Market brief 11/05/2023

VIETNAM STOCK MARKET

1,057.12

1D -0.11%

YTD 4.97%

1,054.93

1D -0.01%

YTD 4.95%

214.41

1D 0.24%

YTD 4.43%

79.13

1D 0.37%

YTD 10.44%

140.65

1D 0.00%

YTD 0.00%

14,021.65

1D 4.76%

YTD 62.74%

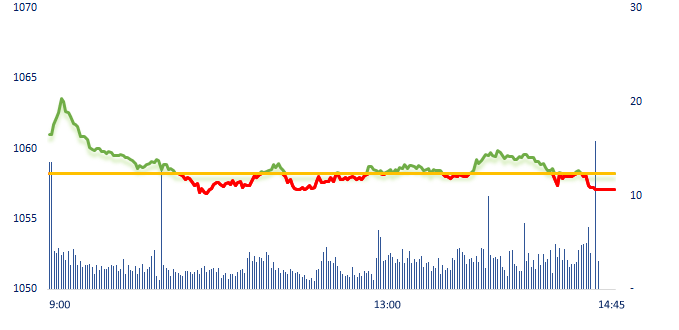

Today, VNIndex had a struggling session. Small and mid-cap stocks in the real estate and construction sectors were the bright spots when DIG, HQC, QCG, EVG... all increased in range and closed at the ceiling price.

ETF & DERIVATIVES

17,990

1D -0.17%

YTD 3.81%

12,450

1D 0.00%

YTD 4.45%

12,920

1D -0.15%

YTD 3.53%

15,800

1D -1.31%

YTD 12.46%

16,140

1D -0.06%

YTD 12.47%

22,260

1D -0.18%

YTD -0.63%

13,450

1D 0.52%

YTD 3.86%

1,046

1D 0.11%

YTD 0.00%

1,046

1D -0.03%

YTD 0.00%

1,050

1D 0.12%

YTD 0.00%

1,052

1D 0.10%

YTD 0.00%

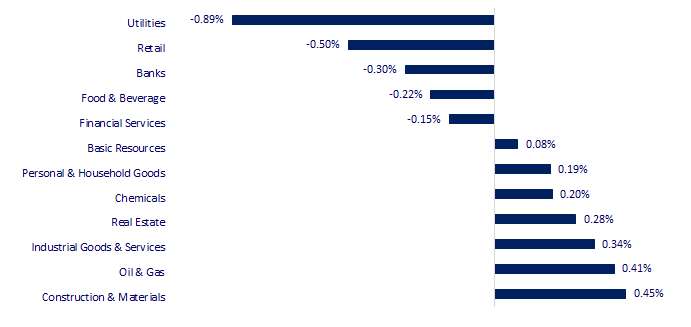

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

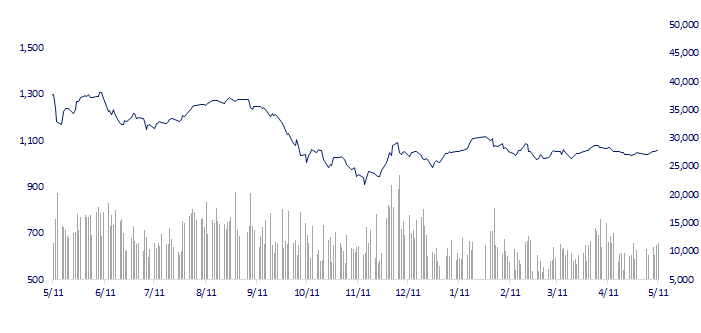

VNINDEX (12M)

GLOBAL MARKET

29,126.72

1D 0.02%

YTD 11.62%

3,309.55

1D -0.29%

YTD 7.13%

2,491.00

1D -0.22%

YTD 11.38%

19,743.79

1D -0.09%

YTD -0.19%

3,229.55

1D -0.39%

YTD -0.67%

1,567.40

1D -0.14%

YTD -6.16%

72.93

1D -5.11%

YTD -15.11%

2,034.65

1D -0.28%

YTD 11.41%

In the afternoon session of May 11, most Asian stock markets recorded dominant color being red due to deflationary pressure in China economy, unsatisfactory annual revenue reports from Japanese companies, and trouble with the unsolved public debt ceiling in America

VIETNAM ECONOMY

4.78%

1D (bps) -4

YTD (bps) -19

7.20%

YTD (bps) -20

2.90%

1D (bps) 1

YTD (bps) -189

3.10%

1D (bps) 4

YTD (bps) -180

23,680

1D (%) 0.17%

YTD (%) -0.34%

26,067

1D (%) -1.76%

YTD (%) 1.59%

3,453

1D (%) -0.06%

YTD (%) -0.92%

Deposit interest rates have continuously decreased sharply from the beginning of February until now, especially after the State Bank of Vietnam (SBV) reduced the operating interest rates on March 15 and April 3. Compared to the peak period at the beginning of the year, the deposit interest rates listed at banks have decreased by about 0.5-1.7% in all terms.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- More than VND13.4 trillion of corporate bonds were bought back before maturity in April;

- Interest rates fall, banks still attract deposits;

- Standard Chartered lowers Vietnam's 2023 GDP growth forecast to 6.5%;

- US inflation cooled down, the Fed might pause raising interest rates;

- The specter of deflation threatens China's economy;

- Europe plans a new economic sanctions package on Russia.

VN30

BANK

91,000

1D -1.09%

5D 2.82%

Buy Vol. 761,228

Sell Vol. 955,026

45,000

1D 0.00%

5D 2.86%

Buy Vol. 984,700

Sell Vol. 1,223,720

28,350

1D 0.35%

5D 0.35%

Buy Vol. 6,239,254

Sell Vol. 5,783,035

29,100

1D -0.68%

5D 0.17%

Buy Vol. 4,717,599

Sell Vol. 5,231,683

19,800

1D 1.28%

5D 1.28%

Buy Vol. 14,266,297

Sell Vol. 16,103,188

18,500

1D 0.00%

5D 1.65%

Buy Vol. 13,796,435

Sell Vol. 18,636,554

19,200

1D 0.26%

5D 2.13%

Buy Vol. 2,399,054

Sell Vol. 3,259,341

23,600

1D -0.63%

5D 0.00%

Buy Vol. 2,743,747

Sell Vol. 3,512,127

26,400

1D 0.19%

5D 4.97%

Buy Vol. 27,038,563

Sell Vol. 35,724,291

20,550

1D -0.48%

5D 1.73%

Buy Vol. 6,699,732

Sell Vol. 7,430,757

24,900

1D 0.00%

5D 0.81%

Buy Vol. 4,835,888

Sell Vol. 5,978,500

BID: BIDV has just issued a notice to find a corporate to organize the debt auction of Dong Phuong Petroleum Joint Stock Company. The value of the temporary debt as of the end of April 11, 2023 is more than VND1,149.4 billion.

REAL ESTATE

13,800

1D 3.76%

5D 1.85%

Buy Vol. 38,059,466

Sell Vol. 42,320,871

77,500

1D -0.13%

5D -0.77%

Buy Vol. 83,037

Sell Vol. 133,644

13,950

1D 1.45%

5D 1.82%

Buy Vol. 22,500,143

Sell Vol. 22,960,972

NVL: NVL is no longer cooperating as a developer of the Viet Phat urban and industrial park project invested by a subsidiary of Van Thinh Phat.

OIL & GAS

92,200

1D -1.07%

5D 0.22%

Buy Vol. 661,904

Sell Vol. 766,564

13,300

1D -0.75%

5D 2.31%

Buy Vol. 11,665,236

Sell Vol. 17,505,546

37,750

1D 0.00%

5D 0.80%

Buy Vol. 993,333

Sell Vol. 1,295,736

LX: PLX will record a pre-tax financial income of about VND730 billion after completing the divestment at PG Bank. These revenues will be recognized in 2nd quarter financial statements.

VINGROUP

50,500

1D -0.20%

5D -1.56%

Buy Vol. 1,873,518

Sell Vol. 2,581,509

49,150

1D -0.41%

5D -0.71%

Buy Vol. 1,338,343

Sell Vol. 1,470,152

28,050

1D 0.90%

5D 2.94%

Buy Vol. 5,920,564

Sell Vol. 5,506,490

VRE: BoDs is confident with its profit target to continue to grow by 20%-30% in 2024-2025 period thanks to higher occupancy rates, rent conversion mechanism and floor area expansion.

FOOD & BEVERAGE

70,000

1D -0.71%

5D 2.04%

Buy Vol. 983,329

Sell Vol. 1,189,038

73,800

1D 0.27%

5D 4.53%

Buy Vol. 974,909

Sell Vol. 1,235,769

164,500

1D -0.42%

5D -1.26%

Buy Vol. 252,537

Sell Vol. 305,174

VNM: After many times of increasing ownership, members of Fraser & Neave (Thailand) currently hold a total of more than 20% of capital in Vinamilk, just behind State shareholders (36%).

OTHERS

45,700

1D -0.54%

5D 0.99%

Buy Vol. 852,371

Sell Vol. 986,877

96,700

1D -0.10%

5D 1.26%

Buy Vol. 218,889

Sell Vol. 323,358

79,100

1D 0.13%

5D 0.76%

Buy Vol. 956,219

Sell Vol. 1,142,105

38,700

1D -0.77%

5D 2.11%

Buy Vol. 3,146,286

Sell Vol. 4,082,360

16,700

1D -0.89%

5D 6.37%

Buy Vol. 6,878,288

Sell Vol. 6,792,619

22,400

1D -0.44%

5D 2.99%

Buy Vol. 30,060,552

Sell Vol. 45,729,964

21,750

1D 0.23%

5D 2.11%

Buy Vol. 23,671,830

Sell Vol. 30,900,553

HPG: Hoa Phat proposed to invest in 4 projects with more than VND120,000 billion in Phu Yen province. Specifically, Hoa Phat proposed Hoa Tam Industrial Park Infrastructure Business Project; Bai Goc port project; Hoa Phat Iron and Steel Complex in Hoa Tam Industrial Park; Project of Commercial and Service Zone. In which, Hoa Phat Iron and Steel Complex in Hoa Tam Industrial Park is expected to have an investment capital of VND80,000 billion.

Market by numbers

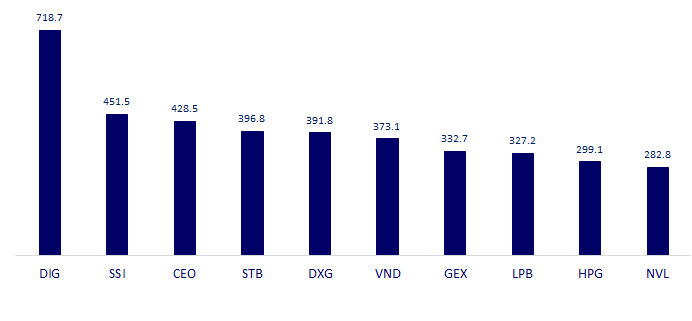

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

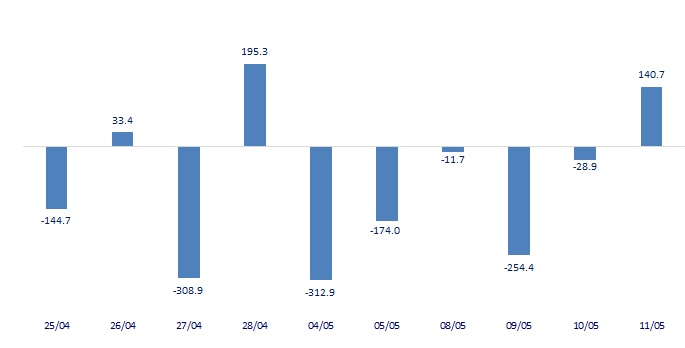

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

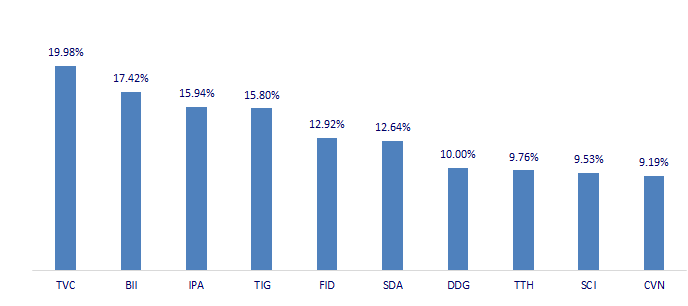

TOP INCREASES 3 CONSECUTIVE SESSIONS

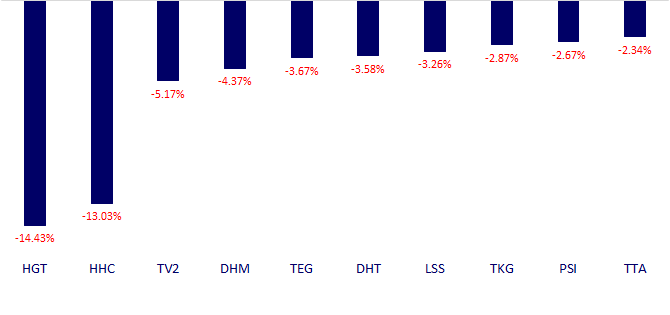

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.