Market Brief 03/03/2023

VIETNAM STOCK MARKET

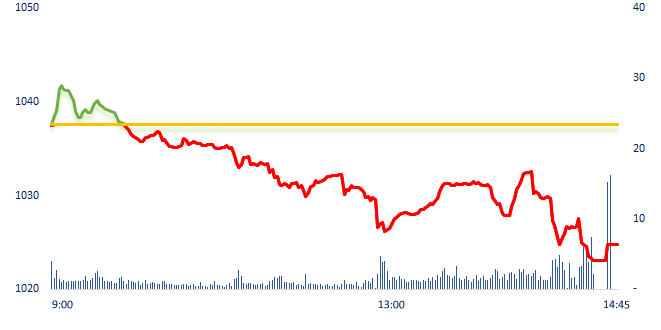

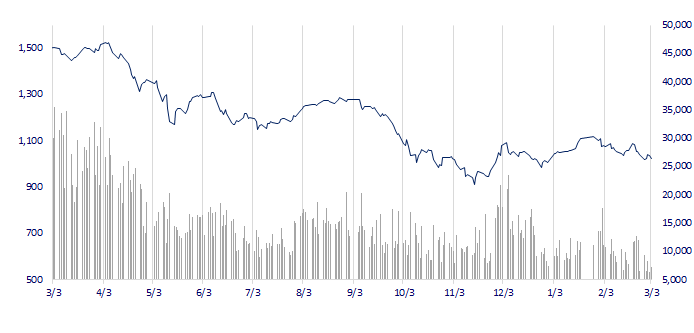

1,024.77

1D -1.24%

YTD 1.76%

1,013.35

1D -1.50%

YTD 0.81%

204.89

1D -0.61%

YTD -0.20%

75.80

1D -0.63%

YTD 5.79%

-119.91

1D 0.00%

YTD 0.00%

8,721.84

1D 21.41%

YTD 1.23%

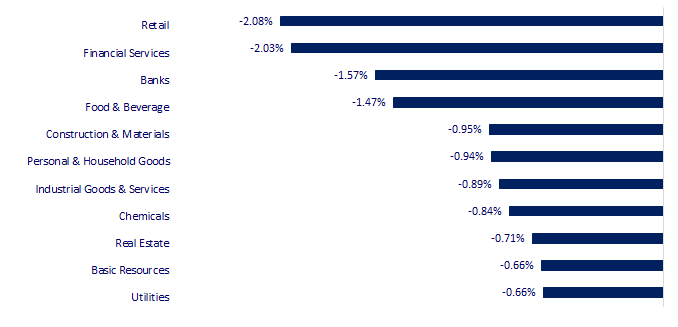

Most industries dropped today, the most negative were retail, financial services or banking with some typical stocks such as MSN (-3.8%), MWG (- 2.2%), SSI (-1.1%), VCB (-2.5%). Notably, PLX was the only stock keeping the green color in the VN30 basket.

ETF & DERIVATIVES

17,270

1D -2.15%

YTD -0.35%

11,970

1D -1.48%

YTD 0.42%

12,350

1D -1.75%

YTD -1.04%

16,000

1D -2.74%

YTD 13.88%

14,660

1D -2.46%

YTD 2.16%

21,700

1D -2.43%

YTD -3.13%

12,890

1D -1.53%

YTD -0.46%

1,003

1D -1.71%

YTD 0.00%

1,005

1D -1.33%

YTD 0.00%

1,005

1D -1.68%

YTD 0.00%

1,005

1D -1.84%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,927.47

1D 1.56%

YTD 7.02%

3,328.39

1D 0.54%

YTD 7.74%

2,432.07

1D 0.17%

YTD 8.75%

20,567.54

1D 0.68%

YTD 3.97%

3,232.02

1D -0.09%

YTD -0.59%

1,606.88

1D -0.36%

YTD -3.80%

84.61

1D 0.13%

YTD -1.51%

1,852.95

1D 0.32%

YTD 1.46%

Tokyo inflation data for February exceeded the BOJ's target for a ninth month, but the core measure did decelerate from a 42-year high. The Bank of Japan (BOJ) is expected to start to dismantle extraordinary stimulus measures some time after Governor Haruhiko Kuroda retires next month.

VIETNAM ECONOMY

6.28%

1D (bps) 1

YTD (bps) 131

7.40%

4.04%

1D (bps) 1

YTD (bps) -75

4.23%

YTD (bps) -67

23,940

1D (%) 0.19%

YTD (%) 0.76%

25,629

1D (%) -1.05%

YTD (%) -0.12%

3,506

1D (%) 0.14%

YTD (%) 0.60%

At the regular Government meeting in the morning of March 3, the Prime Minister requested the State Bank to reduce interest rates, regulate interest rates and control inflation harmoniously. Although there is still many pressures, the interest rate level is likely to peak in the first half of 2023 and then gradually "cool down", thereby reducing pressure on lending rates.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Nearly 1,900 real estate businesses withdrew from the market in the first two months of the year;

- Maybank: Vietnam's GDP growth in the first quarter of 2023 is expected to reach 4.8%;

- The Prime Minister requested the State Bank to research and reduce interest rates;

- South Korea promises to boost exports, attract tourists;

- US hits Iran with new sanctions on shipping, petrochemicals;

- Fed officials signaled that interest rates will continue to increase and remain high until 2024.

VN30

BANK

90,900

1D -2.47%

5D -2.78%

Buy Vol. 2,001,264

Sell Vol. 1,568,024

45,900

1D -1.08%

5D 2.91%

Buy Vol. 1,516,677

Sell Vol. 1,881,803

27,800

1D 0.00%

5D -1.59%

Buy Vol. 3,749,138

Sell Vol. 3,620,363

26,800

1D -1.47%

5D -1.65%

Buy Vol. 3,812,105

Sell Vol. 3,533,739

17,000

1D -1.73%

5D -0.87%

Buy Vol. 15,956,155

Sell Vol. 18,448,760

17,150

1D -1.44%

5D -3.11%

Buy Vol. 10,410,259

Sell Vol. 8,689,204

17,800

1D -1.11%

5D 1.71%

Buy Vol. 2,168,145

Sell Vol. 3,205,550

23,400

1D -1.68%

5D -0.43%

Buy Vol. 4,884,146

Sell Vol. 6,282,650

25,000

1D -2.34%

5D 2.88%

Buy Vol. 21,986,354

Sell Vol. 23,952,447

20,650

1D -1.67%

5D -1.67%

Buy Vol. 2,494,637

Sell Vol. 3,864,560

24,500

1D -2.20%

5D -0.41%

Buy Vol. 3,888,648

Sell Vol. 4,898,143

According to data from life insurance companies (not including Bao Viet), the initial premium revenue of the whole market in January 2023 through the bancassurance channel decreased by about 30%. In Vietnam, statistics show that more than 40% of new contracts come from bancassurance channel.

REAL ESTATE

10,350

1D 0.00%

5D -9.21%

Buy Vol. 13,835,691

Sell Vol. 15,717,568

83,500

1D -0.60%

5D -0.71%

Buy Vol. 156,221

Sell Vol. 187,356

10,500

1D 0.00%

5D -0.47%

Buy Vol. 7,334,847

Sell Vol. 6,288,311

In the structure of real estate loans in 2022, over 60% of outstanding loans are home loans, concentrated in the high-value segment, the remaining 30% are loans for real estate development.

OIL & GAS

104,500

1D -0.48%

5D -1.88%

Buy Vol. 328,909

Sell Vol. 483,598

12,350

1D -2.76%

5D 2.92%

Buy Vol. 27,481,313

Sell Vol. 19,083,446

38,800

1D 0.39%

5D 2.92%

Buy Vol. 1,203,498

Sell Vol. 867,351

According to PVN, the domestic demand for petrol and oil will reach about 25 million tons by 2025 while the supply is currently about 12.2 million tons, providing only about 70% of the demand.

VINGROUP

52,700

1D -0.19%

5D -0.38%

Buy Vol. 1,435,578

Sell Vol. 1,571,210

40,950

1D -0.36%

5D -0.12%

Buy Vol. 2,393,388

Sell Vol. 2,685,092

26,000

1D -0.76%

5D -1.89%

Buy Vol. 3,553,485

Sell Vol. 3,358,536

VRE: Two shopping centers are expected to open in the second half of this year: Vincom Mega Mall Grand Park with floor area - GFA about 46,000m2 and Vincom Plaza Ha Giang (10,000m2).

FOOD & BEVERAGE

76,000

1D -0.65%

5D 1.74%

Buy Vol. 1,403,795

Sell Vol. 2,435,710

76,000

1D -3.80%

5D -11.53%

Buy Vol. 1,026,877

Sell Vol. 1,153,972

187,000

1D -0.58%

5D -0.54%

Buy Vol. 113,993

Sell Vol. 234,983

MSN: According to Masan, the pork market with a value of more than USD10billion is the largest segment in the F&B industry.

OTHERS

48,450

1D -1.12%

5D -0.92%

Buy Vol. 461,992

Sell Vol. 421,950

101,200

1D -0.39%

5D 5.20%

Buy Vol. 339,412

Sell Vol. 407,624

78,500

1D -1.88%

5D -2.85%

Buy Vol. 1,724,793

Sell Vol. 1,441,341

39,400

1D -2.23%

5D -6.41%

Buy Vol. 2,941,476

Sell Vol. 2,827,157

14,100

1D -1.05%

5D -1.40%

Buy Vol. 1,989,325

Sell Vol. 2,467,143

18,450

1D -1.07%

5D -2.89%

Buy Vol. 14,866,076

Sell Vol. 16,221,746

20,350

1D -1.21%

5D -2.16%

Buy Vol. 24,088,224

Sell Vol. 34,916,191

VJC: The opening of China is a significant factor affecting Vietnam's aviation industry, when Chinese tourists account for 32% of the market share of tourists to Vietnam in 2019. It is estimated that the number of Chinese tourists entering the country will gradually recover from the second half of 2023.

Market by numbers

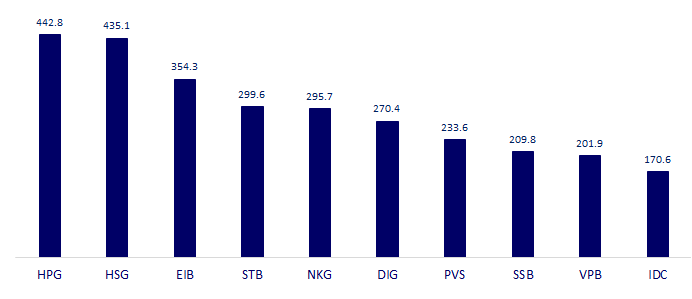

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

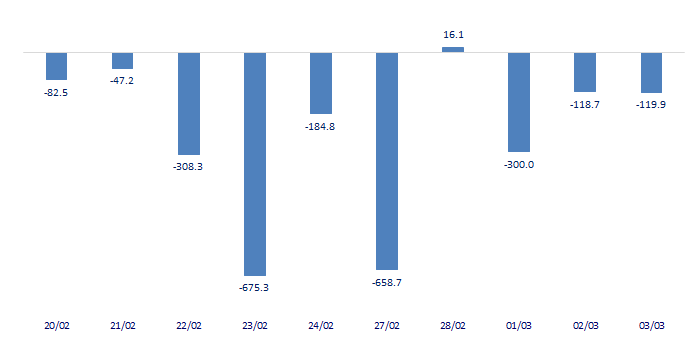

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

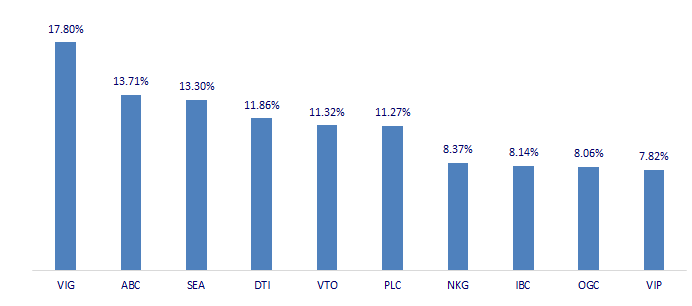

TOP INCREASES 3 CONSECUTIVE SESSIONS

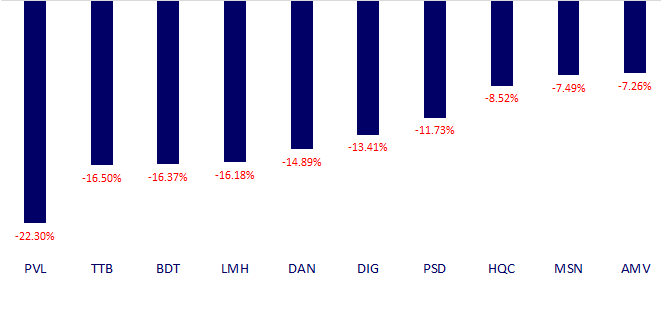

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.