Market brief 03/07/2023

VIETNAM STOCK MARKET

1,125.50

1D 0.47%

YTD 11.76%

1,123.37

1D 0.02%

YTD 11.76%

226.60

1D -0.32%

YTD 10.37%

85.77

1D -0.27%

YTD 19.71%

159.32

1D 0.00%

YTD 0.00%

12,592.42

1D -12.69%

YTD 46.15%

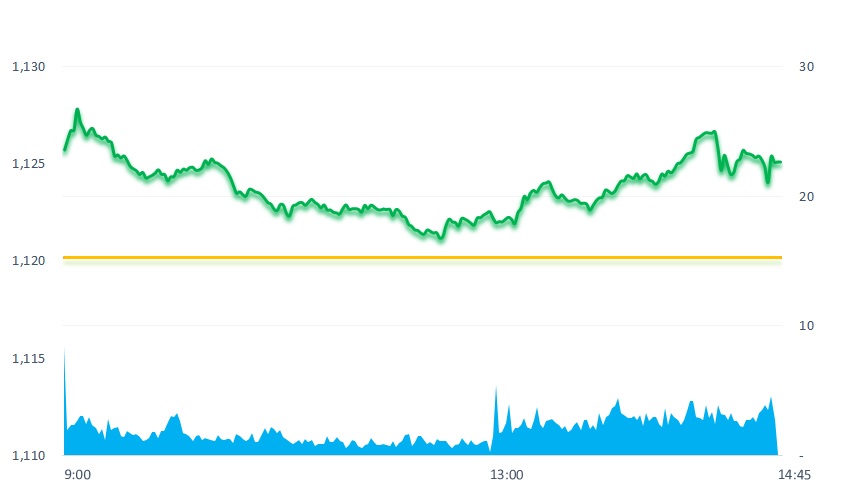

Today, VNIndex traded in a narrow range but the positive view is that the index remained in green throughout the whole session. Market liquidity was quite low when trading volume and trading value were only 558 million shares and nearly VND10,800 billion, respectively.

ETF & DERIVATIVES

19,200

1D -0.78%

YTD 10.79%

13,300

1D -0.23%

YTD 11.58%

13,770

1D -1.01%

YTD 10.34%

16,790

1D -0.06%

YTD 19.50%

17,580

1D 0.23%

YTD 22.51%

23,900

1D -0.79%

YTD 6.70%

14,470

1D -0.75%

YTD 11.74%

1,118

1D 0.02%

YTD 0.00%

1,115

1D 0.04%

YTD 0.00%

1,111

1D -0.05%

YTD 0.00%

1,104

1D 0.16%

YTD 0.00%

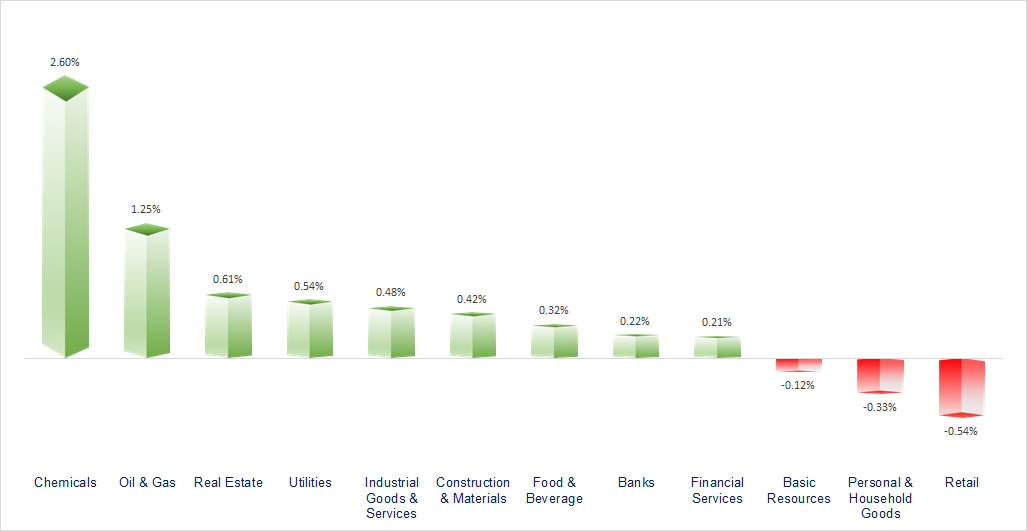

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

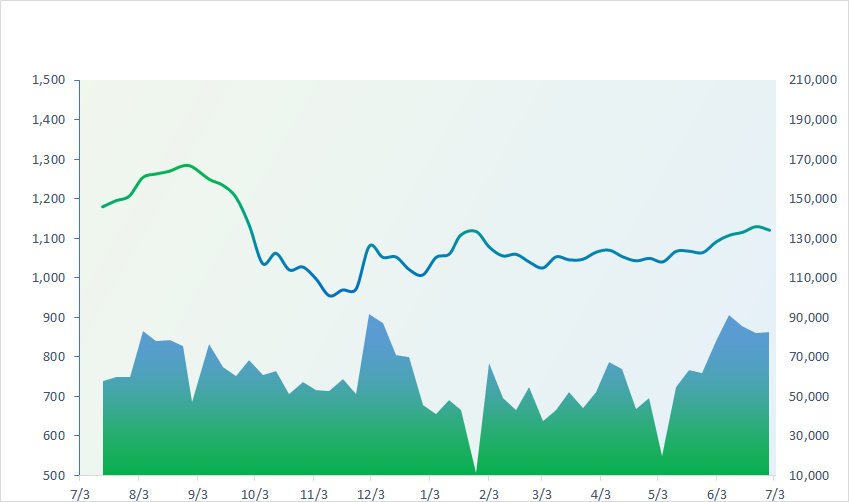

VNINDEX (12M)

GLOBAL MARKET

33,753.33

1D 1.70%

YTD 29.35%

3,243.98

1D 1.31%

YTD 5.01%

2,602.47

1D 1.49%

YTD 16.37%

19,306.59

1D 2.06%

YTD -2.40%

3,207.10

1D 0.04%

YTD -1.36%

1,506.84

1D 0.25%

YTD -9.79%

76.02

1D 0.98%

YTD -11.51%

1,914.14

1D -0.54%

YTD 4.82%

On July 3rd, Asian stocks "followed" the rally on Wall Street. Data showing a continued drop in inflation boosted the markets, stoking hopes that central banks may be nearing the end of a rate hike cycle.

VIETNAM ECONOMY

0.67%

1D (bps) 19

YTD (bps) -430

6.30%

YTD (bps) -110

2.15%

1D (bps) 1

YTD (bps) -264

2.64%

1D (bps) 5

YTD (bps) -226

23,925

1D (%) 0.69%

YTD (%) 0.69%

26,259

1D (%) -0.74%

YTD (%) 2.34%

3,342

1D (%) 0.57%

YTD (%) -4.10%

According to S&P Global, Vietnam's PMI in June reached 46.2 points, up from 45.3 points in May but still below 50 points for the fourth consecutive month. According to S&P Global, this shows that the health of Vietnam's manufacturing industry continues to decline.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam PMI in June 2023 increased to 46.2 points;

- In Q2/2023, many enterprises had higher and more stable orders than in the first quarter;

- Thanh Hoa province is about to have a USD400 million FDI project;

- Electric car companies in the US went bankrupt consecutively;

- China continues to accumulate gas globally;

- Japan's yen fell, heading for a more than 8% drop.

VN30

BANK

100,000

1D 0.00%

5D 0.00%

Buy Vol. 803,778

Sell Vol. 870,017

44,500

1D 2.65%

5D 0.45%

Buy Vol. 2,081,400

Sell Vol. 1,836,755

29,250

1D -0.85%

5D 0.00%

Buy Vol. 5,803,379

Sell Vol. 6,591,836

32,000

1D -1.08%

5D -3.90%

Buy Vol. 5,833,889

Sell Vol. 6,370,680

19,850

1D 0.00%

5D -1.98%

Buy Vol. 20,390,881

Sell Vol. 21,493,492

20,200

1D 0.00%

5D 0.00%

Buy Vol. 24,220,076

Sell Vol. 17,156,095

18,450

1D -0.81%

5D -1.86%

Buy Vol. 3,869,744

Sell Vol. 3,944,766

18,150

1D 0.83%

5D -1.63%

Buy Vol. 4,583,526

Sell Vol. 8,282,722

29,700

1D -0.34%

5D 0.34%

Buy Vol. 19,798,328

Sell Vol. 18,131,220

19,650

1D 0.00%

5D -1.50%

Buy Vol. 5,696,967

Sell Vol. 5,418,860

22,050

1D 0.00%

5D -0.90%

Buy Vol. 7,219,086

Sell Vol. 8,622,509

ACB: ACB has just announced the Resolution of the Board of Directors on amending the charter capital content in the company's charter. Accordingly, the charter capital of ACB was adjusted to increase by VND5,066 billion, from VND33,774 billion to VND38,840 billion. Previously, ACB issued 506,615,264 shares to pay dividends in 2022 to shareholders at the rate of 15%. After the issuance, the total number of outstanding shares of ACB increased from 3,377 million shares to 3,884 million shares.

REAL ESTATE

14,550

1D -2.02%

5D -2.35%

Buy Vol. 57,649,738

Sell Vol. 59,425,157

80,900

1D 2.15%

5D -0.49%

Buy Vol. 469,088

Sell Vol. 483,124

16,700

1D -0.60%

5D -3.19%

Buy Vol. 11,542,574

Sell Vol. 14,550,471

NVL: NVL completed the concept file for a super project of an urban complex of tourism, resort and entertainment in Lam Vien Plateau with a scale of 30,000 ha, capital of USD10 billion in Lam Dong.

OIL & GAS

94,000

1D 1.08%

5D -2.08%

Buy Vol. 745,400

Sell Vol. 933,178

13,300

1D -0.75%

5D -2.56%

Buy Vol. 25,791,217

Sell Vol. 14,676,571

37,650

1D 0.80%

5D 0.27%

Buy Vol. 796,545

Sell Vol. 1,154,939

PLX: The Board of Directors of PLX approved the adjustment of the investment divestment plan in BMF by order matching method on UpCom stock exchange.

VINGROUP

51,100

1D 0.20%

5D -2.11%

Buy Vol. 3,358,939

Sell Vol. 3,148,661

55,900

1D 1.64%

5D 0.72%

Buy Vol. 1,588,481

Sell Vol. 1,832,053

27,000

1D 0.75%

5D 1.12%

Buy Vol. 5,656,979

Sell Vol. 6,703,902

VIC: On July 2, 2023, GSM Smart and Green Mobility Joint Stock Company officially operated SM Green taxi service in Phu Quoc City (Kien Giang) with an initial scale of 100 vehicles.

FOOD & BEVERAGE

70,700

1D -0.42%

5D 0.14%

Buy Vol. 8,566,831

Sell Vol. 6,031,695

75,400

1D 0.27%

5D -2.96%

Buy Vol. 1,095,833

Sell Vol. 1,283,430

153,700

1D 0.07%

5D -1.47%

Buy Vol. 189,630

Sell Vol. 277,382

VNM: This year's Superior Taste Award for the first time featured two dairy products from Vietnam, Ong Tho condensed milk and Vinamilk Super Nut 9-nut milk.

OTHERS

44,500

1D 0.91%

5D -1.66%

Buy Vol. 993,916

Sell Vol. 1,003,254

94,400

1D 0.11%

5D -0.42%

Buy Vol. 1,317,489

Sell Vol. 1,500,431

86,400

1D 0.47%

5D 0.70%

Buy Vol. 1,896,518

Sell Vol. 1,713,781

43,000

1D -0.69%

5D -3.04%

Buy Vol. 3,381,369

Sell Vol. 4,228,558

20,150

1D 3.87%

5D 2.81%

Buy Vol. 10,017,930

Sell Vol. 9,157,343

25,700

1D -0.39%

5D -0.39%

Buy Vol. 28,646,408

Sell Vol. 26,465,520

26,200

1D 0.19%

5D 3.97%

Buy Vol. 28,942,429

Sell Vol. 30,239,025

FPT: Revenue from the Japanese market has recovered, increasing 31.2% in the first quarter and 41% in the first 5 months of the year compared to the same period last year. The Japanese market is expected to return to a high growth rate of 25 - 30% in 2023 as customers return to invest in IT activities and the demand for digital transformation increases after the COVID-19 pandemic.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

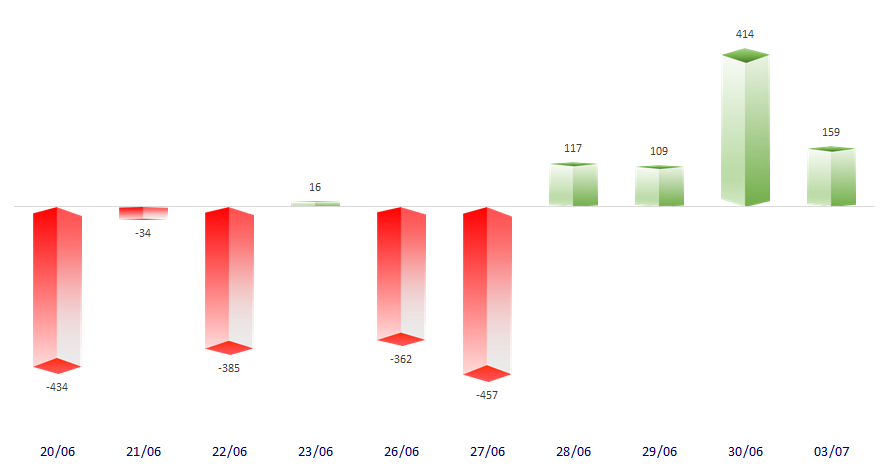

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

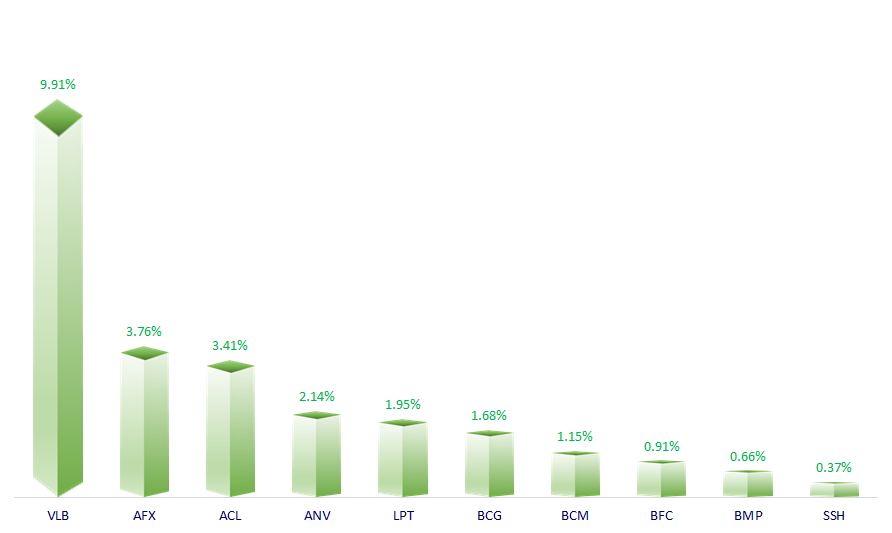

TOP INCREASES 3 CONSECUTIVE SESSIONS

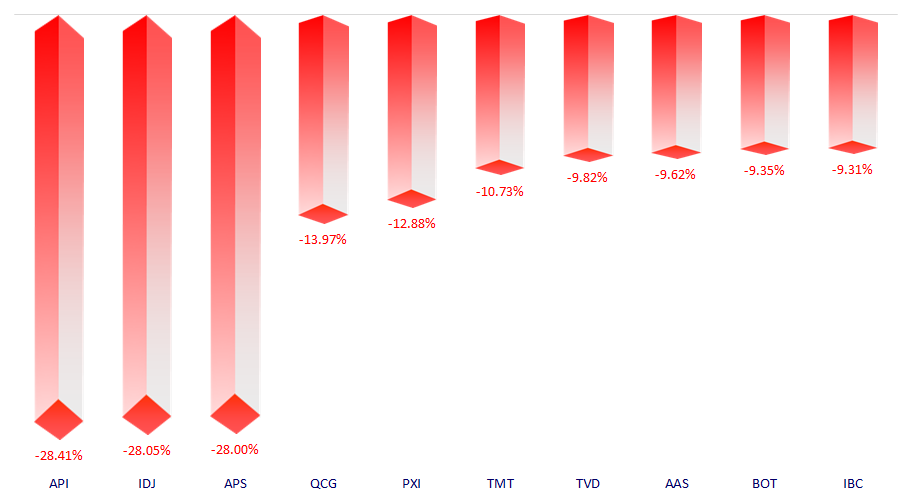

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.