sell Vol. 1,560,259

192,500

1D 2.39%

5D 2.94%

Buy Vol. 97,272

Sell Vol. 83,101

MSN: Masan Corporation (MSN) has just announced a resolution on the restructuring of Masan MEATLife (MML).

OTHERS

49,450

1D 1.96%

5D -1.10%

Buy Vol. 535,637

Sell Vol. 482,067

101,500

1D 1.50%

5D 0.69%

Buy Vol. 282,414

Sell Vol. 288,256

80,500

1D 0.00%

5D -1.59%

Buy Vol. 2,449,797

Sell Vol. 1,943,318

40,800

1D 2.00%

5D -5.12%

Buy Vol. 3,244,594

Sell Vol. 2,246,423

14,400

1D 3.23%

5D -1.03%

Buy Vol. 2,583,094

Sell Vol. 1,971,387

18,950

1D 3.84%

5D -1.81%

Buy Vol. 23,972,548

Sell Vol. 17,399,508

20,900

1D 4.50%

5D -1.42%

Buy Vol. 36,660,260

Sell Vol. 34,660,357

HPG: The Hoa Phat Dung Quat 2 Iron and Steel Production Complex, has been implemented since 2022, currently with a capacity of 5.6 million tons of HRC/year. Combined with Hoa Phat Dung Quat 1, the group's total annual HRC capacity now reaches 8.6 million tons. The group's crude steel production capacity is expected to reach more than 14 million tons from 2025, reaching the Top 30 largest steel enterprises in the world.

Market by numbers

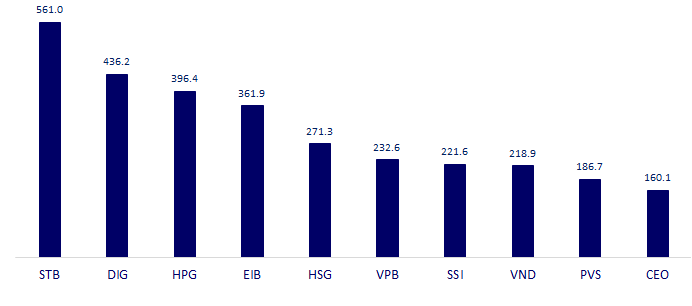

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

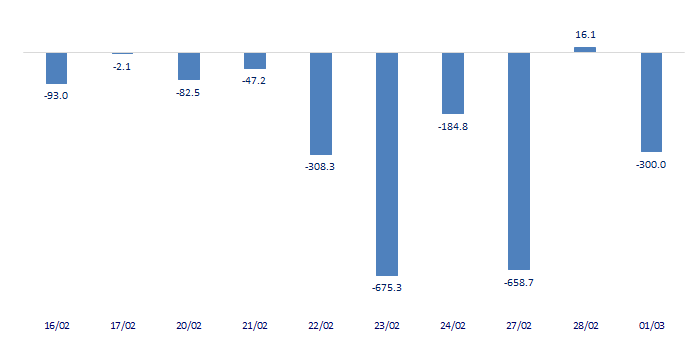

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

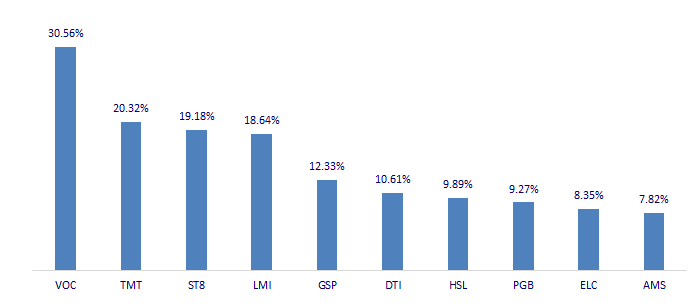

TOP INCREASES 3 CONSECUTIVE SESSIONS

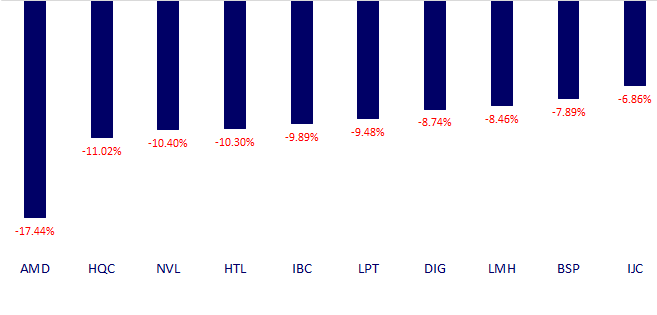

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.