Market brief 09/05/2023

VIETNAM STOCK MARKET

1,053.77

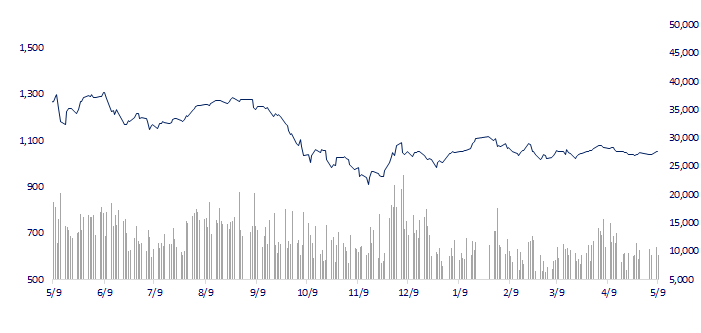

1D 0.03%

YTD 4.64%

1,049.67

1D 0.00%

YTD 4.43%

211.95

1D 0.49%

YTD 3.23%

78.34

1D -0.05%

YTD 9.34%

-254.35

1D 0.00%

YTD 0.00%

11,173.29

1D -9.71%

YTD 29.68%

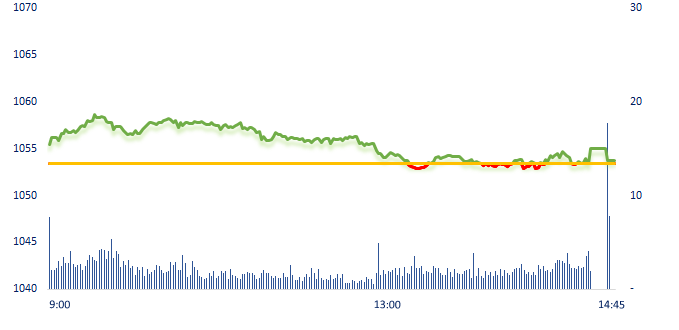

During the morning session, VNIndex continued to be optimistic from yesterday. At the beginning of the afternoon, the market struggled and sometimes dropped. Fortunately, in the end, VN-Index still ended in green. Steel led the gain in today's session with representatives NKG (+3.8%), HSG (+2.2%), HPG (+0.9%)...

ETF & DERIVATIVES

18,000

1D 0.00%

YTD 3.87%

12,410

1D 0.24%

YTD 4.11%

12,940

1D 0.70%

YTD 3.69%

16,580

1D 3.56%

YTD 18.01%

15,940

1D -0.38%

YTD 11.08%

22,160

1D 0.27%

YTD -1.07%

13,440

1D 0.67%

YTD 3.78%

1,034

1D 0.02%

YTD 0.00%

1,038

1D -0.03%

YTD 0.00%

1,039

1D 0.07%

YTD 0.00%

1,042

1D 0.04%

YTD 0.00%

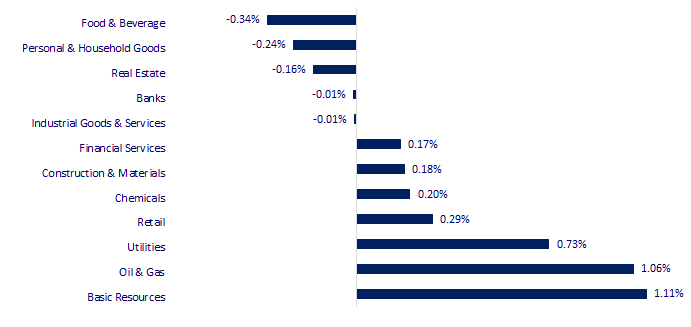

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,242.82

1D 0.98%

YTD 12.07%

3,357.67

1D -1.10%

YTD 8.69%

2,510.06

1D -0.13%

YTD 12.24%

19,867.58

1D -2.12%

YTD 0.44%

3,242.95

1D -0.45%

YTD -0.26%

1,564.66

1D 0.15%

YTD -6.33%

72.55

1D -5.35%

YTD -15.55%

2,038.10

1D 0.42%

YTD 11.60%

Asian stock markets were mixed on the afternoon of May 9 as investors paid attention to the US inflation data release this week. Now, the market is focused on the US release of consumer price index report for April 2023 and daily wholesale price data. Traders are also watching developments in Washington as US President Joe Biden prepares to discuss with congressional leaders on raising the country's debt ceiling.

VIETNAM ECONOMY

5.02%

1D (bps) -2

YTD (bps) 5

7.20%

YTD (bps) -20

2.98%

1D (bps) 4

YTD (bps) -181

3.01%

1D (bps) -11

YTD (bps) -189

23,675

1D (%) 0.23%

YTD (%) -0.36%

26,208

1D (%) -1.15%

YTD (%) 2.14%

3,460

1D (%) -0.06%

YTD (%) -0.72%

According to the State Bank of Vietnam data, total customer deposits at the credit institution system at the end of February 2023 reached nearly VND11.8 million billion, down more than VND23,800 billion compared to the end of 2022, equivalent decreased by 0.2%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government assigned the SBV to direct commercial banks to continue reducing interest rates;

- The State Bank requires strict control of credit quality for potential risk areas;

- Limit the issuance of Government bonds when the old mobilized capital cannot be disbursed;

- US: Credit balance skyrocketed, bank deposits fell to a two-year low;

- Fed warns of credit crisis risk after US banking crisis;

- Eurozone investor confidence unexpectedly dropped.

VN30

BANK

92,300

1D -0.75%

5D 1.99%

Buy Vol. 959,808

Sell Vol. 1,153,383

45,100

1D 0.89%

5D 3.68%

Buy Vol. 1,165,758

Sell Vol. 1,792,699

28,000

1D 0.36%

5D -2.95%

Buy Vol. 4,336,907

Sell Vol. 4,457,182

29,300

1D -0.34%

5D -0.68%

Buy Vol. 3,606,483

Sell Vol. 4,305,213

19,450

1D 0.00%

5D -2.26%

Buy Vol. 9,736,388

Sell Vol. 10,791,658

18,300

1D 0.27%

5D -0.81%

Buy Vol. 9,127,004

Sell Vol. 10,099,180

19,050

1D -0.78%

5D 1.33%

Buy Vol. 2,084,790

Sell Vol. 3,596,074

23,550

1D 1.29%

5D -1.05%

Buy Vol. 6,327,184

Sell Vol. 7,679,209

25,750

1D 0.39%

5D 1.78%

Buy Vol. 14,586,307

Sell Vol. 19,703,738

20,250

1D -0.49%

5D -1.22%

Buy Vol. 4,246,091

Sell Vol. 4,113,859

24,900

1D -0.20%

5D 2.89%

Buy Vol. 5,040,474

Sell Vol. 6,428,676

In terms of demand deposit balance, Vietcombank ranked first with more than VND368.1 trillion. This number decreased by 8.45% compared to the beginning of the year. Currently, CASA accounts for about 28.7% of total customer deposits of this bank. Despite being the bank with the most customer deposits, BIDV's demand deposits only ranked second. BIDV currently holds VND237.3 trillion demand deposits, down 12.28% compared to the beginning of the year.

REAL ESTATE

13,000

1D 0.39%

5D -9.09%

Buy Vol. 28,913,900

Sell Vol. 26,138,224

77,700

1D -0.51%

5D -1.27%

Buy Vol. 183,970

Sell Vol. 198,961

13,450

1D -0.74%

5D -4.95%

Buy Vol. 10,581,348

Sell Vol. 9,091,923

PDR: has just completed its financial obligations for the Astral City project development land. Accordingly, Astral City will be granted a license to open and sell apartments formed in the future.

OIL & GAS

94,100

1D 1.07%

5D 1.40%

Buy Vol. 556,625

Sell Vol. 674,047

13,350

1D 0.38%

5D 1.91%

Buy Vol. 15,985,361

Sell Vol. 16,300,409

38,000

1D 0.53%

5D 1.47%

Buy Vol. 1,089,204

Sell Vol. 1,571,614

POW: According to the plan, in 2023, Vung Ang 1 Thermal Power Plant strives to produce 6.4 billion kWh of electricity, revenue about VND12,800 billion and pay VND205 billion to the State budget.

VINGROUP

50,600

1D -0.59%

5D -2.88%

Buy Vol. 1,993,791

Sell Vol. 3,041,612

49,300

1D -0.20%

5D -0.40%

Buy Vol. 1,986,017

Sell Vol. 2,419,429

27,400

1D -0.18%

5D -1.08%

Buy Vol. 3,247,202

Sell Vol. 3,979,958

VHM: At the end of Q1.2023, VHM's total inventory was VND60,947 billion, up more than 2 times over the same period, but down 7.5% compared to the end of 2022.

FOOD & BEVERAGE

70,700

1D 0.43%

5D 1.00%

Buy Vol. 1,931,612

Sell Vol. 1,869,810

73,600

1D -0.67%

5D 0.68%

Buy Vol. 1,073,773

Sell Vol. 1,598,282

165,100

1D -0.84%

5D -4.01%

Buy Vol. 138,036

Sell Vol. 147,139

SAB: Since completing the acquisition of Sabeco at the end of 2017, Vietnam Beverage Thailand has received a total of more than VND8,200 billion in dividends.

OTHERS

46,000

1D 0.00%

5D 2.45%

Buy Vol. 554,830

Sell Vol. 661,370

95,400

1D -0.93%

5D -1.65%

Buy Vol. 167,474

Sell Vol. 240,292

78,900

1D 0.51%

5D 1.81%

Buy Vol. 1,444,435

Sell Vol. 1,336,213

37,950

1D 0.26%

5D -3.19%

Buy Vol. 1,939,682

Sell Vol. 2,338,066

16,150

1D -0.31%

5D 3.86%

Buy Vol. 5,982,709

Sell Vol. 8,105,010

22,250

1D -0.22%

5D 3.25%

Buy Vol. 27,361,137

Sell Vol. 32,775,515

21,800

1D 0.93%

5D 0.69%

Buy Vol. 37,063,746

Sell Vol. 56,058,945

HPG: In the first quarter, HPG's inventory was almost flat at VND34 trillion, accounting for half of the total inventory value of the entire steel industry. Notably, the provision for devaluation as of March 31 of this business was less than VND290 billion while the figure at the end of last year was more than VND1,200 billion.

Market by numbers

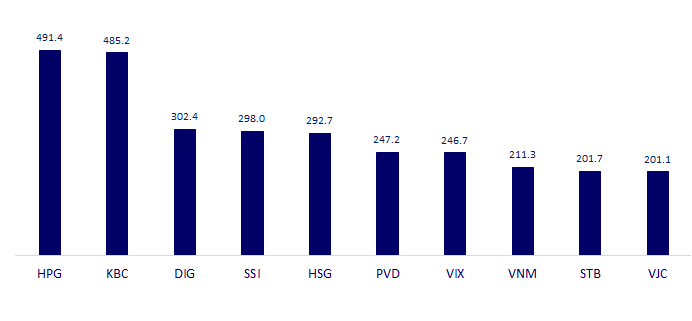

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

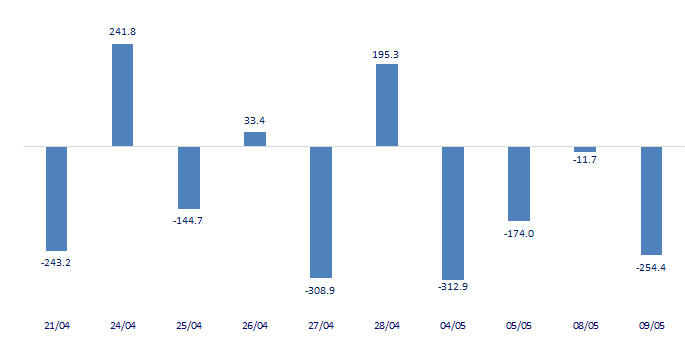

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

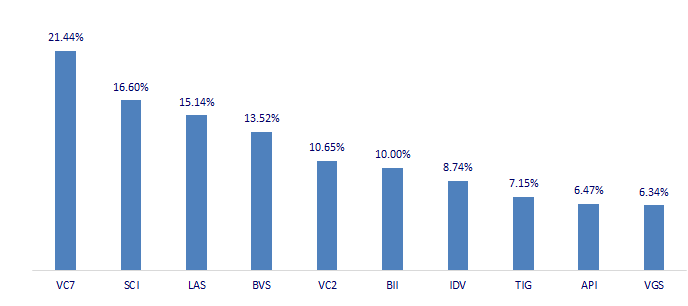

TOP INCREASES 3 CONSECUTIVE SESSIONS

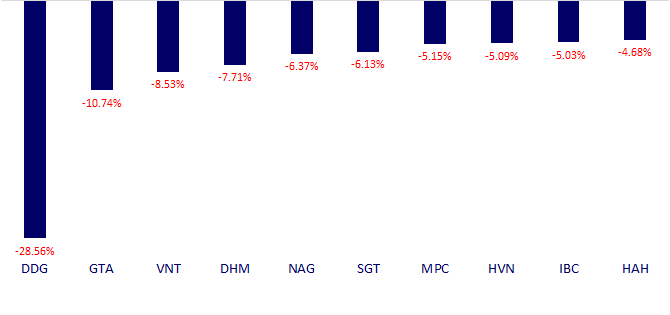

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.