Market brief 05/05/2023

VIETNAM STOCK MARKET

1,040.31

1D -0.03%

YTD 3.30%

1,038.46

1D -0.11%

YTD 3.31%

207.80

1D -0.17%

YTD 1.21%

77.56

1D 0.38%

YTD 8.25%

-174.63

1D 0.00%

YTD 0.00%

10,753.36

1D -11.99%

YTD 24.81%

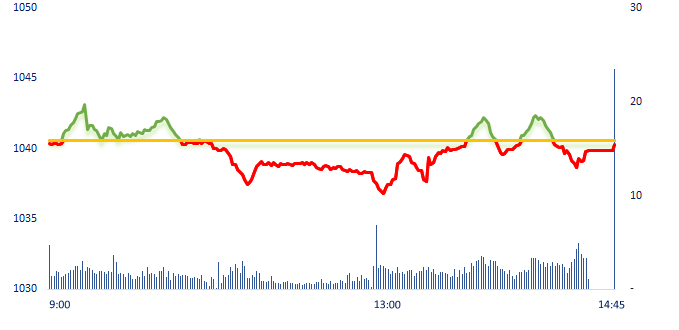

In the last trading session of the week, VN-Index showed signs of recovering at the beginning of the morning session after yesterday's drop. However, the gaining momentum did not last long, causing VNIndex to turn down. Securities stocks continued to be remarkable with the representative of VIX, after hitting the ceiling yesterday, today continued to have a 3rd consecutive increase.

ETF & DERIVATIVES

18,000

1D 0.39%

YTD 3.87%

12,290

1D 0.16%

YTD 3.10%

12,760

1D 0.95%

YTD 2.24%

16,580

1D 6.83%

YTD 18.01%

16,000

1D 1.01%

YTD 11.50%

22,300

1D -0.62%

YTD -0.45%

13,260

1D -0.23%

YTD 2.39%

1,028

1D 0.06%

YTD 0.00%

1,029

1D 0.03%

YTD 0.00%

1,030

1D 0.05%

YTD 0.00%

1,034

1D -0.14%

YTD 0.00%

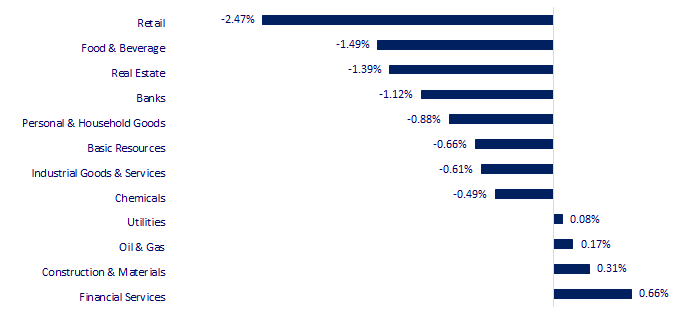

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

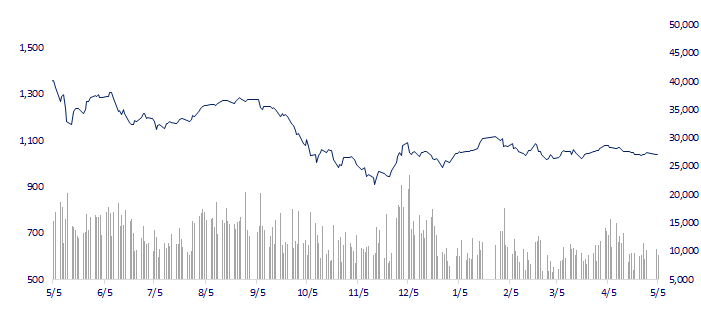

VNINDEX (12M)

GLOBAL MARKET

29,157.95

1D 0.00%

YTD 11.74%

3,334.50

1D -0.48%

YTD 7.94%

2,500.94

1D 0.00%

YTD 11.83%

20,033.00

1D 0.42%

YTD 1.27%

3,266.63

1D -0.08%

YTD 0.47%

1,533.30

1D 0.00%

YTD -8.21%

70.36

1D -3.10%

YTD -18.10%

2,045.25

1D -0.62%

YTD 11.99%

In the afternoon session of May 5, Asian stocks were mixed after Wall Street plunged the previous session on renewed concerns about banking problems.

VIETNAM ECONOMY

4.91%

YTD (bps) -6

7.20%

YTD (bps) -20

2.95%

1D (bps) -5

YTD (bps) -184

3.12%

1D (bps) -5

YTD (bps) -178

23,660

1D (%) 0.15%

YTD (%) -0.42%

26,305

1D (%) -1.05%

YTD (%) 2.52%

3,464

1D (%) -0.06%

YTD (%) -0.60%

According to the SBV, by the end of February 2023, the bad debt ratio on the balance sheet was 2.91% (up from 2.46% at the end of 2016; 1.49% at the end of 2021 and 2.0% at the end of 2022). The SBV determined that the total bad debt on the balance sheet, unresolved debt sold to VAMC and potential bad debt of the system of credit institutions by the end of February 2023 was estimated to account for 5% of the total outstanding loans.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Rice export turnover in the first four months of 2023 increased by 54.5%;

- Vietnam reduces investment abroad;

- The Government proposed the National Assembly to consider reducing VAT at the May meeting;

- There are more and more signals about a credit crisis in the US;

- ECB continues to raise interest rates by 25 basis points;

- Gold nears all-time highs.

VN30

BANK

89,800

1D 1.47%

5D -0.77%

Buy Vol. 462,164

Sell Vol. 682,965

43,450

1D -0.69%

5D -0.11%

Buy Vol. 593,618

Sell Vol. 687,623

27,850

1D -1.42%

5D -3.47%

Buy Vol. 5,303,286

Sell Vol. 5,173,169

28,700

1D -1.20%

5D -2.71%

Buy Vol. 5,514,126

Sell Vol. 5,148,505

19,450

1D -0.51%

5D -2.26%

Buy Vol. 10,322,455

Sell Vol. 12,827,476

18,100

1D -0.55%

5D -1.90%

Buy Vol. 7,711,271

Sell Vol. 8,199,949

19,050

1D 1.33%

5D 1.33%

Buy Vol. 2,036,993

Sell Vol. 2,167,002

23,350

1D -1.06%

5D -1.89%

Buy Vol. 3,414,056

Sell Vol. 3,645,965

24,950

1D -0.80%

5D -1.38%

Buy Vol. 16,476,345

Sell Vol. 18,828,726

20,150

1D -0.25%

5D -1.71%

Buy Vol. 4,754,255

Sell Vol. 5,024,695

24,650

1D -0.20%

5D 1.86%

Buy Vol. 5,866,921

Sell Vol. 5,198,518

BID: BIDV plans to increase charter capital to more than VND61,557 billion in 2023 by 2 issuances. In the first phase, the bank will issue nearly VND642 million shares to pay dividends to shareholders, accounting for 12.69% of the outstanding shares as of December 31, 2022. The source for implementation is from the remaining profit in 2021 after setting aside the fund. In the second phase, BIDV privately issued or offered more than 455 million shares to the public according to the Plan approved by the 2022 AGM (expected 9% of charter capital as of December 31, 2022).

REAL ESTATE

13,550

1D 0.00%

5D -5.24%

Buy Vol. 61,794,996

Sell Vol. 38,536,179

77,900

1D -0.26%

5D -1.02%

Buy Vol. 131,270

Sell Vol. 122,061

13,500

1D -1.46%

5D -4.59%

Buy Vol. 10,597,155

Sell Vol. 10,115,458

NVL: Q1, NVL's net loss is more than VND410 billion while the same period's profit is more than VND1,045 billion. This is also the first time NVL has reported a loss in a quarter since its listing in 2016.

OIL & GAS

91,900

1D -0.11%

5D -0.97%

Buy Vol. 343,557

Sell Vol. 448,659

13,050

1D 0.38%

5D -0.38%

Buy Vol. 28,992,608

Sell Vol. 12,258,229

37,800

1D 0.93%

5D 0.93%

Buy Vol. 1,898,967

Sell Vol. 2,226,145

PLX: In 2023, PLX plans to build 76 new petrol stations with an investment value of VND360 billion, renovate and upgrade 470 stores with an investment value of about vnd950 billion.

VINGROUP

50,700

1D -1.17%

5D -2.69%

Buy Vol. 2,267,322

Sell Vol. 2,927,229

49,000

1D -1.01%

5D -1.01%

Buy Vol. 1,341,006

Sell Vol. 1,929,435

27,150

1D -0.37%

5D -1.99%

Buy Vol. 2,945,284

Sell Vol. 3,270,464

VHM: Vinhomes recorded a profit after tax of VND11,923 billion, 2.5 times higher than the same period. VHM is also the only name on the exchange with a net profit of over VND10,000 billion in Q1.

FOOD & BEVERAGE

68,800

1D 0.29%

5D -1.71%

Buy Vol. 1,600,629

Sell Vol. 1,361,471

73,000

1D 3.40%

5D -0.14%

Buy Vol. 1,912,097

Sell Vol. 1,558,715

165,500

1D -0.66%

5D -3.78%

Buy Vol. 164,983

Sell Vol. 217,702

SAB: Sabeco's goal this year is to maintain a gross margin of nearly 31%, given that average input costs are expected to be higher than last year.

OTHERS

45,900

1D 1.44%

5D 2.23%

Buy Vol. 628,925

Sell Vol. 808,455

96,000

1D 0.52%

5D -1.03%

Buy Vol. 135,963

Sell Vol. 150,786

78,400

1D -0.13%

5D 1.16%

Buy Vol. 895,633

Sell Vol. 689,388

37,800

1D -0.26%

5D -3.57%

Buy Vol. 2,571,533

Sell Vol. 3,245,854

15,500

1D -1.27%

5D -0.32%

Buy Vol. 3,643,184

Sell Vol. 5,507,521

21,450

1D -1.38%

5D -0.46%

Buy Vol. 16,349,468

Sell Vol. 21,348,691

21,450

1D 0.70%

5D -0.92%

Buy Vol. 22,709,442

Sell Vol. 25,626,372

GVR: Q1.2023 with net revenue down 16% to VND4,135 billion. Revenue from rubber latex production and trading was recorded at VND2,915 billion, down 3% over the same period last year; revenue from wood processing reached VND556 billion, down 42%.

Market by numbers

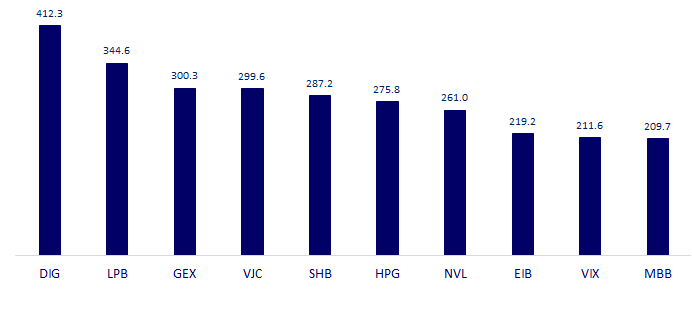

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

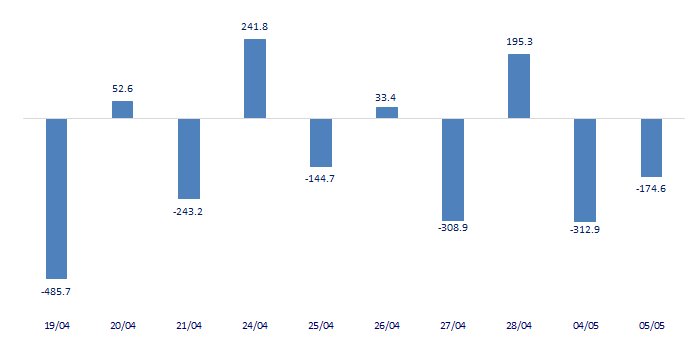

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

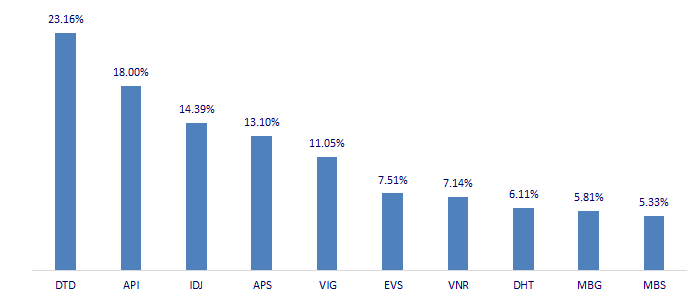

TOP INCREASES 3 CONSECUTIVE SESSIONS

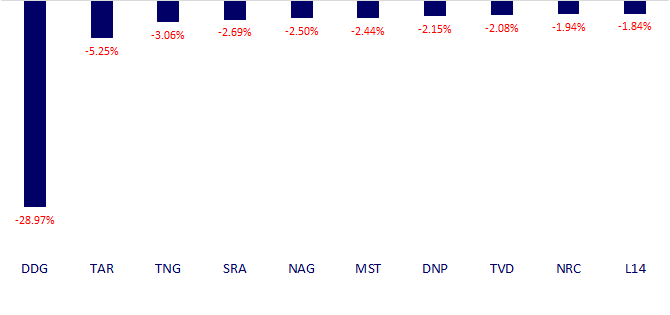

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.