Market brief 13/07/2023

VIETNAM STOCK MARKET

1,165.42

1D 0.97%

YTD 15.72%

1,156.11

1D 0.83%

YTD 15.01%

229.97

1D 0.48%

YTD 12.01%

86.21

1D 0.35%

YTD 20.32%

278.11

1D 0.00%

YTD 0.00%

19,280.91

1D 0.34%

YTD 123.78%

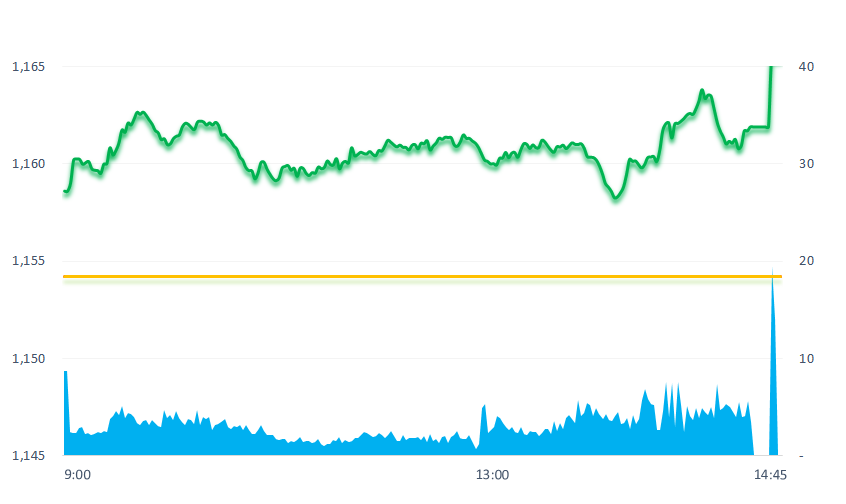

VNIndex opened this morning in excited atmosphere. Large groups such as banking, real estate, food, retail, oil and gas, electricity... were all green. The market's gain was maintained until the end of the session, helping VNIndex to close at the highest level of the session.

ETF & DERIVATIVES

19,800

1D 1.02%

YTD 14.25%

13,680

1D 0.66%

YTD 14.77%

14,200

1D 1.43%

YTD 13.78%

17,830

1D 4.51%

YTD 26.90%

17,870

1D 0.39%

YTD 24.53%

24,950

1D 2.13%

YTD 11.38%

15,000

1D 0.81%

YTD 15.83%

1,155

1D 1.16%

YTD 0.00%

1,152

1D 1.37%

YTD 0.00%

1,146

1D 1.39%

YTD 0.00%

1,136

1D 1.24%

YTD 0.00%

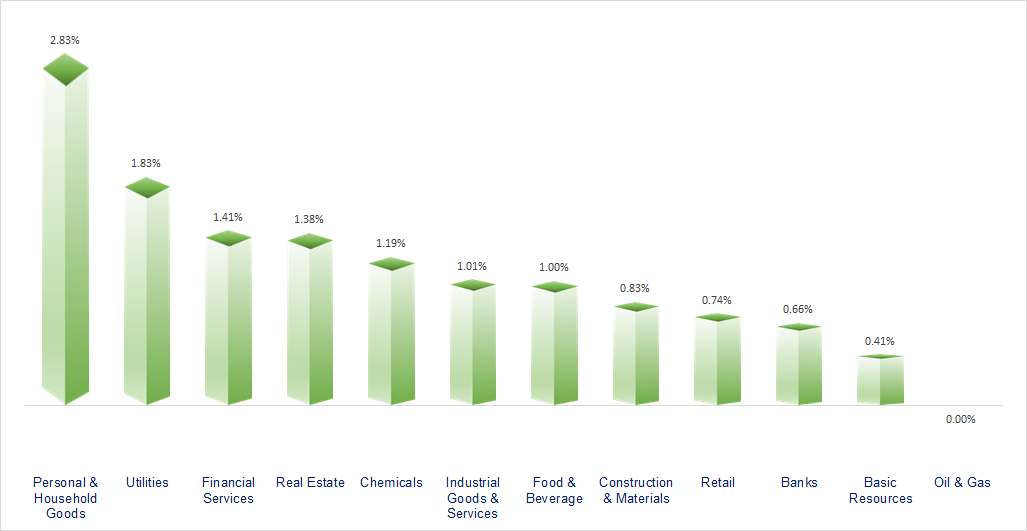

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

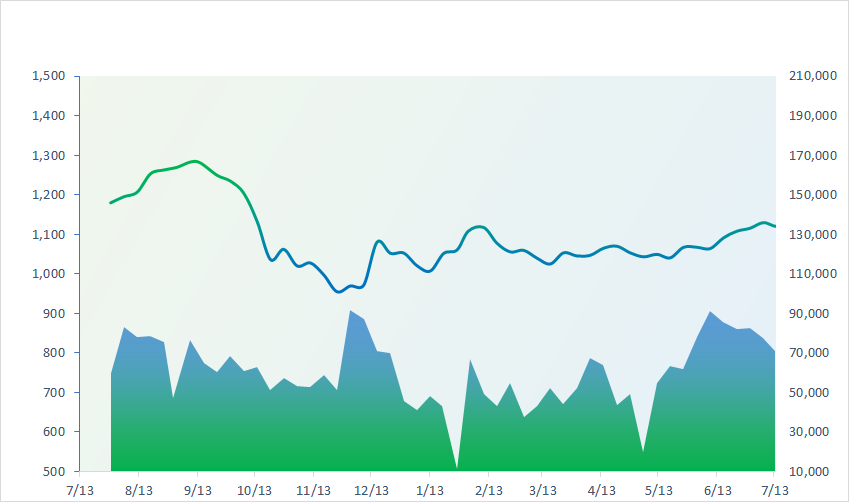

VNINDEX (12M)

GLOBAL MARKET

32,419.33

1D 1.49%

YTD 24.24%

3,236.48

1D 1.26%

YTD 4.77%

2,591.23

1D 0.64%

YTD 15.87%

19,350.62

1D 2.60%

YTD -2.18%

3,238.46

1D 1.99%

YTD -0.40%

1,494.02

1D 0.19%

YTD -10.56%

80.31

1D 0.15%

YTD -6.52%

1,964.85

1D 0.14%

YTD 7.59%

Closing the afternoon session on July 13, many Asian stock exchanges gained, in the context of the weakening dollar and the US Department of Labor's announcement of surprisingly low inflation data, reinforcing the confidence of investors that the monetary tightening cycle of the US Federal Reserve (Fed) is coming to an end.

VIETNAM ECONOMY

0.21%

1D (bps) -3

YTD (bps) -476

6.30%

YTD (bps) -110

2.00%

1D (bps) -7

YTD (bps) -279

2.64%

1D (bps) -1

YTD (bps) -226

23,875

1D (%) 0.02%

YTD (%) 0.48%

26,876

1D (%) 1.35%

YTD (%) 4.74%

3,374

1D (%) 0.42%

YTD (%) -3.19%

In the first 6 months of the year, state budget revenue reached VND875,800 billion, equaling 54% of the estimate; exempted, reduced and extended taxes, fees, charges and land rent about VND70,300 billion (exemption and reduction of VND28,300 billion, extension VND42,000 billion).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Prime Minister: Drastically remove bottlenecks on site clearance and construction materials for traffic works;

- The first 6 months of 2023: Exempted, reduced, extended taxes and fees of more than VND70,000 billion;

- China nearly doubled shrimp imports in May, importing from Vietnam the highest since the beginning of the year;

- US inflation is only 3%, the lowest since March 2021;

- Rising borrowing costs weaken the UK property market;

- The Bank of Canada decided to raise the basic interest rate to 5%.

VN30

BANK

104,900

1D 0.87%

5D 4.17%

Buy Vol. 1,340,971

Sell Vol. 1,623,125

46,900

1D 0.43%

5D 6.71%

Buy Vol. 6,837,962

Sell Vol. 3,693,586

30,000

1D 0.00%

5D 2.21%

Buy Vol. 9,850,161

Sell Vol. 11,661,127

31,950

1D 0.95%

5D 1.27%

Buy Vol. 9,004,070

Sell Vol. 7,466,054

19,950

1D 1.53%

5D 2.05%

Buy Vol. 30,900,033

Sell Vol. 31,287,959

21,100

1D 0.48%

5D 4.46%

Buy Vol. 28,793,825

Sell Vol. 33,600,311

18,600

1D 0.27%

5D 2.20%

Buy Vol. 3,885,388

Sell Vol. 4,491,995

18,250

1D 0.55%

5D 0.27%

Buy Vol. 8,881,181

Sell Vol. 9,043,958

30,000

1D 0.67%

5D 3.09%

Buy Vol. 22,476,777

Sell Vol. 23,155,405

20,200

1D 0.50%

5D 3.06%

Buy Vol. 7,076,459

Sell Vol. 6,644,591

22,000

1D 0.69%

5D 1.38%

Buy Vol. 11,625,259

Sell Vol. 17,091,588

VCB: Chairman of the Board of Directors of Vietcombank said that the plan to privately issue 6.5% of charter capital to foreign investors is at the step of hiring a consulting organization. According to the plan, Vietcombank will conduct private placement for foreign investors in the period of 2023 - 2024..

REAL ESTATE

14,950

1D 2.40%

5D 3.82%

Buy Vol. 54,216,883

Sell Vol. 76,056,333

81,000

1D 0.37%

5D 1.50%

Buy Vol. 564,275

Sell Vol. 560,326

19,200

1D 0.52%

5D 13.61%

Buy Vol. 22,998,180

Sell Vol. 21,489,138

PDR: Bond outstanding balance is about VND1,400 billion. Thus, from the beginning of Q2 until now, PDR has bought back at least VND313 billion before maturity.

OIL & GAS

99,300

1D 2.90%

5D 4.31%

Buy Vol. 2,509,182

Sell Vol. 2,773,798

13,350

1D 0.75%

5D 0.75%

Buy Vol. 21,984,614

Sell Vol. 21,781,267

41,400

1D -0.24%

5D 2.73%

Buy Vol. 2,072,677

Sell Vol. 2,137,303

POW: In the last 6 months, POW is expected to target electricity output of 7.8 billion kWh; Planned revenue is estimated at VND11.6 trillion.

VINGROUP

51,500

1D 0.19%

5D 2.18%

Buy Vol. 3,290,271

Sell Vol. 4,603,971

56,300

1D 2.18%

5D 3.30%

Buy Vol. 3,923,958

Sell Vol. 4,805,028

28,150

1D 0.18%

5D 4.45%

Buy Vol. 12,903,577

Sell Vol. 12,723,941

VIC: The list of 10 best-selling cars in the first half of 2023 includes two electric models from VinFast, VF e34 and VF 8 with sales of 5,072 and 4,555 vehicles, respectively, ranked 8th and 9th.

FOOD & BEVERAGE

73,100

1D -0.54%

5D 3.69%

Buy Vol. 5,944,366

Sell Vol. 7,859,657

81,800

1D 2.89%

5D 7.63%

Buy Vol. 4,630,799

Sell Vol. 4,265,615

153,500

1D 1.66%

5D 0.07%

Buy Vol. 418,364

Sell Vol. 452,027

VNM: VNM is currently in the Top 36 largest dairy companies in the world in revenue. VNM is managing 15 farms and 17 factories, 13 subsidiaries, joint ventures and associates.

OTHERS

47,000

1D 0.32%

5D 4.44%

Buy Vol. 2,033,919

Sell Vol. 2,586,045

94,900

1D 1.06%

5D 0.64%

Buy Vol. 1,833,735

Sell Vol. 1,839,137

75,800

1D 0.66%

5D 1.61%

Buy Vol. 1,748,057

Sell Vol. 2,529,895

49,350

1D 0.41%

5D 14.24%

Buy Vol. 9,272,032

Sell Vol. 10,632,953

21,650

1D 0.23%

5D 4.59%

Buy Vol. 4,097,646

Sell Vol. 4,130,564

28,400

1D 1.61%

5D 7.98%

Buy Vol. 29,452,219

Sell Vol. 26,989,158

27,050

1D 0.19%

5D 0.19%

Buy Vol. 25,502,873

Sell Vol. 30,187,912

MWG: MWG has just had the 5th consecutive gaining session to move up to 49,350 dong/share, thereby setting the highest milestone in more than 5 months since the beginning of February 2023. Market capitalization quickly increased by VND8,900 billion, equivalent to +15% after only 5 trading sessions, the value reached approximately VND72,000 billion.

Market by numbers

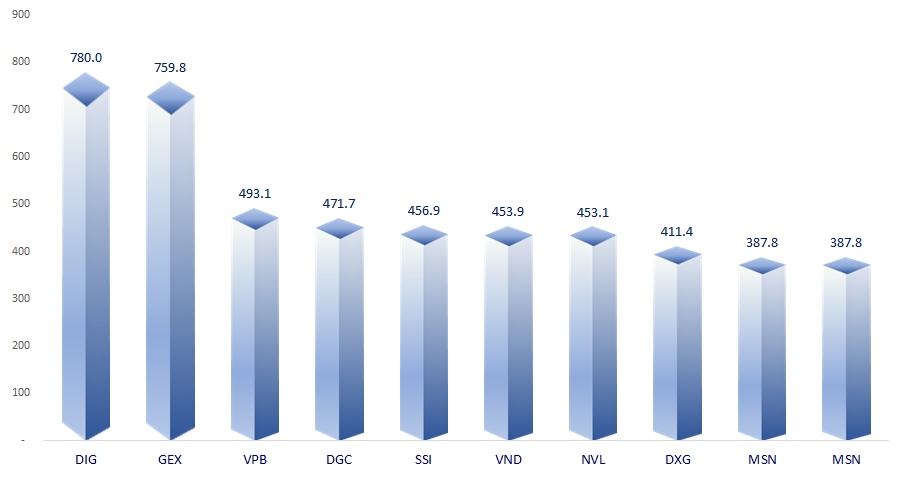

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

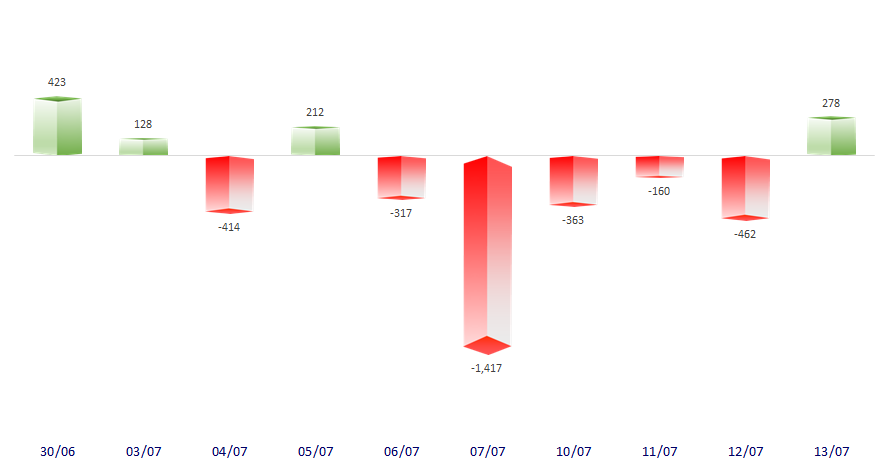

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

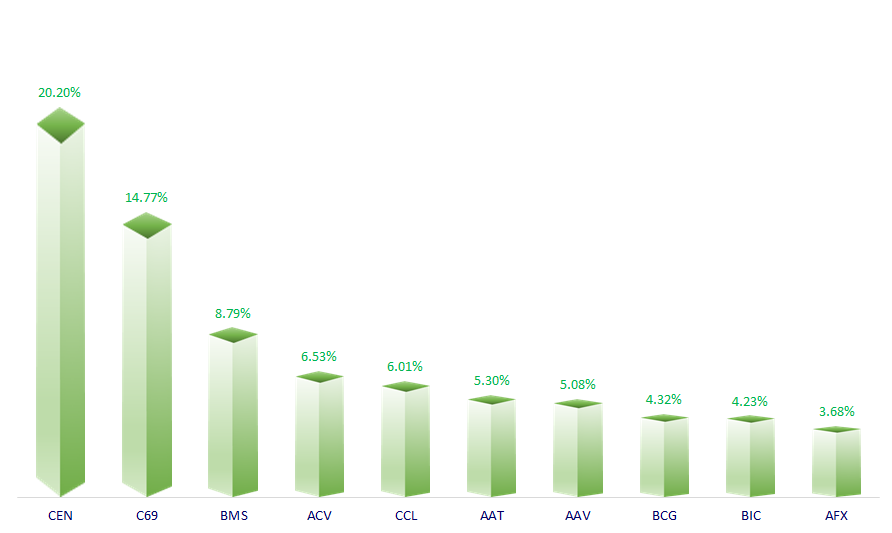

TOP INCREASES 3 CONSECUTIVE SESSIONS

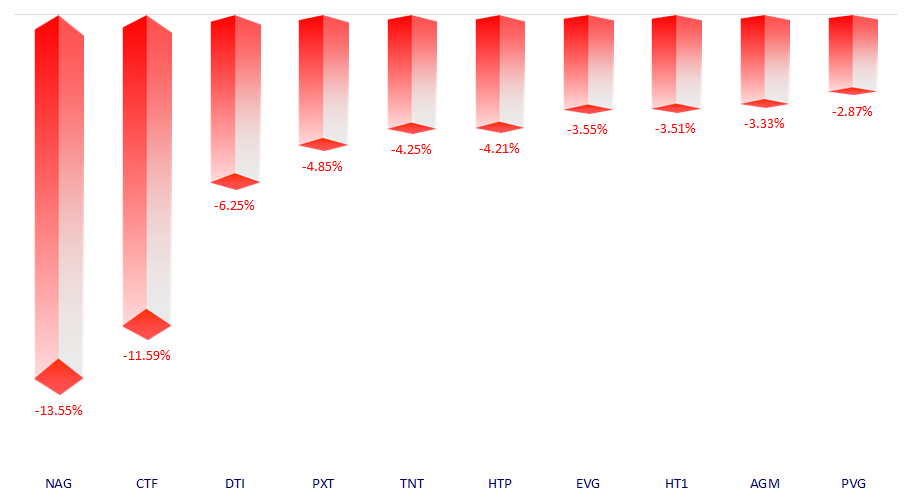

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.