Morning Brief 07/09

GLOBAL MARKET

28,133.31

1D -0.56%

YTD -1.42%

3,426.96

1D -0.81%

YTD 6.07%

11,313.13

1D -1.27%

YTD 26.09%

30.75

5,799.08

1D -0.88%

YTD -23.11%

12,842.66

1D -1.65%

YTD -3.07%

4,965.07

1D -0.89%

YTD -16.95%

23,205.43

1D -1.11%

YTD -1.91%

3,355.37

1D -0.87%

YTD 8.81%

2,368.25

1D -1.15%

YTD 7.76%

24,695.45

1D -1.25%

YTD -13.20%

2,509.64

1D -0.87%

YTD -22.13%

1,311.95

1D -0.01%

YTD -17.89%

38.73

1D -5.61%

YTD -36.25%

1,941.40

1D 0.20%

YTD 27.92%

U.S. stocks bounced back from a sharp selloff but still closed at a two-week low as megacap tech shares sold off. Losses for Amazon.com, Microsoft Corp. and Facebook Inc. pushed the tech-heavy Nasdaq 100 down more than 5% at one point, though it pared those declines to just over 1% as the day wore on and investors spotted bargains. Gains in financial shares limited losses in the S&P 500 Index, which ended the week down 2.3% at the lowest level since Aug. 21. Stocks looked headed for a nervy start to trading Monday after the biggest two-day slide for global equities since June left investors on edge. Currencies began the week with little fanfare, while crude oil declined.

VIETNAM ECONOMY

0.16%

YTD (bps) -127

6.00%

YTD (bps) -50

1.78%

1D (bps) -1

YTD (bps) -221

2.90%

1D (bps) 10

YTD (bps) -180

23,262

1D (%) 0.00%

YTD (%) 0.14%

28,157

1D (%) 0.19%

YTD (%) 5.85%

3,420

1D (%) 0.00%

YTD (%) 0.71%

According to the report of the Ministry of Planning and Investment, by the end of August, the total FDI reached 19.54 billion USD, equaling 86.3% of the same period in 2019. After the first months of 2020 slowed down, FDI inflows has increased sharply in recent months. This is a sign of a new wave of investment in Vietnam - an attractive destination with available competitive advantages, participation in new FTAs, and prevention Covid-19 measures is active and effective.

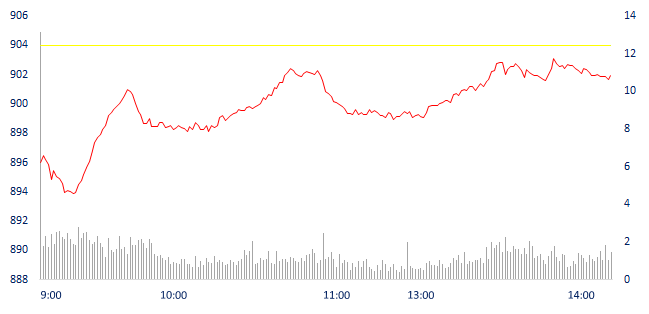

VIETNAM STOCK MARKET

901.54

1D -0.27%

YTD -6.19%

840.54

1D -0.37%

YTD -4.38%

126.15

1D 0.08%

YTD 23.06%

58.89

1D -0.12%

YTD 4.14%

-24.69

7,599.72

1D -7.33%

YTD 117.13%

Foreign investors is net sellling about nearly 25 billion dong. Net selling focused on BCM, VHM and VCB shares on HOSE. SHS and VCG were the most net sold stocks on the HNX. During the session, BCM was negotiated by foreign investors to sell over 3.2 million shares at the ceiling price of 41,100 dong/share.

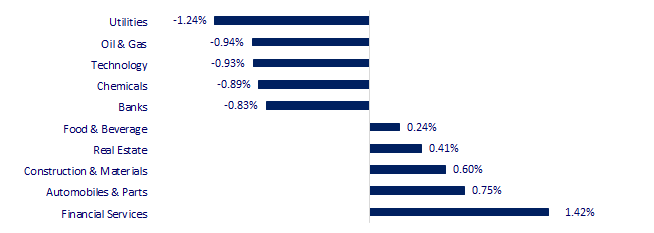

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

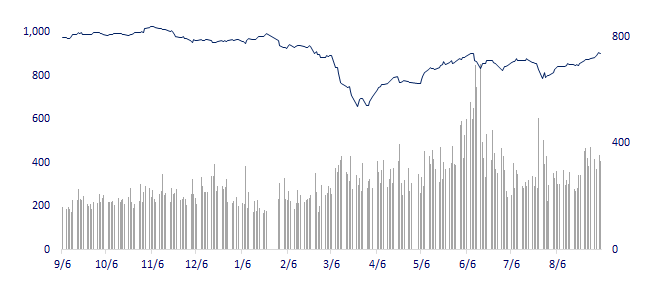

VNINDEX (12M)

SELECTED NEWS

- SBV has adjusted to reduce interest rates, reduce the ceiling of lending interest rates or deposit rates in order to facilitate the difficulties in borrowing capital.

- Restore all passenger transport to / from Da Nang from 0:00 on September 7.

- GDP growth rate in 2020 is about 2% - 2.5% and GDP growth is expected to reach 6.7% by 2021.

- Australia’s central bank will boost its bond-buying program or cut interest rates to help revive the economy from its first recession in almost 30 years

- Growth-Starved Emerging Markets Turn Wary as Risk Signals Build

- The US economy added 1.37 million jobs, the unemployment rate dropped to 8.4%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.