Market brief 09/06/2023

VIETNAM STOCK MARKET

1,107.53

1D 0.56%

YTD 9.97%

1,100.85

1D 0.77%

YTD 9.52%

227.60

1D 0.36%

YTD 10.86%

84.19

1D 0.20%

YTD 17.50%

75.00

1D 0.00%

YTD 0.00%

19,367.90

1D -29.09%

YTD 124.79%

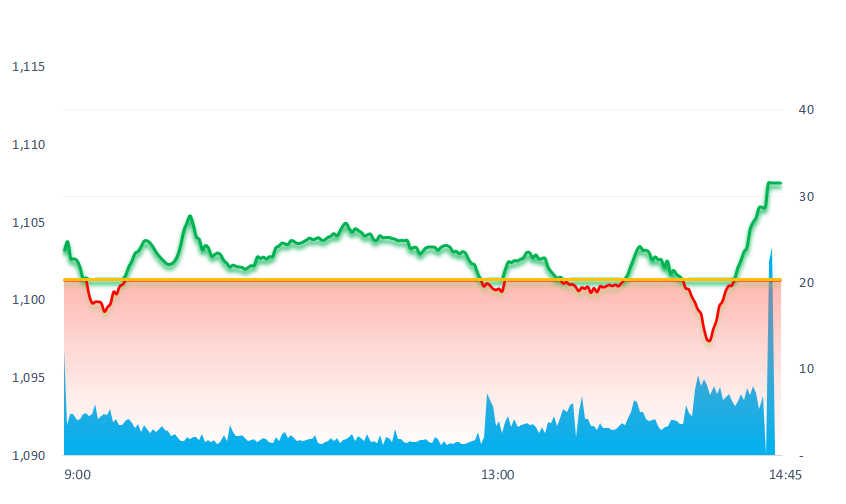

Many investors feared that the market would continue to sell-off today, but that did not happen. Cash inflow continued to pour into the market in the afternoon, helping VNIndex to close at the highest level of the session. Volume and value recorded a significant decrease of more than 30% compared to yesterday.

ETF & DERIVATIVES

18,740

1D -0.11%

YTD 8.14%

13,040

1D 1.09%

YTD 9.40%

13,450

1D -0.37%

YTD 7.77%

16,420

1D 1.99%

YTD 16.87%

17,060

1D 0.00%

YTD 18.89%

23,300

1D 0.56%

YTD 4.02%

14,120

1D 0.14%

YTD 9.03%

1,075

1D 0.08%

YTD 0.00%

1,082

1D 0.32%

YTD 0.00%

1,091

1D 0.48%

YTD 0.00%

1,095

1D 0.58%

YTD 0.00%

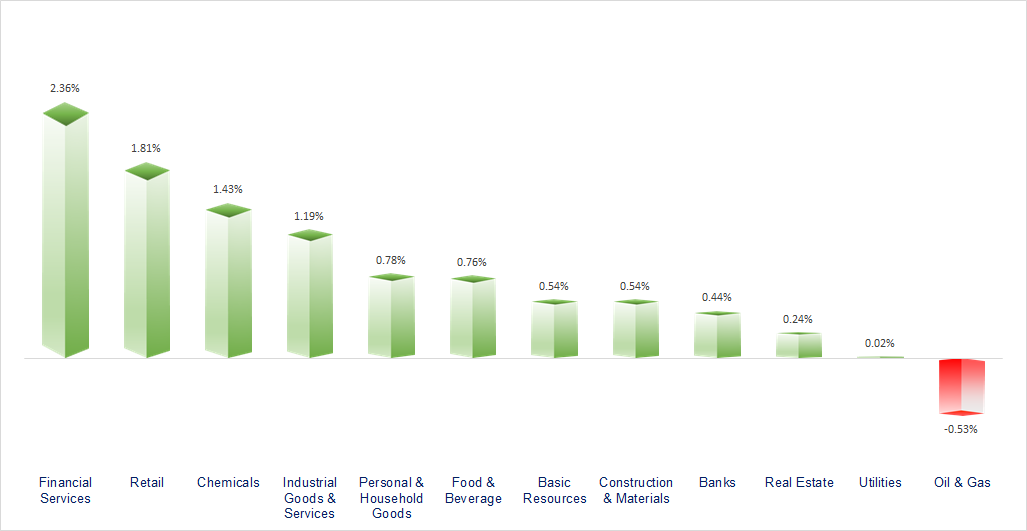

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

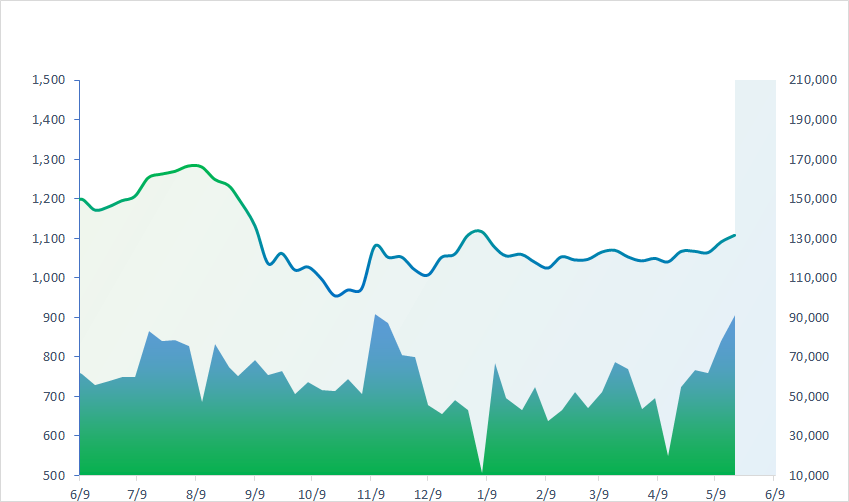

VNINDEX (12M)

GLOBAL MARKET

32,265.17

1D 1.97%

YTD 23.65%

3,231.41

1D 0.55%

YTD 4.60%

2,641.16

1D 1.16%

YTD 18.10%

19,389.95

1D 0.47%

YTD -1.98%

3,186.97

1D 0.01%

YTD -1.98%

1,555.11

1D -0.28%

YTD -6.90%

71.35

1D -5.71%

YTD -16.95%

1,977.95

1D -0.03%

YTD 8.31%

Following the rally of Wall Street, Asian stocks rose in the afternoon of June 9. Japan's Nikkei 225 led regional markets, up 1.97% to 32,265.17 points. Meanwhile, the main indexes of China also recorded gains.

VIETNAM ECONOMY

3.09%

1D (bps) -48

YTD (bps) -188

6.80%

1D (bps) -40

YTD (bps) -60

2.68%

1D (bps) -8

YTD (bps) -211

2.94%

1D (bps) -1

YTD (bps) -196

23,685

1D (%) 0.11%

YTD (%) -0.32%

25,701

1D (%) -1.37%

YTD (%) 0.16%

3,362

1D (%) -0.33%

YTD (%) -3.53%

In the past 5 months, total state budget revenue was estimated at VND769,600 billion, total state budget expenditure was estimated at VND653,100 billion; estimated state budget surplus VND116,500 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The budget may lose about VND9,000 billion when reducing car registration fees;

- EU extends safeguard measures with some steels from Vietnam;

- HCMC real estate market shows signs of recovery;

- China: Major banks cut deposit rates;

- China's producer price index fell the most in 7 years;

- EU deadlocked on new sanctions on Russia.

VN30

BANK

100,500

1D 0.50%

5D 5.90%

Buy Vol. 1,241,973

Sell Vol. 1,488,262

43,450

1D -0.57%

5D -2.80%

Buy Vol. 2,012,332

Sell Vol. 1,873,452

28,350

1D -0.70%

5D -1.05%

Buy Vol. 9,902,039

Sell Vol. 11,059,131

32,400

1D 2.05%

5D 0.62%

Buy Vol. 10,691,997

Sell Vol. 7,918,247

19,500

1D 0.00%

5D -1.76%

Buy Vol. 18,415,888

Sell Vol. 19,331,673

20,250

1D 1.25%

5D 2.79%

Buy Vol. 23,425,749

Sell Vol. 19,741,381

18,500

1D -1.07%

5D -2.89%

Buy Vol. 3,828,487

Sell Vol. 4,691,704

18,650

1D 1.41%

5D -1.29%

Buy Vol. 12,538,148

Sell Vol. 13,884,845

28,100

1D 1.81%

5D -0.71%

Buy Vol. 26,847,692

Sell Vol. 22,252,051

23,400

1D 2.41%

5D 1.52%

Buy Vol. 23,472,960

Sell Vol. 16,641,299

21,550

1D -0.23%

5D -1.15%

Buy Vol. 13,840,634

Sell Vol. 14,587,586

VPB: From June 7, VPBank simultaneously reduced the deposit interest rate by 0.3 percentage points for terms of 6 months or more. In which, the 6-month term is applied with the interest rate of 7.5%; 7-month term is 7.6%/year; 8 - 9 month term is applied with the highest interest rate of 7.8%/year; 10-12 month term is 7.5% and over 12 months is 6.7%.

REAL ESTATE

14,600

1D 2.82%

5D 5.42%

Buy Vol. 68,320,576

Sell Vol. 71,628,284

80,000

1D 0.88%

5D 2.56%

Buy Vol. 857,431

Sell Vol. 576,958

16,900

1D 3.68%

5D 13.04%

Buy Vol. 37,254,633

Sell Vol. 40,433,038

BCM: plans to 2023 with total revenue of VND9,460 billion, up 19% YoY, EBT reaches VND2,628 billion and NPAT VND2,263 billion, up 38% and 32% respectively over the same period.

OIL & GAS

93,700

1D 0.11%

5D 1.85%

Buy Vol. 654,523

Sell Vol. 847,715

13,750

1D -0.36%

5D 0.73%

Buy Vol. 13,588,318

Sell Vol. 15,234,051

38,000

1D -0.78%

5D -0.65%

Buy Vol. 1,067,382

Sell Vol. 1,238,653

POW: In May 2023, POW completed and exceeded the plan with a total power output of 6.97 billion kWh from power plants.

VINGROUP

52,300

1D -0.19%

5D 0.58%

Buy Vol. 1,708,046

Sell Vol. 2,107,025

55,500

1D 0.18%

5D 3.93%

Buy Vol. 1,890,785

Sell Vol. 1,887,829

26,700

1D -0.74%

5D -1.48%

Buy Vol. 4,937,309

Sell Vol. 6,111,291

VIC: On June 8, 2023, VinFast officially announced the small electric car model VF3, researched and developed by VinFast based on the characteristics and traffic habits of domestic consumers.

FOOD & BEVERAGE

65,800

1D 0.46%

5D -0.15%

Buy Vol. 3,980,605

Sell Vol. 4,725,790

76,500

1D 2.82%

5D 5.81%

Buy Vol. 9,035,971

Sell Vol. 3,862,889

158,000

1D -0.19%

5D 0.95%

Buy Vol. 67,415

Sell Vol. 147,652

VNM: By the end of Q1/2023, net revenue of foreign branches reached VND1,203 billion, up 11.3% QoQ thanks to the stable performance of Driftwood in the US and AngkorMilk in Cambodia.

OTHERS

43,800

1D -0.68%

5D -0.68%

Buy Vol. 1,256,878

Sell Vol. 1,491,243

96,000

1D -1.23%

5D -0.83%

Buy Vol. 944,561

Sell Vol. 1,087,092

84,600

1D 1.20%

5D 0.95%

Buy Vol. 1,267,439

Sell Vol. 2,266,279

41,400

1D 1.85%

5D 1.47%

Buy Vol. 6,565,662

Sell Vol. 8,631,260

18,050

1D 0.28%

5D -4.50%

Buy Vol. 6,810,370

Sell Vol. 6,337,707

25,250

1D 3.91%

5D 4.77%

Buy Vol. 46,791,211

Sell Vol. 36,797,094

22,900

1D 0.44%

5D 6.02%

Buy Vol. 45,681,757

Sell Vol. 47,867,419

HPG: Accumulating 5 months, Hoa Phat has produced 2.34 million tons of crude steel, down 36% compared to the first 5 months of 2022. Sales of steel products reached 2.36 million tons, down 31% over the same period. In which, construction steel reached 1.36 million tons, down 33%. HRC recorded 965,000 tons, down 21% compared to 5 months of 2022.

Market by numbers

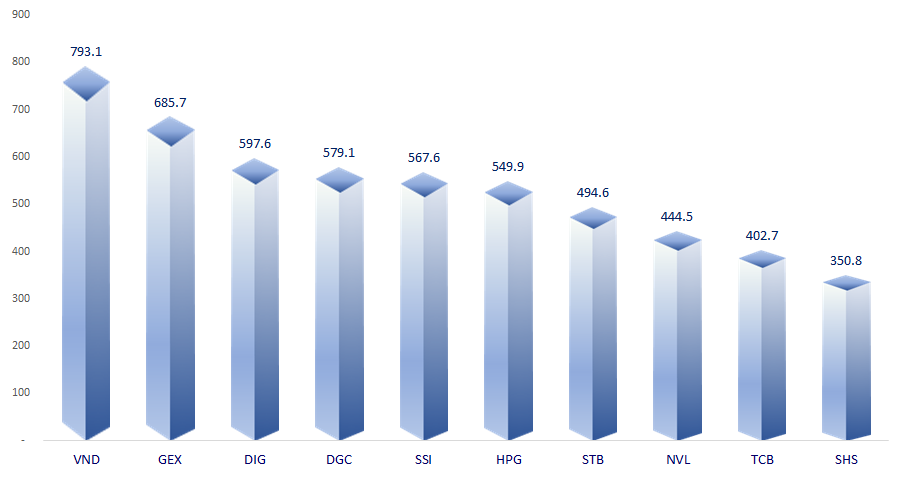

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

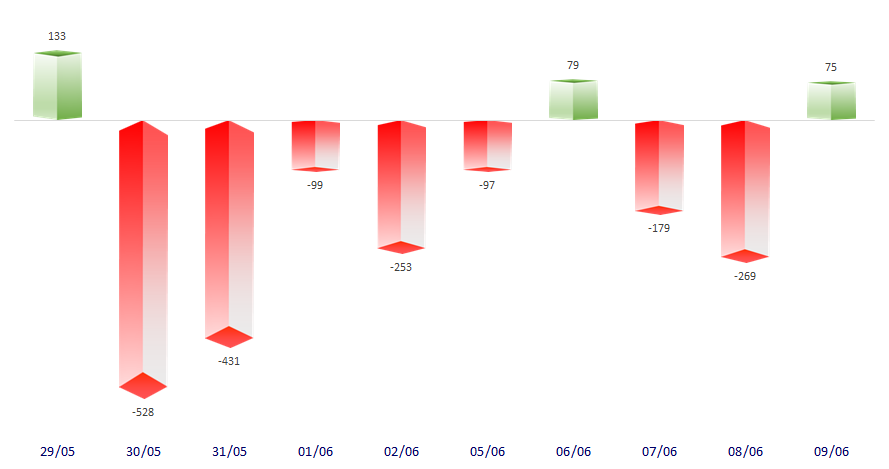

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

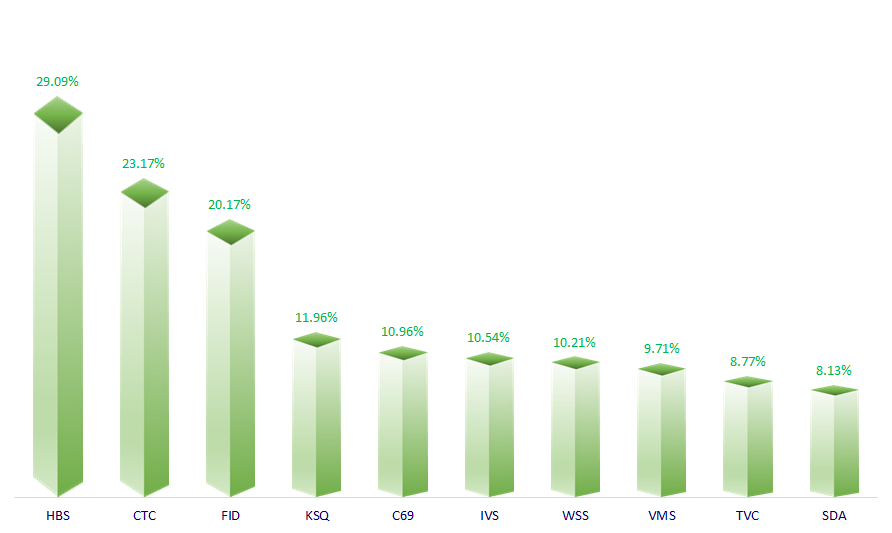

TOP INCREASES 3 CONSECUTIVE SESSIONS

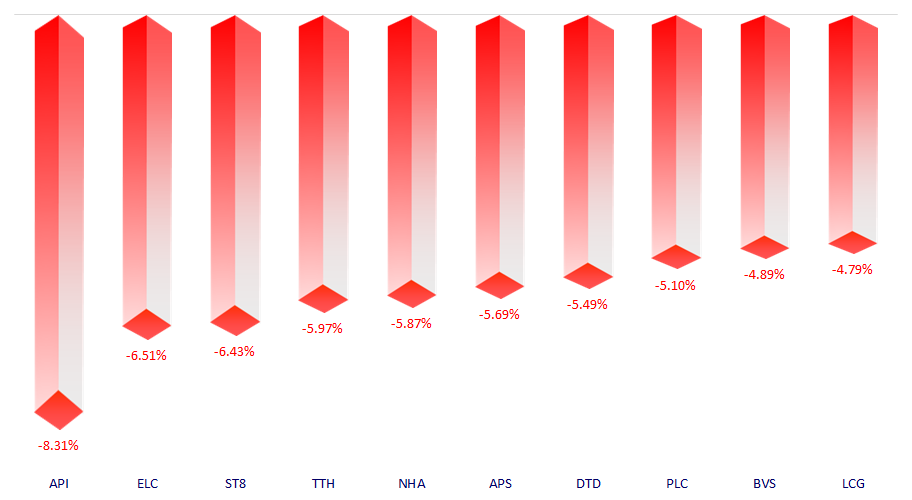

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.