Morning Brief 18/09

GLOBAL MARKET

27,901.98

1D -0.47%

YTD -2.23%

3,357.01

1D -0.84%

YTD 3.91%

10,910.28

1D -1.27%

YTD 21.60%

26.46

6,049.92

1D -0.47%

YTD -19.79%

13,208.12

1D -0.36%

YTD -0.31%

5,039.50

1D -0.69%

YTD -15.70%

23,319.37

1D -0.67%

YTD -1.43%

3,270.44

1D -0.41%

YTD 6.05%

2,406.17

1D -1.22%

YTD 9.49%

24,340.85

1D -1.56%

YTD -14.45%

2,500.78

1D -0.17%

YTD -22.41%

1,284.40

1D -0.70%

YTD -19.62%

40.92

1D 1.72%

YTD -32.64%

1,955.05

1D -0.71%

YTD 28.82%

U.S. stocks fell and Treasuries gained as investors mulled whether the levels of stimulus being provided is enough amid a gradual economic recovery. The benchmark S&P 500 dropped for a second day, though it found some support after bouncing off its 50-day moving average. Technology shares were the biggest decliners, with Apple Inc., FaceBook Inc. and Microsoft Corp. weighing on the Nasdaq Composite. Investors snapped up long-term Treasuries, capturing a brief spike higher in yields following the Federal Reserve’s policy decision Wednesday. Although Fed Chair Jerome Powell said the central bank will remain accommodative after relaxing its inflation policy, he didn’t provide clarity as to just how high it can go and for how long. That, along with the lack of fresh details on the Fed’s plans for its bond-buying program, sparked long-end demand.

VIETNAM ECONOMY

0.13%

1D (bps) -1

YTD (bps) -130

6.00%

YTD (bps) -50

1.59%

1D (bps) -6

YTD (bps) -240

2.63%

1D (bps) -10

YTD (bps) -207

23,273

1D (%) 0.02%

YTD (%) 0.19%

28,033

1D (%) -0.67%

YTD (%) 5.38%

3,458

1D (%) -0.17%

YTD (%) 1.83%

With a great driver of export, Vietnam's economy is forecasted by Goldman Sachs to recover from the third quarter and GDP in 2021 may reach 8.1%. Despite assessing that Vietnam successfully controlled Covid-19, Goldman Sachs said that measures of social gap had caused jobs to decline, and the economy was affected. According to Goldman Sachs, GDP in 2020 is expected to reach 2.7%. This increase is lower than the forecast of the World Bank (2.8%) but higher than ADB (1.8%).

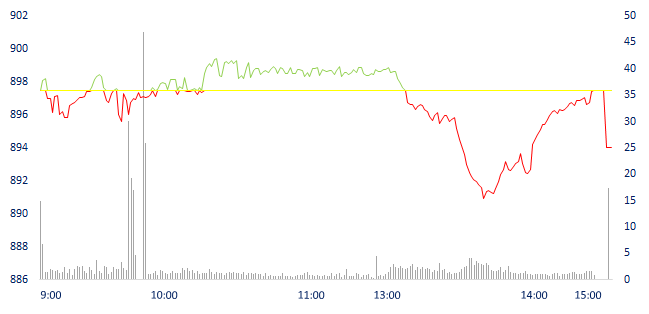

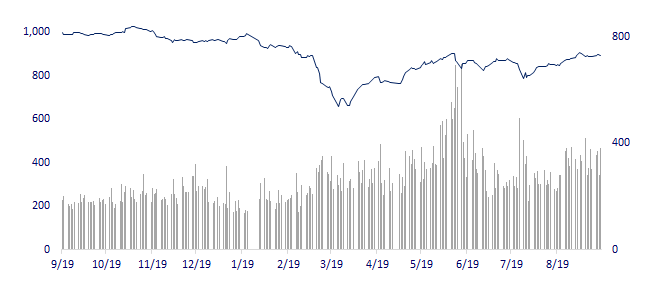

VIETNAM STOCK MARKET

894.04

1D -0.38%

YTD -6.97%

831.84

1D -0.32%

YTD -5.37%

128.47

1D 0.47%

YTD 25.32%

59.87

1D 0.18%

YTD 5.87%

-133.16

7,570.44

1D 24.21%

YTD 116.30%

Foreign investors net sold more than 133 billion dong. The net selling focused on VHM, BID and VNM stocks on HOSE. SHB continued to be the ticker that was sold the most on the HNX. VN-Index movements in the second half of this afternoon session mostly have a relationship with the derivative as today is the last trading day of a futures contract - VN30F3009.

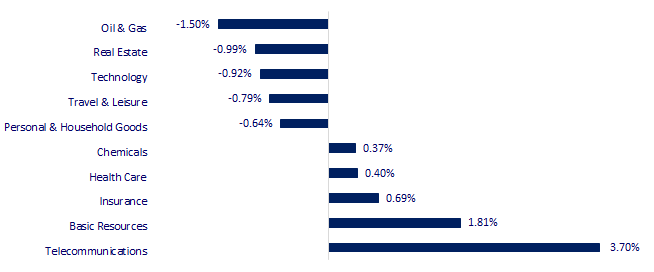

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

SELECTED NEWS

- In 8M2020, the number of enterprises temporarily suspending their business was nearly 34,300, soaring by 70.8% over the same period last year.

- Da Nang tourism damage in 2020 may reach 26,000 billion VND

- EU investor wants to do a port logistics project with nearly 1 billion USD in Vietnam

- India’s economic recovery prospects have gone from bad to worse after the nation emerged as a new global hotspot for the coronavirus pandemic.

- FED started a second round of stress tests, is considering extending the unprecedented constraints on dividend payments and share buybacks of U.S. banks.

- The Central Bank of Japan maintains a super-easy monetary policy to support the economy, keeping the short-term interest rate target at -0.1%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.