Market brief 21/04/2023

VIETNAM STOCK MARKET

1,042.91

1D -0.60%

YTD 3.56%

1,046.18

1D -0.71%

YTD 4.08%

206.92

1D 0.15%

YTD 0.78%

77.99

1D 0.18%

YTD 8.85%

-242.56

1D 0.00%

YTD 0.00%

12,109.80

1D 49.54%

YTD 40.55%

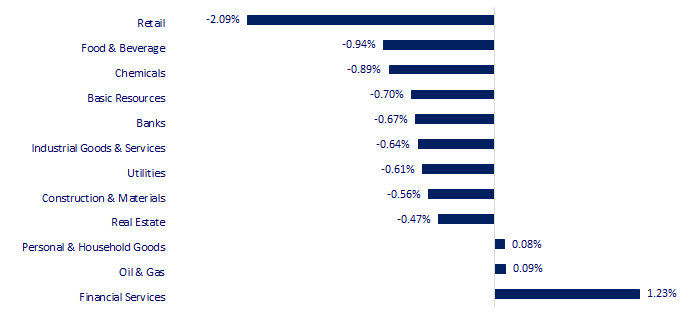

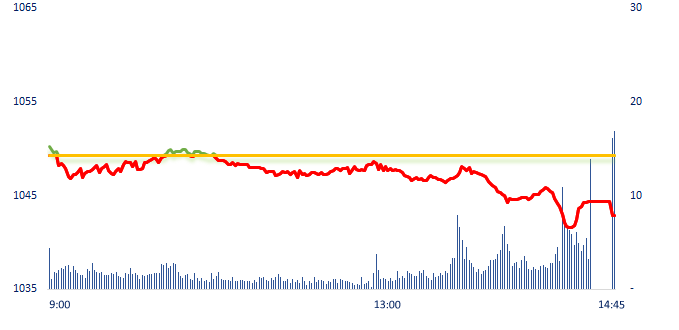

The market struggled strongly around the reference level in the morning before dropping sharply in the afternoon session. Almost sectors were in the red today, typically the real estate and retail sectors with negative stocks such as NVL, PDR, MWG, MSN... In contrast, the financial services sector strongly increase today.

ETF & DERIVATIVES

17,890

1D -0.94%

YTD 3.23%

12,420

1D -0.32%

YTD 4.19%

13,790

1D 5.59%

YTD 10.50%

15,720

1D 1.42%

YTD 11.89%

15,740

1D -0.57%

YTD 9.69%

22,330

1D -1.15%

YTD -0.31%

13,470

1D 0.15%

YTD 4.02%

1,034

1D -2.93%

YTD 0.00%

1,037

1D -0.37%

YTD 0.00%

1,038

1D -0.55%

YTD 0.00%

1,040

1D -0.67%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

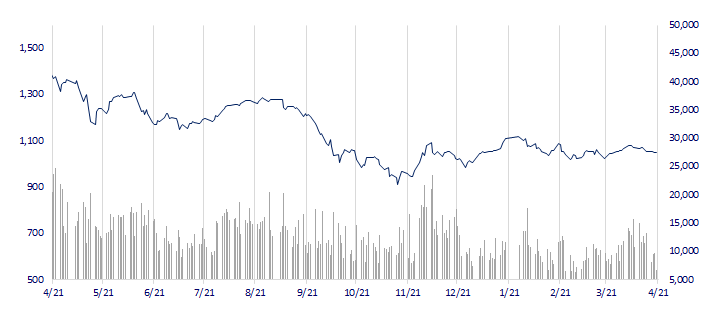

VNINDEX (12M)

GLOBAL MARKET

28,564.37

1D -0.26%

YTD 9.47%

3,301.26

1D -1.95%

YTD 6.86%

2,544.40

1D -0.73%

YTD 13.77%

20,075.73

1D -1.50%

YTD 1.49%

3,321.82

1D 0.25%

YTD 2.17%

1,558.36

1D -0.43%

YTD -6.71%

81.06

1D 0.11%

YTD -5.65%

1,998.00

1D -0.78%

YTD 9.41%

At the end of the session, Asian markets all dropped points due to the negative business results of businesses in the first quarter of 2023.

VIETNAM ECONOMY

3.23%

1D (bps) -54

YTD (bps) -174

7.40%

3.09%

1D (bps) -6

YTD (bps) -170

3.18%

1D (bps) -16

YTD (bps) -172

23,666

1D (%) -0.16%

YTD (%) -0.40%

26,470

1D (%) -0.15%

YTD (%) 3.16%

3,481

1D (%) -0.20%

YTD (%) -0.11%

According to the request of the Ministry of Finance, non-life insurers must manage risks with 3 independent lines of protection at: Operational departments; risk management, compliance audit and other control departments; and internal audit department.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Sea transport dropped sharply, in 2023, many difficulties are forecast;

- Vietnam's economy will grow from 6.3-6.5% in 2023;

- The President of Ho Chi Minh City gave urgent instructions on the disbursement of public investment capital;

- Elon Musk's assets "evaporated" $13 billion in 24 hours;

- The Central Bank of China signaled to reduce the scale of economic stimulus;

- The "Buffett effect" makes waves for Japanese stocks.

VN30

BANK

87,500

1D -0.91%

5D -1.02%

Buy Vol. 680,472

Sell Vol. 793,053

44,200

1D -0.90%

5D -0.56%

Buy Vol. 774,946

Sell Vol. 756,576

28,600

1D -0.52%

5D -1.72%

Buy Vol. 2,395,465

Sell Vol. 2,002,744

28,700

1D -0.52%

5D -0.69%

Buy Vol. 3,800,066

Sell Vol. 4,187,665

19,450

1D 0.52%

5D -5.12%

Buy Vol. 16,651,239

Sell Vol. 13,567,593

18,050

1D -0.55%

5D -1.37%

Buy Vol. 8,335,151

Sell Vol. 8,925,029

18,800

1D -2.08%

5D -3.59%

Buy Vol. 2,825,875

Sell Vol. 2,696,310

22,550

1D 0.67%

5D -2.80%

Buy Vol. 4,587,686

Sell Vol. 4,775,250

25,600

1D -0.39%

5D -0.39%

Buy Vol. 16,909,267

Sell Vol. 25,031,154

20,150

1D -1.23%

5D -3.13%

Buy Vol. 5,620,452

Sell Vol. 6,232,469

24,250

1D 0.00%

5D -2.81%

Buy Vol. 5,134,011

Sell Vol. 3,823,021

VCB: At the General Meeting of Shareholders, the management submitted to shareholders to approve the business plan for 2023 with the goal of profit before tax to increase by at least 15% compared to 2022. Before that, this bank recorded a consolidated profit before tax of VND37,368 billion in 2022. Thus, in 2023, Vietcombank expects a minimum profit of about VND43 trillion.

REAL ESTATE

13,600

1D -5.56%

5D -4.23%

Buy Vol. 55,346,644

Sell Vol. 62,120,254

79,100

1D -0.38%

5D -0.25%

Buy Vol. 69,176

Sell Vol. 89,786

13,000

1D -2.99%

5D -2.99%

Buy Vol. 24,923,110

Sell Vol. 22,022,929

NVL: NVL stocks will be put on warning from April 25, 2023 for the reason of late submission of the audited financial statements for 2022 by more than 15 days after the deadline.

OIL & GAS

95,400

1D -0.63%

5D -2.75%

Buy Vol. 644,744

Sell Vol. 790,654

12,800

1D -2.66%

5D -2.29%

Buy Vol. 23,148,459

Sell Vol. 20,208,831

36,750

1D 0.82%

5D 0.68%

Buy Vol. 1,064,374

Sell Vol. 1,352,562

Oil prices fell to their lowest levels since late March 2023 on Thursday (April 20), due to concerns that an economic downturn could reduce fuel demand.

VINGROUP

52,700

1D 0.19%

5D -0.38%

Buy Vol. 2,936,509

Sell Vol. 2,958,411

50,300

1D -0.79%

5D 0.60%

Buy Vol. 1,728,810

Sell Vol. 1,277,344

27,900

1D -1.41%

5D -2.45%

Buy Vol. 4,183,100

Sell Vol. 4,231,732

VIC: VinES and StoreDot will jointly research and develop super-fast rechargeable batteries (XFCs) for VinFast electric vehicles.

FOOD & BEVERAGE

70,900

1D -1.39%

5D -2.61%

Buy Vol. 2,107,611

Sell Vol. 2,060,866

76,400

1D -2.05%

5D -2.18%

Buy Vol. 1,937,936

Sell Vol. 1,941,216

170,500

1D 0.00%

5D 2.10%

Buy Vol. 315,585

Sell Vol. 425,004

VNM: Vinamilk signed a strategic partnership with 6 leading nutrition groups in the world.

OTHERS

46,850

1D -0.32%

5D -2.40%

Buy Vol. 540,274

Sell Vol. 464,907

97,500

1D -2.01%

5D -1.02%

Buy Vol. 232,029

Sell Vol. 259,667

79,300

1D -0.13%

5D -0.38%

Buy Vol. 1,152,427

Sell Vol. 862,303

39,300

1D -2.72%

5D -1.75%

Buy Vol. 4,464,521

Sell Vol. 7,484,142

15,100

1D -0.33%

5D -1.31%

Buy Vol. 3,697,825

Sell Vol. 3,139,444

21,650

1D 2.61%

5D 2.12%

Buy Vol. 58,177,577

Sell Vol. 59,884,593

20,700

1D -0.48%

5D 0.24%

Buy Vol. 17,454,448

Sell Vol. 22,146,663

SSI: In the first quarter of the year, the total operating revenue of SSI reached VND1,439 billion, 26.5% lower than the same period and 11.9% higher than the same period of last year. However, the business reported a pre-tax profit of more than VND590 billion. This is the highest profit in 4 quarters, more than 2 times higher than the last quarter of 2022 and also the highest level of the whole securities industry in the first quarter of 2023.

Market by numbers

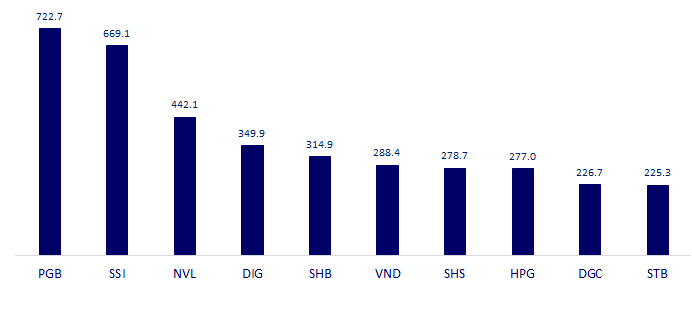

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

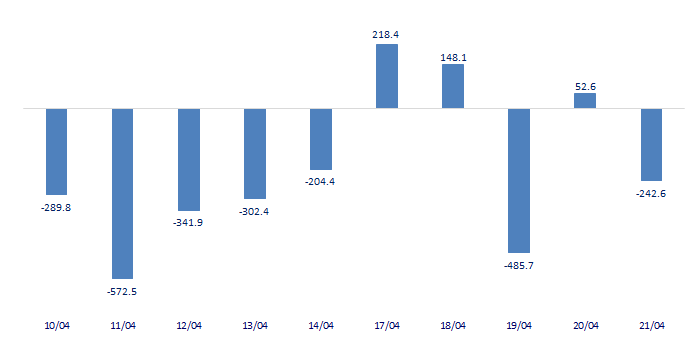

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

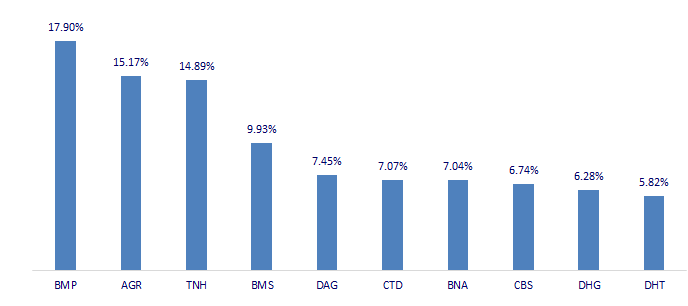

TOP INCREASES 3 CONSECUTIVE SESSIONS

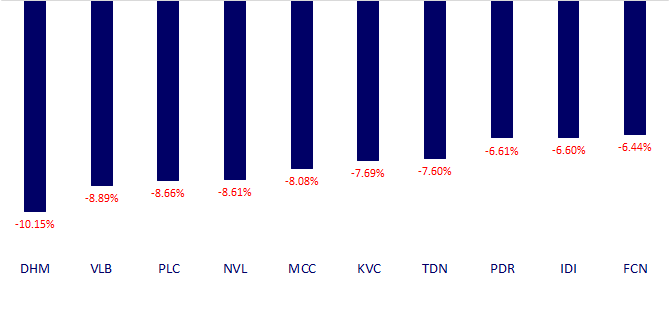

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.