Market brief 08/05/2023

VIETNAM STOCK MARKET

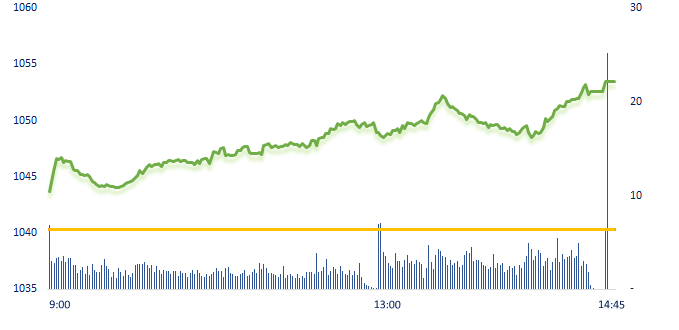

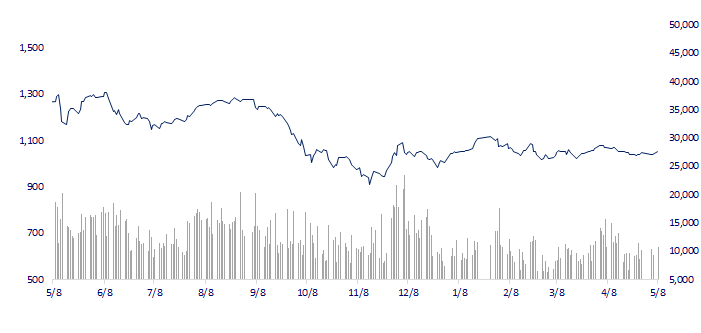

1,053.44

1D 1.26%

YTD 4.60%

1,049.72

1D 1.08%

YTD 4.43%

210.92

1D 1.50%

YTD 2.73%

78.38

1D 1.06%

YTD 9.39%

-11.68

1D 0.00%

YTD 0.00%

12,375.11

1D 15.08%

YTD 43.63%

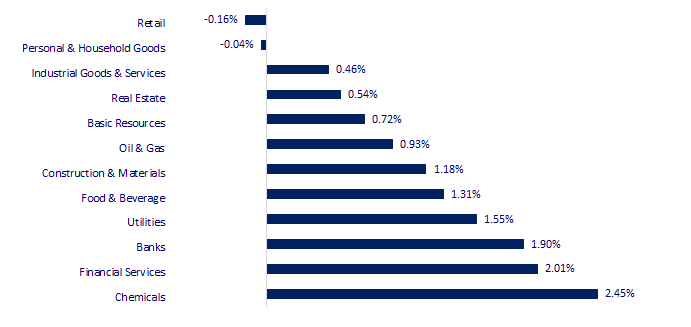

In the first trading session of the week, VNIndex maintained the green from the beginning of the session and closed at the highest price in the session. Chemical stocks led the gain in today's session with the whole industry gaining 2.45% with some representatives closing at ceiling prices such as LAS, VPG...

ETF & DERIVATIVES

18,000

1D 0.00%

YTD 3.87%

12,380

1D 0.73%

YTD 3.86%

12,850

1D 0.71%

YTD 2.96%

16,010

1D -3.44%

YTD 13.95%

16,000

1D 0.00%

YTD 11.50%

22,100

1D -0.90%

YTD -1.34%

13,350

1D 0.68%

YTD 3.09%

1,034

1D 0.57%

YTD 0.00%

1,038

1D 0.95%

YTD 0.00%

1,039

1D 0.83%

YTD 0.00%

1,042

1D 0.80%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

28,958.50

1D -0.68%

YTD 10.98%

3,395.00

1D 1.81%

YTD 9.90%

2,513.21

1D 0.49%

YTD 12.38%

20,297.03

1D 1.32%

YTD 2.61%

3,257.66

1D -0.27%

YTD 0.19%

1,562.25

1D 1.89%

YTD -6.47%

72.92

1D -3.03%

YTD -15.12%

2,031.35

1D 0.30%

YTD 11.23%

Ending the afternoon session on May 8, the Japanese stock market closed at a low level, while most other Asian stock markets witnessed "green". On the Tokyo exchange, investors began to sell off stocks due to concerns that the yen is strengthening against the dollar.

VIETNAM ECONOMY

5.04%

1D (bps) 4

YTD (bps) 7

7.20%

YTD (bps) -20

2.94%

1D (bps) -1

YTD (bps) -185

3.12%

YTD (bps) -178

23,620

1D (%) 0.00%

YTD (%) -0.59%

26,608

1D (%) 0.14%

YTD (%) 3.70%

3,460

1D (%) -0.09%

YTD (%) -0.72%

Governor Nguyen Thi Hong said that the State Bank has bought about USD6 billion since the beginning of the year until now. This means that the SBV puts money into the economy along with other channels of monetary policy.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interest rates went up, individual deposits increased sharply, exceeding VND6 million billion;

- Prime Minister: Inflation is decreasing, more priority should be given to growth;

- Risk of electricity shortage in the North;

- Russia returns to the top 10 largest economies in the world;

- Common voice in the negotiation to raise the public debt ceiling in the US have not found yet;

- China has continuously lost its export market share to the US.

VN30

BANK

93,000

1D 3.56%

5D 2.76%

Buy Vol. 2,518,374

Sell Vol. 2,189,619

44,700

1D 2.88%

5D 2.76%

Buy Vol. 2,039,115

Sell Vol. 1,960,946

27,900

1D 0.18%

5D -3.29%

Buy Vol. 5,174,638

Sell Vol. 4,564,476

29,400

1D 2.44%

5D -0.34%

Buy Vol. 5,060,400

Sell Vol. 4,411,729

19,450

1D 0.00%

5D -2.26%

Buy Vol. 9,772,538

Sell Vol. 13,531,917

18,250

1D 0.83%

5D -1.08%

Buy Vol. 8,114,584

Sell Vol. 9,359,172

19,200

1D 0.79%

5D 2.13%

Buy Vol. 3,803,268

Sell Vol. 3,827,413

23,250

1D -0.43%

5D -2.31%

Buy Vol. 4,688,498

Sell Vol. 4,860,033

25,650

1D 2.81%

5D 1.38%

Buy Vol. 20,440,348

Sell Vol. 20,741,463

20,350

1D 0.99%

5D -0.73%

Buy Vol. 8,914,326

Sell Vol. 7,531,265

24,950

1D 1.22%

5D 3.10%

Buy Vol. 4,781,102

Sell Vol. 4,878,076

According to financial statements Q1.2023 of banks traded on the stock exchange, the total assets of banks are currently about VND12.86 million billion, up 2.14% compared to the beginning of the year. Top 10 banks with the largest asset scale are holding VND10.17 million billion, equivalent to 79.5% of the total assets of the listed banks. BIDV, Vietcombank, and VietinBank are still at the top of the rankings with total assets of more than VND5.77 million billion, up 0.6% compared to the beginning of the year and accounting for nearly half of the total assets of banks (44.89%).

REAL ESTATE

12,950

1D -4.43%

5D -9.44%

Buy Vol. 68,107,180

Sell Vol. 57,816,632

78,100

1D 0.26%

5D -0.76%

Buy Vol. 135,683

Sell Vol. 143,627

13,550

1D 0.37%

5D -4.24%

Buy Vol. 10,200,185

Sell Vol. 12,012,644

NVL: Q1, Inventory was recorded at VND136,905 billion, up 13.7% over the same period. In which, VND125,107 billion is real estate for sale under construction, equivalent to 91.4% of total inventory.

OIL & GAS

93,100

1D 1.31%

5D 0.32%

Buy Vol. 565,333

Sell Vol. 425,394

13,300

1D 1.92%

5D 1.53%

Buy Vol. 55,906,907

Sell Vol. 18,097,353

37,800

1D 0.00%

5D 0.93%

Buy Vol. 943,625

Sell Vol. 1,703,556

POW: In the first 4 months of the year, Vung Ang 1 Thermal Power Plant produced 1,326 million kWh of electricity, earning a revenue of VND2,733 billion.

VINGROUP

50,900

1D 0.39%

5D -2.30%

Buy Vol. 2,107,324

Sell Vol. 2,705,552

49,400

1D 0.82%

5D -0.20%

Buy Vol. 2,451,744

Sell Vol. 1,901,230

27,450

1D 1.10%

5D -0.90%

Buy Vol. 4,666,495

Sell Vol. 5,569,302

VHM: The end of May will be the maturity date of a bond lot worth VND5,280 billion issued by VHM in 2020 with a term of 3 years and interest rate of 9% for the first year.

FOOD & BEVERAGE

70,400

1D 2.33%

5D 0.57%

Buy Vol. 2,791,631

Sell Vol. 2,006,946

74,100

1D 1.51%

5D 1.37%

Buy Vol. 1,628,174

Sell Vol. 2,385,566

166,500

1D 0.60%

5D -3.20%

Buy Vol. 161,384

Sell Vol. 126,273

MSN: Masan group has 2 lots due in May, including VND2,600 billion of Nui Phao Mining and Processing Co., Ltd (due May 29) and VND2,000 billion of Masan Group (due on May 6).

OTHERS

46,000

1D 0.22%

5D 2.45%

Buy Vol. 656,642

Sell Vol. 738,908

96,300

1D 0.31%

5D -0.72%

Buy Vol. 113,670

Sell Vol. 196,785

78,500

1D 0.13%

5D 1.29%

Buy Vol. 939,338

Sell Vol. 690,516

37,850

1D 0.13%

5D -3.44%

Buy Vol. 2,224,562

Sell Vol. 2,468,507

16,200

1D 4.52%

5D 4.18%

Buy Vol. 9,222,039

Sell Vol. 7,827,665

22,300

1D 3.96%

5D 3.48%

Buy Vol. 50,682,209

Sell Vol. 51,510,367

21,600

1D 0.70%

5D -0.23%

Buy Vol. 19,155,827

Sell Vol. 29,778,307

HPG: In April 2023, Hoa Phat Group produced 525,000 tons of crude steel, down 29% compared to the same period in 2022 but increasing by more than 19% compared to March 2023. Hoa Phat said that sales of steel products reached 457,000 tons, down 23% compared to April last year. In which, hot rolled coil (HRC) contributed 239,000 tons, the highest since the beginning of the year.

Market by numbers

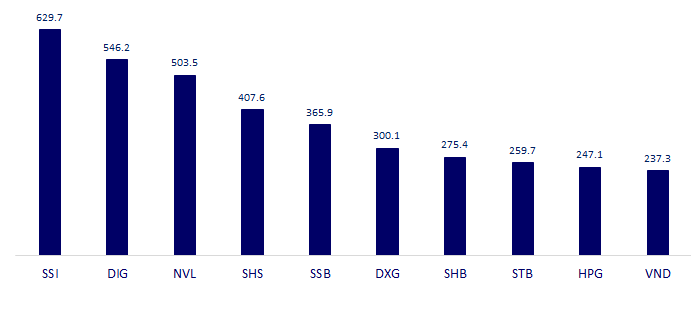

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

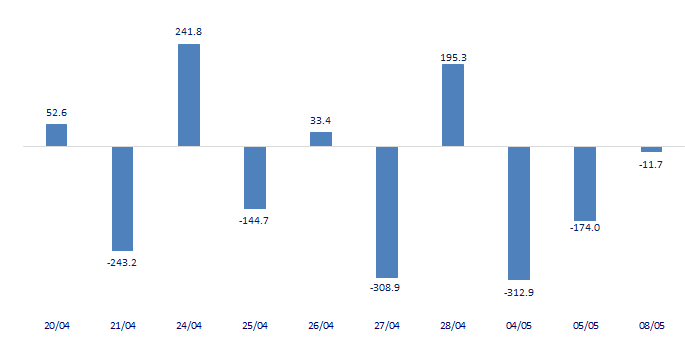

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

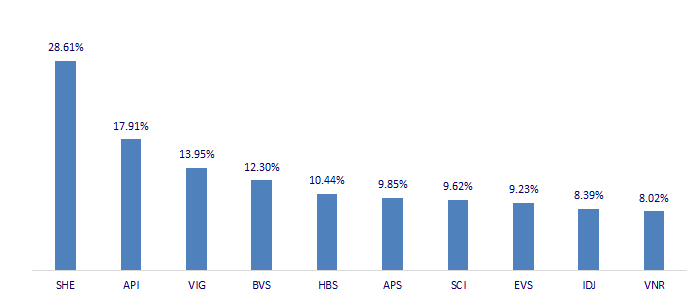

TOP INCREASES 3 CONSECUTIVE SESSIONS

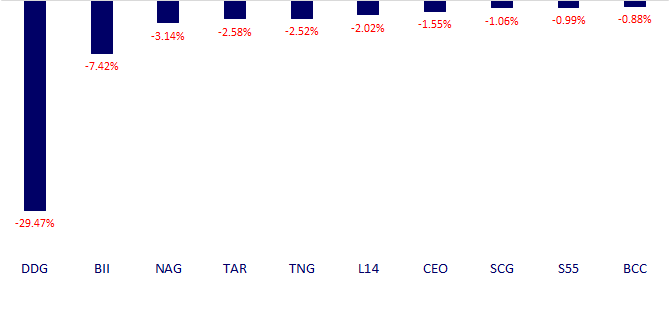

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.