Market brief 10/07/2023

VIETNAM STOCK MARKET

1,149.02

1D 0.96%

YTD 14.09%

1,143.16

1D 1.22%

YTD 13.73%

228.37

1D 1.13%

YTD 11.23%

85.23

1D 0.67%

YTD 18.95%

-372.15

1D 0.00%

YTD 0.00%

21,914.46

1D 17.13%

YTD 154.35%

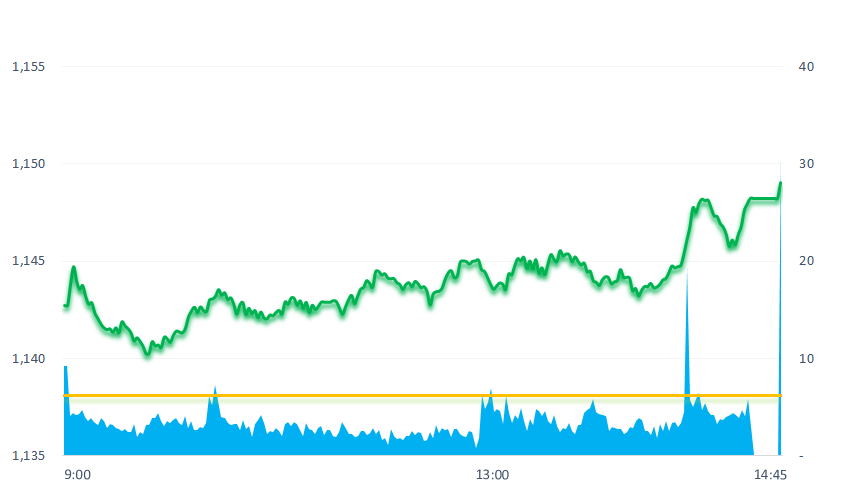

Today, right from the beginning of the ATO session, the market rallied but the pressure of profit-taking in the first half forced VNIndex down significantly. However, after that, the cash inflow to buy was very impressive, pushing the price of large-cap groups up. The uptrend spread to most industry groups. Stocks with the top liquidity include securities, real estate and banking…

ETF & DERIVATIVES

19,540

1D 0.67%

YTD 12.75%

13,530

1D 1.05%

YTD 13.51%

13,990

1D 0.79%

YTD 12.10%

16,760

1D -0.71%

YTD 19.29%

17,940

1D 1.87%

YTD 25.02%

24,290

1D 1.42%

YTD 8.44%

14,770

1D 1.37%

YTD 14.05%

1,137

1D 1.02%

YTD 0.00%

1,134

1D 1.02%

YTD 0.00%

1,130

1D 1.24%

YTD 0.00%

1,119

1D 0.96%

YTD 0.00%

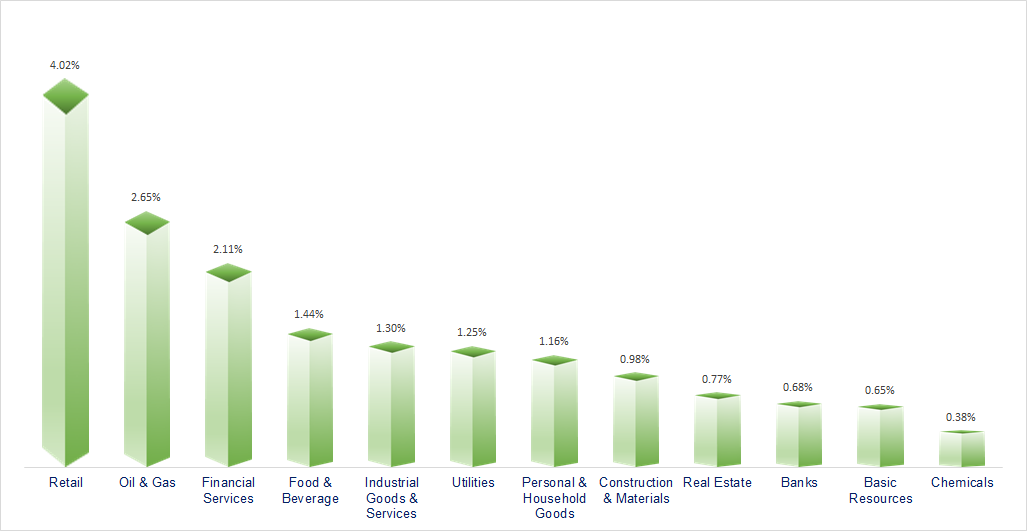

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

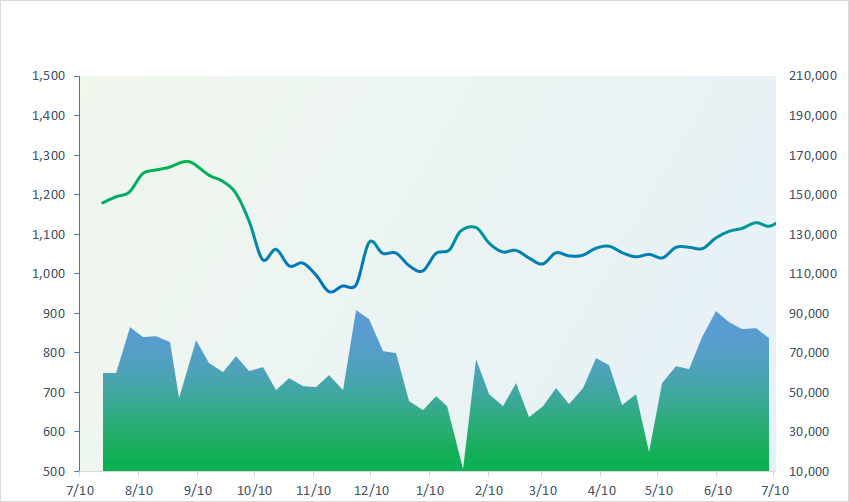

VNINDEX (12M)

GLOBAL MARKET

32,189.73

1D -0.61%

YTD 23.36%

3,203.70

1D 0.22%

YTD 3.70%

2,520.70

1D -0.24%

YTD 12.71%

18,479.72

1D 0.62%

YTD -6.58%

3,149.32

1D 0.31%

YTD -3.14%

1,496.89

1D 0.43%

YTD -10.39%

77.92

1D -0.52%

YTD -9.30%

1,928.65

1D -0.14%

YTD 5.61%

The Hong Kong stock market rallied on July 10 on hopes that China would end a prolonged "correction" in the technology sector. However, the rally in Asia was initially stalled as inflation data showed a weakening Chinese economy.

VIETNAM ECONOMY

0.41%

1D (bps) -7

YTD (bps) -456

6.30%

YTD (bps) -110

2.14%

1D (bps) 2

YTD (bps) -265

2.73%

1D (bps) 4

YTD (bps) -217

23,863

1D (%) 0.05%

YTD (%) 0.43%

26,361

1D (%) 0.66%

YTD (%) 2.74%

3,338

1D (%) 0.03%

YTD (%) -4.22%

According to statistical data from the Vietnam Bond Market Association (VBMA), as of June 30, 2023, there were 13 private corporate bond issuances in June, and no issuance to the public. The total value of corporate bond issuance in June was VND8,170 billion. The average interest rate is 10.5%/year, the average term is 4.2 years.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Standard Chartered: Vietnam's economy is recovering;

- VBMA: Nearly VND8.2 trillion of corporate bonds were issued in June;

- Export of wood and wood products is forecasted to continue difficult in the second half of the year;

- China is on the brink of deflation;

- EU investment in New Zealand can increase up to 80% after signing of FTA;

- Foreign investors net sold Korean stocks for the third consecutive month.

VN30

BANK

102,700

1D -2.19%

5D 2.70%

Buy Vol. 1,577,397

Sell Vol. 1,470,529

46,950

1D 5.98%

5D 5.51%

Buy Vol. 9,594,803

Sell Vol. 6,989,456

29,700

1D 0.34%

5D 1.54%

Buy Vol. 12,457,493

Sell Vol. 12,132,807

32,000

1D 1.43%

5D 0.00%

Buy Vol. 10,058,861

Sell Vol. 8,620,332

20,050

1D 1.01%

5D 1.01%

Buy Vol. 26,435,009

Sell Vol. 32,621,236

20,750

1D 1.47%

5D 2.72%

Buy Vol. 34,552,386

Sell Vol. 27,047,598

18,350

1D 0.00%

5D -0.54%

Buy Vol. 6,316,022

Sell Vol. 5,596,748

18,200

1D 0.83%

5D 0.28%

Buy Vol. 10,109,003

Sell Vol. 10,673,137

29,850

1D 0.84%

5D 0.51%

Buy Vol. 23,581,916

Sell Vol. 25,482,702

20,300

1D 2.53%

5D 3.31%

Buy Vol. 19,834,190

Sell Vol. 16,947,726

21,950

1D 1.15%

5D -0.45%

Buy Vol. 15,109,398

Sell Vol. 17,705,183

VCB: Vietcombank plans to issue nearly 856.6 million shares to pay dividends at the rate of 18.1%. The last registration date is 07/26/2023. The ex-rights date is July 25, 2023. It is expected that after the issuance, Vietcombank's charter capital will increase by nearly VN8,566 billion to VND55,892 billion.

REAL ESTATE

14,900

1D 2.76%

5D 2.41%

Buy Vol. 54,297,072

Sell Vol. 63,800,231

80,500

1D 0.50%

5D -0.49%

Buy Vol. 346,145

Sell Vol. 369,612

18,500

1D 6.94%

5D 10.78%

Buy Vol. 59,306,004

Sell Vol. 34,577,856

NVL: Novaland has not yet arranged a source of payment Novaland's bond lot NVLH2123006 was issued on June 29, 2021, and matured on June 29, 2023. The bond lot is worth VND300 billion.

OIL & GAS

97,500

1D 1.56%

5D 3.72%

Buy Vol. 1,666,599

Sell Vol. 1,946,957

13,200

1D 0.76%

5D -0.75%

Buy Vol. 17,295,569

Sell Vol. 15,661,745

41,800

1D 3.72%

5D 11.02%

Buy Vol. 4,184,299

Sell Vol. 3,527,521

GAS: In Q2/2023, PV GAS's profit after tax was estimated at VND2,618 billion, down 49% compared to the same period in 2022. This is the lowest profit in the last 6 quarters.

VINGROUP

50,900

1D 1.60%

5D -0.39%

Buy Vol. 5,419,925

Sell Vol. 5,481,075

53,800

1D -0.37%

5D -3.76%

Buy Vol. 3,124,831

Sell Vol. 3,186,797

26,950

1D -0.19%

5D -0.19%

Buy Vol. 8,753,042

Sell Vol. 10,002,928

VIC: On July 7, VinFast offers a range of electric car products spanning all segments. In particular, VinFast VF 6 belongs to the B-class SUV segment.

FOOD & BEVERAGE

72,100

1D 1.69%

5D 1.98%

Buy Vol. 11,736,085

Sell Vol. 11,353,652

77,900

1D 3.59%

5D 3.32%

Buy Vol. 4,399,550

Sell Vol. 3,399,787

150,300

1D -0.46%

5D -2.21%

Buy Vol. 358,191

Sell Vol. 333,071

VNM: In 6M, VNM is estimated to achieve revenue of nearly VND29.2 trillion and profit after tax of more than VND4.1 trillion, fulfilling 46% of the revenue plan and 48% of the after-tax profit target.

OTHERS

45,600

1D 0.77%

5D 2.47%

Buy Vol. 1,900,789

Sell Vol. 2,101,809

94,200

1D 0.43%

5D -0.21%

Buy Vol. 1,179,578

Sell Vol. 1,092,719

75,300

1D 0.00%

5D 1.39%

Buy Vol. 1,971,806

Sell Vol. 2,207,479

47,750

1D 4.95%

5D 11.05%

Buy Vol. 16,510,280

Sell Vol. 15,936,805

21,250

1D 0.00%

5D 5.46%

Buy Vol. 6,808,975

Sell Vol. 7,080,519

27,500

1D 3.97%

5D 7.00%

Buy Vol. 56,001,813

Sell Vol. 48,576,179

27,700

1D 0.91%

5D 5.73%

Buy Vol. 35,284,928

Sell Vol. 41,790,872

HPG: According to a newly updated report, on June 28, HPG climbed to the top 3 largest investments in the portfolio of Vietnam Enterprise Investments Limited (VEIL) - Dragon Capital with a weight of 8,29%. This is the highest proportion in more than a year that VEIL has allocated to leading steel stocks.

Market by numbers

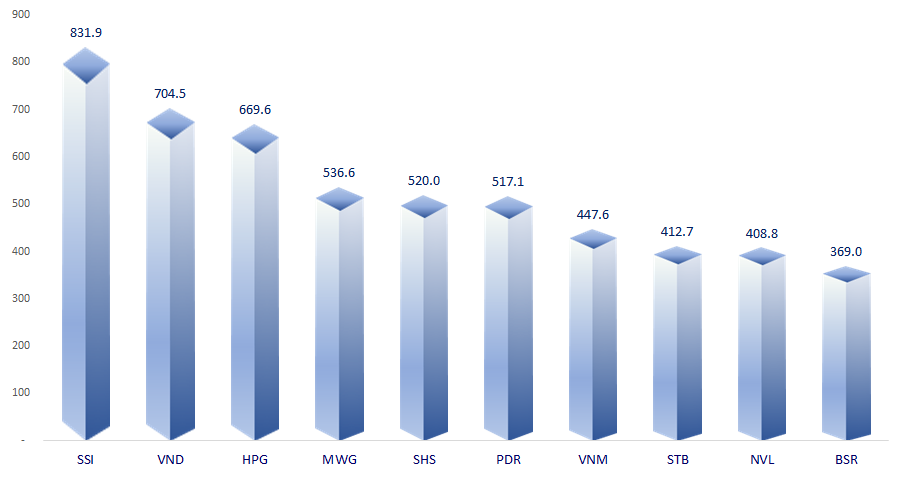

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

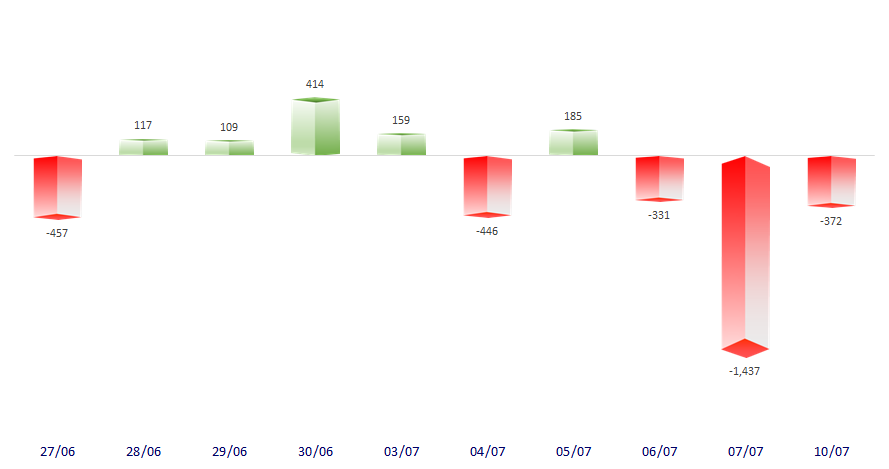

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

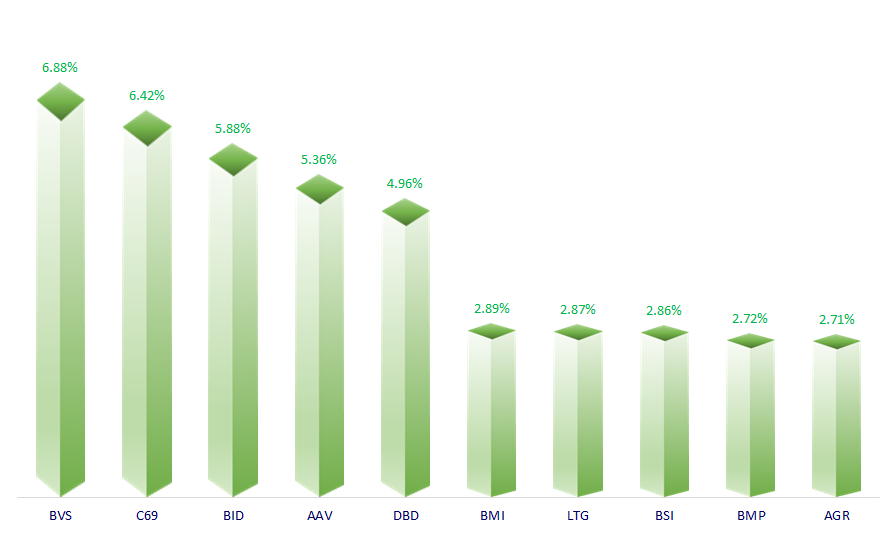

TOP INCREASES 3 CONSECUTIVE SESSIONS

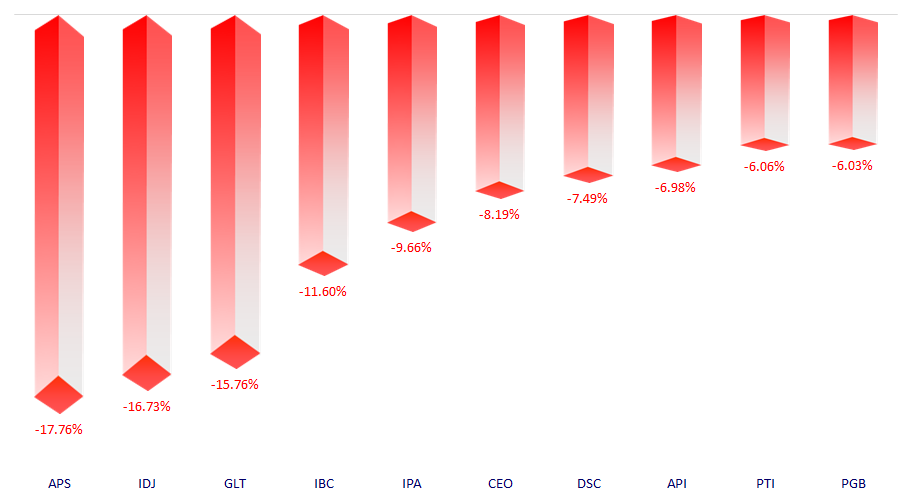

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.