Market brief 16/05/2023

VIETNAM STOCK MARKET

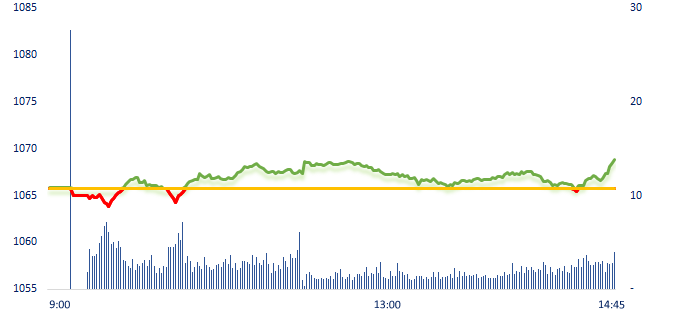

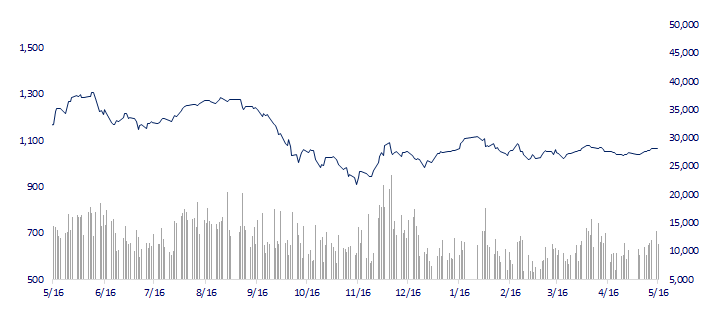

1,065.91

1D 0.02%

YTD 5.84%

1,069.64

1D -0.12%

YTD 6.41%

214.62

1D 0.14%

YTD 4.53%

80.66

1D 0.22%

YTD 12.58%

-10.55

1D 0.00%

YTD 0.00%

13,308.46

1D -17.35%

YTD 54.46%

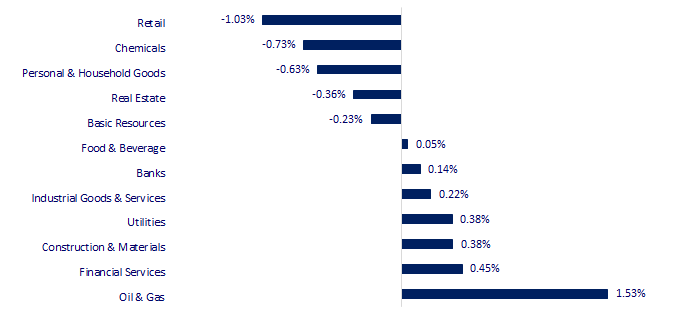

Today, investors trades relatively cautiously. Near the end of the afternoon session, there was a time VNIndex dropped below reference level, but the market still closed in green. Notably, oil and gas group gained strongly with representatives such as PVB (+5.7%), PVC (+4.32), PVD (+2.3%), PVS (+3.9%), POW (+1.5%)...

ETF & DERIVATIVES

18,230

1D -0.05%

YTD 5.19%

12,640

1D -0.32%

YTD 6.04%

13,070

1D -0.53%

YTD 4.73%

16,500

1D 4.43%

YTD 17.44%

16,260

1D -0.06%

YTD 13.31%

22,450

1D -0.13%

YTD 0.22%

13,560

1D -0.37%

YTD 4.71%

1,060

1D 0.18%

YTD 0.00%

1,061

1D -0.27%

YTD 0.00%

1,064

1D 0.00%

YTD 0.00%

1,067

1D 0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

29,842.99

1D 0.73%

YTD 14.37%

3,290.99

1D -0.60%

YTD 6.53%

2,480.24

1D 0.04%

YTD 10.90%

19,978.25

1D 0.04%

YTD 1.00%

3,214.04

1D -0.02%

YTD -1.15%

1,539.84

1D -0.10%

YTD -7.81%

71.17

1D -6.02%

YTD -17.16%

2,012.75

1D -0.46%

YTD 10.22%

Asian stock markets were mixed on May 16. Many Japanese public companies hit a 33-year high, helped by a recovery in semiconductor (chip) manufacturers following a rally in the US tech industry. Chinese economic data was weaker than expected.

VIETNAM ECONOMY

4.93%

1D (bps) 1

YTD (bps) -4

7.20%

YTD (bps) -20

2.80%

1D (bps) -5

YTD (bps) -199

3.03%

1D (bps) -5

YTD (bps) -187

23,660

1D (%) 0.17%

YTD (%) -0.42%

25,986

1D (%) -0.98%

YTD (%) 1.27%

3,437

1D (%) -0.17%

YTD (%) -1.38%

From this week, a large of the total amount of more than VND110,700 billion will be pumped back to the banking system by the State Bank (SBV), when lots of 91-day bills are issued from mid-February expire.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank began to pump nearly VND111,000 billion to the banking system;

- Minister Ho Duc Phuc: Solve bottlenecks, accelerate disbursement of public investment capital;

- Successfully mobilized more than VND34,800 billion through Government bonds;

- EC raises Eurozone growth and inflation forecasts;

- China's economy received sad news in April;

- The ECB may keep interest rates higher for longer.

VN30

BANK

92,600

1D 0.98%

5D 0.33%

Buy Vol. 1,008,769

Sell Vol. 1,408,113

45,000

1D 0.22%

5D -0.22%

Buy Vol. 1,007,607

Sell Vol. 1,649,121

27,950

1D -0.53%

5D -0.18%

Buy Vol. 5,253,266

Sell Vol. 5,530,298

29,800

1D -0.33%

5D 1.71%

Buy Vol. 3,432,684

Sell Vol. 6,204,236

19,600

1D -1.01%

5D 0.77%

Buy Vol. 11,529,648

Sell Vol. 17,089,133

18,800

1D -0.27%

5D 2.73%

Buy Vol. 12,545,416

Sell Vol. 17,719,029

19,500

1D 0.52%

5D 2.36%

Buy Vol. 3,061,833

Sell Vol. 3,770,810

23,850

1D -0.21%

5D 1.27%

Buy Vol. 2,558,292

Sell Vol. 3,759,870

27,400

1D 1.48%

5D 6.41%

Buy Vol. 26,341,282

Sell Vol. 29,701,391

20,900

1D 0.24%

5D 3.21%

Buy Vol. 11,787,785

Sell Vol. 12,798,139

25,000

1D 0.00%

5D 0.40%

Buy Vol. 3,458,026

Sell Vol. 4,152,726

Most banks set business plans for 2023 cautious with an average profit increase of 10 - 17% such as ACB (+17%), VIB (+15%), MBB (+ 15%), SHB (+10%)… At the end of the first quarter of the year, the progress of the banks' implementation was slower than in previous years when no banks announced the profit target realization rate sudden high

REAL ESTATE

13,650

1D 1.11%

5D 5.00%

Buy Vol. 24,880,898

Sell Vol. 27,796,220

77,400

1D 0.00%

5D -0.39%

Buy Vol. 56,821

Sell Vol. 82,355

13,600

1D -1.45%

5D 1.12%

Buy Vol. 9,005,132

Sell Vol. 10,449,817

NVL: Novaland plans to borrow VND350 billion from investor Aqua Riverside City for the purpose of supplementing the company's operating capital.

OIL & GAS

92,400

1D 0.22%

5D -1.81%

Buy Vol. 595,915

Sell Vol. 764,980

13,500

1D 1.50%

5D 1.12%

Buy Vol. 20,755,060

Sell Vol. 25,859,445

38,050

1D 0.66%

5D 0.13%

Buy Vol. 1,613,116

Sell Vol. 2,082,134

PLX: At the end of Q1.2023, PLX inventory decreased by VND2,650 billion, to nearly VND14,600 billion, the lowest since the beginning of 2022.

VINGROUP

52,900

1D -2.76%

5D 4.55%

Buy Vol. 3,989,446

Sell Vol. 6,426,004

52,200

1D 0.97%

5D 5.88%

Buy Vol. 1,935,421

Sell Vol. 2,534,747

28,400

1D 0.00%

5D 3.65%

Buy Vol. 3,999,526

Sell Vol. 5,322,382

VIC: Up to now, Vingroup is the largest issuer of sustainable development debt in Vietnam, with a value of USD1.325 billion. (VinFast - USD900 million, VinPearl - USD425 million)

FOOD & BEVERAGE

69,700

1D 1.01%

5D -1.41%

Buy Vol. 2,460,633

Sell Vol. 1,974,939

73,300

1D -1.08%

5D -0.41%

Buy Vol. 718,452

Sell Vol. 808,022

163,000

1D -0.67%

5D -1.27%

Buy Vol. 121,990

Sell Vol. 229,119

VNM: High price of raw materials caused the gross profit margin of dairy companies to decrease in Q1 and is expected to be overcome from Q2 when the price of milk powder has dropped sharply.

OTHERS

45,300

1D -0.44%

5D -1.52%

Buy Vol. 553,750

Sell Vol. 907,502

97,500

1D 0.21%

5D 2.20%

Buy Vol. 1,146,805

Sell Vol. 1,113,294

81,500

1D 0.62%

5D 3.30%

Buy Vol. 1,733,550

Sell Vol. 1,844,670

38,450

1D -1.16%

5D 1.32%

Buy Vol. 3,762,795

Sell Vol. 4,072,773

16,000

1D -0.93%

5D -0.93%

Buy Vol. 9,027,187

Sell Vol. 7,346,527

22,900

1D 0.00%

5D 2.92%

Buy Vol. 35,088,922

Sell Vol. 33,683,634

22,000

1D -0.45%

5D 0.92%

Buy Vol. 30,805,546

Sell Vol. 35,537,936

MWG: Promote the "cheap" program to attract customers during the period of weak demand. As a result, revenue in April 2023 recovered, but gross profit margin will decrease compared to previous month. MWG recorded a revenue of VND9.7 trillion, an increase of more than 20% compared to March and equal to the revenue level of December 2022.

Market by numbers

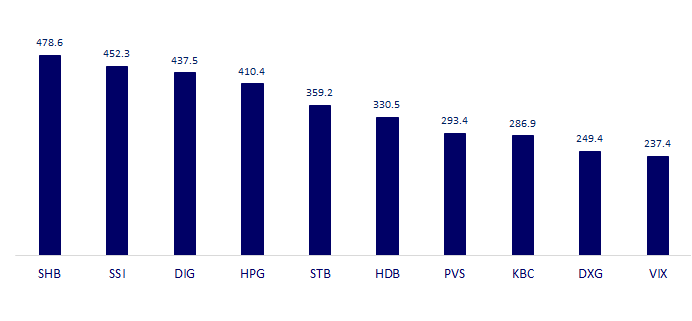

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

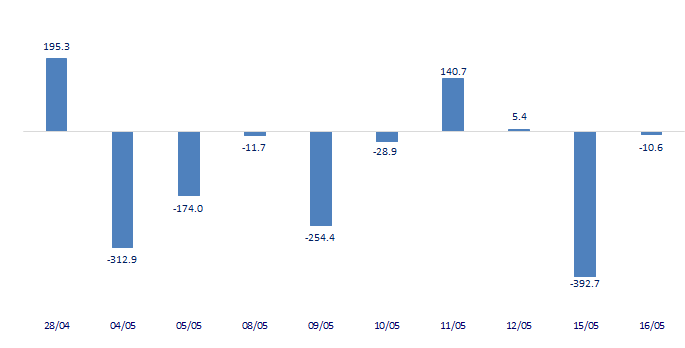

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

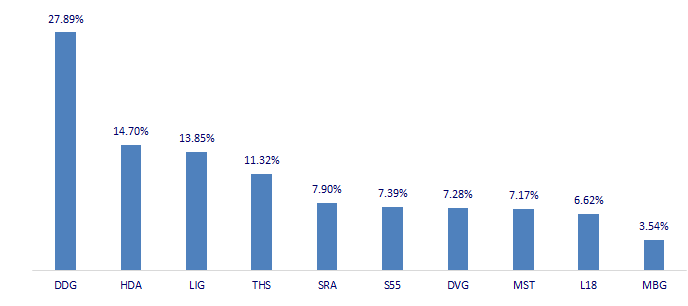

TOP INCREASES 3 CONSECUTIVE SESSIONS

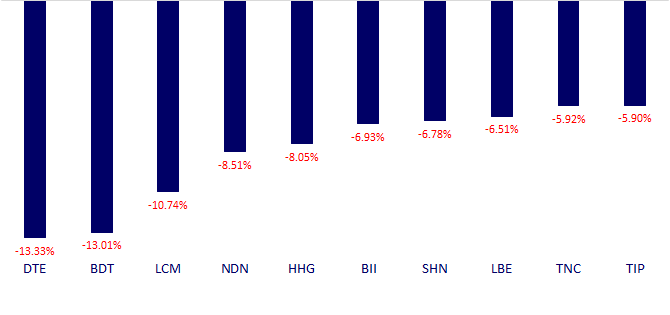

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.