Market Brief 02/03/2023

VIETNAM STOCK MARKET

1,037.61

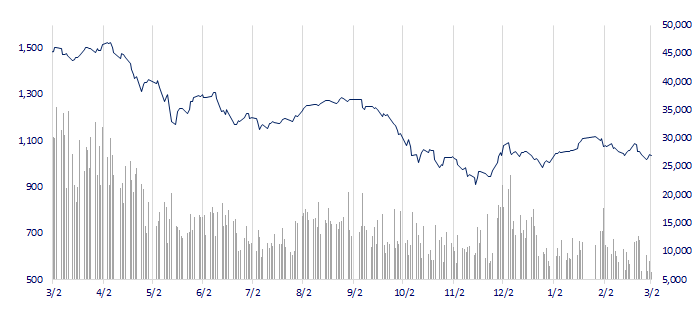

1D -0.28%

YTD 3.03%

1,028.73

1D -0.55%

YTD 2.34%

206.14

1D -0.33%

YTD 0.40%

76.28

1D -0.47%

YTD 6.46%

-118.70

1D 0.00%

YTD 0.00%

7,183.56

1D -24.71%

YTD -16.62%

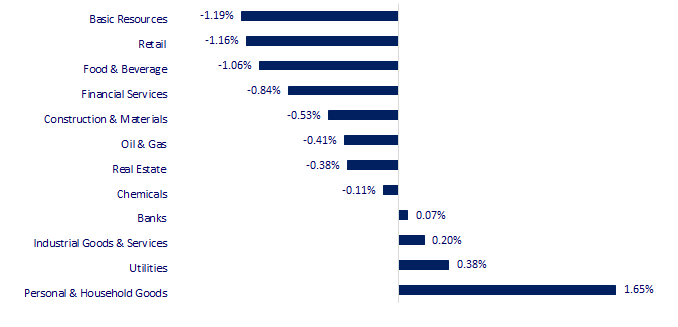

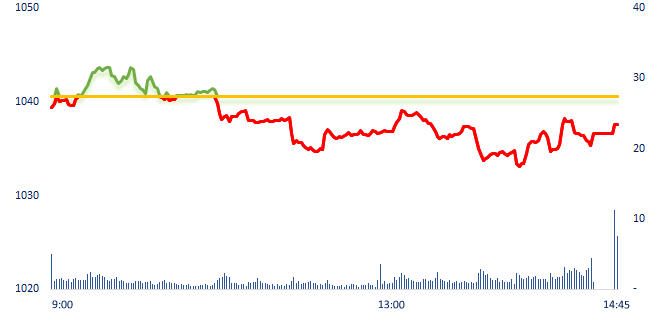

The market turned down after a strong recovery session, mainly weighed down by some bluechips such as SAB, CTG, MSN or HPG. Information about the Ministry of Construction's proposal to suspend the credit package of VND110,000 billion right before the start of the afternoon session put some pressure on the market. The group of basic resources led the decline, mainly due to the negative impact of HPG.

ETF & DERIVATIVES

17,650

1D 0.63%

YTD 1.85%

12,150

1D -0.25%

YTD 1.93%

12,570

1D 0.08%

YTD 0.72%

16,450

1D 2.17%

YTD 17.08%

15,030

1D 1.83%

YTD 4.74%

22,240

1D 0.63%

YTD -0.71%

13,090

1D -0.46%

YTD 1.08%

1,021

1D -0.56%

YTD 0.00%

1,019

1D -1.02%

YTD 0.00%

1,022

1D -0.63%

YTD 0.00%

1,024

1D -0.78%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,498.87

1D -0.06%

YTD 5.38%

3,310.65

1D -0.05%

YTD 7.17%

2,427.85

1D 0.62%

YTD 8.56%

20,429.46

1D -0.92%

YTD 3.28%

3,234.90

1D -0.62%

YTD -0.51%

1,612.64

1D -0.45%

YTD -3.46%

84.88

1D 0.63%

YTD -1.20%

1,838.15

1D -0.19%

YTD 0.65%

Oil edged higher on Thursday, though gains made on signs of a strong economic rebound in top crude importer China were kept in check by fears over the impact of potnetial increases to European interest rates.

VIETNAM ECONOMY

6.27%

1D (bps) 27

YTD (bps) 130

7.40%

4.03%

1D (bps) -3

YTD (bps) -76

4.23%

1D (bps) -2

YTD (bps) -67

23,935

1D (%) 0.21%

YTD (%) 0.74%

25,653

1D (%) -1.37%

YTD (%) -0.02%

3,510

1D (%) -0.34%

YTD (%) 0.72%

Commercial banks have agreed to reduce the maximum deposit interest rate by about 0.5% for terms from 6 months to 12 months, starting from March 6. In the context of low demand for loans in the first two months of the year, a reduction in interest rates is necessary, because if the interest rate level continues to be maintained at the current high level, it will lead to the collapse of many businesses. Especially businesses that have difficulty in consuming output products such as real estate businesses.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Temporarily suspending the proposal of a credit package of VND110,000 billion;

- Coal prices fell deeply to the level before the war between Russia and Ukraine;

- Foreign investment in Ho Chi Minh City up 43%;

- The number of Twitter employees is at a record low;

- The wave of replacing human resources with AI in the US;

- WSJ: Chinese financier Fan Bao, who went missing last month, has been detained by authorities in mainland China since February.

VN30

BANK

93,200

1D 0.22%

5D -0.11%

Buy Vol. 1,688,204

Sell Vol. 1,840,083

46,400

1D 1.64%

5D 1.87%

Buy Vol. 1,781,355

Sell Vol. 1,895,064

27,800

1D -1.59%

5D -4.14%

Buy Vol. 3,562,580

Sell Vol. 3,883,242

27,200

1D -0.37%

5D -2.68%

Buy Vol. 2,188,662

Sell Vol. 3,333,519

17,300

1D -0.86%

5D -1.42%

Buy Vol. 10,402,239

Sell Vol. 11,554,948

17,400

1D -1.42%

5D -4.13%

Buy Vol. 7,910,824

Sell Vol. 9,324,544

18,000

1D 1.69%

5D -0.28%

Buy Vol. 2,488,810

Sell Vol. 3,547,302

23,800

1D -0.83%

5D -0.83%

Buy Vol. 4,332,614

Sell Vol. 6,522,169

25,600

1D 0.79%

5D 2.40%

Buy Vol. 21,153,580

Sell Vol. 28,444,598

21,000

1D -0.47%

5D -2.33%

Buy Vol. 2,193,433

Sell Vol. 3,803,735

25,050

1D -0.40%

5D -1.38%

Buy Vol. 4,702,770

Sell Vol. 6,782,475

VCB: Vietcombank has announced the business plan for 2023 with a minimum increase of 12% in pre-tax profit compared to the previous year, estimated to exceed VND41 trillion. Thus, Vietcombank has only set the same profit growth target as the previous year, although the growth prospect may be higher than 12% even excluding the factor that VCB received the compulsory transfer of weak credit institutions.

REAL ESTATE

10,350

1D 0.98%

5D -12.29%

Buy Vol. 16,027,281

Sell Vol. 15,065,254

84,000

1D -0.36%

5D -0.71%

Buy Vol. 76,183

Sell Vol. 86,772

10,500

1D 0.96%

5D -3.67%

Buy Vol. 4,584,462

Sell Vol. 4,649,223

The Ministry of Construction has suspended the proposal of a credit package of VND110,000 billion in favor of a proposal of VND120,000 billion announced by SBV.

OIL & GAS

105,000

1D -0.10%

5D -0.76%

Buy Vol. 279,479

Sell Vol. 309,748

12,700

1D 2.83%

5D 4.10%

Buy Vol. 69,030,852

Sell Vol. 44,275,085

38,650

1D 0.00%

5D 0.78%

Buy Vol. 1,188,568

Sell Vol. 1,231,217

PLX: In 2023, Petrolimex may gain more market share from small businesses that are likely to be excluded from the market after a difficult year.

VINGROUP

52,800

1D 0.19%

5D -0.38%

Buy Vol. 1,497,972

Sell Vol. 2,412,623

41,100

1D -0.24%

5D -2.14%

Buy Vol. 3,290,894

Sell Vol. 3,413,019

26,200

1D -2.24%

5D -1.13%

Buy Vol. 3,012,310

Sell Vol. 4,627,270

VRE: Vincom Retail plans to hand over real estate projects in Quang Tri and Dien Bien this year.

FOOD & BEVERAGE

76,500

1D -0.52%

5D 1.06%

Buy Vol. 2,020,551

Sell Vol. 2,464,598

79,000

1D -1.86%

5D -9.82%

Buy Vol. 874,569

Sell Vol. 1,023,687

188,100

1D -1.77%

5D 1.06%

Buy Vol. 73,514

Sell Vol. 112,646

MSN: The restructuring of Masan's investment in MML in the context that the meat industry is currently facing difficulties, the selling price decreased while the price of input materials remained high.

OTHERS

49,000

1D -0.91%

5D -1.21%

Buy Vol. 287,689

Sell Vol. 320,985

101,600

1D 0.10%

5D 3.46%

Buy Vol. 369,565

Sell Vol. 451,511

80,000

1D -0.62%

5D -1.72%

Buy Vol. 1,190,132

Sell Vol. 880,135

40,300

1D -1.23%

5D -6.28%

Buy Vol. 1,751,725

Sell Vol. 1,867,675

14,250

1D -1.04%

5D -3.72%

Buy Vol. 2,001,832

Sell Vol. 2,473,943

18,650

1D -1.58%

5D -5.33%

Buy Vol. 10,626,999

Sell Vol. 14,925,782

20,600

1D -1.44%

5D -4.19%

Buy Vol. 18,452,279

Sell Vol. 28,489,443

According to Reputa's 2022 ranking, in the fields of electronics and telecommunications, FPT Shop (FRT) leads in the top 5 most popular stores on social networks, with a total of 35 points. Following are Dien May Xanh (MWG) (23.53 points), Media Mart (23.46 points), Mobile World (MWG) (23.3 points) and Tablet Plaza (21.32 points).

Market by numbers

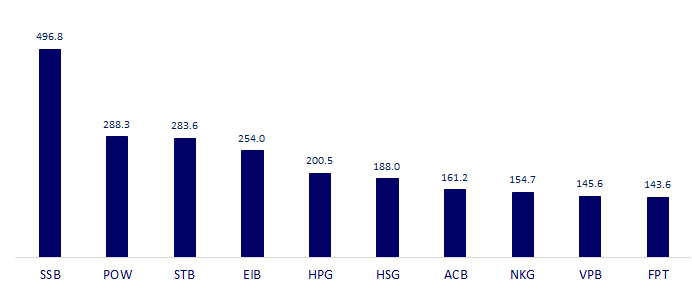

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

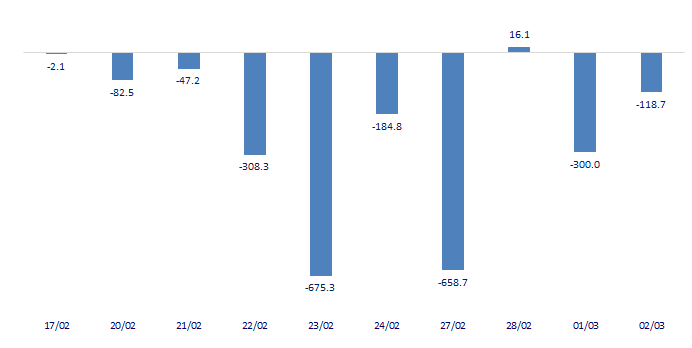

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

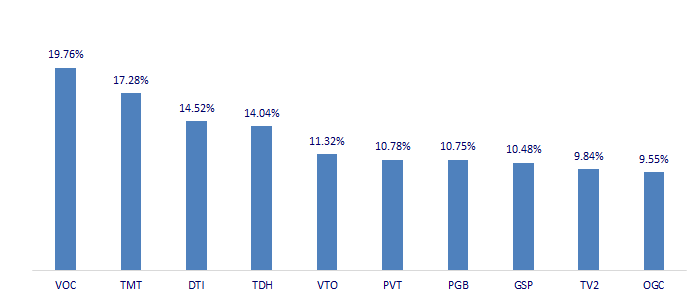

TOP INCREASES 3 CONSECUTIVE SESSIONS

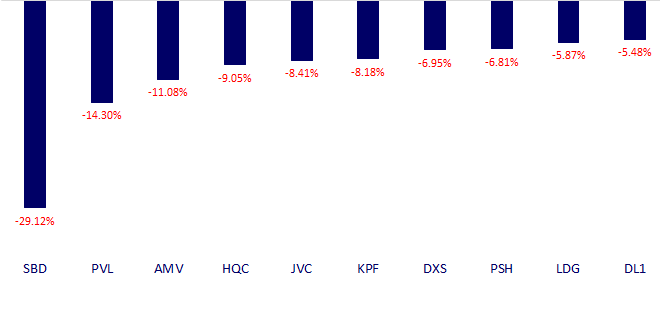

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.