Market brief 07/04/2023

VIETNAM STOCK MARKET

1,069.71

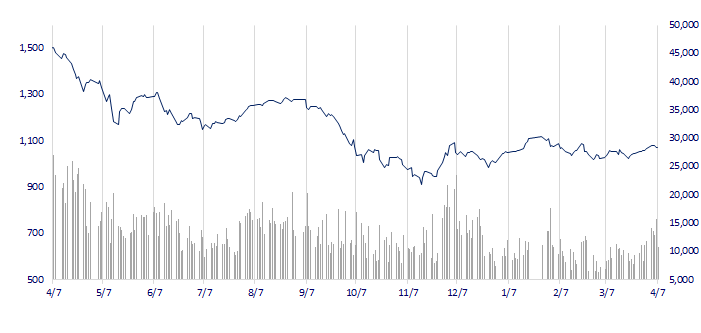

1D -0.11%

YTD 6.22%

1,078.88

1D 0.00%

YTD 7.33%

211.60

1D 0.08%

YTD 3.06%

78.16

1D -0.23%

YTD 9.09%

-160.34

1D 0.00%

YTD 0.00%

13,040.47

1D -30.11%

YTD 51.35%

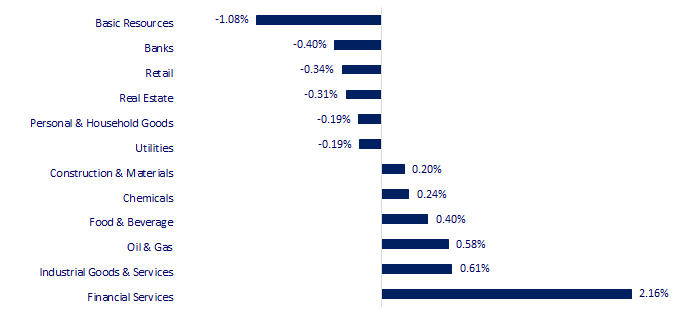

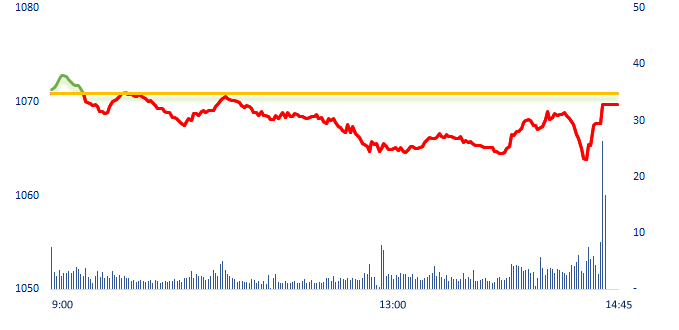

The market tended to decline during the session but then recovered at the last minute. Financial services, food and beverage as well as some midcap stocks in the real estates sector were bright spots in today with some typical stocks such as BSI, FTS, SSI, DIG, IDJ , HQC,…

ETF & DERIVATIVES

18,380

1D -0.65%

YTD 6.06%

12,760

1D -0.08%

YTD 7.05%

13,320

1D 0.15%

YTD 6.73%

15,110

1D -3.33%

YTD 7.54%

16,000

1D -1.42%

YTD 11.50%

22,610

1D -0.44%

YTD 0.94%

13,590

1D -0.51%

YTD 4.94%

1,068

1D 0.16%

YTD 0.00%

1,069

1D -0.07%

YTD 0.00%

1,072

1D 0.16%

YTD 0.00%

1,075

1D 0.20%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,518.31

1D 0.17%

YTD 5.46%

3,327.65

1D 0.45%

YTD 7.72%

2,490.41

1D 1.27%

YTD 11.36%

20,331.20

1D 0.00%

YTD 2.78%

3,300.48

1D 0.00%

YTD 1.51%

1,577.07

1D 0.38%

YTD -5.59%

84.94

1D 0.25%

YTD -1.13%

2,023.90

1D -0.56%

YTD 10.83%

At the end of the session, Asian markets increased slightly in doubt about the possibility of a global recession. The Kospi rallied the most today as the BoK kept interest rates unchanged at 3.5% and is likely to decrease by the end of year.

VIETNAM ECONOMY

5.06%

1D (bps) 59

YTD (bps) 9

7.40%

3.17%

1D (bps) -3

YTD (bps) -162

3.34%

1D (bps) 4

YTD (bps) -156

23,621

1D (%) -0.16%

YTD (%) -0.59%

26,322

1D (%) 1.17%

YTD (%) 2.58%

3,484

1D (%) 0.11%

YTD (%) -0.03%

After falling to the lowest level since July 2022, interbank interest rate has rebounded sharply in recent sessions. Compared to the end of last week, the interbank interest rate has increased 3 times.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- AMRO is optimistic about Vietnam economic growth prospects;

- Bac Lieu proposed the Ministry of Industry and Trade to adjust the price of wind and solar power;

- Vietnam macroeconomic picture in the first quarter and forecast for the whole year of 2023;

- IMF forecasts world economic growth of about 3% in the next 5 years;

- JPMorgan CEO: Banking crisis increases the possibility of recession;

- Major global automakers are left out in the Chinese market.

VN30

BANK

90,000

1D -1.32%

5D -1.53%

Buy Vol. 1,486,032

Sell Vol. 1,150,075

45,650

1D -0.76%

5D -1.19%

Buy Vol. 1,481,744

Sell Vol. 1,555,391

29,500

1D -0.17%

5D 1.03%

Buy Vol. 4,500,104

Sell Vol. 3,906,203

29,550

1D -0.17%

5D 4.23%

Buy Vol. 6,475,267

Sell Vol. 8,035,876

20,900

1D 0.00%

5D -0.71%

Buy Vol. 16,930,430

Sell Vol. 26,239,677

18,600

1D 0.54%

5D 1.92%

Buy Vol. 18,242,061

Sell Vol. 16,434,204

19,450

1D -1.02%

5D 1.04%

Buy Vol. 4,562,594

Sell Vol. 4,765,346

23,100

1D 0.00%

5D 4.05%

Buy Vol. 8,189,077

Sell Vol. 12,473,294

26,000

1D 1.36%

5D -0.76%

Buy Vol. 32,763,614

Sell Vol. 26,491,550

20,900

1D -0.48%

5D -0.06%

Buy Vol. 7,789,829

Sell Vol. 7,079,964

25,050

1D 0.60%

5D 0.20%

Buy Vol. 5,696,460

Sell Vol. 6,164,859

CTG: Vietinbank expects that by the end of 2023, the pre-tax income will reach VND960 billion, an increase of 46% compared to the end of 2022. Total assets as of December 31, 2023 are expected to reach VND125,000 billion, an increase of 12% compared to 2022. Capital mobilization from customers will increase by 17% to VND95,000 billion. Credit balance will increase 12% to VND75,600 billion and NPL was controlled below 2.5%.

REAL ESTATE

13,400

1D 1.13%

5D 5.51%

Buy Vol. 41,600,638

Sell Vol. 43,206,285

80,200

1D -0.37%

5D -3.26%

Buy Vol. 137,455

Sell Vol. 185,467

13,500

1D 0.00%

5D 8.00%

Buy Vol. 14,321,650

Sell Vol. 12,306,893

PDR: Phat Dat spent VND636 billion to acquire 31.8% of shares of Phat Dat Industrial Park Company.

OIL & GAS

101,200

1D -0.30%

5D -0.78%

Buy Vol. 268,311

Sell Vol. 525,838

13,050

1D -0.76%

5D -1.14%

Buy Vol. 8,557,388

Sell Vol. 12,268,766

37,700

1D 0.94%

5D 0.67%

Buy Vol. 2,425,844

Sell Vol. 3,137,492

PLX: Petrolimex successfully sold 40% of PG Bank shares to 4 investors to earn VND2,568 billion.

VINGROUP

54,400

1D -0.18%

5D -1.09%

Buy Vol. 3,931,455

Sell Vol. 3,430,794

50,700

1D -0.98%

5D -1.55%

Buy Vol. 1,304,732

Sell Vol. 1,900,829

29,200

1D -1.02%

5D -1.18%

Buy Vol. 2,343,989

Sell Vol. 3,729,423

VIC: Customers who have deposited VF e34 and VF 8 no longer need to buy a car can be unconditionally refunded 120% of the price by the company.

FOOD & BEVERAGE

74,700

1D 0.54%

5D 0.40%

Buy Vol. 1,459,452

Sell Vol. 1,836,893

77,600

1D 0.78%

5D -0.26%

Buy Vol. 1,163,862

Sell Vol. 1,428,176

177,000

1D 0.06%

5D -4.17%

Buy Vol. 113,657

Sell Vol. 156,234

MSN: Masan Consumer plans to merge into Masan Consumer Holdings Co., Ltd.

OTHERS

48,500

1D 0.00%

5D 0.10%

Buy Vol. 480,844

Sell Vol. 419,359

103,000

1D 0.78%

5D -2.00%

Buy Vol. 252,978

Sell Vol. 329,051

80,500

1D 0.25%

5D 1.77%

Buy Vol. 1,421,898

Sell Vol. 850,737

39,000

1D -0.26%

5D 1.17%

Buy Vol. 3,718,495

Sell Vol. 3,818,524

15,900

1D 1.92%

5D 2.58%

Buy Vol. 6,055,904

Sell Vol. 4,196,601

22,500

1D 2.97%

5D 4.65%

Buy Vol. 58,092,571

Sell Vol. 48,715,240

21,200

1D -1.40%

5D 1.92%

Buy Vol. 31,510,476

Sell Vol. 41,872,343

FPT: FPT is expected to invest USD35 - 50 million per year for M&A. At the same time, there is a plan to spend VND2,300 billion to invest in main cables, undersea optical cables, upgrade the quality of domestic telecommunications infrastructure and data center systems,...

Market by numbers

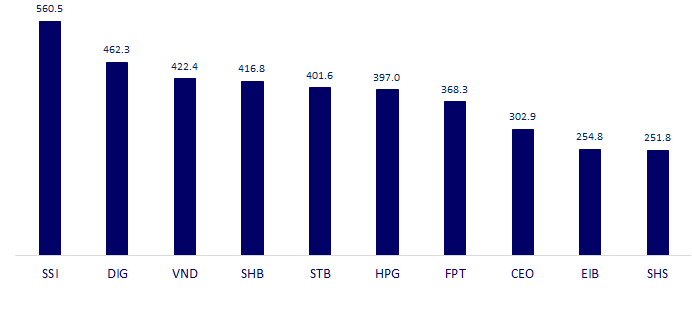

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

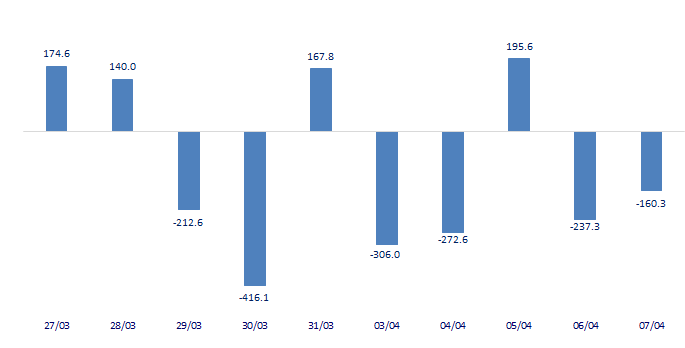

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

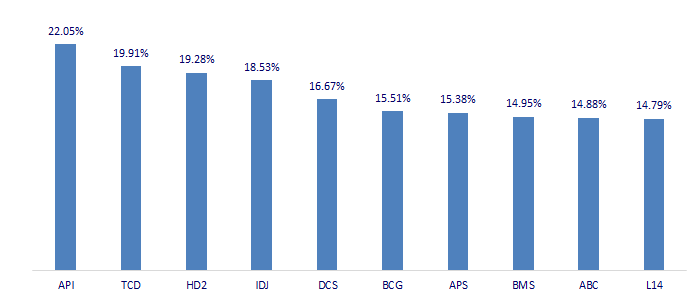

TOP INCREASES 3 CONSECUTIVE SESSIONS

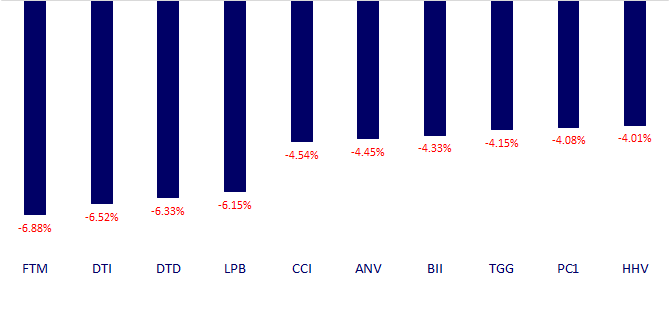

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.