Market brief 15/06/2023

VIETNAM STOCK MARKET

1,116.97

1D -0.04%

YTD 10.91%

1,108.57

1D -0.18%

YTD 10.28%

229.53

1D 0.27%

YTD 11.80%

84.55

1D -0.32%

YTD 18.00%

411.81

1D 0.00%

YTD 0.00%

15,553.42

1D -22.33%

YTD 80.52%

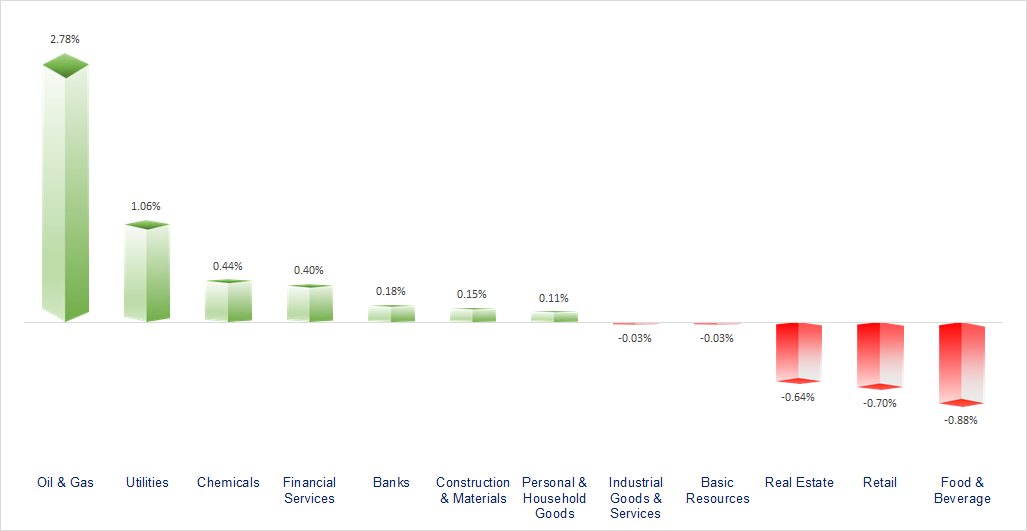

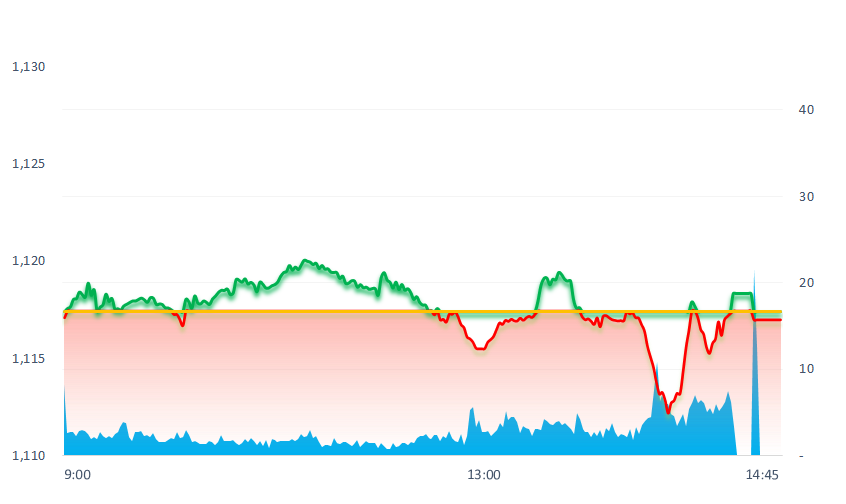

VNIndex only maintained the green in the morning session, then turned to decrease. Food and beverage stocks had the strongest drop (-0.88%) when all 3 representatives of VNM, MSN and SAB all recorded a rather deep drop of 1.19%, 1.15% and 1.85%, respectively.

ETF & DERIVATIVES

19,000

1D -0.52%

YTD 9.64%

13,210

1D 0.00%

YTD 10.82%

13,630

1D -0.51%

YTD 9.21%

16,850

1D 3.37%

YTD 19.93%

17,050

1D -0.87%

YTD 18.82%

23,500

1D -0.42%

YTD 4.91%

14,330

1D -0.35%

YTD 10.66%

1,109

1D -0.25%

YTD 0.00%

1,099

1D -0.94%

YTD 0.00%

1,091

1D -0.86%

YTD 0.00%

1,086

1D -0.90%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

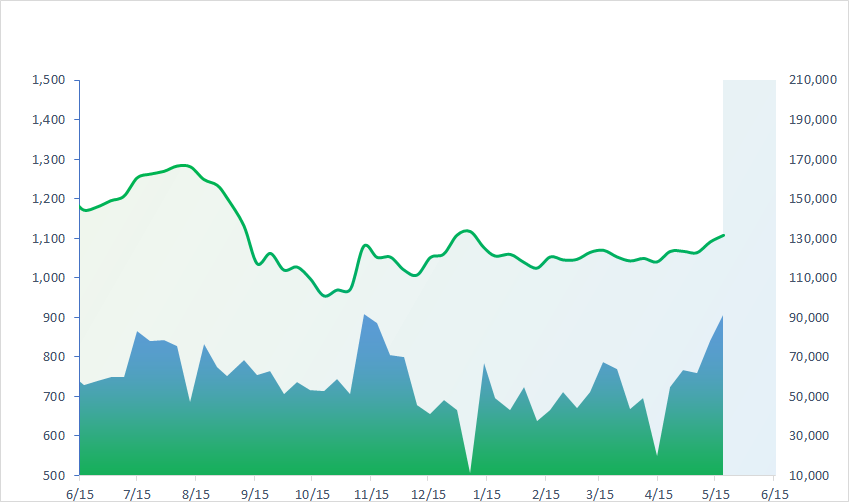

VNINDEX (12M)

GLOBAL MARKET

33,485.49

1D -0.05%

YTD 28.32%

3,252.98

1D 0.74%

YTD 5.30%

2,608.54

1D -0.40%

YTD 16.64%

19,828.92

1D 2.17%

YTD 0.24%

3,242.85

1D 0.77%

YTD -0.26%

1,557.71

1D -0.22%

YTD -6.74%

74.19

1D 1.44%

YTD -13.64%

1,945.10

1D -0.17%

YTD 6.51%

In the afternoon of June 15, Asian stock markets mixed up and down, after simultaneously gaining in the morning session, thanks to the news that the US Federal Reserve (Fed) halted interest rate hikes and the PBoC unexpectedly lowered medium-term lending rates to stimulate economic growth.

VIETNAM ECONOMY

1.73%

1D (bps) -26

YTD (bps) -324

6.80%

YTD (bps) -60

2.66%

1D (bps) -2

YTD (bps) -213

2.90%

1D (bps) -1

YTD (bps) -200

23,745

1D (%) 0.30%

YTD (%) -0.06%

25,952

1D (%) -0.86%

YTD (%) 1.14%

3,359

1D (%) 0.24%

YTD (%) -3.62%

On June 15, the State Bank increased the central exchange rate by 4 dong, to 23,704 dong/USD. The USD price at banks is almost unchanged.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many types of Vietnamese rice have higher selling prices than Thailand and India;

- TKV ensures to supply about 18.7 million tons of coal for power production in the last 6 months of the year;

- Vietnam and the UAE will soon complete negotiations on the Comprehensive Economic Partnership Agreement in the near future;

- Fed decided to keep interest rates unchanged, signaling there will be 2 more hikes this year;

- IEA: Global oil demand peaks at the end of the decade;

- The special committee further investigated the Credit Suisse bailout.

VN30

BANK

103,500

1D 0.88%

5D 3.50%

Buy Vol. 2,043,115

Sell Vol. 1,440,677

43,850

1D -0.34%

5D 0.34%

Buy Vol. 1,442,578

Sell Vol. 1,886,182

29,000

1D 1.05%

5D 1.58%

Buy Vol. 11,717,213

Sell Vol. 15,449,283

32,650

1D 0.15%

5D 2.83%

Buy Vol. 6,241,435

Sell Vol. 7,064,912

19,700

1D -0.25%

5D 1.03%

Buy Vol. 16,681,261

Sell Vol. 24,057,277

19,700

1D -0.25%

5D 0.98%

Buy Vol. 15,603,976

Sell Vol. 18,747,181

18,650

1D 0.00%

5D -0.27%

Buy Vol. 3,125,080

Sell Vol. 3,696,467

18,150

1D 0.00%

5D -1.31%

Buy Vol. 5,155,925

Sell Vol. 5,393,838

27,800

1D 0.00%

5D 0.72%

Buy Vol. 25,449,394

Sell Vol. 20,260,162

23,150

1D -0.64%

5D 1.31%

Buy Vol. 10,479,561

Sell Vol. 13,007,498

21,700

1D 0.23%

5D 0.46%

Buy Vol. 8,435,266

Sell Vol. 12,529,817

VIB: A new loan of USD100 million from IFC with a term of 5 years has just been signed, bringing the total credit limit granted to VIB by IFC to USD450 million. With this agreement, VIB will have more financial resources to strengthen and boost credit activities for individual customers to buy and repair houses.

REAL ESTATE

15,250

1D 0.33%

5D 7.39%

Buy Vol. 77,059,478

Sell Vol. 69,381,013

80,000

1D -0.99%

5D 0.88%

Buy Vol. 603,495

Sell Vol. 556,366

17,300

1D 2.06%

5D 6.13%

Buy Vol. 35,159,642

Sell Vol. 30,097,938

NVL: NovaGroup has registered to sell 136 million shares of NVL to balance the investment portfolio and support the structure of debts and other obligations. Expected time from June 16 to July 14.

OIL & GAS

96,600

1D 2.11%

5D 3.21%

Buy Vol. 2,231,900

Sell Vol. 2,396,973

13,550

1D -1.45%

5D -1.81%

Buy Vol. 12,047,549

Sell Vol. 15,745,476

38,300

1D 0.66%

5D 0.00%

Buy Vol. 2,410,546

Sell Vol. 2,602,770

GAS: PGV will extend the gas trading contract with GAS with an offtake volume of 1.85 billion m3, the extension period is 10 years to ensure gas supply for the Phu My power plant cluster.

VINGROUP

53,500

1D -0.56%

5D 2.10%

Buy Vol. 3,432,230

Sell Vol. 4,262,052

56,500

1D -0.88%

5D 1.99%

Buy Vol. 3,109,280

Sell Vol. 6,522,715

26,850

1D -1.10%

5D -0.19%

Buy Vol. 4,516,698

Sell Vol. 6,651,710

VIC: VinFast thoroughly handles all problems arising at the factory due to manufacturer's errors, and directly supports customers with service vouchers or money depending on the group of errors.

FOOD & BEVERAGE

66,300

1D -1.19%

5D 1.22%

Buy Vol. 7,650,534

Sell Vol. 8,489,260

77,100

1D -1.15%

5D 3.63%

Buy Vol. 1,798,347

Sell Vol. 2,173,759

159,000

1D -1.85%

5D 0.44%

Buy Vol. 165,589

Sell Vol. 344,045

VNM: PLATINUM VICTORY PTE. LTD continues to not buy any VNM shares out of nearly 21 million shares registered to buy from May 17 to June 15, 2023

OTHERS

44,400

1D -0.45%

5D 0.68%

Buy Vol. 1,602,076

Sell Vol. 1,696,380

97,100

1D 0.00%

5D -0.10%

Buy Vol. 1,110,897

Sell Vol. 1,214,243

84,100

1D -0.12%

5D 0.60%

Buy Vol. 1,479,144

Sell Vol. 2,011,330

41,700

1D -0.83%

5D 2.58%

Buy Vol. 5,220,148

Sell Vol. 5,385,729

18,050

1D 0.84%

5D 0.28%

Buy Vol. 4,136,127

Sell Vol. 4,494,808

25,700

1D 1.18%

5D 5.76%

Buy Vol. 30,009,303

Sell Vol. 30,969,325

23,150

1D 0.22%

5D 1.54%

Buy Vol. 29,970,563

Sell Vol. 36,710,620

The VanEck Vectors Vietnam ETF (VNM ETF) in the period from June 2 to September 9, 2023 had a decision to net buy all stocks in the portfolio. HPG, VND and NVL were the 3 stocks bought the most by VNM ETF, with volumes of 345,200 shares, 322,900 shares, and 300,800 shares, respectively. No shares were sold in VNM ETF's portfolio.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

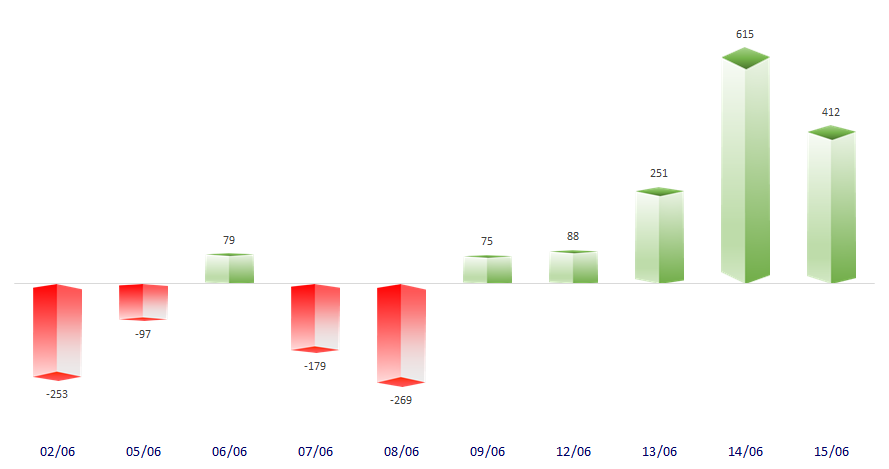

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.