Market brief 08/03/2023

VIETNAM STOCK MARKET

1,049.18

1D 1.09%

YTD 4.18%

1,040.59

1D 1.31%

YTD 3.52%

208.68

1D 0.57%

YTD 1.64%

76.49

1D 0.42%

YTD 6.76%

249.65

1D 0.00%

YTD 0.00%

10,230.29

1D 11.58%

YTD 18.74%

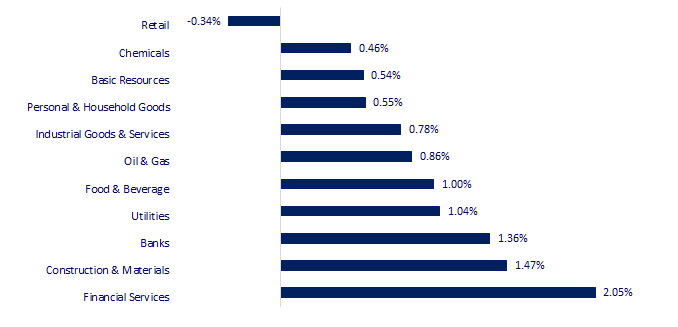

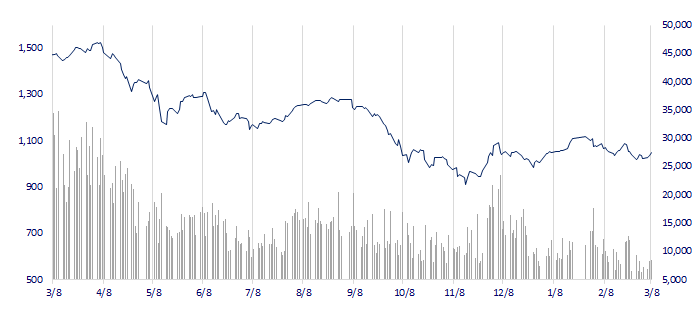

VN-Index opened in red in the first few minutes. However, the market did not continue to decrease but gradually recovered throughout the session before turning green in the afternoon after 2pm when strong demand entered the market. Financial services, construction and banking are the 3 most positive sectors in the market today, including some typical stocks such as VND, SSI, VCG, CTD, EIB, VPB,...

ETF & DERIVATIVES

17,700

1D 1.43%

YTD 2.14%

12,200

1D 0.91%

YTD 2.35%

12,680

1D 0.56%

YTD 1.60%

16,400

1D 0.00%

YTD 16.73%

14,910

1D 0.34%

YTD 3.90%

21,950

1D 0.23%

YTD -2.01%

13,200

1D 1.46%

YTD 1.93%

1,028

1D 0.37%

YTD 0.00%

1,029

1D 0.50%

YTD 0.00%

1,033

1D 0.91%

YTD 0.00%

1,038

1D 0.98%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,444.19

1D 0.48%

YTD 9.00%

3,283.25

1D -0.06%

YTD 6.28%

2,431.91

1D -1.28%

YTD 8.74%

20,051.25

1D -2.35%

YTD 1.36%

3,226.86

1D -0.57%

YTD -0.75%

1,613.81

1D -0.29%

YTD -3.39%

83.05

1D -0.42%

YTD -3.33%

1,819.35

1D 0.18%

YTD -0.38%

Asian assets face selling pressure after Federal Reserve Chair Jerome Powell jolted investors with unexpectedly aggressive comments on the outlook for higher interest rates.

VIETNAM ECONOMY

6.00%

1D (bps) -8

YTD (bps) 103

7.40%

4.08%

1D (bps) 4

YTD (bps) -72

4.26%

1D (bps) 4

YTD (bps) -64

23,887

1D (%) 0.26%

YTD (%) 0.53%

25,725

1D (%) 0.18%

YTD (%) 0.26%

3,475

1D (%) 0.23%

YTD (%) -0.29%

The domestic gold price continued to decline following the decline of the world gold price, currently world gold price is still VND14.41 million/tael, lower than the selling price of SJC gold at the same time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Proposing to reduce 50% of registration fee for domestic manufactured automobiles;

- Loan interest decrease slows down, homebuyers impatiently find a way to pay off;

- The resort real estate market "freezes", investors discount up to 40% of the selling price;

- Short-term US government bond yields exceeded 5%;

- The largest shareholder sold off all shares of Credit Suisse;

- There is a more than 50% probability that the Fed will raise the interest rate by 50 basis points.

VN30

BANK

92,200

1D 0.33%

5D -0.86%

Buy Vol. 1,589,507

Sell Vol. 1,477,918

48,000

1D 2.35%

5D 5.15%

Buy Vol. 2,115,148

Sell Vol. 2,350,635

29,400

1D 1.38%

5D 4.07%

Buy Vol. 6,363,932

Sell Vol. 5,474,247

27,300

1D 0.74%

5D 0.00%

Buy Vol. 4,154,873

Sell Vol. 2,994,924

18,150

1D 4.31%

5D 4.01%

Buy Vol. 48,333,059

Sell Vol. 42,516,789

17,600

1D 1.15%

5D -0.28%

Buy Vol. 16,878,984

Sell Vol. 13,329,677

18,600

1D 0.54%

5D 5.08%

Buy Vol. 3,423,343

Sell Vol. 4,065,122

23,950

1D 1.91%

5D -0.21%

Buy Vol. 11,055,296

Sell Vol. 7,776,940

25,350

1D 1.40%

5D -0.20%

Buy Vol. 27,537,046

Sell Vol. 29,828,255

20,700

1D 0.49%

5D -1.90%

Buy Vol. 5,253,255

Sell Vol. 4,636,729

25,000

1D 2.04%

5D -0.60%

Buy Vol. 7,269,508

Sell Vol. 4,728,673

TPB: With the desire to reduce difficulties with customers, Tien Phong Commercial Joint Stock Bank (TPBank) soon decreased lending interest rates from 1.5% - 2%, and at the same time introduced loan solutions and new preferential interest rates for corporate and individual customers.

REAL ESTATE

11,050

1D 1.84%

5D 7.80%

Buy Vol. 27,874,511

Sell Vol. 27,795,816

84,500

1D 0.60%

5D 0.24%

Buy Vol. 262,260

Sell Vol. 146,587

11,850

1D 4.87%

5D 13.94%

Buy Vol. 18,412,482

Sell Vol. 12,182,436

BCM: Becamex IDC launches WTC Tower office complex.

OIL & GAS

105,900

1D 1.34%

5D 0.76%

Buy Vol. 390,902

Sell Vol. 346,927

12,750

1D 1.59%

5D 3.24%

Buy Vol. 31,229,751

Sell Vol. 15,206,014

38,900

1D -0.26%

5D 0.65%

Buy Vol. 1,079,662

Sell Vol. 788,590

PLX: Without investors participating, the auction of shares of Dong Nai Fuel and Building Materials JSC owned by Petrolimex did not take place.

VINGROUP

53,000

1D 0.57%

5D 0.57%

Buy Vol. 1,597,225

Sell Vol. 1,478,581

42,350

1D 0.12%

5D 2.79%

Buy Vol. 3,299,479

Sell Vol. 3,221,145

27,250

1D 2.44%

5D 1.68%

Buy Vol. 3,585,694

Sell Vol. 3,606,777

VHM: Vinhomes plans to establish two new real estate companies with a total charter capital of nearly VND11,500 billion.

FOOD & BEVERAGE

76,500

1D 0.92%

5D -0.52%

Buy Vol. 2,237,863

Sell Vol. 3,014,483

80,400

1D 2.68%

5D -0.12%

Buy Vol. 2,350,641

Sell Vol. 2,044,160

186,500

1D -0.21%

5D -2.61%

Buy Vol. 268,395

Sell Vol. 152,004

VNM: Vinamilk cooperated with Japan's Sojitz multi-industry group to officially kick off the Beef Breeding and Processing Complex with a total investment of VND3,000 billion.

OTHERS

49,000

1D 1.45%

5D -0.91%

Buy Vol. 480,118

Sell Vol. 389,614

98,300

1D 1.24%

5D -3.15%

Buy Vol. 303,236

Sell Vol. 232,082

79,500

1D 0.89%

5D -1.24%

Buy Vol. 1,571,751

Sell Vol. 875,888

39,400

1D -0.76%

5D -3.43%

Buy Vol. 3,538,497

Sell Vol. 3,086,591

14,500

1D 0.69%

5D 0.69%

Buy Vol. 4,021,774

Sell Vol. 2,967,431

19,800

1D 2.06%

5D 4.49%

Buy Vol. 30,530,277

Sell Vol. 26,109,899

21,200

1D 0.47%

5D 1.44%

Buy Vol. 29,566,151

Sell Vol. 32,441,905

HPG: On March 6, Hoa Phat announced to increase steel price by 200,000 VND/ton for construction rebar products. Specifically, the price of D10 CB300 Hoa Phat rebar in the Northern region increased from 15.84 million VND/ton to 16.04 million VND/ton. Steel prices in the South increased to 16.08 million VND/ton. In the Central region, the selling price increased from 15.73 million VND/ton to 15.93 million VND/ton.

Market by numbers

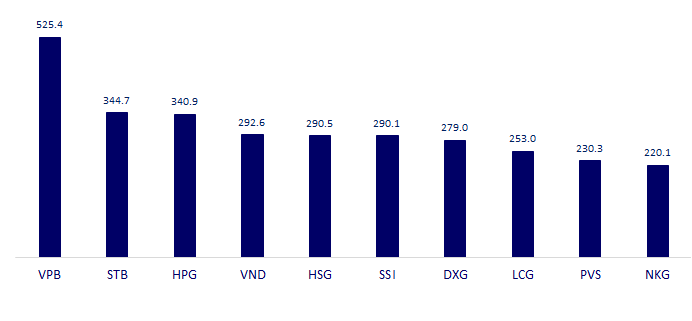

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

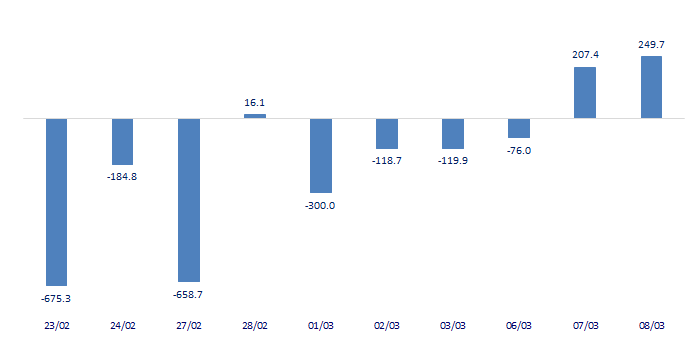

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

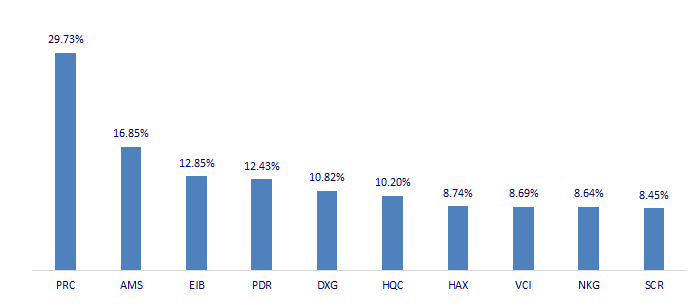

TOP INCREASES 3 CONSECUTIVE SESSIONS

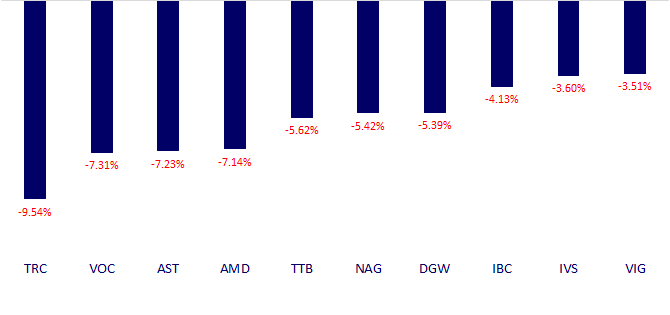

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.