Market Brief 20/04/2023

VIETNAM STOCK MARKET

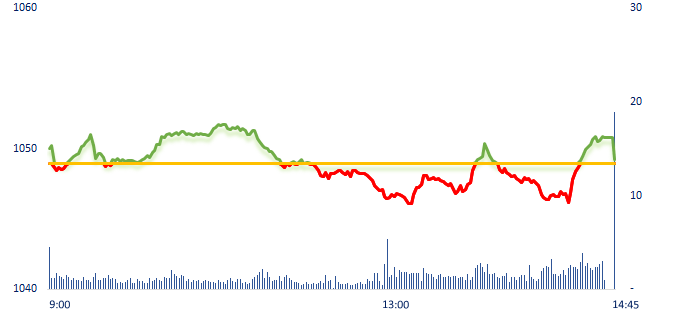

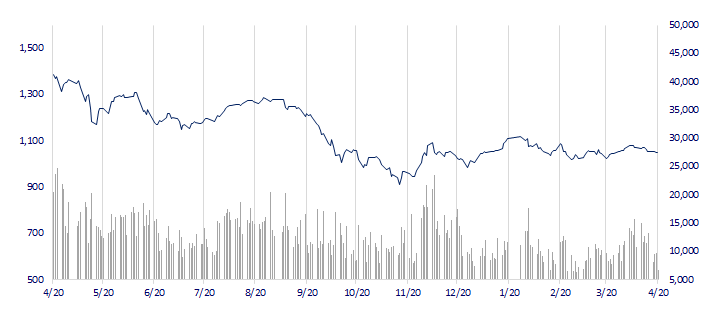

1,049.25

1D 0.03%

YTD 4.19%

1,053.61

1D -0.24%

YTD 4.82%

206.61

1D 0.37%

YTD 0.63%

77.85

1D -0.33%

YTD 8.65%

52.60

1D 0.00%

YTD 0.00%

8,097.95

1D -26.49%

YTD -6.01%

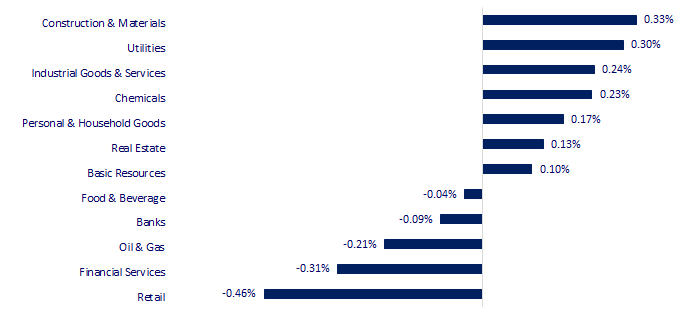

There was no large cash flow, causing stocks as well as industry groups to be fragmented and lacking a leading industry, the trading volume returned to the lowest level in the past 1 month. Construction materials was the biggest gainer today, mainly contributed by BMP (+4.4%) NTP (+5.2%), retail led the drop due to the drop of DGW (-2.2). %) PET (-2%) FRT (-1.3%).

ETF & DERIVATIVES

18,060

1D -0.06%

YTD 4.21%

12,460

1D -0.24%

YTD 4.53%

13,060

1D 0.46%

YTD 4.65%

15,500

1D -0.70%

YTD 10.32%

15,830

1D -1.86%

YTD 10.31%

22,590

1D 0.18%

YTD 0.85%

13,450

1D 0.30%

YTD 3.86%

1,041

1D -0.53%

YTD 0.00%

1,044

1D -0.54%

YTD 0.00%

1,047

1D -0.52%

YTD 0.00%

1,054

1D -0.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,639.50

1D 0.11%

YTD 9.75%

3,367.03

1D -0.09%

YTD 8.99%

2,563.11

1D -0.46%

YTD 14.61%

20,382.00

1D 0.07%

YTD 3.04%

3,313.41

1D -0.32%

YTD 1.91%

1,565.10

1D -0.99%

YTD -6.30%

81.86

1D -1.67%

YTD -4.71%

2,014.90

1D 1.39%

YTD 10.33%

Following a 2% fall on Wednesday, oil prices fell to their lowest in about three weeks on Thursday, depressed by a firmer dollar and rate hike expectations which outweighed lower U.S. crude stocks.

VIETNAM ECONOMY

3.77%

1D (bps) -66

YTD (bps) -120

7.40%

3.15%

1D (bps) 5

YTD (bps) -164

3.34%

1D (bps) 6

YTD (bps) -156

23,705

1D (%) 0.19%

YTD (%) -0.23%

26,205

1D (%) -0.77%

YTD (%) 2.13%

3,485

1D (%) 0.26%

YTD (%) 0.00%

The international dollar has rebounded on the back of higher Treasury yields as the market is sensitive to the Fed's monetary policy expectations. In Vietnam, banks and the black market both reduced the USD transaction price in the context of the increase in the central exchange rate and the reference rate at the SBV.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Long Thanh Airport, North-South Expressway to be expected to be supervised by the National Assembly;

- Hai Phong works to draw investment from Taiwan (China)’s electronic firms;

- Preparing for the opening of the Hanoi - Ca Mau route;

- The bond market just sounded the alarm on US default risks;

- Foxconn wages fall below USD3 per hour in Shenzhen as Apple shifts supply chain away from China;

- The risk of low-income countries defaulting on debt.

VN30

BANK

88,300

1D -0.23%

5D 0.11%

Buy Vol. 553,455

Sell Vol. 649,847

44,600

1D 0.45%

5D -0.78%

Buy Vol. 701,299

Sell Vol. 722,424

28,750

1D 0.17%

5D -2.21%

Buy Vol. 2,799,101

Sell Vol. 2,669,467

28,850

1D -0.52%

5D -4.47%

Buy Vol. 4,237,588

Sell Vol. 6,253,129

19,350

1D -1.78%

5D -6.07%

Buy Vol. 23,869,706

Sell Vol. 20,122,175

18,150

1D 0.28%

5D -2.16%

Buy Vol. 8,070,446

Sell Vol. 9,093,337

19,200

1D 0.79%

5D -2.54%

Buy Vol. 1,762,314

Sell Vol. 2,141,930

22,400

1D 0.22%

5D -3.45%

Buy Vol. 2,535,072

Sell Vol. 2,104,488

25,700

1D 0.78%

5D -2.84%

Buy Vol. 18,686,285

Sell Vol. 22,281,168

20,400

1D -0.24%

5D -3.55%

Buy Vol. 5,067,577

Sell Vol. 4,258,242

24,250

1D -0.61%

5D -2.81%

Buy Vol. 5,941,865

Sell Vol. 4,738,747

MBB: Military Insurance Corporation (MIG - a subsidiary of MBB) recorded original insurance revenue of VND1,217 billion in Q1, of which net revenue from insurance business reached VND937 billion, up 14% over the same period, pre-tax profit reached 86 billion.

REAL ESTATE

14,400

1D -1.03%

5D -0.69%

Buy Vol. 27,758,704

Sell Vol. 31,992,098

79,400

1D 0.25%

5D -0.50%

Buy Vol. 67,386

Sell Vol. 80,410

13,400

1D -2.19%

5D -4.29%

Buy Vol. 17,260,618

Sell Vol. 16,720,405

PDR: Phat Dat recorded a net profit of VND24 billion in Q1, paid more than VND1,000 billion of principal.

OIL & GAS

96,000

1D 0.42%

5D -4.00%

Buy Vol. 520,043

Sell Vol. 698,322

13,150

1D -0.38%

5D -2.23%

Buy Vol. 22,622,571

Sell Vol. 10,500,030

36,450

1D 0.14%

5D -2.02%

Buy Vol. 1,190,094

Sell Vol. 1,014,808

POW: Update on the status of NT3, NT4 Thermal Power, POW said that 17/18 bidding packages have been signed, specifically 9 packages have been completed, 8 packages are in progress.

VINGROUP

52,600

1D 0.00%

5D -0.75%

Buy Vol. 2,633,026

Sell Vol. 2,437,005

50,700

1D 0.60%

5D 0.40%

Buy Vol. 1,023,817

Sell Vol. 1,047,187

28,300

1D 0.00%

5D -0.35%

Buy Vol. 2,721,112

Sell Vol. 2,934,451

VHM: In the field of industrial - real estate, Vinhomes is actively promoting investment to increase occupancy rate in Cat Hai project, Hai Phong.

FOOD & BEVERAGE

71,900

1D -0.14%

5D -2.18%

Buy Vol. 1,618,297

Sell Vol. 1,689,335

78,000

1D -0.89%

5D -1.52%

Buy Vol. 1,531,379

Sell Vol. 1,728,970

170,500

1D 0.06%

5D 0.59%

Buy Vol. 435,178

Sell Vol. 485,492

SAB: In 2023, Sabeco sets a business plan with expected net revenue of VND40,272 billion, up 15.1% over the same period.

OTHERS

47,000

1D 1.84%

5D -2.89%

Buy Vol. 703,327

Sell Vol. 446,244

99,500

1D -0.60%

5D 0.20%

Buy Vol. 221,287

Sell Vol. 194,128

79,400

1D 0.13%

5D -0.25%

Buy Vol. 1,064,854

Sell Vol. 958,578

40,400

1D -0.25%

5D -1.58%

Buy Vol. 2,403,709

Sell Vol. 4,392,042

15,150

1D 0.66%

5D -5.02%

Buy Vol. 3,289,200

Sell Vol. 2,701,461

21,100

1D -0.94%

5D -2.99%

Buy Vol. 21,971,878

Sell Vol. 22,136,733

20,800

1D 0.00%

5D 1.71%

Buy Vol. 14,505,225

Sell Vol. 14,527,239

FPT: In Q1, FPT recorded revenue of VND11,681 billion, profit before tax of VND2,121 billion, up 20.1% yoy and 19.2% yoy, respectively. Technology segment continued to be the main growth driver and contributed 59% of revenue and 43% of pre-tax profit of corporation in the first quarter.

Market by numbers

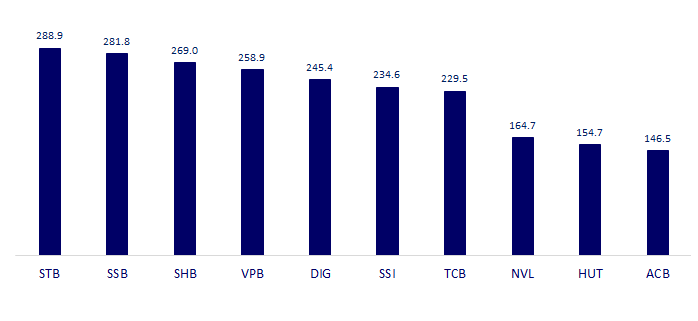

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

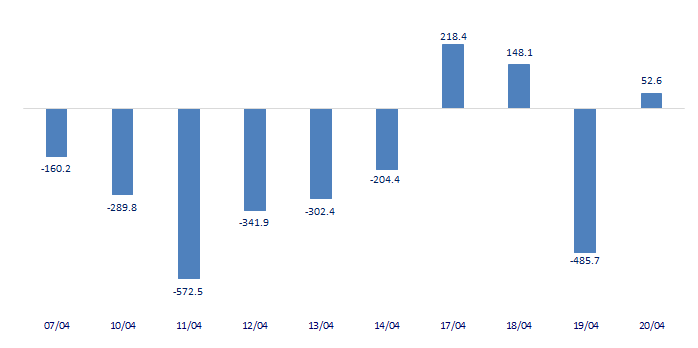

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

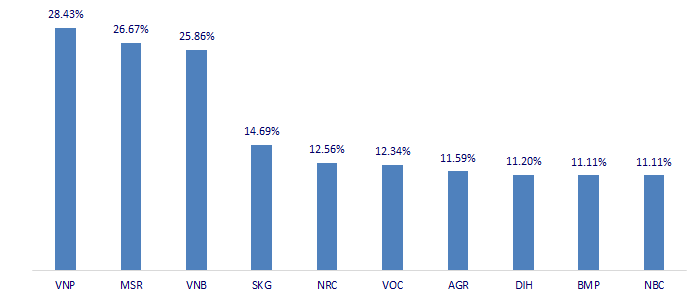

TOP INCREASES 3 CONSECUTIVE SESSIONS

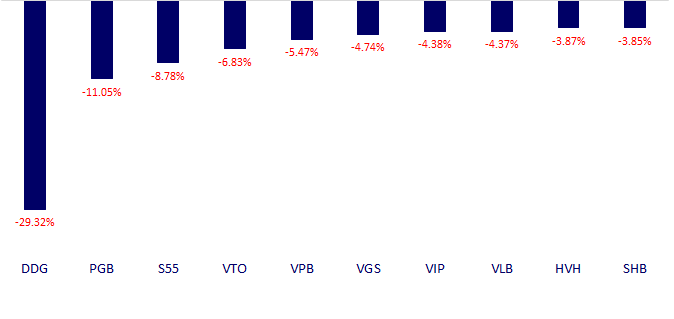

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.