Market brief 19/05/2023

VIETNAM STOCK MARKET

1,067.07

1D -0.12%

YTD 5.96%

1,068.84

1D -0.18%

YTD 6.33%

213.91

1D 0.42%

YTD 4.19%

81.08

1D 0.21%

YTD 13.16%

982.63

1D 0.00%

YTD 0.00%

15,718.88

1D 14.77%

YTD 82.44%

Today, the market had a slight decrease compared to yesterday. Coal, oil and gas stocks rose sharply after the news that Prime Minister Pham Minh Chinh directed Vinacomin and PVN up to ensure the supply of raw materials for coal, gas and oil power plants.

ETF & DERIVATIVES

18,200

1D -0.55%

YTD 5.02%

12,630

1D -0.16%

YTD 5.96%

12,990

1D -0.46%

YTD 4.09%

16,100

1D 0.31%

YTD 14.59%

16,300

1D 0.06%

YTD 13.59%

22,310

1D -0.18%

YTD -0.40%

13,640

1D 0.29%

YTD 5.33%

1,057

1D -0.13%

YTD 0.00%

1,058

1D -0.05%

YTD 0.00%

1,061

1D -0.19%

YTD 0.00%

1,063

1D -1.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

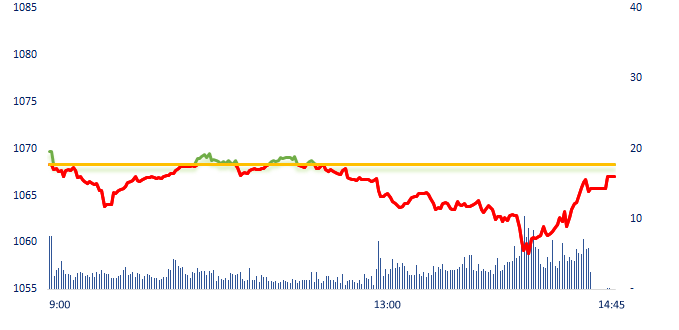

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

30,808.35

1D 0.77%

YTD 18.06%

3,283.54

1D -0.42%

YTD 6.29%

2,537.79

1D 0.89%

YTD 13.48%

19,450.57

1D -1.40%

YTD -1.67%

3,202.59

1D 0.63%

YTD -1.50%

1,514.89

1D -0.77%

YTD -9.31%

76.73

1D 1.11%

YTD -10.69%

1,966.50

1D 0.25%

YTD 7.68%

Most Asian stocks rallied in the afternoon of May 19, with Nikkei 225 index hitting a 30-year high. The market's gain in this session was generally boosted by investors' expectations that US policymakers will reach an agreement to raise the debt ceiling to avoid the risk of default.

VIETNAM ECONOMY

4.44%

1D (bps) -11

YTD (bps) -53

7.20%

YTD (bps) -20

2.86%

1D (bps) 3

YTD (bps) -193

3.03%

1D (bps) 2

YTD (bps) -187

23,670

1D (%) 0.15%

YTD (%) -0.38%

25,766

1D (%) -0.87%

YTD (%) 0.42%

3,416

1D (%) 0.59%

YTD (%) -1.98%

Today (May 19) is the date of maturity of a batch of VND10,000 billion bills issued by the State Bank of Vietnam (SBV) on February 17, corresponding to the amount that is provided to the banking system. Thus, the amount that the State Bank returned to the banking system via the T-bill channel in the last 3 sessions amounted to VND20,000 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: No shortage of electricity for production, business and consumption;

- The Ministry of Industry and Trade proposes to continue reducing the registration fee for cars;

- Poultry farming industry is worried about loss, bankruptcy;

- Russia takes oil market share in Asia from OPEC+ producers;

- The national debt crisis overshadowed the US financial market;

- 16% of French do not have enough to eat because of high food prices.

VN30

BANK

94,200

1D -0.84%

5D 1.51%

Buy Vol. 899,133

Sell Vol. 906,992

44,400

1D -0.56%

5D -1.33%

Buy Vol. 1,047,429

Sell Vol. 1,436,915

28,000

1D 0.90%

5D -1.41%

Buy Vol. 4,714,683

Sell Vol. 4,650,924

29,650

1D 0.34%

5D 1.19%

Buy Vol. 5,980,559

Sell Vol. 5,850,232

19,300

1D 0.26%

5D -2.28%

Buy Vol. 13,677,668

Sell Vol. 12,811,389

18,650

1D 0.27%

5D 0.00%

Buy Vol. 9,189,457

Sell Vol. 11,099,959

19,400

1D 0.00%

5D 0.00%

Buy Vol. 2,594,561

Sell Vol. 2,917,734

23,450

1D 0.21%

5D -0.42%

Buy Vol. 2,328,525

Sell Vol. 2,289,866

27,850

1D 2.39%

5D 3.92%

Buy Vol. 53,232,755

Sell Vol. 40,328,652

21,400

1D -0.23%

5D 4.39%

Buy Vol. 11,279,833

Sell Vol. 9,367,507

24,950

1D -0.20%

5D -0.20%

Buy Vol. 6,288,471

Sell Vol. 6,784,492

By the end of the first quarter, 7/28 banks pushed the NPL ratio above 3%. Notably, some banks hit 23% while credit growth was negative. VPBank continued to increase the ratio of bad debt to outstanding loans from 5.73% (at the beginning of the year) to 6.24%. As for the parent bank, this ratio increased from 2.8% to 3.42%.

REAL ESTATE

13,200

1D -0.75%

5D -3.65%

Buy Vol. 25,784,617

Sell Vol. 21,862,311

77,900

1D -0.76%

5D 0.52%

Buy Vol. 74,920

Sell Vol. 120,410

13,350

1D 1.14%

5D -4.30%

Buy Vol. 7,756,220

Sell Vol. 6,320,091

NVL: As of December 31, 2022, Credit Suisse AG lended VND11,450 billion, including VND8,240 billion of long-term bonds, VND1,905 billion of short-term and VND1,175 billion of long-term loans.

OIL & GAS

94,900

1D 2.04%

5D 2.59%

Buy Vol. 1,572,249

Sell Vol. 1,552,951

13,500

1D 0.75%

5D 0.75%

Buy Vol. 22,256,874

Sell Vol. 31,269,350

37,600

1D 0.40%

5D 0.13%

Buy Vol. 1,037,975

Sell Vol. 1,460,625

PLX: Q1/2023, revenue reached VND67,432 billion, up 0.6% QoQ. Gross profit reached VND3,559 billion, up over 28%. Pre-tax profit reached VND838 billion, up nearly 47% QoQ.

VINGROUP

52,500

1D -1.32%

5D 1.55%

Buy Vol. 3,088,969

Sell Vol. 3,637,737

54,100

1D -1.64%

5D 5.66%

Buy Vol. 2,551,578

Sell Vol. 3,350,158

28,000

1D -0.36%

5D -0.53%

Buy Vol. 5,105,342

Sell Vol. 4,795,669

VIC: VinFast announced its orientation to expand into the Southeast Asian electric vehicle market with a complete range of electric vehicles.

FOOD & BEVERAGE

68,600

1D -0.87%

5D -1.44%

Buy Vol. 2,216,647

Sell Vol. 2,310,024

72,400

1D -1.09%

5D -2.69%

Buy Vol. 1,380,259

Sell Vol. 1,284,440

160,700

1D -0.99%

5D -1.95%

Buy Vol. 134,423

Sell Vol. 190,589

MSN: BoDs approved the plan to issue ESOP shares, the expected number of shares to be issued 7,118,623 shares (accounting for 0.499% of the total number of outstanding shares)

OTHERS

44,300

1D -1.12%

5D -3.70%

Buy Vol. 1,101,548

Sell Vol. 1,503,498

98,700

1D -0.70%

5D 1.54%

Buy Vol. 1,052,339

Sell Vol. 1,162,036

82,800

1D -0.12%

5D 2.86%

Buy Vol. 2,851,323

Sell Vol. 2,523,905

38,300

1D 0.52%

5D -1.79%

Buy Vol. 3,372,401

Sell Vol. 2,894,028

16,250

1D 2.52%

5D -3.27%

Buy Vol. 5,455,462

Sell Vol. 4,998,950

22,900

1D 0.44%

5D -1.51%

Buy Vol. 33,613,828

Sell Vol. 37,643,547

21,800

1D -0.68%

5D -2.46%

Buy Vol. 20,844,495

Sell Vol. 26,794,045

FPT: J.P.Morgan has just released a report recommending to increase the investment proportion with FPT and forecast that FPT's CAGR in the period 2022 - 2025 will reach over 20%. According to J.P. Morgan, competitive advantages in cost, technological capabilities, digital transformation services, expansion of new customer groups and large-scale contracts, and globalization strategy will help FPT good growth.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

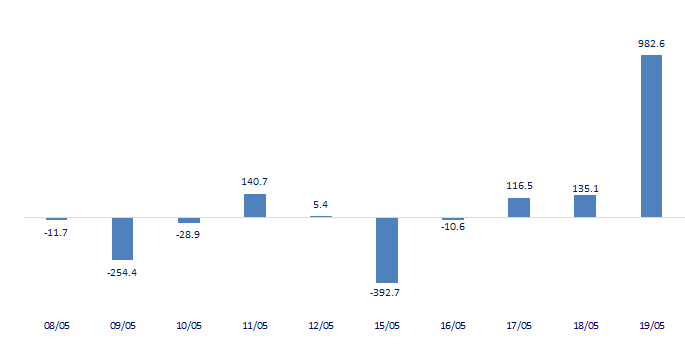

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.