Market brief 06/03/2023

VIETNAM STOCK MARKET

1,027.18

1D 0.24%

YTD 1.99%

1,014.26

1D 0.09%

YTD 0.90%

206.56

1D 0.82%

YTD 0.61%

76.00

1D 0.26%

YTD 6.07%

-76.25

1D 0.00%

YTD 0.00%

7,857.48

1D -9.91%

YTD -8.80%

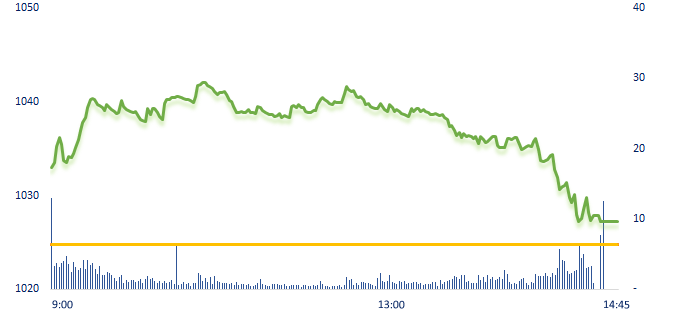

With the optimistic sentiment from the US market, as well as the government issuance of new regulations of corporate bonds to support real estate businesses, the Vietnam stock market started with green color from the first minutes of the session. The market remained positive until almost the end of the session before dropping back to the reference level.

ETF & DERIVATIVES

17,300

1D 0.17%

YTD -0.17%

11,950

1D -0.17%

YTD 0.25%

12,420

1D 0.57%

YTD -0.48%

15,500

1D -3.13%

YTD 10.32%

14,720

1D 0.41%

YTD 2.58%

21,780

1D 0.37%

YTD -2.77%

12,900

1D 0.08%

YTD -0.39%

1,004

1D 0.10%

YTD 0.00%

1,005

1D -0.02%

YTD 0.00%

1,005

1D 0.02%

YTD 0.00%

1,010

1D 0.48%

YTD 0.00%

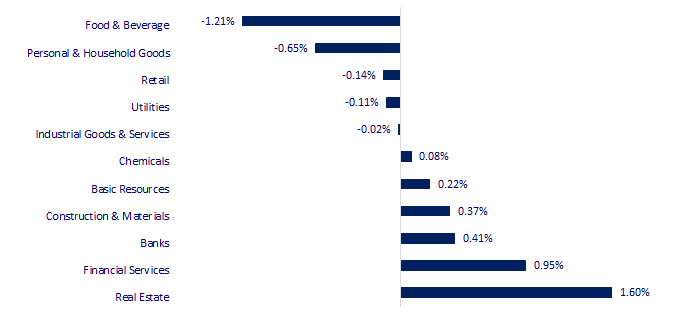

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

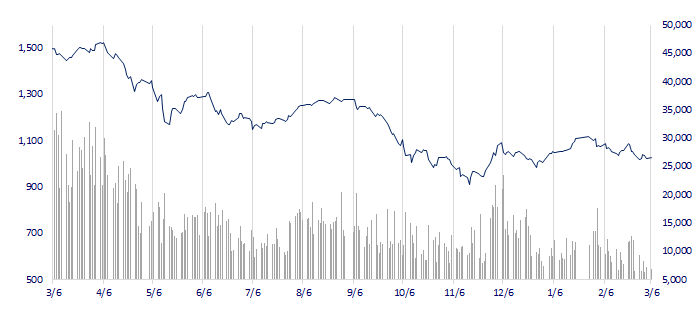

VNINDEX (12M)

GLOBAL MARKET

28,237.78

1D 1.11%

YTD 8.21%

3,322.03

1D -0.19%

YTD 7.53%

2,462.62

1D 1.26%

YTD 10.12%

20,603.19

1D 0.17%

YTD 4.15%

3,239.31

1D 0.23%

YTD -0.37%

1,606.88

1D 0.00%

YTD -3.80%

85.16

1D -0.18%

YTD -0.87%

1,857.00

1D -0.02%

YTD 1.69%

Shares shook of earlier declines in Hong Kong before rebound while those on the mainland remained lower as investors digested the implications of China’s goal of growth around just 5%. Investors saw this as a sign that policymakers in Beijing are unlikely to employ any large-scale stimulus.

VIETNAM ECONOMY

6.22%

1D (bps) -6

YTD (bps) 125

7.40%

4.05%

1D (bps) 1

YTD (bps) -74

4.23%

YTD (bps) -67

23,835

1D (%) -0.27%

YTD (%) 0.32%

25,884

1D (%) -0.25%

YTD (%) 0.88%

3,485

1D (%) -0.57%

YTD (%) 0.00%

The Government has just issued Decree No. 08/2023/ND-CP dated March 5, 2023 amending, supplementing and suspending the effect of a number of articles in the Decrees about corporate bonds. In which, for the issuers that cannot fully pay the bond principal and interest according to the commitment, it can be negotiated to pay with other assets as prescribed.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The funding plan for Metro No. 1 must be available before March 8;

- The Ministry of Industry and Trade proposed that EVN urgently unify the price of solar power and wind power in transition;

- The Government promulgates new regulations on corporate bond issuance;

- Saudi Arabia raised the price of oil sold to Asia and Europe in April;

- China aims to increase grain yield under new food security push;

- Korea: February CPI growth slowed down.

VN30

BANK

91,000

1D 0.11%

5D -1.94%

Buy Vol. 976,624

Sell Vol. 1,410,208

45,800

1D -0.22%

5D 3.50%

Buy Vol. 1,436,425

Sell Vol. 2,153,997

28,350

1D 1.98%

5D 2.90%

Buy Vol. 5,525,665

Sell Vol. 5,936,296

27,200

1D 1.49%

5D 0.74%

Buy Vol. 4,435,551

Sell Vol. 4,764,167

17,100

1D 0.59%

5D 0.59%

Buy Vol. 22,292,738

Sell Vol. 20,947,812

17,300

1D 0.87%

5D 0.29%

Buy Vol. 12,058,973

Sell Vol. 12,988,679

18,000

1D 1.12%

5D 6.51%

Buy Vol. 3,765,843

Sell Vol. 5,660,218

23,450

1D 0.21%

5D 0.86%

Buy Vol. 4,002,410

Sell Vol. 5,752,000

24,900

1D -0.40%

5D 5.51%

Buy Vol. 31,298,986

Sell Vol. 34,390,879

20,600

1D -0.24%

5D 0.24%

Buy Vol. 3,312,034

Sell Vol. 4,220,051

24,300

1D -0.82%

5D 0.21%

Buy Vol. 7,562,365

Sell Vol. 7,831,847

VCB: On the morning of March 6, Vietcombank announced a new deposit rate schedule and adjusted it down in some terms. Accordingly, Vietcombank's interest rate continues to be among the lowest in the market. Specifically, for the form of savings deposit at the counter, the current 2-5 year term interest rate is 7.2%/year, down 0.2% compared to before. The bank also reduced interest rates for 6-month and 9-month terms from 6%/year to 5.8%/year. Meanwhile, the 12-month term interest rate remained unchanged at 7.4%/year, which is the highest level at Vietcombank.

REAL ESTATE

11,050

1D 6.76%

5D 2.79%

Buy Vol. 43,083,342

Sell Vol. 13,645,133

83,700

1D 0.24%

5D 0.36%

Buy Vol. 152,313

Sell Vol. 108,453

11,200

1D 6.67%

5D 9.80%

Buy Vol. 15,769,415

Sell Vol. 3,410,692

PDR: After completing the procedure to buy more issued shares for existing shareholders, Phat Dat will own 49.5 million shares, accounting for 99% of the charter capital of Bac Cuong company.

OIL & GAS

103,700

1D -0.77%

5D -0.29%

Buy Vol. 178,246

Sell Vol. 379,861

12,450

1D 0.81%

5D 3.75%

Buy Vol. 39,337,499

Sell Vol. 14,429,081

38,900

1D 0.26%

5D 4.99%

Buy Vol. 946,588

Sell Vol. 1,443,890

PLX: Petrolimex will offer 120 million shares, equivalent to 40% of charter capital at PG Bank with a starting price of VND21,300/share through a public auction at HoSE.

VINGROUP

52,600

1D -0.19%

5D 0.19%

Buy Vol. 2,199,039

Sell Vol. 2,942,614

42,100

1D 2.81%

5D 2.93%

Buy Vol. 4,985,613

Sell Vol. 5,760,608

26,150

1D 0.58%

5D 1.55%

Buy Vol. 3,503,324

Sell Vol. 4,318,361

VIC: Vingroup's chairman establishes VinFast electric taxi and car rental company.

FOOD & BEVERAGE

75,000

1D -1.32%

5D -0.27%

Buy Vol. 1,399,208

Sell Vol. 2,404,678

74,400

1D -2.11%

5D -6.88%

Buy Vol. 1,455,996

Sell Vol. 1,297,893

185,000

1D -1.07%

5D 0.36%

Buy Vol. 103,026

Sell Vol. 190,520

MSN: Masan has nearly USD1 billion in bonds maturing in 2023.

OTHERS

48,000

1D -0.93%

5D -0.41%

Buy Vol. 341,499

Sell Vol. 434,759

96,300

1D -4.84%

5D -2.23%

Buy Vol. 385,558

Sell Vol. 523,586

78,200

1D -0.38%

5D -2.62%

Buy Vol. 1,607,757

Sell Vol. 1,411,312

39,400

1D 0.00%

5D -2.72%

Buy Vol. 1,973,402

Sell Vol. 2,532,090

14,200

1D 0.71%

5D 1.79%

Buy Vol. 2,125,190

Sell Vol. 2,191,074

18,750

1D 1.63%

5D 2.74%

Buy Vol. 18,675,299

Sell Vol. 21,122,029

20,400

1D 0.25%

5D 1.49%

Buy Vol. 20,636,203

Sell Vol. 26,092,838

HPG: Accumulated in the first 2 months, Hoa Phat crude steel output reached 809,000 tons, down 42% over the same period. Sales of construction steel, HRC and billet recorded 877,000 tons, down 34% compared to the first 2 months of 2022.

Market by numbers

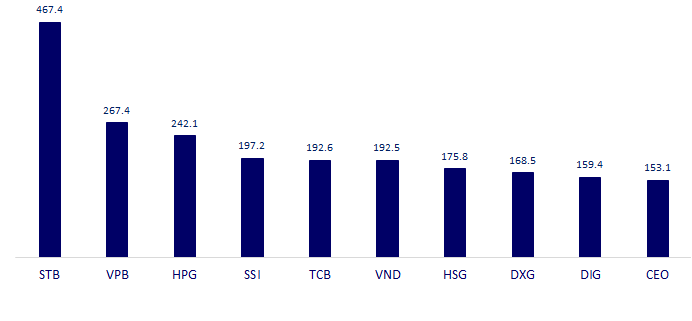

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

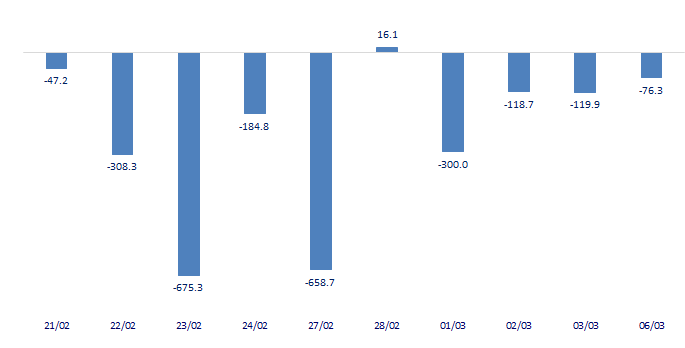

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

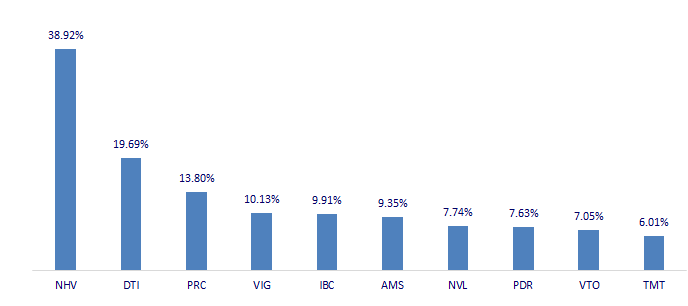

TOP INCREASES 3 CONSECUTIVE SESSIONS

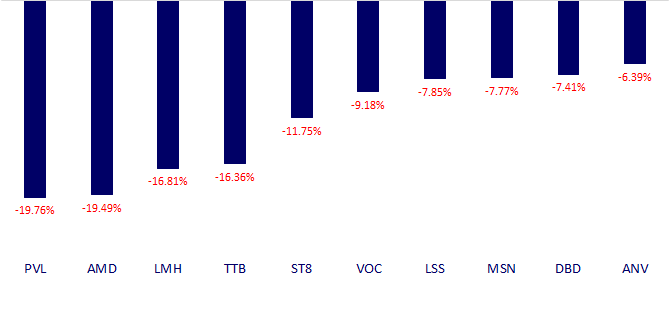

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.