Market brief 20/06/2023

VIETNAM STOCK MARKET

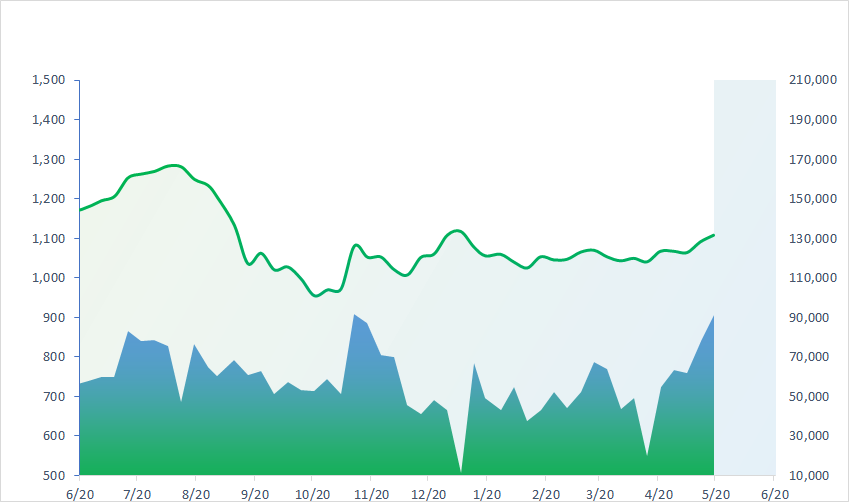

1,111.72

1D 0.57%

YTD 10.39%

1,104.27

1D 0.49%

YTD 9.86%

228.77

1D 0.99%

YTD 11.43%

84.82

1D 0.32%

YTD 18.38%

-433.94

1D 0.00%

YTD 0.00%

16,091.29

1D -5.44%

YTD 86.76%

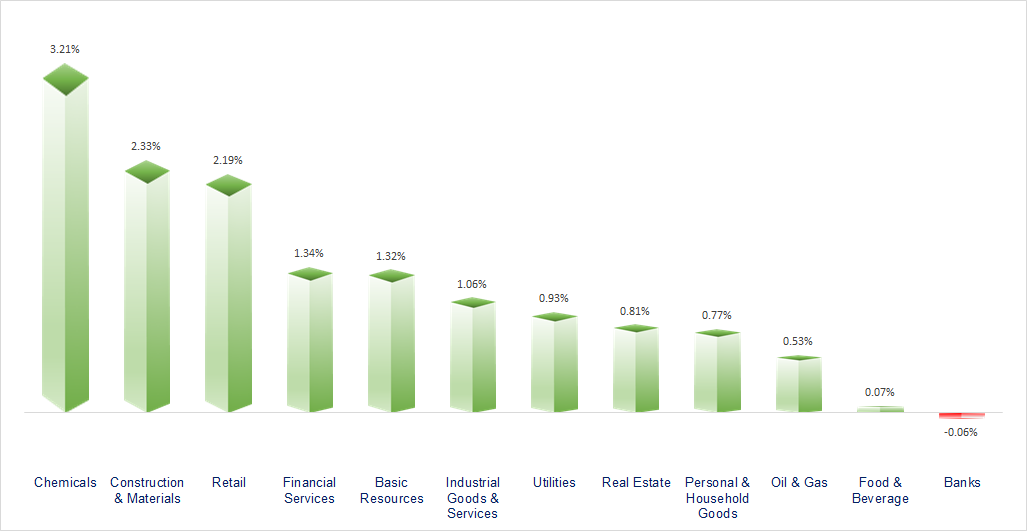

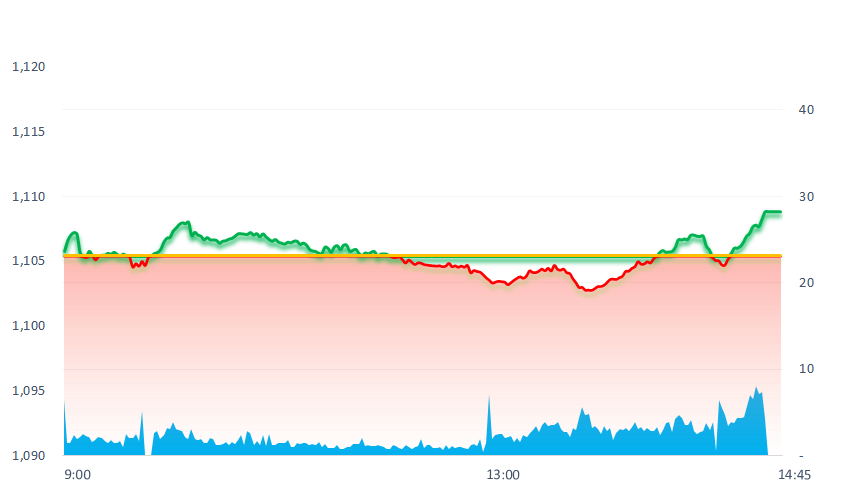

VNIndex traded in a narrow range for most of the session. At the end of the session, the main index recorded a strong breakout and closed at the highest level. The retail sector has a good momentum with a gain of 2.19%, with large stock MWG gaining 2.41% to VND42,500. FRT and DGW also recorded an increase of 2.23% and 2% respectively.

ETF & DERIVATIVES

18,880

1D -0.05%

YTD 8.94%

13,060

1D 0.69%

YTD 9.56%

13,500

1D -0.44%

YTD 8.17%

16,700

1D 2.45%

YTD 18.86%

17,270

1D -0.17%

YTD 20.35%

23,450

1D 0.73%

YTD 4.69%

14,160

1D -0.21%

YTD 9.34%

1,097

1D 0.05%

YTD 0.00%

1,094

1D 0.05%

YTD 0.00%

1,089

1D 0.06%

YTD 0.00%

1,082

1D 0.27%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,388.91

1D 0.06%

YTD 27.95%

3,240.36

1D -0.47%

YTD 4.89%

2,604.91

1D -0.18%

YTD 16.48%

19,607.08

1D -1.54%

YTD -0.88%

3,220.23

1D -0.65%

YTD -0.96%

1,537.59

1D -1.24%

YTD -7.95%

76.83

1D 1.15%

YTD -10.57%

1,963.35

1D 0.13%

YTD 7.51%

Asian stock markets mostly fell in the afternoon session of June 20 after the PBoC cut interest rates at a lower rate than expected. This move of the PBoC made the market more concerned about the recovery of the world's second largest economy.

VIETNAM ECONOMY

0.78%

1D (bps) -23

YTD (bps) -419

6.80%

YTD (bps) -60

2.64%

YTD (bps) -215

2.84%

YTD (bps) -206

23,737

1D (%) 0.18%

YTD (%) -0.10%

26,155

1D (%) -1.00%

YTD (%) 1.93%

3,348

1D (%) -0.21%

YTD (%) -3.93%

The average lending interest rate of new transactions of commercial banks is at 8.9%/year, down about 1% compared to the end of 2022. With the impact of policy lag, the interest rate level is forecasted continuing to decrease in the near future.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Deputy Prime Minister requested the State Bank to announce the credit growth limit for the whole year for each bank;

- HSBC: It is likely that Vietnam's operating interest rate will drop to 4%;

- Draining the dead water level, many hydropower plants in the North still stopped generating electricity;

- US midterm review of safeguard measures with solar panels;

- UBS faces the risk of being fined hundreds of millions of dollars;

- BoK: Inflation in Korea accelerates later this year.

VN30

BANK

99,900

1D -1.77%

5D -2.54%

Buy Vol. 3,142,979

Sell Vol. 2,186,373

43,500

1D 0.46%

5D -1.92%

Buy Vol. 1,399,583

Sell Vol. 1,362,180

29,200

1D 2.10%

5D 3.18%

Buy Vol. 5,164,068

Sell Vol. 4,722,338

32,150

1D 0.16%

5D -1.98%

Buy Vol. 4,625,054

Sell Vol. 3,582,610

19,500

1D 0.26%

5D 0.00%

Buy Vol. 37,193,359

Sell Vol. 25,342,566

19,650

1D 0.51%

5D -0.76%

Buy Vol. 15,018,250

Sell Vol. 11,806,334

18,700

1D 1.91%

5D 0.54%

Buy Vol. 4,152,698

Sell Vol. 4,023,171

18,250

1D -0.27%

5D 0.55%

Buy Vol. 4,202,465

Sell Vol. 4,784,690

29,250

1D 1.74%

5D 3.72%

Buy Vol. 23,625,360

Sell Vol. 18,125,963

23,300

1D 0.87%

5D -0.43%

Buy Vol. 10,086,676

Sell Vol. 11,656,492

21,650

1D 0.00%

5D 0.23%

Buy Vol. 10,738,263

Sell Vol. 12,210,582

VCB: According to the latest interest rate table listed by Vietcombank, this bank has reduced the deposit interest rate by 0.5 - 0.7 percentage points for terms from 1 to less than 6 months, bringing the interest rate for terms from 1 to 2 months down to 3.4%/year and 3 - 5 months down to 4.1%/year, for over-the-counter deposit. Vietcombank also reduced 0.3 -0.5 percentage points of deposit interest rates for terms of 6 months or more. Currently, the highest deposit interest rate listed by this bank is 6.3% for terms of 12 months or more.

REAL ESTATE

14,500

1D 3.57%

5D -7.05%

Buy Vol. 62,071,231

Sell Vol. 45,310,467

82,000

1D 1.23%

5D 0.74%

Buy Vol. 690,833

Sell Vol. 642,224

17,200

1D 6.50%

5D -2.82%

Buy Vol. 29,690,373

Sell Vol. 19,943,535

NVL: On June 22, NVL will hold an AGM to approve the business plan for 2023 with the target of VND9,531 billion in revenue and VND214 billion in profit after tax, down 15% and 90% YoY

OIL & GAS

96,500

1D 1.37%

5D 2.66%

Buy Vol. 904,498

Sell Vol. 841,670

13,600

1D 0.37%

5D -1.81%

Buy Vol. 20,903,562

Sell Vol. 13,506,754

37,200

1D 0.00%

5D -2.23%

Buy Vol. 1,287,675

Sell Vol. 1,184,038

POW: In May 2023, POW completed and exceeded the plan with the total electricity output from power plants of 6.97 billion kWh.

VINGROUP

52,000

1D -0.19%

5D -3.88%

Buy Vol. 2,856,049

Sell Vol. 2,503,391

55,100

1D 0.18%

5D -2.82%

Buy Vol. 1,573,831

Sell Vol. 1,473,632

26,650

1D 0.38%

5D -1.66%

Buy Vol. 3,713,178

Sell Vol. 5,047,383

VIC: Vinfast will receive orders for VF3 electric cars from September 2023 and in the third quarter of 2024 will deliver cars to customers.

FOOD & BEVERAGE

65,500

1D -0.46%

5D -3.11%

Buy Vol. 5,594,606

Sell Vol. 5,296,166

75,200

1D 0.94%

5D -4.57%

Buy Vol. 1,417,129

Sell Vol. 1,005,806

155,300

1D -0.96%

5D -4.02%

Buy Vol. 193,489

Sell Vol. 251,439

MSN: According to statistics from TechinAsia, Masan's The Crown X - was poured USD1.5 billion, the highest level in the past 10 years in Vietnam for technology enterprises.

OTHERS

44,000

1D 0.69%

5D -2.22%

Buy Vol. 1,158,326

Sell Vol. 1,263,193

95,100

1D -0.52%

5D -1.45%

Buy Vol. 887,218

Sell Vol. 1,065,769

85,500

1D 0.94%

5D 1.30%

Buy Vol. 1,833,692

Sell Vol. 1,675,204

42,500

1D 2.41%

5D -1.16%

Buy Vol. 5,323,080

Sell Vol. 4,719,853

18,800

1D 5.03%

5D 2.17%

Buy Vol. 7,374,586

Sell Vol. 6,911,310

25,700

1D 1.18%

5D 5.37%

Buy Vol. 34,694,609

Sell Vol. 35,003,634

23,650

1D 1.28%

5D 1.07%

Buy Vol. 26,915,235

Sell Vol. 26,267,112

FPT: Revenue and profit before tax in 5 months reached VND19,943 billion and VND3,610 billion, respectively, up 23% and 19% over the same period. PAT reached VND3,064 billion, of which, profit after tax for shareholders of parent company was VND2,518 billion, up 20%, EPS increased 19% to VND2,293.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

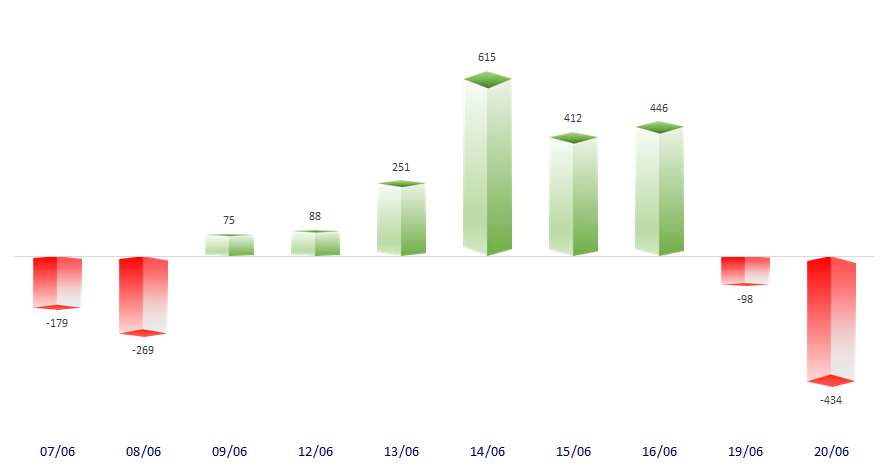

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.