Market brief 12/07/2023

VIETNAM STOCK MARKET

1,154.20

1D 0.21%

YTD 14.61%

1,146.54

1D -0.01%

YTD 14.06%

228.88

1D -0.15%

YTD 11.48%

85.91

1D 0.10%

YTD 19.90%

-380.32

1D 0.00%

YTD 0.00%

19,216.51

1D -23.36%

YTD 123.03%

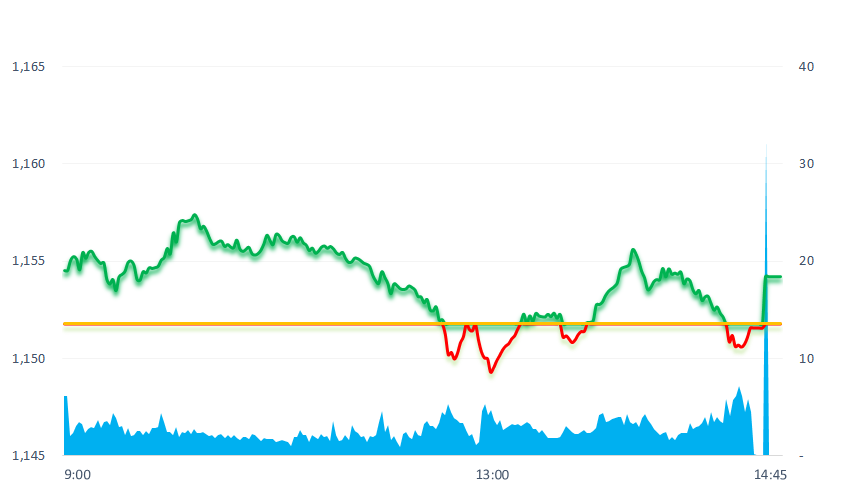

Today, the market had an optimistic morning session when the green color remained for the first time, then selling pressure appeared on a large scale and pulled the index down below reference. VNIndex was quite struggling in the afternoon but at the end of the session, VNIndex still maintained a positive green color.

ETF & DERIVATIVES

19,600

1D 0.00%

YTD 13.10%

13,590

1D 0.07%

YTD 14.01%

14,000

1D -0.36%

YTD 12.18%

17,060

1D 0.00%

YTD 21.42%

17,800

1D -1.71%

YTD 24.04%

24,430

1D -0.16%

YTD 9.06%

14,880

1D 0.27%

YTD 14.90%

1,142

1D 0.33%

YTD 0.00%

1,136

1D 0.04%

YTD 0.00%

1,131

1D -0.18%

YTD 0.00%

1,122

1D -0.09%

YTD 0.00%

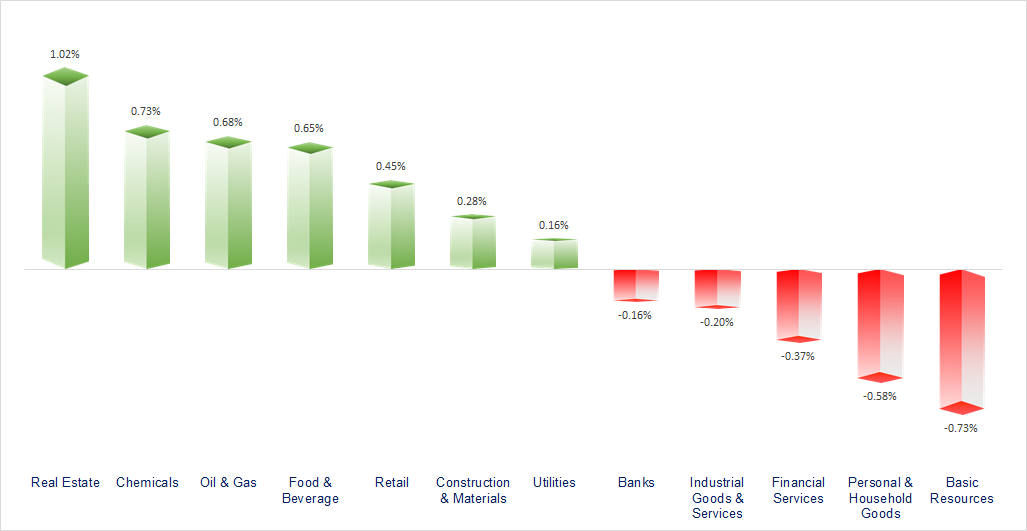

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

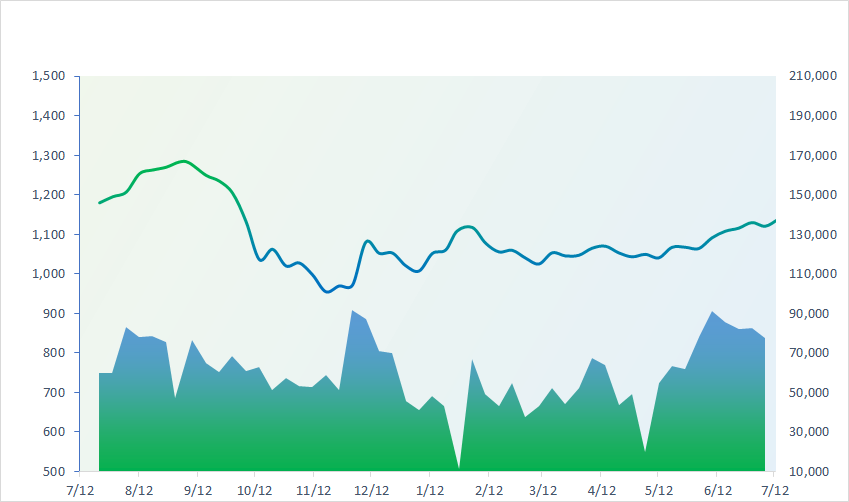

VNINDEX (12M)

GLOBAL MARKET

31,943.93

1D -0.81%

YTD 22.42%

3,196.13

1D -0.78%

YTD 3.46%

2,574.72

1D 0.48%

YTD 15.13%

18,860.95

1D 1.08%

YTD -4.65%

3,175.36

1D 0.36%

YTD -2.34%

1,491.14

1D -0.39%

YTD -10.73%

79.36

1D -0.25%

YTD -7.62%

1,939.25

1D -0.19%

YTD 6.19%

Asian stocks were mixed in the trading session on July 12. While Japan's Nikkei 225 Index and China's Shanghai Composite posted losses, Hang Seng (Hongkong) were once again among the best performers after China signaled a correction to big corporation in the technology field is coming to an end.

VIETNAM ECONOMY

0.24%

1D (bps) -13

YTD (bps) -473

6.30%

YTD (bps) -110

2.07%

1D (bps) -8

YTD (bps) -272

2.65%

1D (bps) -3

YTD (bps) -225

23,870

1D (%) -0.17%

YTD (%) 0.46%

26,519

1D (%) -0.01%

YTD (%) 3.35%

3,360

1D (%) -0.03%

YTD (%) -3.59%

Remittances to Ho Chi Minh City in 6 months are estimated at USD4.4 billion, equal to 66% compared to 2022. The amount of remittances remitted to the city continues to grow well, is expected to reach USD7 billion in 2023, an increase about 6-7% compared to 2022.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- WB expert: 'Vietnam GDP growth in 2023 will be less than 5%';

- Raise wages but must prevent the wave of price increases;

- Rice prices are at their highest level in 11 years but may increase by 20% more;

- OECD: AI revolution could threaten 27% of jobs;

- Asia's luxury goods market is growing;

- ADB and EMA promote clean energy in ASEAN.

VN30

BANK

104,000

1D 0.97%

5D 1.96%

Buy Vol. 1,386,753

Sell Vol. 1,271,945

46,700

1D 0.32%

5D 5.30%

Buy Vol. 5,946,957

Sell Vol. 4,214,670

30,000

1D -0.99%

5D 1.52%

Buy Vol. 11,156,674

Sell Vol. 11,919,973

31,650

1D -0.94%

5D -0.94%

Buy Vol. 7,524,261

Sell Vol. 8,878,338

19,650

1D -1.26%

5D -1.50%

Buy Vol. 22,919,392

Sell Vol. 27,657,682

21,000

1D -0.94%

5D 2.94%

Buy Vol. 23,451,203

Sell Vol. 26,092,558

18,550

1D -0.27%

5D 0.54%

Buy Vol. 3,148,660

Sell Vol. 3,976,944

18,150

1D -0.82%

5D 0.28%

Buy Vol. 7,860,587

Sell Vol. 10,734,162

29,800

1D -0.67%

5D -0.33%

Buy Vol. 64,241,981

Sell Vol. 61,854,361

20,100

1D -0.99%

5D 1.01%

Buy Vol. 7,155,824

Sell Vol. 9,362,782

21,850

1D -0.68%

5D -0.46%

Buy Vol. 9,505,458

Sell Vol. 18,703,632

VPB: VPBank plans to collect shareholders' written opinions at the end of July or the beginning of August 2023 on the supplement and concretization of the plan to use the proceeds from the private placement of shares to SMBC. SMBC's investment brought VPBank VND35.9 trillion of Tier 1 capital (price VND30,160/share), equivalent to USD1.5 billion, thereby bringing VPBank's total equity from VND103.5 trillion to approximately VND140 thousand billions.

REAL ESTATE

14,600

1D -0.68%

5D -0.68%

Buy Vol. 41,265,172

Sell Vol. 56,803,550

80,700

1D -0.37%

5D 0.75%

Buy Vol. 448,412

Sell Vol. 488,440

19,100

1D 3.80%

5D 10.09%

Buy Vol. 43,867,845

Sell Vol. 31,925,054

PDR: On July 11, PDR bought back all VND71.9 billion of outstanding bonds of code PDRH213002. The bond lot was issued in April 2021 and will mature on July 28.

OIL & GAS

96,500

1D -0.72%

5D 2.33%

Buy Vol. 940,280

Sell Vol. 1,413,551

13,250

1D 0.00%

5D -1.85%

Buy Vol. 11,020,630

Sell Vol. 16,606,677

41,500

1D 0.61%

5D 2.98%

Buy Vol. 2,570,549

Sell Vol. 2,714,450

POW: Business results in 6M with estimated revenue of VND16,567 billion, up 14% over the same period. Electricity output in the first half of the year was about 8.31 million kWh.

VINGROUP

51,400

1D 1.18%

5D 0.78%

Buy Vol. 3,977,373

Sell Vol. 5,024,669

55,100

1D 2.23%

5D -1.78%

Buy Vol. 3,282,201

Sell Vol. 3,365,556

28,100

1D 2.93%

5D 2.18%

Buy Vol. 28,086,204

Sell Vol. 23,746,729

VIC: VinFast VF 6 will be sold in 2 versions: Eco and Plus. The Eco version uses an electric motor with a capacity of 174 horsepower, the Plus uses an electric motor with a capacity of 201 horsepower.

FOOD & BEVERAGE

73,500

1D 0.96%

5D 5.30%

Buy Vol. 7,254,523

Sell Vol. 8,382,255

79,500

1D 0.38%

5D 4.88%

Buy Vol. 2,802,477

Sell Vol. 3,222,796

151,000

1D 0.67%

5D -1.82%

Buy Vol. 297,475

Sell Vol. 275,411

VNM: After 6 months, Vinamilk has achieved 46% of the revenue target and nearly 48% of the after-tax profit target.

OTHERS

46,850

1D 2.97%

5D 4.58%

Buy Vol. 4,650,354

Sell Vol. 3,608,238

93,900

1D -0.32%

5D -0.42%

Buy Vol. 1,120,592

Sell Vol. 1,240,556

75,300

1D 0.40%

5D 0.67%

Buy Vol. 1,736,332

Sell Vol. 1,764,594

49,150

1D 0.72%

5D 13.38%

Buy Vol. 8,967,628

Sell Vol. 8,638,826

21,600

1D 0.47%

5D 7.46%

Buy Vol. 5,840,379

Sell Vol. 4,878,154

27,950

1D -0.36%

5D 6.68%

Buy Vol. 39,952,518

Sell Vol. 42,285,789

27,000

1D -1.10%

5D 0.19%

Buy Vol. 55,556,630

Sell Vol. 49,773,144

HPG: From the beginning of 2023, HPG is the stock with the strongest net buying by foreign investors on the stock exchange with a total accumulated value of up to VND4,200 billion. Two funds holding more than 100 million HPG shares are Vietnam Enterprise Investments Limited (VEIL), the largest fund managed by Dragon Capital, and VinaCapital Vietnam Opportunity Fund (VOF), a member fund of VinaCapital.

Market by numbers

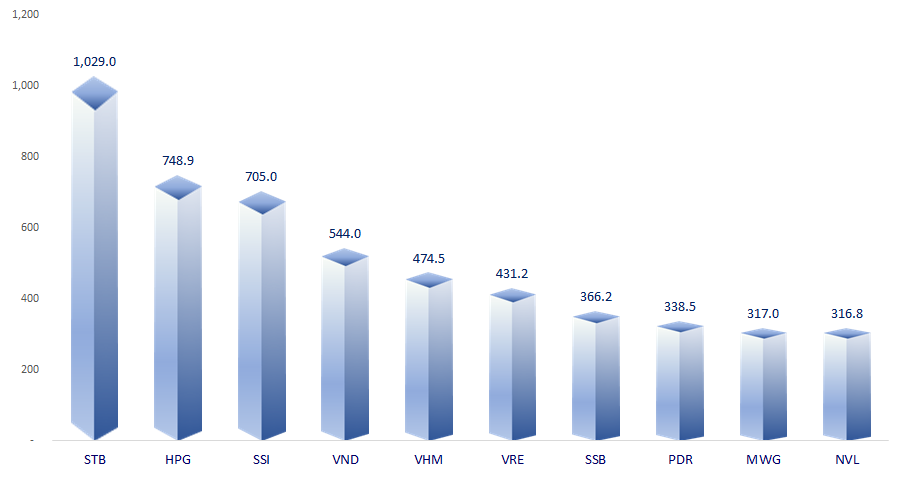

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

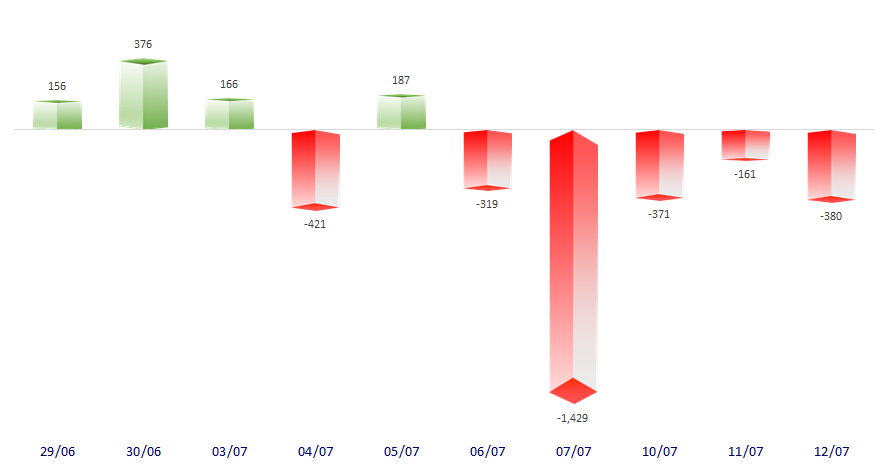

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.