Market brief 26/04/2023

VIETNAM STOCK MARKET

1,040.80

1D 0.57%

YTD 3.35%

1,045.24

1D 0.79%

YTD 3.98%

205.84

1D 0.56%

YTD 0.26%

78.01

1D 0.03%

YTD 8.88%

33.37

1D 0.00%

YTD 0.00%

13,000.54

1D 11.33%

YTD 50.89%

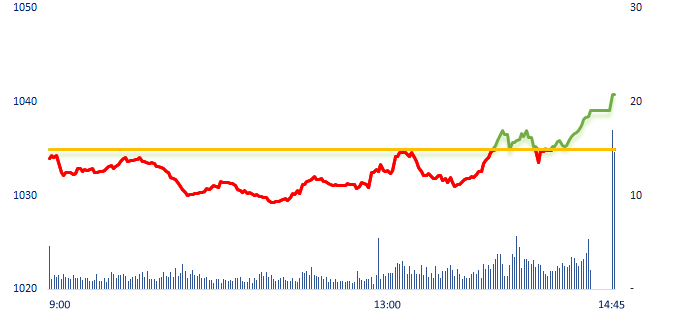

Today while the selling force dominated in the morning session, making VNIndex temporarily pause in the red, near the end of the afternoon session, investors witnessed the reversal of VNIndex when most of the industry groups gained. Market liquidity increased slightly compared to yesterday's session, but still at a lower level than the average of the last 20 trading sessions.

ETF & DERIVATIVES

17,920

1D 1.24%

YTD 3.40%

12,350

1D 1.31%

YTD 3.61%

12,760

1D 0.08%

YTD 2.24%

16,050

1D 4.22%

YTD 14.23%

15,660

1D 0.38%

YTD 9.13%

22,220

1D 1.00%

YTD -0.80%

13,150

1D -0.30%

YTD 1.54%

1,032

1D 0.34%

YTD 0.00%

1,032

1D 0.58%

YTD 0.00%

1,034

1D 0.52%

YTD 0.00%

1,038

1D 0.66%

YTD 0.00%

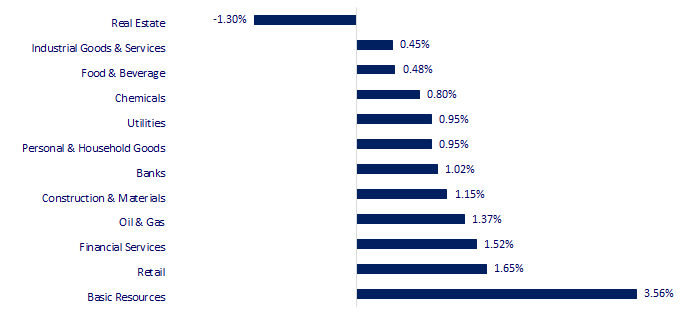

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

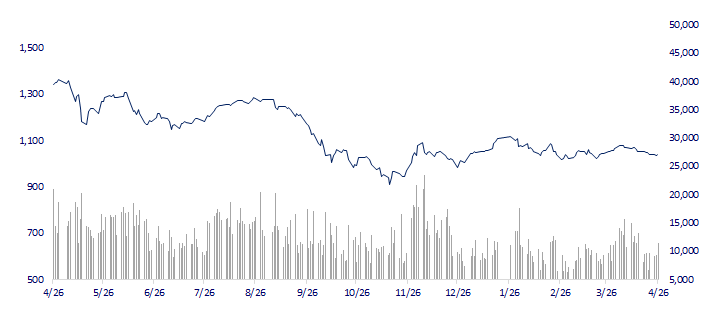

VNINDEX (12M)

GLOBAL MARKET

28,416.47

1D -0.71%

YTD 8.90%

3,264.10

1D -0.02%

YTD 5.66%

2,484.83

1D -0.17%

YTD 11.11%

19,757.27

1D 0.71%

YTD -0.12%

3,293.91

1D -0.01%

YTD 1.31%

1,543.95

1D 0.14%

YTD -7.57%

77.23

1D -4.36%

YTD -10.10%

2,010.15

1D 0.15%

YTD 10.07%

Asian stocks went in the opposite direction on April 26, following a decline on Wall Street due to concerns about the banking sector and the general recession. Weak consumer data and mixed earnings reports fueled these concerns during the US session.

VIETNAM ECONOMY

4.52%

1D (bps) -151

YTD (bps) -45

7.40%

3.04%

1D (bps) -4

YTD (bps) -175

3.24%

1D (bps) 5

YTD (bps) -167

23,643

1D (%) -0.03%

YTD (%) -0.49%

26,646

1D (%) 0.59%

YTD (%) 3.85%

3,460

1D (%) 0.09%

YTD (%) -0.72%

So far, basically, the deposit interest rates and lending rates of the market have decreased significantly, according to the State Bank's assessment. Specifically, currently, the newly arising lending interest rate for the economy has decreased by 0.6% compared to the end of 2022 and will continue to tend to decrease in the coming time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- OECD forecasts Vietnam's economy to grow by 6.5% in 2023;

- Vietnam regains the No. 1 position in furniture exports to the US, widening the gap with China;

- The Prime Minister requested to complete the plan to reduce 2% VAT soon;

- Central banks cut dollar trading with the Fed;

- New BOJ governor pledged to keep interest rates low, but signaled the possibility of rate hikes in the future;

- Korea achieved a low growth rate in the first quarter of 2023.

VN30

BANK

89,400

1D 1.25%

5D 1.02%

Buy Vol. 1,058,035

Sell Vol. 1,141,624

44,100

1D 1.26%

5D -0.68%

Buy Vol. 1,086,532

Sell Vol. 838,976

28,400

1D -0.35%

5D -1.05%

Buy Vol. 6,317,752

Sell Vol. 6,490,625

30,000

1D 3.45%

5D 3.45%

Buy Vol. 6,023,604

Sell Vol. 4,575,307

19,350

1D 0.26%

5D -1.78%

Buy Vol. 20,533,218

Sell Vol. 15,634,939

18,350

1D 0.55%

5D 1.38%

Buy Vol. 10,661,956

Sell Vol. 10,001,332

18,900

1D 3.00%

5D -0.79%

Buy Vol. 3,040,305

Sell Vol. 2,561,574

23,000

1D 1.10%

5D 2.91%

Buy Vol. 8,755,067

Sell Vol. 6,645,831

25,400

1D 1.40%

5D -0.39%

Buy Vol. 28,316,954

Sell Vol. 24,364,372

20,450

1D 2.25%

5D 0.00%

Buy Vol. 5,421,103

Sell Vol. 4,472,839

24,150

1D 0.00%

5D -1.02%

Buy Vol. 7,166,156

Sell Vol. 5,676,010

TPB: TPBank's BoDs submits to shareholders a business plan for 2023 with a profit target of VND8,700 billion, an increase by 11% compared to the performance level in 2022. To achieve the above figure, total assets are expected to increase by 7% to 350,000 billion. Mobilized capital from market 1 is estimated to increase by 6% to VND306,960 billion. The target NPL ratio is below 2.2% and the capital adequacy ratio is 12.6%.

REAL ESTATE

13,950

1D 1.45%

5D -4.12%

Buy Vol. 31,335,792

Sell Vol. 23,525,325

78,700

1D 0.00%

5D -0.63%

Buy Vol. 75,689

Sell Vol. 98,567

13,100

1D 1.16%

5D -4.38%

Buy Vol. 9,867,921

Sell Vol. 7,623,148

PDR: At the end of March 2023, the total bond of the Company was just over VND1,612 billion, at the beginning of the year more than VND 2,510 billion, which is a decrease by nearly 36%.

OIL & GAS

93,400

1D 1.52%

5D -2.30%

Buy Vol. 745,703

Sell Vol. 576,936

12,800

1D 0.00%

5D -3.03%

Buy Vol. 26,574,255

Sell Vol. 8,785,713

36,900

1D 1.37%

5D 1.37%

Buy Vol. 812,519

Sell Vol. 958,647

PLX: Completed divestment at PGB through a public auction via HSX with the amount of 120 million shares.

VINGROUP

51,900

1D -1.14%

5D -1.33%

Buy Vol. 3,310,568

Sell Vol. 3,718,489

48,000

1D -4.38%

5D -4.76%

Buy Vol. 3,140,449

Sell Vol. 4,173,531

27,500

1D -0.72%

5D -2.83%

Buy Vol. 6,942,764

Sell Vol. 6,095,148

VRE: Vincom Retail's BoDs submitted a plan that all profits will be retained and used for production and business activities of the company.

FOOD & BEVERAGE

71,000

1D 1.57%

5D -1.39%

Buy Vol. 1,813,048

Sell Vol. 1,777,088

71,400

1D 0.14%

5D -9.28%

Buy Vol. 2,283,072

Sell Vol. 1,697,595

171,000

1D 0.00%

5D 0.35%

Buy Vol. 252,873

Sell Vol. 322,581

MSN: In 2023, MSN sets a target of VND90,000-100,000 billion in revenue and VND ,000-5,000 billion in profit after tax. The AGM approved the 2022 cash dividend with the payout ratio of 8%.

OTHERS

45,850

1D 0.55%

5D -0.65%

Buy Vol. 702,482

Sell Vol. 596,607

95,200

1D -0.73%

5D -4.90%

Buy Vol. 332,900

Sell Vol. 293,899

78,300

1D -0.13%

5D -1.26%

Buy Vol. 1,595,838

Sell Vol. 1,115,944

38,400

1D 1.86%

5D -5.19%

Buy Vol. 3,825,632

Sell Vol. 3,348,905

15,350

1D 1.66%

5D 1.99%

Buy Vol. 2,763,513

Sell Vol. 2,769,315

21,350

1D 1.18%

5D 0.23%

Buy Vol. 39,511,741

Sell Vol. 30,946,922

22,000

1D 4.51%

5D 5.77%

Buy Vol. 45,128,443

Sell Vol. 42,463,724

VJC: In 2023, Vietjet continues to aim for high revenue growth of over 25% thanks to international tourists, when China opens the Chinese market from March 15, 2023 and Vietjet operates routes fly to Australia from April 2023. In addition, the 30% decrease in jet fuel costs compared to 2022 will strengthen Vietjet's ability to generate profits in 2023. Vietjet expects profit after tax to reach VND 1,000 billion this year.

Market by numbers

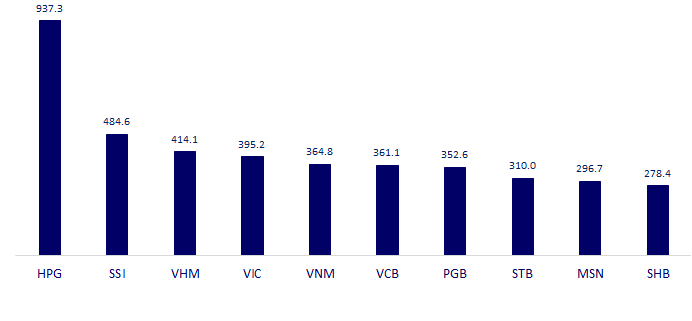

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

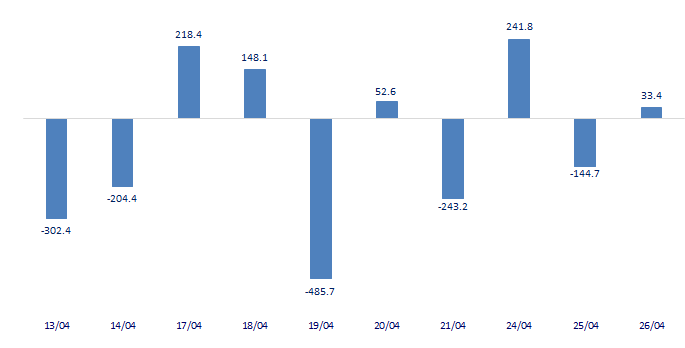

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

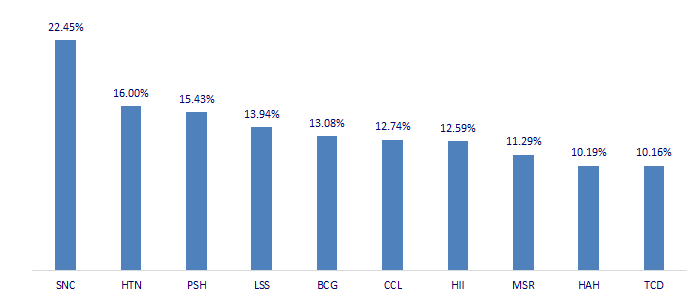

TOP INCREASES 3 CONSECUTIVE SESSIONS

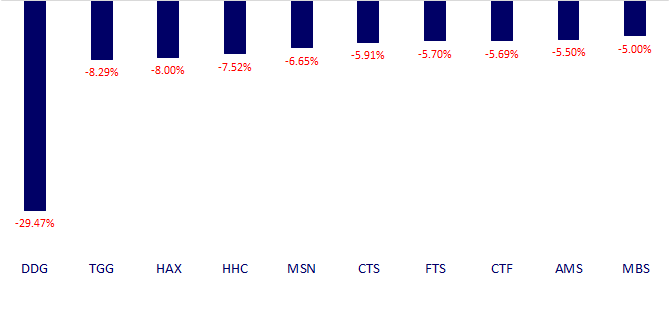

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.