Market brief 06/07/2023

VIETNAM STOCK MARKET

1,126.22

1D -0.74%

YTD 11.83%

1,119.44

1D -0.91%

YTD 11.37%

225.08

1D -1.21%

YTD 9.63%

85.09

1D -0.37%

YTD 18.76%

-331.21

1D 0.00%

YTD 0.00%

21,188.67

1D 8.13%

YTD 145.92%

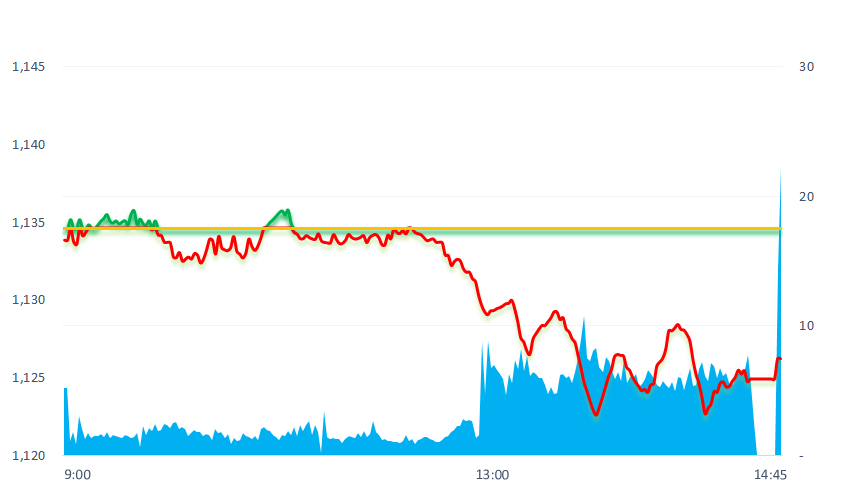

Today, the market traded around the reference level in most of the morning session. But after 11 a.m, VNIndex suddenly dropped deeply due to a series of billion-dollar stocks falling. Notable transactions of VND and related companies IPA. IPA closed at floor price, VND also dropped strongly (-6.5%) with a volume of nearly 106 million shares.

ETF & DERIVATIVES

19,400

1D -0.31%

YTD 11.94%

13,270

1D -0.75%

YTD 11.33%

13,770

1D -0.94%

YTD 10.34%

16,640

1D -0.12%

YTD 18.43%

17,540

1D -1.18%

YTD 22.23%

23,650

1D -1.46%

YTD 5.58%

14,540

1D -1.02%

YTD 12.28%

1,116

1D -0.71%

YTD 0.00%

1,113

1D -0.73%

YTD 0.00%

1,110

1D -0.49%

YTD 0.00%

1,102

1D -0.43%

YTD 0.00%

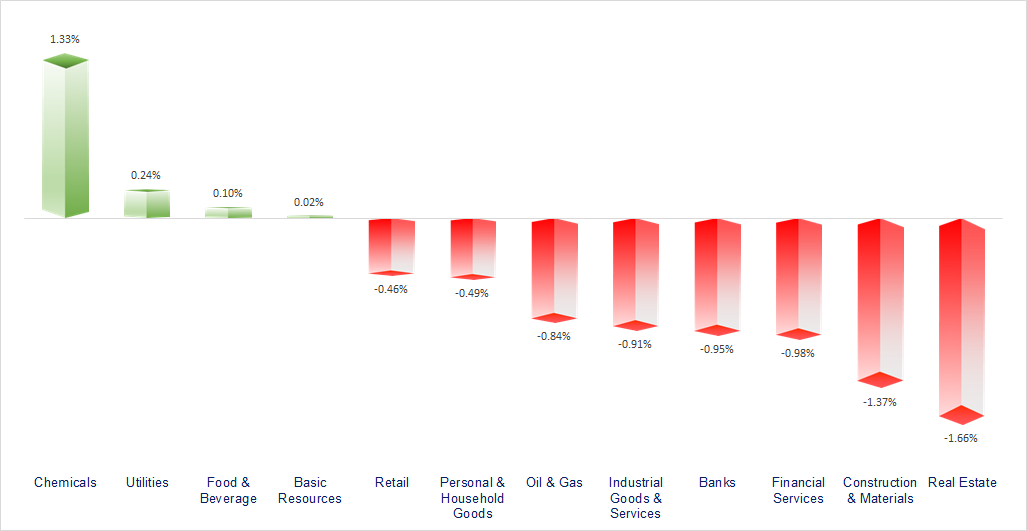

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

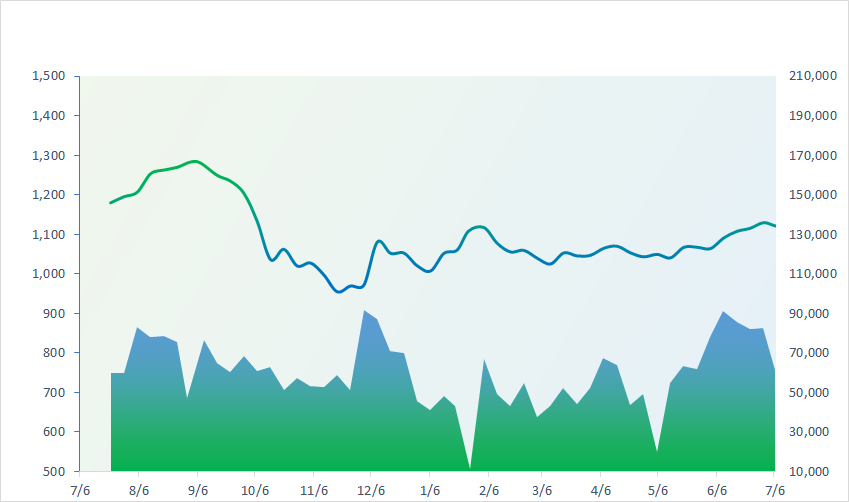

VNINDEX (12M)

GLOBAL MARKET

32,773.02

1D -1.70%

YTD 25.59%

3,205.57

1D -0.54%

YTD 3.76%

2,556.29

1D -0.88%

YTD 14.30%

18,533.05

1D -3.02%

YTD -6.31%

3,150.43

1D -1.10%

YTD -3.10%

1,490.46

1D -1.22%

YTD -10.77%

76.70

1D 0.10%

YTD -10.72%

1,924.81

1D 0.00%

YTD 5.40%

Asian stock markets fell on July 6, following the general trend of global stock markets, after the US Federal Reserve (Fed) confirmed the possibility of raising interest rates, amid disagreements. The increase in US-China trade put pressure on investor sentiment.

VIETNAM ECONOMY

0.61%

1D (bps) -9

YTD (bps) -436

6.30%

YTD (bps) -110

2.14%

YTD (bps) -265

2.66%

1D (bps) -1

YTD (bps) -224

23,925

1D (%) -0.17%

YTD (%) 0.69%

26,259

1D (%) -0.09%

YTD (%) 2.34%

3,346

1D (%) -0.09%

YTD (%) -3.99%

According to credit institutions, the liquidity of the banking system in the second quarter of 2023 remained in a "good" state and was more abundant than in the first quarter of 2023. Credit institutions forecast that the liquidity situation will continue to be abundant in the third quarter of 2023 and the whole year of 2023 compared to 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam imported the first 70,000 tons of LNG;

- Commodity transactions in Vietnam increased by 6% in the first half of 2023;

- UOB continues to lower Vietnam's 2023 GDP growth forecast to 5.2%;

- The Fed may conduct more rate hikes, but at a slower pace;

- US manufacturing activity continued to decline in June;

- Global foreign direct investment to decline 12% in 2022.

VN30

BANK

100,700

1D -1.27%

5D -1.18%

Buy Vol. 1,487,155

Sell Vol. 1,623,532

43,950

1D -0.90%

5D -1.24%

Buy Vol. 2,385,467

Sell Vol. 2,985,595

29,350

1D -0.68%

5D -1.84%

Buy Vol. 10,199,262

Sell Vol. 10,142,882

31,550

1D -1.25%

5D -3.37%

Buy Vol. 10,505,901

Sell Vol. 10,016,959

19,550

1D -2.01%

5D -1.76%

Buy Vol. 24,411,353

Sell Vol. 30,802,892

20,200

1D -0.98%

5D -0.49%

Buy Vol. 27,929,114

Sell Vol. 27,314,629

18,200

1D -1.36%

5D -0.82%

Buy Vol. 5,796,985

Sell Vol. 7,170,955

18,200

1D 0.55%

5D 0.55%

Buy Vol. 8,295,132

Sell Vol. 7,528,703

29,100

1D -2.68%

5D -1.52%

Buy Vol. 41,352,138

Sell Vol. 49,963,385

19,600

1D -1.51%

5D -0.76%

Buy Vol. 7,482,601

Sell Vol. 8,756,190

21,700

1D -1.14%

5D -0.91%

Buy Vol. 9,266,481

Sell Vol. 16,063,770

MBB: MBB announces the closing of the right to pay dividends in 2022 in shares. The ex-rights date is July 14. MBB plans to issue more than 680 million common shares to pay dividends (15%) to existing shareholders, raising charter capital by VND6,800 billion. The source for implementation is the accumulated after-tax profit in 2022.

REAL ESTATE

14,400

1D -2.04%

5D -4.00%

Buy Vol. 47,424,213

Sell Vol. 44,661,987

79,800

1D -0.37%

5D 0.76%

Buy Vol. 402,318

Sell Vol. 391,277

16,900

1D -2.59%

5D 2.42%

Buy Vol. 20,147,235

Sell Vol. 24,487,068

NVL: Ms. Bui Cao Ngoc Quynh, daughter of Mr. Bui Thanh Nhon, Chairman of Novaland, bought more than 3 million shares of NVL out of a total of nearly 3.5 million registered units.

OIL & GAS

95,200

1D 0.95%

5D 0.63%

Buy Vol. 2,691,468

Sell Vol. 2,543,785

13,250

1D -1.85%

5D -2.21%

Buy Vol. 26,202,448

Sell Vol. 22,363,101

40,300

1D 0.00%

5D 7.47%

Buy Vol. 3,783,408

Sell Vol. 4,389,192

GAS: On July 10, PV Gas will receive the first ship to transport 70,000 tons of LNG to LNG Thi Vai Terminal.

VINGROUP

50,400

1D -1.18%

5D -2.70%

Buy Vol. 3,783,857

Sell Vol. 5,003,402

54,500

1D -2.85%

5D -0.91%

Buy Vol. 2,200,231

Sell Vol. 2,541,261

26,950

1D -2.00%

5D -0.19%

Buy Vol. 8,615,956

Sell Vol. 11,390,479

VIC: Vingroup and K-Sure will cooperate bilaterally in projects with the participation of Korean companies promoted by Vingroup, and support commercial insurance to expand new markets.

FOOD & BEVERAGE

70,500

1D 1.00%

5D -1.95%

Buy Vol. 13,908,259

Sell Vol. 11,014,919

76,000

1D 0.26%

5D 0.80%

Buy Vol. 1,623,196

Sell Vol. 1,688,303

153,400

1D -0.26%

5D -0.39%

Buy Vol. 176,583

Sell Vol. 285,699

VNM: Vinamilk estimates that the money from saving resources in the present and in the future will bring benefits that are higher than the initial investment costs.

OTHERS

45,000

1D 0.45%

5D 1.58%

Buy Vol. 3,802,194

Sell Vol. 3,323,584

94,300

1D 0.00%

5D 0.21%

Buy Vol. 961,958

Sell Vol. 1,226,905

74,600

1D -0.27%

5D 0.33%

Buy Vol. 2,648,142

Sell Vol. 2,664,551

43,200

1D -0.35%

5D 1.17%

Buy Vol. 6,456,902

Sell Vol. 7,943,809

20,700

1D 2.99%

5D 8.66%

Buy Vol. 9,791,337

Sell Vol. 7,575,448

26,300

1D 0.38%

5D 3.34%

Buy Vol. 48,904,077

Sell Vol. 49,479,823

27,000

1D 0.19%

5D 4.65%

Buy Vol. 43,859,666

Sell Vol. 48,983,987

HPG: In June 2023, Hoa Phat Group produced 520,000 tons of crude steel, down 23% compared to the same period of 2022. Sales volume of construction steel products, hot rolled coil (HRC), billet reached 540,000 tons, down 4% year-on-year in 2022 but the highest level since the beginning of this year

Market by numbers

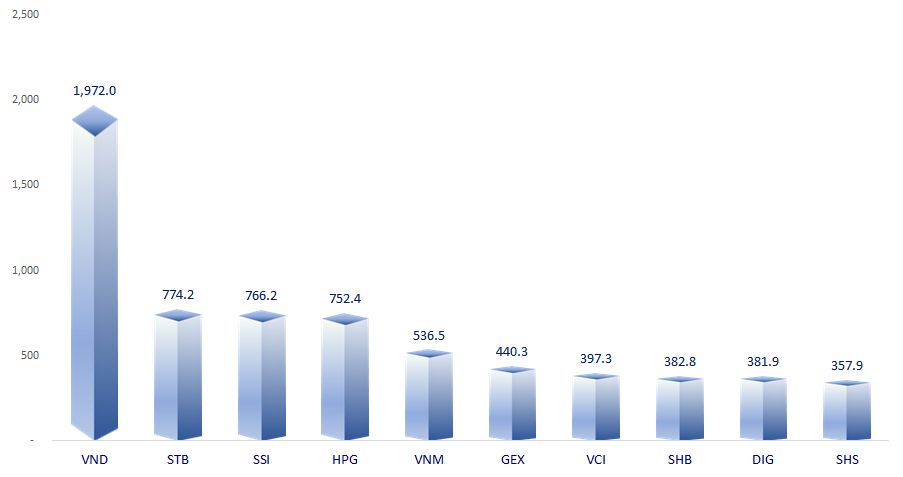

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

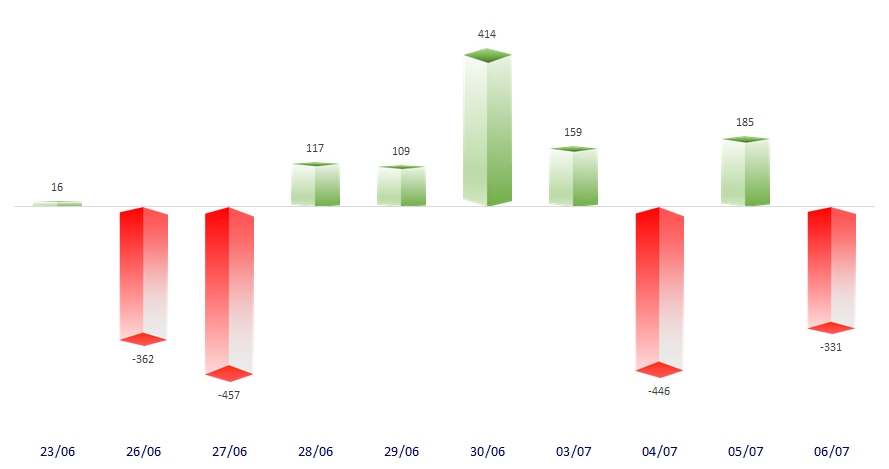

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

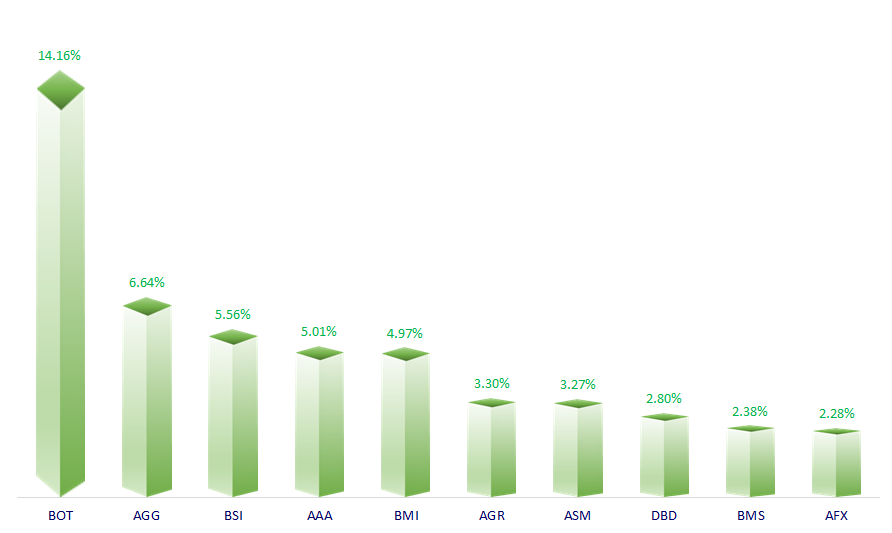

TOP INCREASES 3 CONSECUTIVE SESSIONS

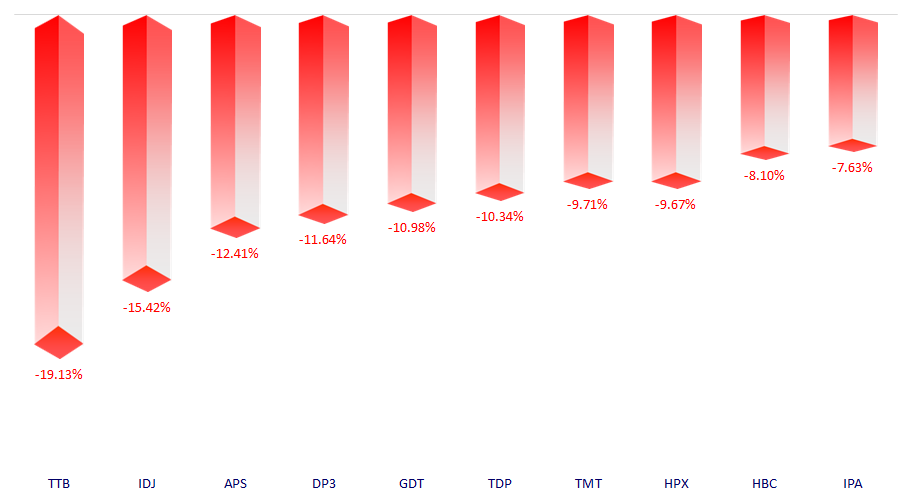

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.