Market Brief 14/03/2023

VIETNAM STOCK MARKET

1,040.13

1D -1.20%

YTD 3.28%

1,037.35

1D -1.21%

YTD 3.20%

202.55

1D -1.60%

YTD -1.34%

75.77

1D -0.80%

YTD 5.75%

399.62

1D 0.00%

YTD 0.00%

12,035.27

1D -2.44%

YTD 39.69%

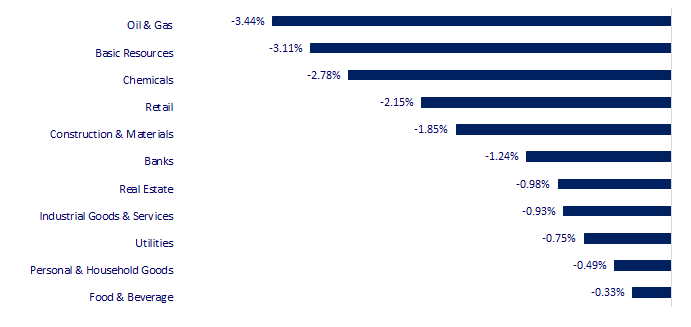

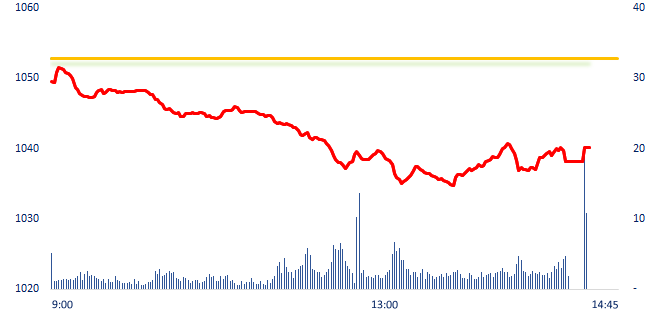

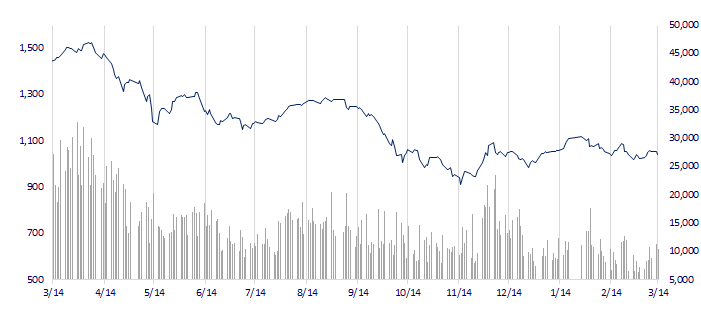

The market plummeted in the session of March 14, red covered the entire trading time. SAB and VJC were the only two stocks that kept the green color in the VN30 basket today, at the same time, SAB also had the most impact on the increase of VN-Index. Oil and gas stocks led the decline, following the plunge in oil prices, as the market feared an economic crisis would spread from the collapse of SVB.

ETF & DERIVATIVES

17,640

1D -1.29%

YTD 1.79%

12,230

1D -1.05%

YTD 2.60%

12,690

1D -1.48%

YTD 1.68%

16,090

1D 5.16%

YTD 14.52%

14,980

1D -1.77%

YTD 4.39%

21,990

1D -0.50%

YTD -1.83%

13,200

1D -0.98%

YTD 1.93%

1,028

1D -0.97%

YTD 0.00%

1,029

1D -0.92%

YTD 0.00%

1,034

1D -1.14%

YTD 0.00%

1,038

1D -0.96%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,222.04

1D -2.19%

YTD 4.32%

3,245.31

1D -0.72%

YTD 5.05%

2,348.97

1D -2.56%

YTD 5.03%

19,247.96

1D -2.27%

YTD -2.70%

3,129.75

1D -0.08%

YTD -3.74%

1,523.89

1D -3.13%

YTD -8.77%

79.01

1D -2.18%

YTD -8.03%

1,906.00

1D -0.42%

YTD 4.37%

Japanese policymakers on Tuesday played down the risk of the economy taking a hit from the collapse of U.S. lender SVB, even as fears of a contagion hit financial stocks and sent domestic share prices tumbling. The drop in bank shares sent the Nikkei down by 2.19%. The market turbulence also comes ahead of a leadership transition at the Bank of Japan (BOJ) with all eyes on how soon the new governor, Kazuo Ueda, will dial back its massive stimulus once he takes office next month.

VIETNAM ECONOMY

5.72%

1D (bps) -44

YTD (bps) 75

7.40%

3.98%

1D (bps) 1

YTD (bps) -81

4.13%

1D (bps) -2

YTD (bps) -77

23,775

1D (%) 0.08%

YTD (%) 0.06%

25,688

1D (%) -1.15%

YTD (%) 0.11%

3,495

1D (%) -0.57%

YTD (%) 0.29%

The dollar rose in somewhat calmer trading on Tuesday, after tumbling on Monday following the collapse of Silicon Valley Bank (SVB), as investors waited for the release of U.S. consumer inflation data later in the day.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI flows into industrial zones suddenly slowed down;

- Charter flights between Vietnam and China are increasing;

- Quang Nam sets a target of nearly VND27,000 billion in budget revenue;

- HSBC pays GBP1 to rescue UK arm of Silicon Valley Bank;

- US banks sitting on unrealized losses of USD620 billion;

- Shareholders accuse CEO and CFO of concealing how rising interest rates would leave its SVB unit “particularly susceptible” to a bank run.

VN30

BANK

91,000

1D -0.55%

5D -0.98%

Buy Vol. 1,232,346

Sell Vol. 1,535,968

45,050

1D -2.59%

5D -3.94%

Buy Vol. 2,879,205

Sell Vol. 2,668,432

29,000

1D -1.02%

5D 0.00%

Buy Vol. 3,264,743

Sell Vol. 3,985,059

26,300

1D -1.68%

5D -2.95%

Buy Vol. 4,774,150

Sell Vol. 4,910,515

19,400

1D 0.00%

5D 11.49%

Buy Vol. 31,628,812

Sell Vol. 50,839,951

17,200

1D -1.71%

5D -1.15%

Buy Vol. 17,159,080

Sell Vol. 13,926,734

18,050

1D -2.17%

5D -2.43%

Buy Vol. 3,238,689

Sell Vol. 3,834,024

24,200

1D -0.41%

5D 2.98%

Buy Vol. 11,244,180

Sell Vol. 11,591,324

24,400

1D -2.40%

5D -2.40%

Buy Vol. 54,117,536

Sell Vol. 47,372,205

20,250

1D -2.17%

5D -1.70%

Buy Vol. 5,582,977

Sell Vol. 5,573,367

24,050

1D -1.84%

5D -1.84%

Buy Vol. 10,307,993

Sell Vol. 9,391,853

Currently, there are only a few banks that list the highest interest rates from 9%/year. At the 6-month term, only 3 banks still list the deposit interest rate of 9%/year, including VietBank, SCB, and HDBank. In addition, some banks listed 8.8%/year include BaoVietBank, VietABank, BacABank, etc.

REAL ESTATE

10,700

1D -2.73%

5D -1.38%

Buy Vol. 25,240,132

Sell Vol. 25,851,117

83,100

1D -0.72%

5D -1.07%

Buy Vol. 204,077

Sell Vol. 230,736

11,800

1D 0.00%

5D 4.42%

Buy Vol. 7,782,889

Sell Vol. 8,170,074

NVL: If successfully offering 2.9 billion shares and Mr.Bui Thanh Nhon's family does not buy anymore shares, the ownership ratio of Mr.Bui Thanh Nhon's family will decrease to only 21%.

OIL & GAS

107,700

1D -0.37%

5D 3.06%

Buy Vol. 354,067

Sell Vol. 380,638

12,850

1D -2.28%

5D 2.39%

Buy Vol. 28,407,085

Sell Vol. 24,231,410

37,100

1D -2.50%

5D -4.87%

Buy Vol. 1,301,618

Sell Vol. 1,279,581

In the period of 2023 - 2024, the finished petroleum product market is forecasted to continue to be tightened due to the prolonged Russia-Ukraine crisis.

VINGROUP

53,000

1D -0.56%

5D 0.57%

Buy Vol. 1,497,032

Sell Vol. 2,331,580

44,750

1D 0.00%

5D 5.79%

Buy Vol. 3,781,520

Sell Vol. 4,946,890

28,800

1D -1.03%

5D 8.27%

Buy Vol. 3,143,898

Sell Vol. 4,941,516

VHM: Vinhomes Riverside has just successfully issued VND4,700 billion of bonds, the largest in the past 1 year.

FOOD & BEVERAGE

76,600

1D -0.39%

5D 1.06%

Buy Vol. 2,620,141

Sell Vol. 3,383,643

83,600

1D -1.07%

5D 6.77%

Buy Vol. 1,411,417

Sell Vol. 1,640,820

190,000

1D 1.60%

5D 1.66%

Buy Vol. 351,455

Sell Vol. 325,794

SAB was the stock that gained the most, contributing to the VN-Index in the session on March 14.

OTHERS

48,700

1D -1.62%

5D 0.83%

Buy Vol. 382,324

Sell Vol. 469,798

101,700

1D 0.99%

5D 4.74%

Buy Vol. 353,906

Sell Vol. 434,556

78,700

1D -0.25%

5D -0.13%

Buy Vol. 1,379,950

Sell Vol. 972,635

38,600

1D -2.03%

5D -2.77%

Buy Vol. 2,656,491

Sell Vol. 3,195,217

14,300

1D -4.35%

5D -0.69%

Buy Vol. 4,298,538

Sell Vol. 4,964,229

19,050

1D -3.05%

5D -1.80%

Buy Vol. 27,606,438

Sell Vol. 28,295,316

20,300

1D -3.79%

5D -3.79%

Buy Vol. 53,279,319

Sell Vol. 56,398,872

VJC: The Chinese government has decided to choose Vietnam as experimental place for the list of opening tourist groups from March 14. This is positive information for the group of airlines, tourism and accommodation service companies.

Market by numbers

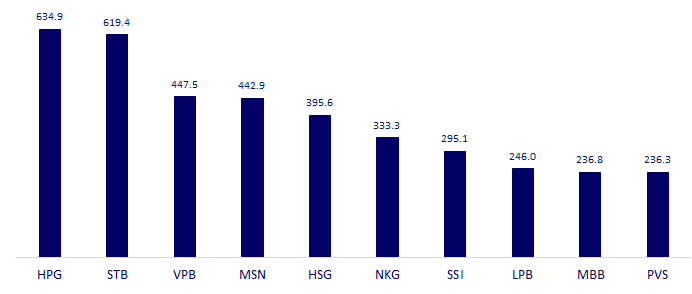

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

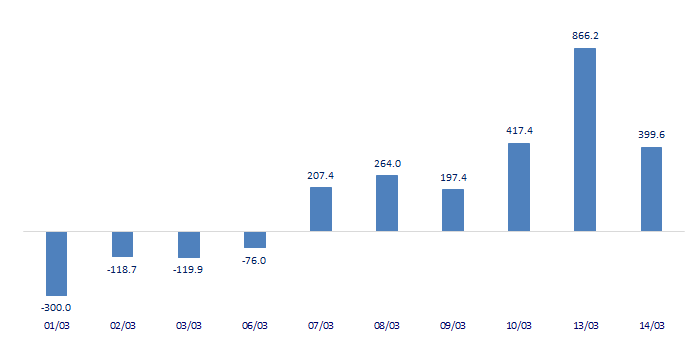

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

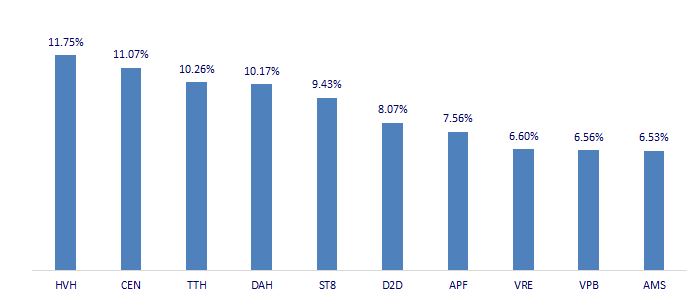

TOP INCREASES 3 CONSECUTIVE SESSIONS

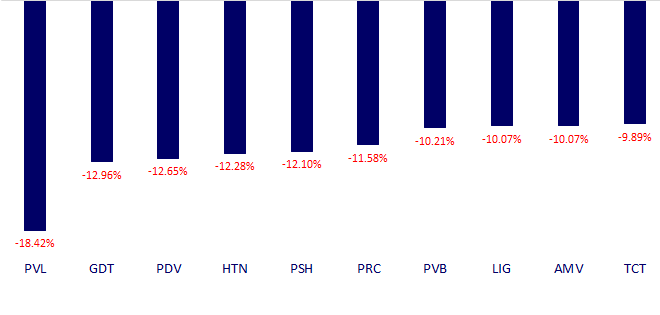

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.