Market brief 18/05/2023

VIETNAM STOCK MARKET

1,068.31

1D 0.74%

YTD 6.08%

1,070.76

1D 0.82%

YTD 6.52%

213.01

1D 0.07%

YTD 3.75%

80.91

1D 0.42%

YTD 12.92%

135.12

1D 0.00%

YTD 0.00%

13,695.73

1D -12.00%

YTD 58.96%

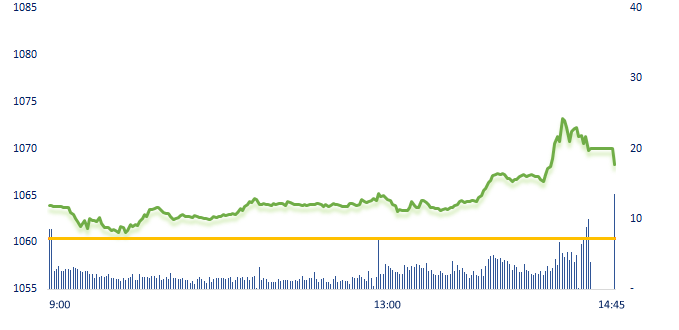

The market remained in green throughout the trading time, however, the gaining momentum was mainly pulled at the end of the session. Foreign investors had the second consecutive session of net buying with a value of VND135 billion, focusing on HPG (+173.2 billion), they continued to be net buyers of all 3 Vingroup stocks, VIC, VHM, and VRE, but the total value decreased to VND123.4 billion.

ETF & DERIVATIVES

18,300

1D 1.50%

YTD 5.60%

12,650

1D 0.80%

YTD 6.12%

13,050

1D 1.01%

YTD 4.57%

16,050

1D 0.12%

YTD 14.23%

16,290

1D 1.18%

YTD 13.52%

22,350

1D 0.22%

YTD -0.22%

13,600

1D 0.59%

YTD 5.02%

1,058

1D 0.03%

YTD 0.00%

1,059

1D 0.24%

YTD 0.00%

1,063

1D 0.33%

YTD 0.00%

1,074

1D 0.86%

YTD 0.00%

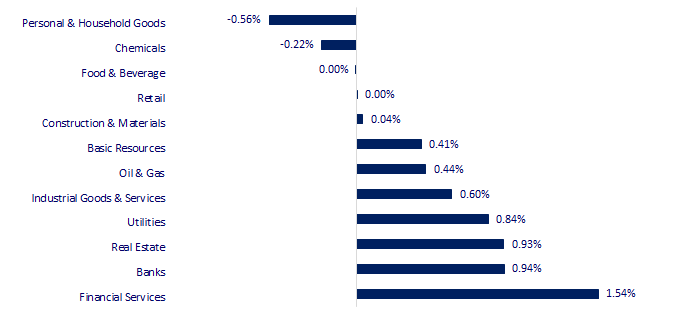

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

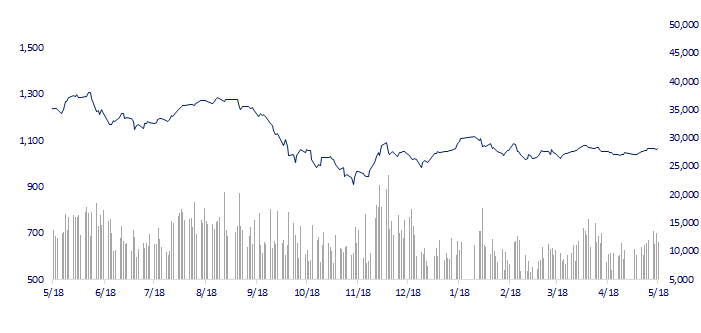

VNINDEX (12M)

GLOBAL MARKET

30,573.93

1D 1.60%

YTD 17.17%

3,297.32

1D 0.40%

YTD 6.73%

2,515.40

1D 0.83%

YTD 12.48%

19,727.25

1D 0.85%

YTD -0.27%

3,182.55

1D 0.27%

YTD -2.12%

1,526.69

1D 0.26%

YTD -8.60%

72.73

1D -5.26%

YTD -15.34%

1,976.66

1D -0.51%

YTD 8.24%

Asian stock markets rallied in the afternoon session of May 18, thanks to the lead of Wall Street and the signal of reaching an agreement to raise the debt ceiling in the US.

VIETNAM ECONOMY

4.55%

1D (bps) -28

YTD (bps) -42

7.20%

YTD (bps) -20

2.83%

1D (bps) 1

YTD (bps) -196

3.01%

1D (bps) -2

YTD (bps) -189

23,665

1D (%) 0.17%

YTD (%) -0.40%

25,807

1D (%) -1.34%

YTD (%) 0.58%

3,406

1D (%) -0.44%

YTD (%) -2.27%

As of May 4, the market recorded 98 issuers who were slow to fulfill their corporate bond debt obligations with a total value of VND128.5 trillion, up 13.6% compared to the last update.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Delayed obligations payment of corporate bonds VND128 trillion;

- Nghe An attracts investment exceeding VND10,000 billion in the first 4 months of 2023;

- Total import and export value of goods in 4 months reached USD206.76 billion;

- It is difficult for Europe to separate economically from China;

- Russian GDP fell in the first quarter;

- China consumes record crude oil.

VN30

BANK

95,000

1D 2.37%

5D 4.40%

Buy Vol. 2,143,801

Sell Vol. 2,498,834

44,650

1D -0.33%

5D -0.78%

Buy Vol. 759,722

Sell Vol. 1,330,894

27,750

1D 0.91%

5D -2.12%

Buy Vol. 7,978,986

Sell Vol. 7,525,247

29,550

1D 1.03%

5D 1.55%

Buy Vol. 5,592,771

Sell Vol. 5,682,815

19,250

1D 0.26%

5D -2.78%

Buy Vol. 15,125,781

Sell Vol. 14,358,597

18,600

1D 0.81%

5D 0.54%

Buy Vol. 13,254,798

Sell Vol. 14,672,404

19,400

1D -1.02%

5D 1.04%

Buy Vol. 3,313,100

Sell Vol. 3,435,197

23,400

1D 0.65%

5D -0.85%

Buy Vol. 2,634,157

Sell Vol. 2,914,577

27,200

1D 0.74%

5D 3.03%

Buy Vol. 31,459,572

Sell Vol. 30,543,590

21,450

1D 3.13%

5D 4.38%

Buy Vol. 23,712,499

Sell Vol. 21,467,354

25,000

1D 0.40%

5D 0.40%

Buy Vol. 5,600,120

Sell Vol. 6,772,405

Among large banks, HDBank and VPBank continued to have the highest interest rates for 1-year terms, at 8.3%/year and 8%/year respectively. SHB also has an approximate rate of 7.9%/year. Meanwhile, ACB and Techcombank dropped sharply to 7.7%/year and 7.6%/year. Big 4 banks are the lowest in the system with only 7.2%/year.

REAL ESTATE

13,300

1D 0.00%

5D -3.62%

Buy Vol. 20,034,123

Sell Vol. 20,657,897

78,500

1D 1.29%

5D 1.29%

Buy Vol. 79,240

Sell Vol. 95,546

13,200

1D -1.49%

5D -5.38%

Buy Vol. 15,987,405

Sell Vol. 14,371,691

NVL: As of April 17, 2023, Novaland had reached an agreement with banks on the release of the mortgage amount of VND2,498 billion (out of VND5,537 billion as of December 31, 2022).

OIL & GAS

93,000

1D 1.20%

5D 0.87%

Buy Vol. 833,684

Sell Vol. 772,501

13,400

1D 0.75%

5D 0.75%

Buy Vol. 10,691,927

Sell Vol. 14,367,056

37,450

1D -0.13%

5D -0.79%

Buy Vol. 857,724

Sell Vol. 1,249,937

POW: In May, PV Power expects mobilized electricity output to be 1,477 million kWh, up 8% compared to April. Revenue is expected to increase by 8% to VND2,831 billion.

VINGROUP

53,200

1D 0.00%

5D 5.35%

Buy Vol. 2,831,807

Sell Vol. 4,475,180

55,000

1D 3.00%

5D 11.90%

Buy Vol. 4,433,125

Sell Vol. 5,131,868

28,100

1D 0.72%

5D 0.18%

Buy Vol. 5,937,979

Sell Vol. 6,907,909

VIC: Capital mobilization plan, Vingroup proposes to shareholders a plan to issue a maximum of VND5,000 billion of convertible bonds with a maximum coupon rate of 15%/year.

FOOD & BEVERAGE

69,200

1D 0.29%

5D -1.14%

Buy Vol. 3,868,047

Sell Vol. 4,238,575

73,200

1D 0.14%

5D -0.81%

Buy Vol. 1,380,499

Sell Vol. 1,547,648

162,300

1D -0.12%

5D -1.34%

Buy Vol. 283,384

Sell Vol. 286,157

MSN: HNX approved for Masan Group to list MSN123008 and MSN123009 bonds with a total value of VND1,500 billion

OTHERS

44,800

1D -0.55%

5D -1.97%

Buy Vol. 949,349

Sell Vol. 1,299,178

99,400

1D 1.12%

5D 2.79%

Buy Vol. 1,294,346

Sell Vol. 1,300,213

82,900

1D 1.72%

5D 4.80%

Buy Vol. 3,249,905

Sell Vol. 2,478,939

38,100

1D -0.13%

5D -1.55%

Buy Vol. 2,649,853

Sell Vol. 3,414,653

15,850

1D 0.00%

5D -5.09%

Buy Vol. 5,161,481

Sell Vol. 4,520,160

22,800

1D 1.56%

5D 1.79%

Buy Vol. 48,633,330

Sell Vol. 54,373,261

21,950

1D 0.69%

5D 0.92%

Buy Vol. 30,532,110

Sell Vol. 34,575,016

FPT: FPT has announced its business results for the first 4 months of 2023, continuing to achieve a growth rate of about 20%. Specifically, in the first 4 months of the year, FPT's revenue reached VND15,749 billion and pre-tax profit of VND2,880 billion, up 21.2% and 19.1% respectively over the same period last year. Deducting expenses, FPT's profit after tax in 4 months is VND2,449 billion, an increase of about 18% compared to the same period in 2022.

Market by numbers

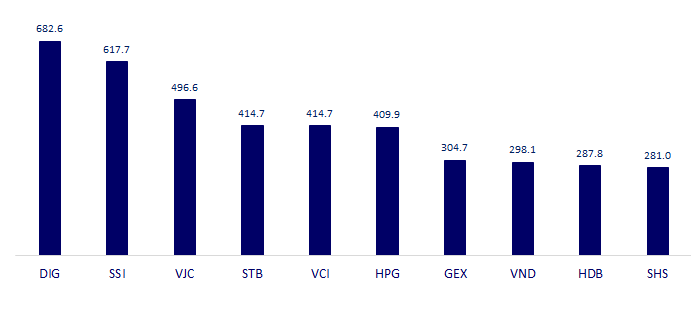

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

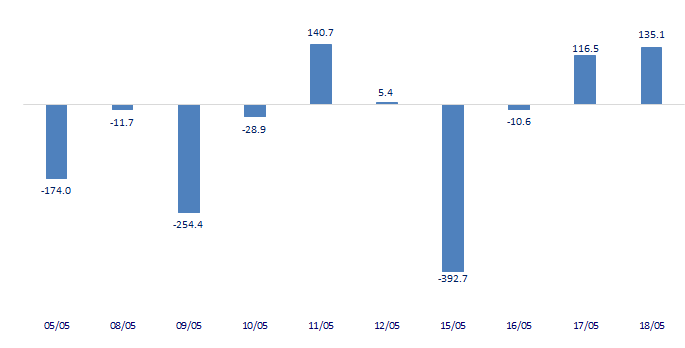

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

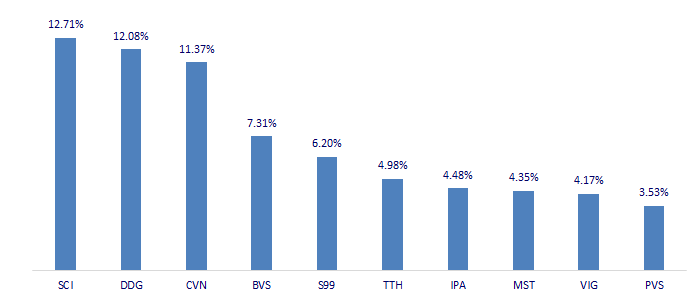

TOP INCREASES 3 CONSECUTIVE SESSIONS

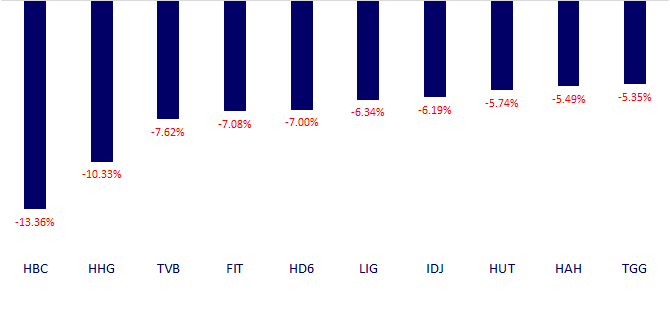

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.