Market brief 23/06/2023

VIETNAM STOCK MARKET

1,129.38

1D 0.36%

YTD 12.14%

1,126.76

1D 0.82%

YTD 12.09%

231.54

1D -0.16%

YTD 12.78%

85.71

1D 0.25%

YTD 19.62%

16.32

1D 0.00%

YTD 0.00%

21,447.75

1D -1.69%

YTD 148.93%

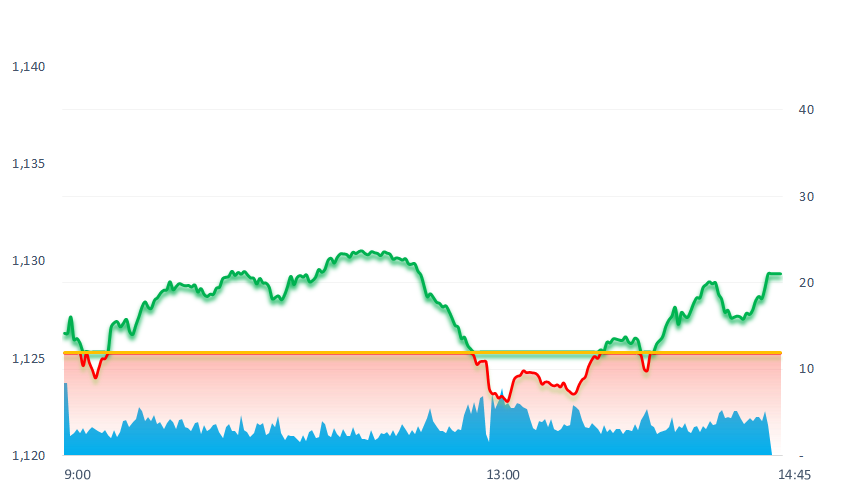

Today, VNIndex's uptrend decreased compared to the previous 3 sessions when it encountered selling pressure at the end of the morning session and the beginning of the afternoon session, causing the VNIndex to sink into the red. However, thanks to the strong cash inflow to government investment and banking stocks, VNIndex recovered and still closed up 4.08 points (or 0.36%) to 1,129.38 points.

ETF & DERIVATIVES

19,290

1D 0.84%

YTD 11.31%

13,360

1D 1.06%

YTD 12.08%

13,700

1D 0.00%

YTD 9.78%

16,860

1D 2.00%

YTD 20.00%

17,730

1D 0.40%

YTD 23.55%

23,900

1D 0.21%

YTD 6.70%

14,690

1D 1.45%

YTD 13.44%

1,119

1D 0.46%

YTD 0.00%

1,116

1D 0.66%

YTD 0.00%

1,108

1D 0.15%

YTD 0.00%

1,101

1D 0.48%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

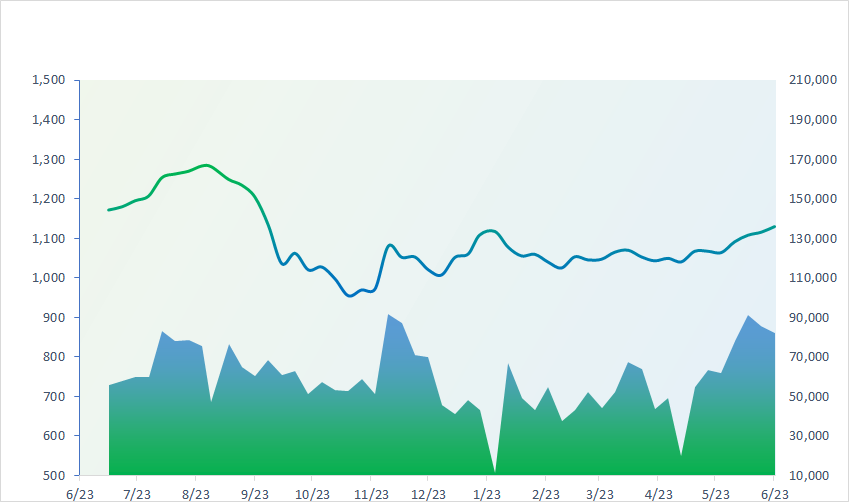

VNINDEX (12M)

GLOBAL MARKET

32,781.54

1D -1.45%

YTD 25.63%

3,197.90

1D 0.00%

YTD 3.52%

2,570.10

1D -0.91%

YTD 14.92%

18,889.97

1D -1.71%

YTD -4.51%

3,191.60

1D -0.96%

YTD -1.84%

1,505.52

1D -0.25%

YTD -9.87%

73.18

1D -1.35%

YTD -14.82%

1,927.40

1D 0.15%

YTD 5.54%

Asian stock markets fell in the afternoon of June 23, after a series of interest rate hikes by central banks raised concerns about the global economy. The market is now turning its attention to Japan after higher-than-expected inflation figures.

VIETNAM ECONOMY

1.00%

YTD (bps) -397

6.30%

YTD (bps) -110

2.15%

1D (bps) -3

YTD (bps) -264

2.53%

1D (bps) -15

YTD (bps) -237

23,735

1D (%) 0.16%

YTD (%) -0.11%

26,000

1D (%) -1.89%

YTD (%) 1.33%

3,347

1D (%) 0.00%

YTD (%) -3.96%

In the first 5 months of 2023, Vietnam's fertilizer export turnover decreased by 42.2%, of which, in the main market, Cambodia, the turnover decreased by 19.2% and the price decreased by 25.1% over the same period last year 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's economy is forecasted to grow by 6 - 6.5% in 2023;

- The General Department of Taxation requires commercial banks to provide transaction information, balances.. for inspection within 10 days;

- Export turnover decreased, fertilizer enterprises focused on expanding the market;

- Japan's core CPI hits 42-year high;

- UK: BoE raised interest rates by 0.5 percentage points due to prolonged inflation;

- US: Fed Chairman defends his view of raising interest rates to curb inflation.

VN30

BANK

99,900

1D -0.50%

5D -4.86%

Buy Vol. 1,375,870

Sell Vol. 1,276,932

44,300

1D 0.80%

5D 1.37%

Buy Vol. 3,712,493

Sell Vol. 3,591,851

29,250

1D -0.68%

5D 2.63%

Buy Vol. 9,167,615

Sell Vol. 10,278,013

32,900

1D 0.92%

5D 1.08%

Buy Vol. 8,912,412

Sell Vol. 8,058,524

20,200

1D 3.06%

5D 3.32%

Buy Vol. 89,623,756

Sell Vol. 82,967,095

20,200

1D 1.51%

5D 2.54%

Buy Vol. 32,726,612

Sell Vol. 26,315,269

18,650

1D -0.27%

5D 0.27%

Buy Vol. 4,572,603

Sell Vol. 5,078,062

18,500

1D 0.54%

5D 1.65%

Buy Vol. 11,621,309

Sell Vol. 12,860,976

30,300

1D 1.00%

5D 4.48%

Buy Vol. 40,957,209

Sell Vol. 34,836,303

19,950

1D 1.01%

5D 3.64%

Buy Vol. 12,837,956

Sell Vol. 10,148,807

21,900

1D 1.15%

5D 0.46%

Buy Vol. 24,754,469

Sell Vol. 21,983,867

VIB: VIB plans to issue 7.6 million ESOP shares, issue rate 0.36%. The total issuance value at par value is 76 billion dong. These shares are restricted from being transferred for 1 year from the end of the issuance.

REAL ESTATE

14,500

1D -1.02%

5D -2.68%

Buy Vol. 63,122,386

Sell Vol. 68,702,482

80,600

1D -0.86%

5D -0.74%

Buy Vol. 457,799

Sell Vol. 520,796

17,150

1D -1.15%

5D 1.78%

Buy Vol. 27,046,570

Sell Vol. 27,377,087

BCM: has just approved a plan to issue a maximum of VND2,000 billion of private bonds. Currently, BCM has not announced the detailed issuance as well as the purpose and plan to use capital.

OIL & GAS

95,200

1D -0.42%

5D -0.31%

Buy Vol. 1,036,059

Sell Vol. 1,405,120

13,700

1D -0.36%

5D 1.48%

Buy Vol. 18,266,712

Sell Vol. 17,828,794

37,500

1D -0.40%

5D 0.81%

Buy Vol. 1,426,238

Sell Vol. 1,413,826

Ending Thursday's session, the Brent oil contract dropped USD2.98 (or 3.9%) to USD74.14 a barrel. WTI oil contract lost USD3.02 (4.2%) to 69.51 USD/barrel.

VINGROUP

52,000

1D -0.76%

5D -2.80%

Buy Vol. 3,923,352

Sell Vol. 3,424,371

56,000

1D 0.54%

5D 0.00%

Buy Vol. 3,011,435

Sell Vol. 2,969,257

26,850

1D -0.56%

5D 1.32%

Buy Vol. 5,299,794

Sell Vol. 7,231,888

VIC: By the end of May, VinFast has sold 8,483 electric vehicles, an increase of more than 500% over the same period. In the same period last year, VinFast only sold VF e34 with 1,359 units

FOOD & BEVERAGE

69,100

1D 3.29%

5D 4.54%

Buy Vol. 21,672,712

Sell Vol. 19,000,456

77,300

1D 1.31%

5D 0.91%

Buy Vol. 2,856,985

Sell Vol. 2,475,773

156,500

1D 1.10%

5D 0.97%

Buy Vol. 402,091

Sell Vol. 325,846

VNM: VNM had the strongest gain in a year (3.3% today) and nearly 12 million units matched, a record high in the 17-year listing history of this stock.

OTHERS

45,100

1D 2.15%

5D 2.38%

Buy Vol. 2,990,712

Sell Vol. 2,957,186

94,700

1D 0.53%

5D -0.84%

Buy Vol. 776,941

Sell Vol. 810,838

85,100

1D -0.47%

5D 0.71%

Buy Vol. 1,594,718

Sell Vol. 1,721,593

42,900

1D -0.35%

5D 3.75%

Buy Vol. 4,352,961

Sell Vol. 4,709,170

19,000

1D -1.81%

5D 6.74%

Buy Vol. 5,995,953

Sell Vol. 6,843,505

26,000

1D -0.38%

5D 3.54%

Buy Vol. 30,738,938

Sell Vol. 25,100,634

25,400

1D 2.21%

5D 8.32%

Buy Vol. 67,267,874

Sell Vol. 51,272,394

FPT: IT services in the foreign market continued its impressive growth with a revenue of VND9,245 billion, equivalent to an increase of 32%, led by the growth of the Japanese market (up 41%) and APAC (up 50%).

Market by numbers

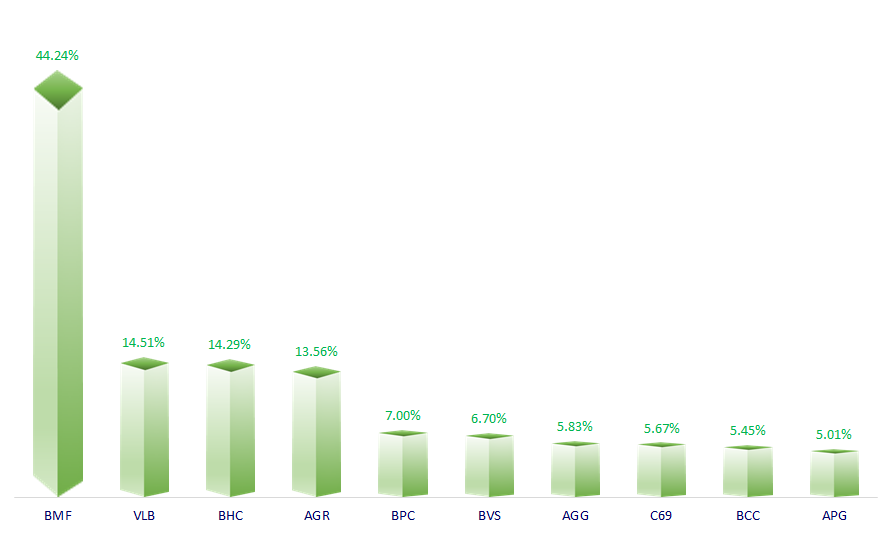

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

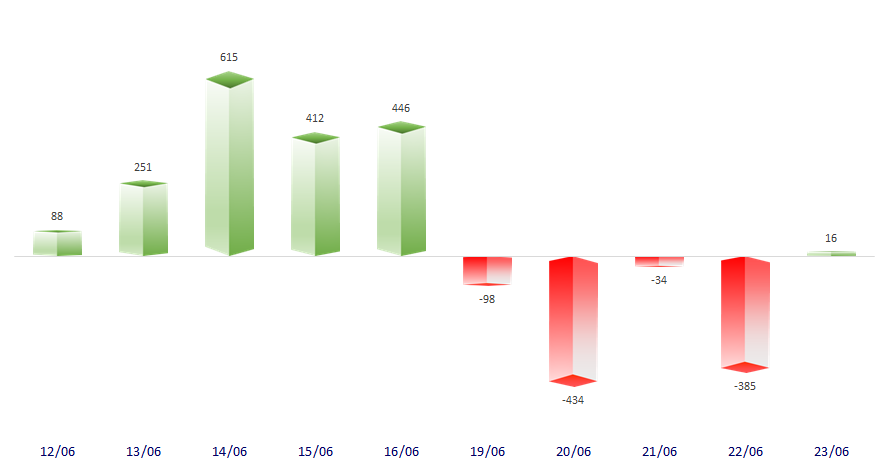

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

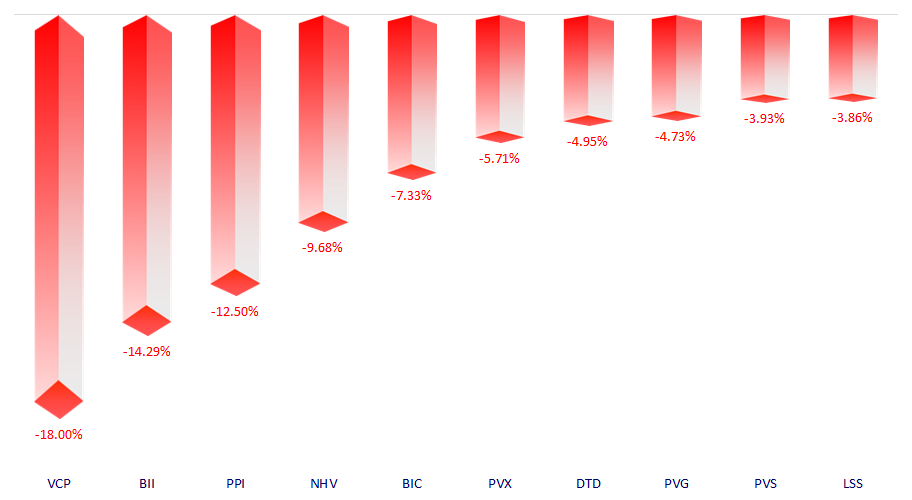

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.