Market brief 05/07/2023

VIETNAM STOCK MARKET

1,134.62

1D 0.23%

YTD 12.66%

1,129.76

1D 0.16%

YTD 12.39%

227.84

1D -0.40%

YTD 10.97%

85.41

1D -0.14%

YTD 19.20%

185.06

1D 0.00%

YTD 0.00%

19,595.74

1D 12.55%

YTD 127.44%

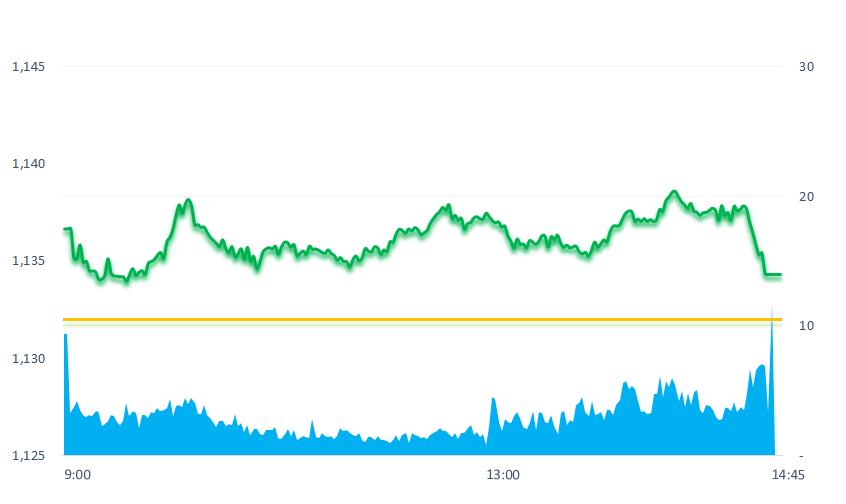

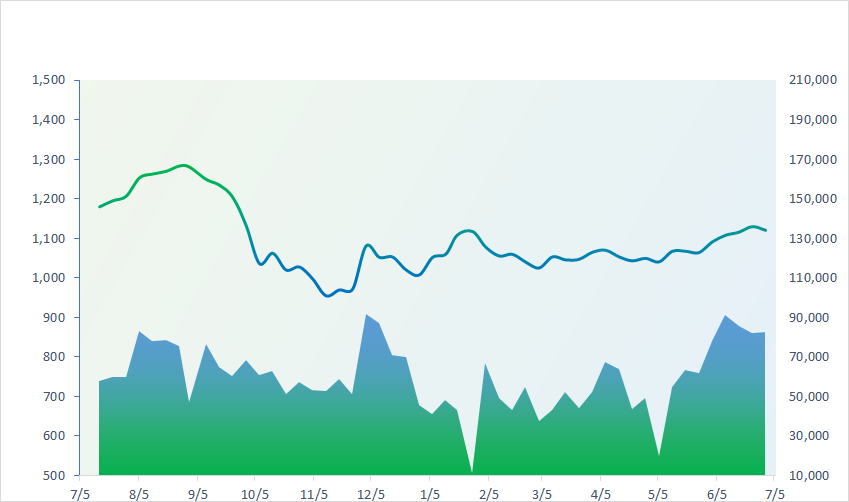

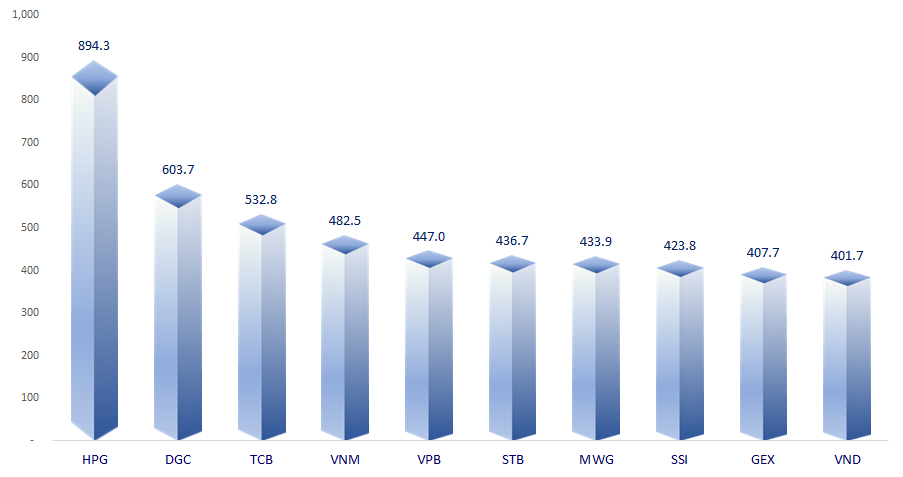

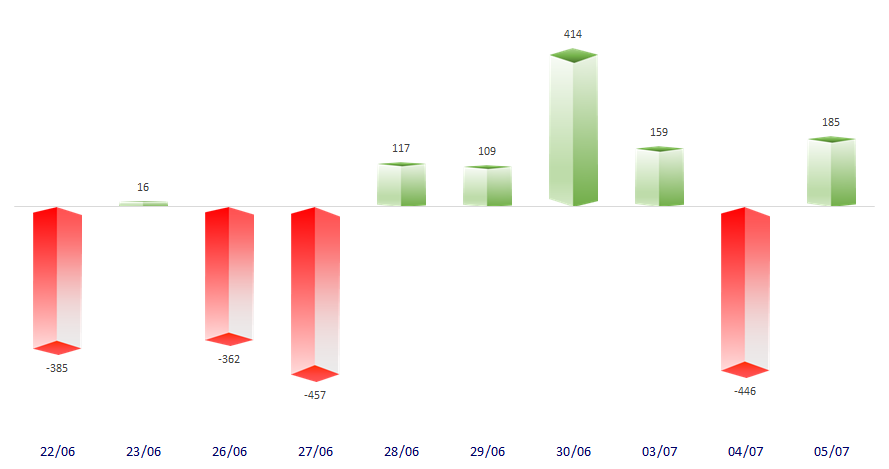

Today, the market maintained a good gain in most of the session, but towards the end of the session, the selling increased strongly and pulled the index down. At the close, VNIndex still remained in green with liquidity continued to improve compared to yesterday. Foreign investors turned to a net buying of VND185 billion, continuing to focus on buying HPG (VND121 billion).

ETF & DERIVATIVES

19,460

1D 0.83%

YTD 12.29%

13,370

1D 0.15%

YTD 12.16%

13,900

1D 0.65%

YTD 11.38%

16,660

1D -0.30%

YTD 18.58%

17,750

1D 0.91%

YTD 23.69%

24,000

1D 0.42%

YTD 7.14%

14,690

1D -0.07%

YTD 13.44%

1,124

1D 0.09%

YTD 0.00%

1,121

1D 0.03%

YTD 0.00%

1,116

1D -0.19%

YTD 0.00%

1,107

1D 0.05%

YTD 0.00%

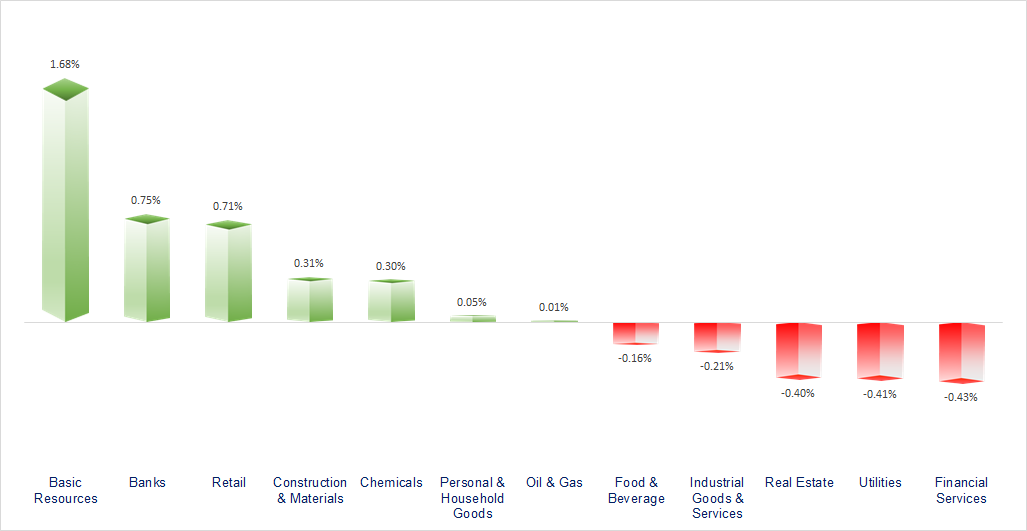

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,338.70

1D -0.25%

YTD 27.76%

3,222.95

1D -0.69%

YTD 4.33%

2,579.00

1D -0.55%

YTD 15.32%

19,110.38

1D -1.57%

YTD -3.39%

3,185.38

1D -0.57%

YTD -2.03%

1,508.87

1D -0.42%

YTD -9.67%

76.04

1D 0.09%

YTD -11.49%

1,927.29

1D -0.30%

YTD 5.54%

Asian stock markets mostly fell in the afternoon session of July 5 when the data showed that the Chinese economy continued to face difficulties in June 2023.

VIETNAM ECONOMY

0.70%

1D (bps) -3

YTD (bps) -427

6.30%

YTD (bps) -110

2.14%

1D (bps) -1

YTD (bps) -265

2.67%

YTD (bps) -223

23,965

1D (%) 0.21%

YTD (%) 0.86%

26,283

1D (%) 0.00%

YTD (%) 2.43%

3,349

1D (%) -0.15%

YTD (%) -3.90%

The Governor of the State Bank said that as of June 27, credit increased by 4.03% and increased by 9.08% over the same period. Notably, in terms of structure, credit to real estate business in the first 5 months increased 14%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam - Japan signed an ODA agreement of nearly VND11,000 billion;

- Governor of the State Bank: The package of VND120,000 billion has been disbursed;

- Reduce import tax on gasoline;

- The UK is the only economy in the G7 group to see inflation increase;

- European electricity prices fell to negative again;

- America's second largest bank lost USD100 billion on bonds.

VN30

BANK

102,000

1D 2.00%

5D 0.89%

Buy Vol. 1,632,032

Sell Vol. 1,488,532

44,350

1D 0.80%

5D -2.21%

Buy Vol. 2,374,361

Sell Vol. 3,194,244

29,550

1D 0.34%

5D -1.50%

Buy Vol. 7,737,924

Sell Vol. 7,934,505

31,950

1D -0.16%

5D -4.05%

Buy Vol. 8,304,416

Sell Vol. 7,634,101

19,950

1D 0.50%

5D -1.48%

Buy Vol. 36,057,235

Sell Vol. 44,377,978

20,400

1D 0.25%

5D -1.45%

Buy Vol. 23,974,450

Sell Vol. 26,874,149

18,450

1D -0.54%

5D -1.60%

Buy Vol. 4,978,347

Sell Vol. 5,361,682

18,100

1D -0.28%

5D -1.90%

Buy Vol. 6,847,909

Sell Vol. 7,304,821

29,900

1D 0.17%

5D 0.00%

Buy Vol. 39,909,312

Sell Vol. 30,315,486

19,900

1D 1.27%

5D 0.25%

Buy Vol. 11,747,721

Sell Vol. 13,432,216

21,950

1D -0.23%

5D -1.57%

Buy Vol. 13,442,079

Sell Vol. 14,984,100

VCB: Vietcombank has just issued a notice to sell the collateral property, which is My Khe Resort of Quang Ngai Tourism Joint Stock Company for auction with a starting price of nearly VND39.8 billion, an increase of VND9.3 billion compared to the first sale price in August 2022 (VND30.5 billion). The auction is scheduled to take place at 9:00 am on July 27, 2023.

REAL ESTATE

14,700

1D -1.01%

5D -5.77%

Buy Vol. 45,997,848

Sell Vol. 58,578,949

80,100

1D -0.87%

5D 0.13%

Buy Vol. 421,587

Sell Vol. 436,287

17,350

1D 2.06%

5D 2.06%

Buy Vol. 31,787,073

Sell Vol. 36,250,501

NVL: NVL continues to have a margin cut in the 3rd quarter because the stock is subject to HOSE's warning

OIL & GAS

94,300

1D -0.84%

5D -1.15%

Buy Vol. 718,160

Sell Vol. 1,129,870

13,500

1D 0.75%

5D -2.17%

Buy Vol. 31,978,489

Sell Vol. 15,783,296

40,300

1D 1.13%

5D 5.77%

Buy Vol. 3,779,369

Sell Vol. 4,321,138

POW: in the first 6 months of 2023, the total power output of two thermal power plants Nhon Trach 1 and 2 reached 2,633 million kWh, reaching 118% of the plan.

VINGROUP

51,000

1D -0.58%

5D -2.30%

Buy Vol. 3,950,112

Sell Vol. 4,255,267

56,100

1D -0.71%

5D 1.26%

Buy Vol. 2,489,783

Sell Vol. 2,724,495

27,500

1D 1.10%

5D 0.73%

Buy Vol. 10,469,845

Sell Vol. 10,380,052

VIC: After 10 weeks of opening and putting into operation in 5 provinces and cities including Hanoi, Ho Chi Minh City, Hue, Nha Trang, Da Nang, Xanh SM taxi has served more than 1 million trips.

FOOD & BEVERAGE

69,800

1D -1.13%

5D -1.13%

Buy Vol. 10,605,984

Sell Vol. 10,267,346

75,800

1D 0.26%

5D -1.56%

Buy Vol. 2,149,885

Sell Vol. 2,370,386

153,800

1D 0.13%

5D -0.58%

Buy Vol. 173,138

Sell Vol. 322,819

MSN: It is expected to issue more than 7.1 million ESOP shares, equivalent to 0.499% of the total number of outstanding shares. This number of shares will be restricted to transfer within 1 year.

OTHERS

44,800

1D -0.55%

5D -0.78%

Buy Vol. 1,007,652

Sell Vol. 1,325,913

94,300

1D 0.21%

5D -0.63%

Buy Vol. 997,426

Sell Vol. 1,255,241

74,800

1D 0.02%

5D 0.02%

Buy Vol. 2,695,639

Sell Vol. 3,656,632

43,350

1D 0.23%

5D -1.25%

Buy Vol. 10,608,942

Sell Vol. 11,567,230

20,100

1D -0.99%

5D 4.15%

Buy Vol. 8,460,972

Sell Vol. 8,749,552

26,200

1D -1.13%

5D -1.32%

Buy Vol. 27,036,632

Sell Vol. 33,865,499

26,950

1D 2.67%

5D 1.32%

Buy Vol. 56,811,832

Sell Vol. 54,594,290

FPT: On July 28, MWG will close the list of shareholders to pay the 2022 dividend in cash at the rate of 5%. This is the lowest cash dividend rate of MWG since going public. In 2021, this business pays a cash dividend at the rate of 10%, while in the previous period this ratio was regularly maintained at 15%.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

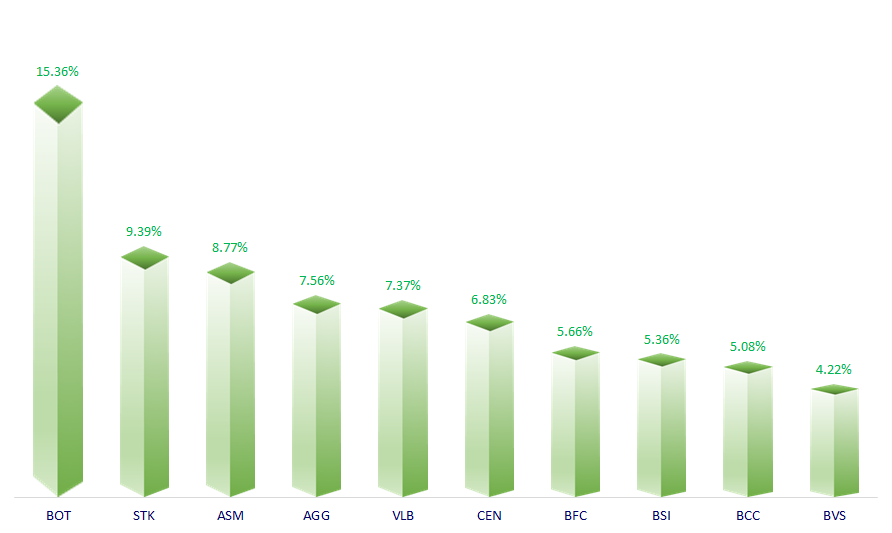

TOP INCREASES 3 CONSECUTIVE SESSIONS

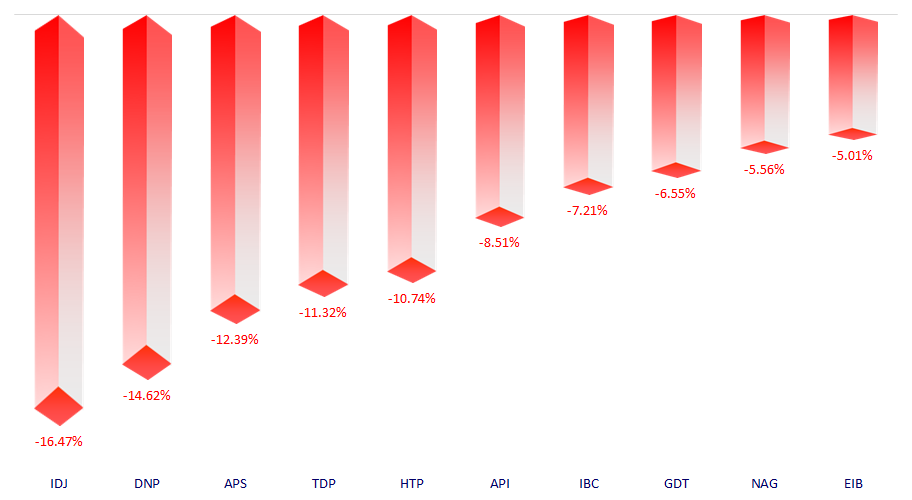

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.